Who's Winning the Global EV Chessboard?

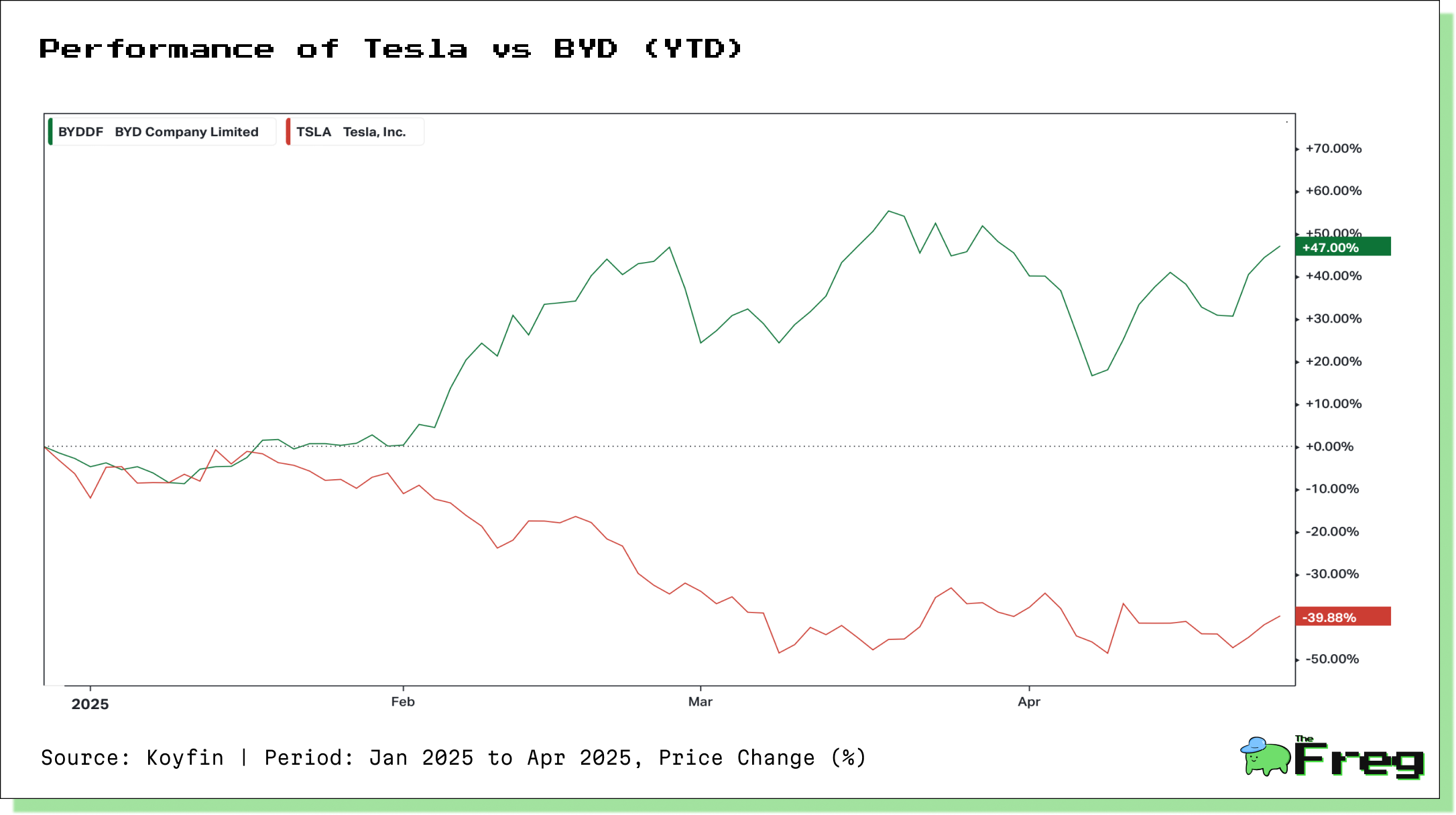

BYD’s meteoric rise in 2025 is rewriting the rules of the electric vehicle race, challenging Tesla’s long-standing dominance with surging sales, technological breakthroughs, and global strategy.

In the high-stakes game of global electric vehicles, 2025 is shaping up to be the year that reshuffles the board. China’s BYD, long viewed as a fast follower to Tesla, is now playing a leading role—outpacing its U.S. rival in quarterly profits, global BEV sales, and technological innovation.

A Shift in Power

With its first-quarter financial results on the horizon, BYD is expected to post net income of $1.16 billion to $1.37 billion—an 86–118% surge year-over-year—buoyed by the delivery of over 1 million new energy vehicles (NEVs) in Q1 alone.

Meanwhile, Tesla’s performance in the same period paints a contrasting picture: profits down 71%, automotive revenue off by 20%, and shrinking operating margins that dropped to just 2.1%.

Tariffs and Trade: A Double-Edged Sword

The reimposition of a 25% import tariff on Chinese EVs by the U.S., followed by additional 100% duties proposed by President Donald Trump, initially seemed to favor Tesla’s domestic positioning. However, BYD’s agile global expansion has turned these constraints into a strategic opportunity.

While Tesla is partially shielded by its U.S.-based production, CEO Elon Musk has acknowledged that 30–40% of Tesla’s components are sourced from abroad—exposing it to indirect cost pressures. BYD, in contrast, has responded with a proactive manufacturing strategy, opening facilities in Brazil, Hungary, Thailand, and Turkey to sidestep tariffs and build local relevance.

Even with a 17% import duty in Europe, BYD’s sales on the continent tripled in Q1 2025, underscoring its ability to navigate protectionist environments and continue gaining market share. In less restrictive markets like Southeast Asia and Latin America, BYD’s footprint is expanding even faster.

BYD’s Technological Leap: Fast Charging

One of BYD’s most disruptive advances is its new “megawatt flash charging” system—capable of delivering 400 kilometers (249 miles) of range in just five minutes. That performance rivals the refueling speed of gasoline cars and significantly outpaces Tesla’s Superchargers, which deliver approximately 275 kilometers in 15 minutes.

With plans to build over 4,000 ultra-fast stations across China and beyond, BYD is turning one of the EV industry’s greatest bottlenecks—charging anxiety—into a strategic advantage.

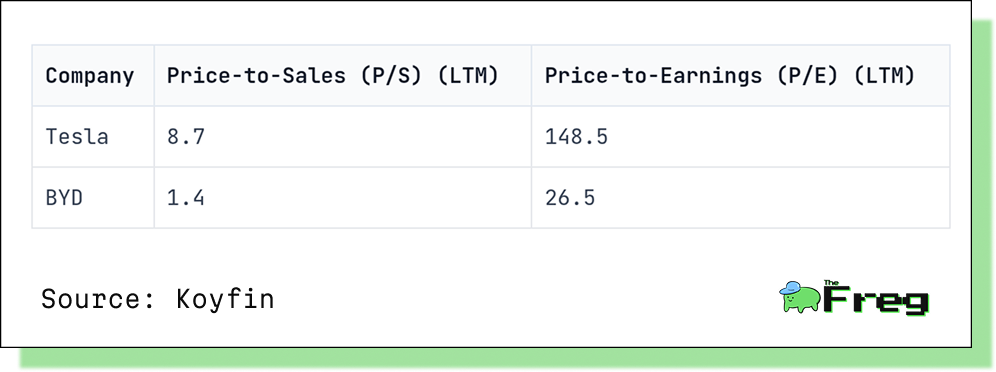

Valuation Gap: Hype vs. Execution

Despite declining fundamentals, Tesla continues to command a steep valuation premium. The valuations reflect that investor have faith in long-term visions like autonomous driving and robo-taxis, rather than near-term automotive performance.

In contrast, BYD trades at a modest multiples, yet posted 56% revenue growth last year and is on pace to beat Tesla in both earnings and deliveries in 2025.

Global Expansion Strategy

BYD’s overseas sales are expected to double this year to over 800,000 units, supported by growing demand in the UK, Latin America, and Southeast Asia. With a sales target of 5.5 million vehicles in 2025 and analysts forecasting up to 7 million in 2026, BYD is not just scaling—it’s reshaping global consumer expectations.

Tesla, on the other hand, is contending with slumping international sales, including a 76% drop in Germany and more than 50% declines in other key European markets. The company's future success may depend on reigniting demand, accelerating production of its next-gen platform, and navigating geopolitical headwinds more deftly.

Tesla is far from finished. Its brand power, innovation pipeline, and domestic dominance still give it significant firepower. However, BYD’s current momentum is undeniable. With record financials, aggressive global expansion, and technology that addresses critical consumer pain points, BYD is playing a calculated, well-executed strategy on the EV chessboard.