Wall Street’s Relentless Rally: What’s Powering U.S. Markets—and How Global Indices Stack Up

U.S. stocks soar to new highs in 2025, fuelled by AI and Nvidia’s rise, but growing risks from tariffs, inflation, and market concentration signal the need for cautious optimism.

In a year of remarkable financial milestones, U.S. equity markets are once again defying gravity. The Nasdaq Composite recently reached unprecedented heights, closing at 20,611.34 on July 9, 2025—a historic fifth record this year. This surge, driven by the accelerating AI boom and resilient investor sentiment, raises both enthusiasm and caution. How sustainable is this rally, and what forces are shaping its trajectory?

The Engines of Market Momentum

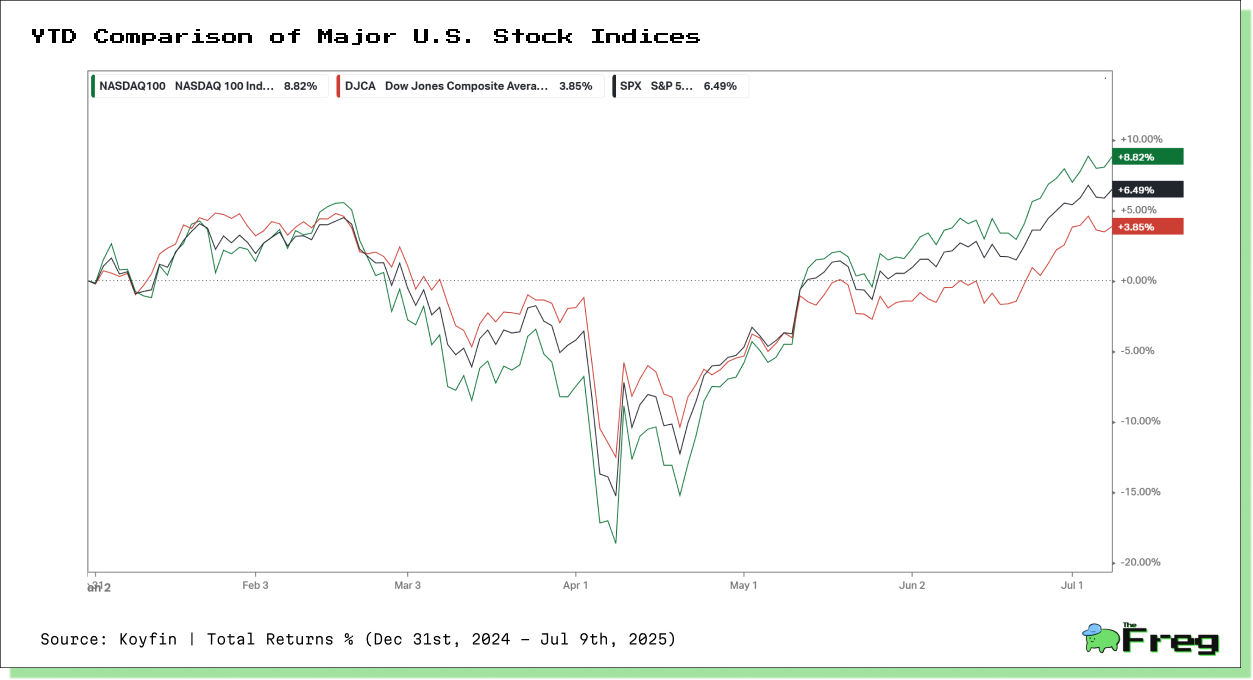

A look at the performance of major U.S. equity benchmarks since the start of the year reveals a clear divergence in momentum, with the Nasdaq 100 leading the charge. As shown in the chart, the Nasdaq 100 has delivered a robust gain of +8.82% year-to-date, outpacing both the S&P 500 (+6.49%) and the Dow Jones Composite Average (+3.85%). The sharp rebound since May underscores investor enthusiasm, particularly around growth and technology stocks, following a steep sell-off in March and early April. The market’s ability to recover from these lows highlights resilient risk appetite, even amid rising geopolitical tensions and ongoing inflation concerns.

The Nasdaq’s outperformance reflects the extraordinary investor focus on artificial intelligence and high-growth tech leaders—sectors that have been central to the recent rally. Meanwhile, the Dow’s more modest gains point to the relatively subdued performance of industrials and financials, which have lagged in the current cycle. The spread between these indices has widened in recent weeks, raising questions about market breadth and sustainability. As investors pile into tech-heavy names, the overall market is becoming increasingly dependent on a narrow group of mega-cap stocks, intensifying the risk of sharp reversals should sentiment shift.

Nvidia's $4 Trillion Breakthrough: The AI Vanguard

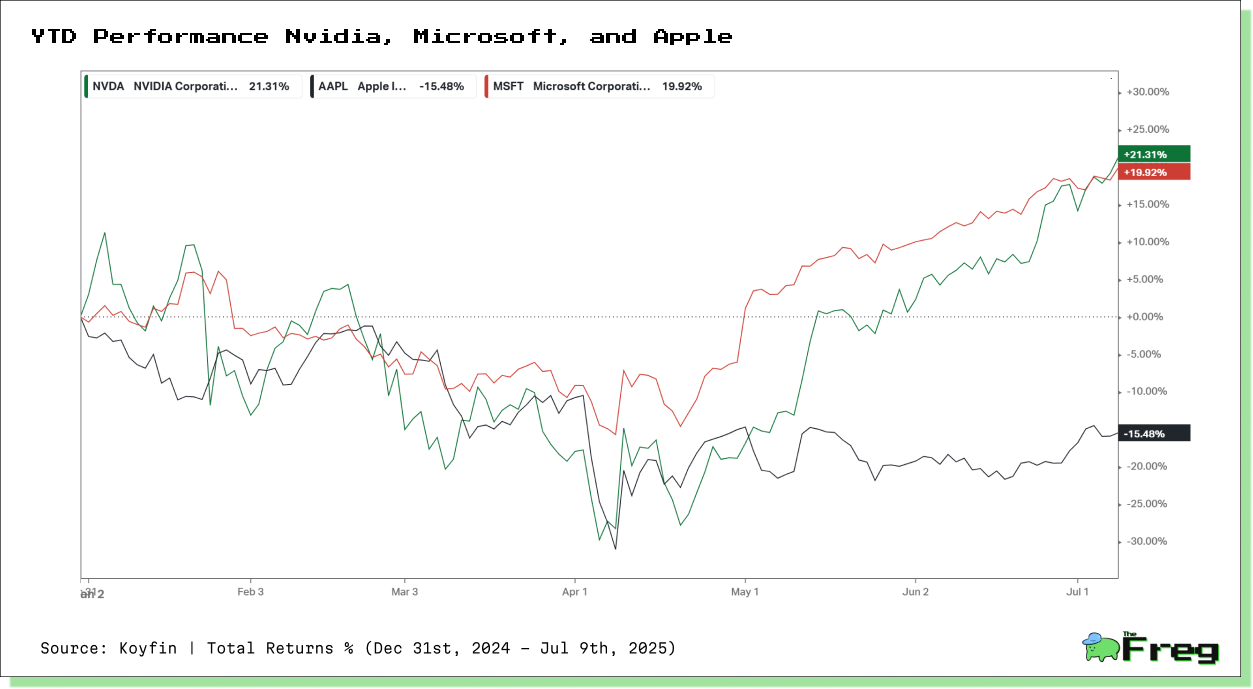

On July 9, Nvidia became the first public company to hit a $4 trillion market capitalization, surpassing both Apple and Microsoft. This is not merely a tech story—it is a narrative about the rise of artificial intelligence as the defining economic force of the decade. The meteoric rise of Nvidia has been the defining story of 2025's market rally. As the chart illustrates, Nvidia shares have surged an impressive +21.31% year-to-date, decisively outpacing both Microsoft (+19.92%) and Apple, whose stock has slumped -15.48% over the same period. This divergence underscores Nvidia’s unparalleled position at the heart of the AI revolution. Investors are rewarding the semiconductor giant’s central role in supplying the chips that power artificial intelligence applications, from cloud computing to autonomous vehicles. The company's market capitalization crossing the $4 trillion mark reflects not just optimism but hard earnings power—bolstered by its 69% year-over-year revenue growth to $44.1 billion in Q1 2025.

In contrast, Apple’s underperformance highlights how traditional tech hardware players are facing headwinds in this new AI-driven landscape. Meanwhile, Microsoft’s robust gains suggest its AI investments, particularly through Azure and strategic partnerships, are paying dividends. The chart paints a clear picture: markets are increasingly discriminating between those leading the AI transformation and those lagging behind. While Nvidia’s ascent is emblematic of AI enthusiasm, the gap between winners and losers is widening, signalling both opportunity and risk as the sector matures.

How the U.S. Rally Stacks Up Globally

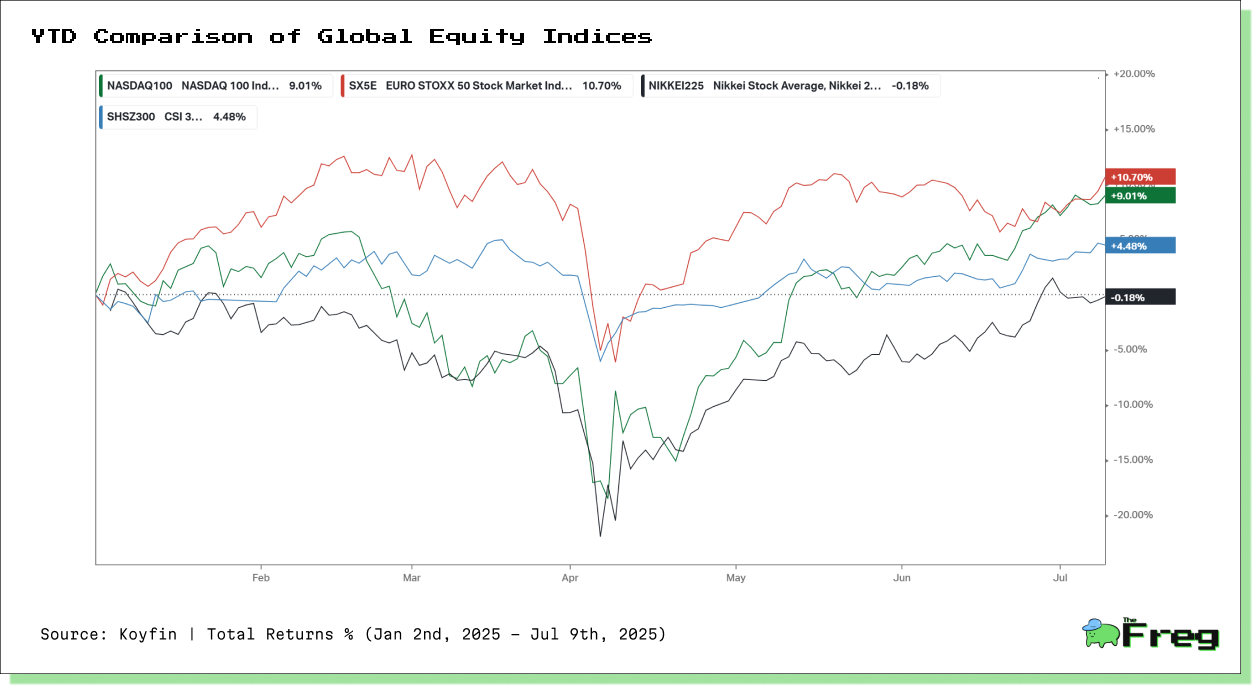

The U.S. stock market’s strong performance in 2025, led by the Nasdaq 100 with a +9.01% gain, remains competitive but not unmatched globally. The Euro Stoxx 50 has slightly outperformed with a +10.70% rise, driven by improving economic data and resilience in European corporate earnings. Meanwhile, China’s CSI 300 is up a more modest +4.48%, reflecting fragile investor sentiment and sluggish domestic recovery.

Japan’s Nikkei 225, however, has underperformed, slipping -0.18% as currency weakness and export concerns weigh on market confidence. The divergence captured in the graph highlights that while U.S. equities, particularly tech, continue to attract strong investor interest, leadership is more geographically dispersed than headlines suggest. For global investors, this creates both diversification opportunities and the need for selective positioning across regions.

The Risk of Market Concentration

Today's market rally is strikingly narrow. As of December 2024, the top 10 stocks account for nearly 40% of the S&P 500’s weight—a concentration surpassing that seen during the late 1990s tech bubble. The “Magnificent Seven” mega-cap tech giants now collectively outweigh the entire Russell 2000 index.

Barclays and JPMorgan have both flagged this concentration as a structural risk. Any stumble by one of these giants—particularly in AI execution—could trigger outsized market reactions, as seen when DeepSeek’s AI breakthrough briefly wiped $1 trillion from global tech valuations.

A Market at a Crossroads

The U.S. stock market in 2025 is a study in contrasts: record-breaking highs driven by the AI revolution stand alongside growing macroeconomic and geopolitical risks. Nvidia’s historic ascent has fuelled optimism, but challenges—from trade tensions and persistent inflation to extreme market concentration—underscore the fragility beneath the surface. Investors face a landscape where sentiment can shift rapidly, and past performance offers no guarantees. Recalibrating expectations, focusing on diversification, and building portfolio resilience will be essential. As markets transition from euphoria to uncertainty, prudent risk management and selective opportunities may define investment success in the years ahead.