Weekly Wrap: Nifty Edges Up Despite India-Pak Conflict and Tariff Truce Jitters

Nifty crossed 25,000 this week, showing resilience amid India-Pakistan tensions and a U.S.-China tariff truce. Sectoral churn, steady FII inflows, and macro stability kept investors optimistic despite global uncertainties.

Global markets navigated a volatile but ultimately constructive week, balancing trade breakthroughs, geopolitical flashpoints, and shifting earnings narratives. While the Nifty 50 clung to the 25,000 milestone, it was India’s small-cap stocks that stole the spotlight, even as investors parsed signals from the U.S.-China trade truce, tech earnings, and a surprise India-Pakistan ceasefire.

U.S.-China Trade Truce: Relief with a Caveat

Markets began the week on a high as Washington and Beijing agreed to a 90-day trade truce on May 12. The deal saw the U.S. slashing tariffs on Chinese goods from a punishing 145% to 30%, while China reciprocated by reducing duties from 125% to 10%. Crucially, Beijing also agreed to lift export restrictions on rare earth minerals imposed since April 2.

Though initially celebrated on Wall Street and in global equities—with several indices touching multi-month highs—the deal left investors wary. It failed to address core friction points like the persistent U.S. trade deficit with China and disagreements over fentanyl regulation. Analysts forecast that the 30% tariff level is likely to remain until late 2025, which could wipe out as much as 70% of Chinese exports to the U.S.

JPMorgan Chase revised its macro view, retracting its 2025 recession forecast, while Raymond James retained a conservative U.S. GDP growth estimate of 1%, assigning a 50% probability to a mild recession.

India-Pakistan Ceasefire Eases Tensions, Markets Cheer

Indian markets had a rollercoaster start to the week after a ceasefire between India and Pakistan—brokered by the U.S. following days of cross-border missile and drone strikes—triggered a wave of optimism. On Monday, the Sensex surged 2,975 points (+3.74%), marking its biggest single-day gain in four years.

The truce followed a deadly terror attack in Pahalgam that killed 26 tourists. While initial violations were reported, both sides have since agreed to lower military alertness, extending the ceasefire to May 18. There are also unconfirmed reports of Pakistan considering relocating its military HQ from Chaklala to Islamabad after Indian precision strikes damaged the Nur Khan airbase.

Historically, markets have shown resilience to geopolitical conflict. A JM Financial analysis found that while such tensions can dent GDP growth, Indian equities tend to recover quickly—especially when ceasefires are brokered swiftly.

Small and Mid Caps Outshine

As benchmarks treaded water, broader markets charged ahead. The Nifty Smallcap100 and Midcap100 logged gains of 9% and 7% respectively over the past five sessions, outpacing the Nifty 50’s modest 0.39% gain.

Key drivers included:

- Earnings Strength: Midcap companies posted 20% profit growth versus just 4% for Nifty 50 firms (Elara Capital).

- Sectoral Momentum: Shipbuilding and infra stocks rallied, led by Cochin Shipyard (+13.5%), Titagarh (+14.1%), and GRSE (+12%).

- Historical Returns: The Nifty Smallcap250 has delivered 95% over 3 years and 367% over 5 years.

However, this momentum comes with a warning. Kotak Institutional Equities noted some valuations look overheated, with downside risks of up to 60% in select names like Cochin Shipyard.

Mag 7 Tech Titans Show Cracks Amid AI Hype

The “Magnificent Seven” tech giants are showing signs of fatigue. After two years of unrelenting dominance, Q1 2025 earnings grew just 19.6% YoY on revenue growth of 10.9%, sharply down from 31.7% earnings growth in Q4 2024.

Full-year earnings projections have also been downgraded—from 15.7% to 9.9%.

Still, some green shoots emerged. Nvidia, Microsoft, and Meta are now in the green for 2025, thanks in part to Nvidia’s blockbuster AI chip sale to Saudi Arabia. The Roundhill Magnificent 7 ETF is up 11% YTD, trouncing the S&P 500’s 4.5%.

All eyes are now on Nvidia’s Q1 results, slated for May 28, which could determine whether the tech rally has legs amid continued global volatility.

Weekly Market Scorecard

Sectoral Snapshot

Institutional Flows: Bulls Step Back In

Macro Watch: Stable Inflation, Early Monsoon Hopes

A bright spot: IMD has forecast an early monsoon arrival on May 27, with above-average rainfall across core agricultural states. This is expected to boost rural consumption and agri-linked stocks, potentially providing a fresh leg of growth to domestic markets.

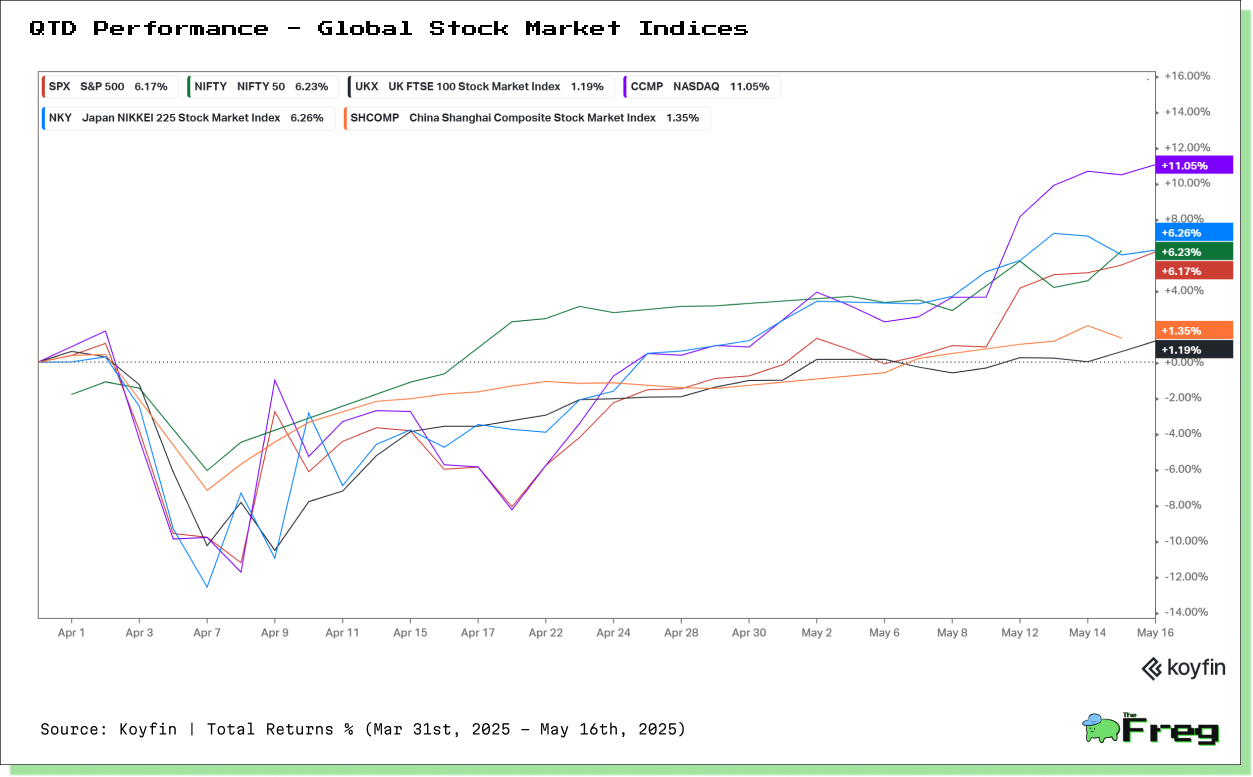

Global Market Check-In

Earnings and Monsoon in Focus

With the Q4 earnings season in full swing, investors will be tracking sectoral trends closely. Nifty 50 earnings are expected to grow by just 2% YoY in Q4FY25—well below earlier projections of 8%.

Alongside this, global sentiment will be shaped by the durability of the U.S.-China truce and further developments in the Middle East. Domestically, Gift Nifty is pointing to continued strength, but elevated valuations mean profit-booking could surface swiftly.

As markets hover near new highs, investors are advised to remain selective and stay alert to signals from global central banks, rainfall data, and corporate earnings guidance.