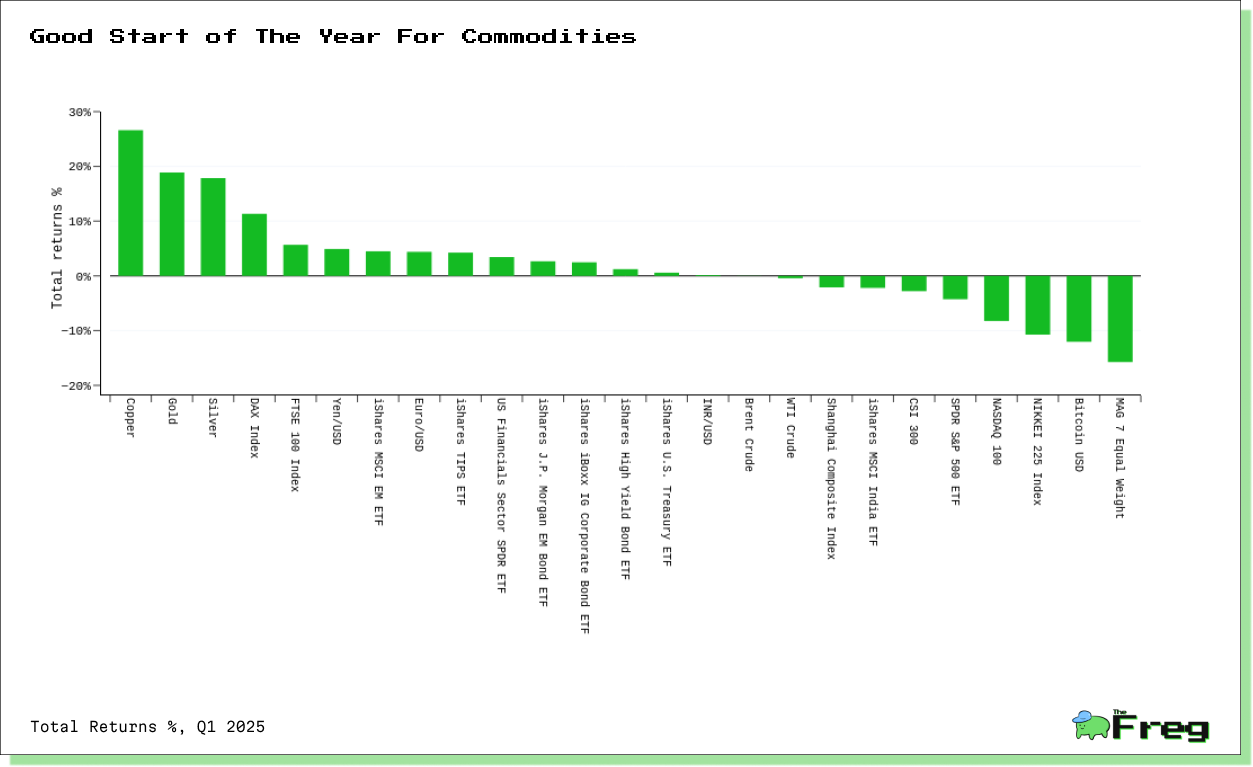

Winners and Losers in Q1 2025

Gold shines amid global uncertainty, reaching new heights as investors seek safe havens. European markets outperform the U.S., driven by defense spending, while tech stocks face headwinds in a volatile first quarter of 2025.

The first quarter of 2025 saw dramatic shifts in global markets, with traditional safe havens like gold outperforming while tech stocks and cryptocurrencies struggled. Geopolitical tensions, particularly new tariff policies from the Trump administration, sparked volatility and reshaped investor sentiment. This period was marked by a notable divergence between U.S. and European equities, with the latter benefiting from increased defense spending initiatives.

Gold and Copper's Dominance

Gold and copper emerged as standout performers in the commodities market during Q1 2025, collectively contributing to nearly 75% of the total return in a major commodity indices despite representing only 27.5% of the index weight. Gold prices have since surged to $3,162.79 per ounce, this rally was fueled by central bank purchases, geopolitical uncertainties, and investor demand for safe-haven assets. Copper also showed strength, with prices reaching

$5 per pound, up 25% year-over-year. The robust performance of these metals underscores the advantages of maintaining broad exposure to commodities rather than focusing on individual picks.

- Gold's rise benefited companies like Northern Star, which reported a 28% increase in revenue for the first half of the 2024-25 financial year.

- Copper's strength reflects ongoing global infrastructure spending and expanding electric vehicle markets, which require substantial copper inputs.

- Freeport-McMoRan, a major copper producer, expects an average realized copper price of $4.40 per pound for Q1 2025, significantly higher than the previous year.

S&P 500's March Slump

The S&P 500 experienced its worst monthly performance since December 2022, plummeting 5.8% in March 2025. This dramatic decline erased over $3 trillion in market value, comparable to the total market capitalization of Apple. The index briefly dipped into correction territory, trading more than 10% below its all-time closing high from February 19.

Key factors contributing to the S&P 500's March slump:

- President Trump's announcement of new tariffs, sparking fears of a global trade conflict

- A sharp selloff in technology stocks, with the Magnificent Seven tech giants exerting downward pressure on the market

- Rising concerns about a potential recession and slowing economic growth4

- Uncertainty surrounding the Federal Reserve's interest rate policy amid inflationary pressures

Despite a volatile final trading day, the S&P 500 managed to close 0.4% higher on March 31, partially recovering from steeper losses earlier in the session. However, this late rally did little to offset the substantial losses incurred throughout the month, leaving investors bracing for potential further volatility in the coming quarters.

March Meltdown Highlights

The first quarter of 2025 was marked by significant market volatility, with the S&P 500 experiencing its largest quarterly decline since 2022. European equities outperformed their U.S. counterparts, driven by a major shift towards increased defense spending. This resulted in the biggest quarterly performance gap between the European Indices and the S&P 500 in a decade.

Key points from Q1 2025:

- Gold prices surged to an all-time high, posting a 19.0% quarterly increase -

the largest since 1986. - U.S. Treasuries saw a total return of 2.9%, with the 10-year yield dropping 36 basis points to 4.21%.

- The Magnificent 7 tech stocks fell into bear market territory.

- The U.S. Dollar weakened, with the dollar index down 3.9%, while the Euro strengthened 4.5% against the USD.

- Cryptocurrencies struggled, with Bitcoin falling 12.1% to $82,421.

The market volatility was largely attributed to aggressive tariff measures, concerns about tech valuations following the release of DeepSeek's AI model, and growing fears of stagflation.