US-China Trade Truce Sparks Capital Shift Concerns for India

A fragile U.S.-China trade truce has stirred optimism globally—but for India, it raises fears of capital flight. As investors eye China's rebound, Indian markets brace for a tactical, but possibly temporary, shift in FII sentiment.

The financial world was jolted by what seems like a rare moment of calm in global geopolitics: a 90-day tariff reduction agreement between the U.S. and China. While the détente brought short-term cheer to equity markets worldwide, it has cast a long shadow over emerging markets like India, where the sharp rally in equities now faces the threat of capital outflows.

At the heart of the worry lies the potential redirection of Foreign Institutional Investor (FII) flows from India to China. As relative valuations, policy pivots, and macroeconomic signals realign, India must brace for what could be more than a fleeting tactical shift.

Global Relief, Local Anxiety

Markets rejoiced after the Geneva talks led to a temporary truce in the U.S.-China trade war. Tariffs on both sides saw dramatic cuts—U.S. duties on Chinese goods dropped from 145% to 30%, and China reciprocated by slashing tariffs on U.S. imports from 125% to 10%, effective through August 12, 2025.

Wall Street responded immediately. S&P 500 futures spiked nearly 3%, and the tech-heavy Nasdaq surged 4%, underscoring investor optimism. However, this optimism comes with caveats. As JPMorgan Private Bank aptly noted, the truce is “a welcome respite, but not a cure-all.”

Despite the rollback of recent retaliatory tariffs, legacy Trump-era duties remain intact. That keeps average U.S. tariffs on Chinese goods hovering around 50%, meaning the structural distrust in U.S.-China trade relations is far from resolved.

The Capital Pivot: “Sell India, Buy China”?

The question haunting Indian markets: Will the détente trigger a “Sell India, Buy China” play among global investors?

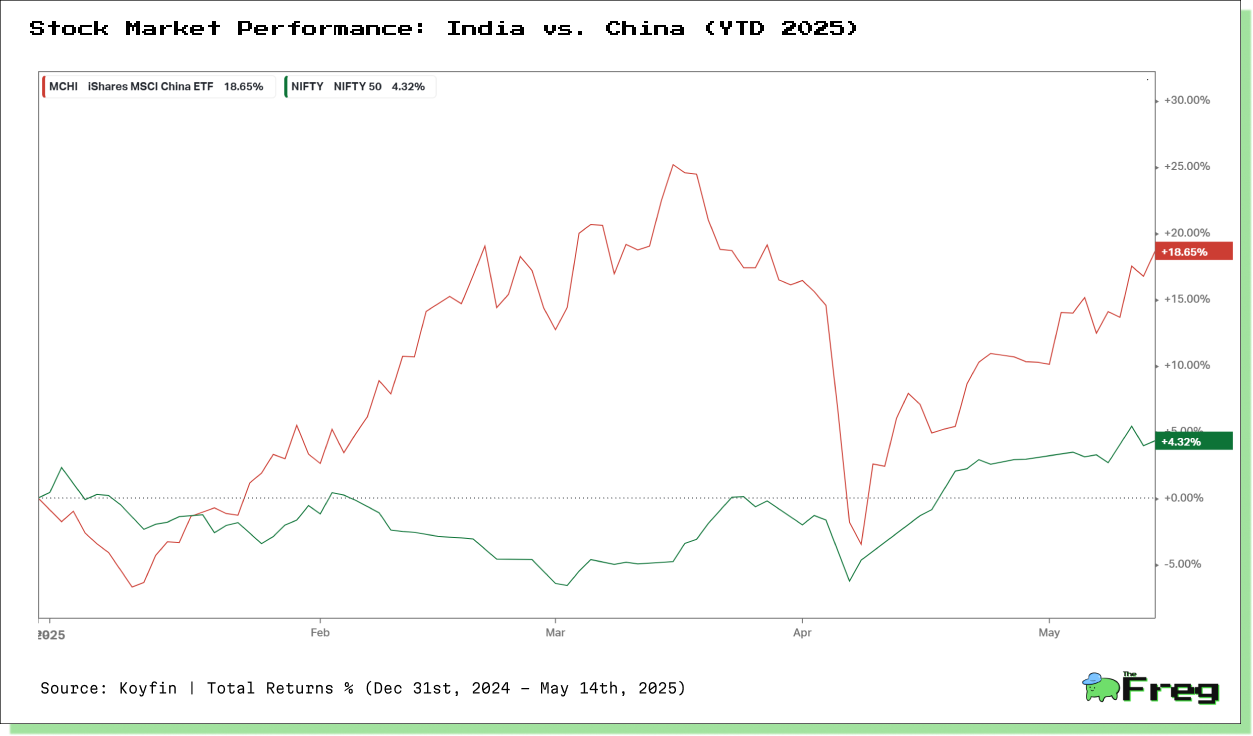

Since October 2024, India's market capitalization has dropped by about $1 trillion, while China's has swelled by $2 trillion. Chinese equities, buoyed by post-COVID stimulus and now boosted further by the tariff cut, offer compelling value. By contrast, Indian equities—trading at a premium—are starting to look expensive.

Comparative Market Performance

The realignment appears to be more than just sentiment-driven. Chinese authorities have pumped billions into high-tech and green sectors. Meanwhile, India’s approach remains measured—focused on structural reforms and fiscal prudence.

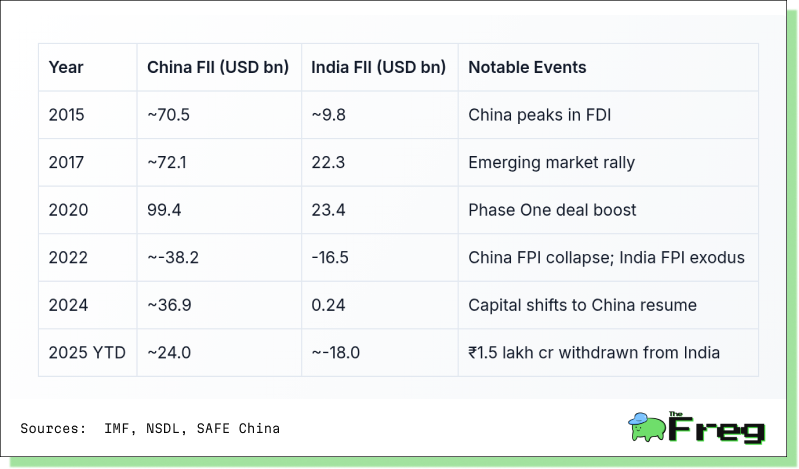

Historical Investment Patterns: A Familiar Playbook

The situation isn’t without precedent. In 2020, during the "Phase One" U.S.-China trade deal, foreign investors briefly poured into Chinese markets. FII flows to China rose 11.4% in the following quarter, while India saw temporary outflows.

Yet history also suggests these shifts are often short-lived. China’s chronic debt issues, regulatory unpredictability, and governance concerns have previously capped long-term foreign interest.

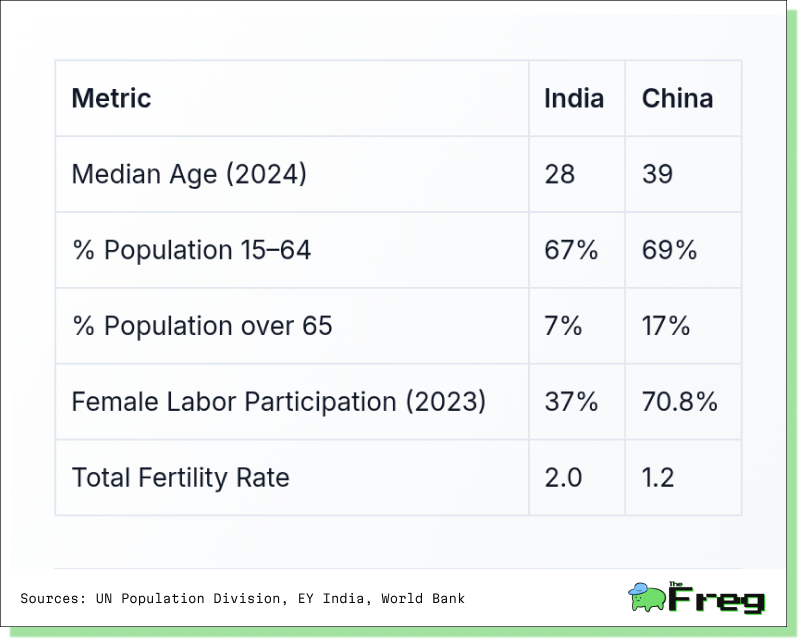

Structural Advantage: India’s Demographic Dividend

Despite the outflows, India retains powerful long-term tailwinds. Over 50% of its 1.4 billion people are under 25. The working-age population is expected to peak around 2041, providing a sustained labor force that China—already graying—can no longer match.

Demographic Comparison

India is also powering ahead on infrastructure and consumption. Consumer spending is projected to reach $4.3 trillion by 2030, up from $2.4 trillion in 2024.

Manufacturing and Valuation Vulnerabilities

While India has been the poster child of the “China+1” strategy, the new trade détente threatens that position. With tariffs easing, China regains some of its lost manufacturing appeal. India’s semiconductor ambitions and specialty chemicals boom now face headwinds.

Valuation-wise, Indian stocks are priced for perfection. The Nifty 50 trades at a 12-month forward P/E of 21.1x, slightly above the historical average. Sectors like IT and financials—popular with FIIs—are particularly vulnerable to reallocation toward cheaper Chinese alternatives.

FII Flow Trends: A Decade in Perspective

To contextualize the capital churn, here’s a decade-long look at FII flows into India and China:

The 2022 outperformance of India marked a high point in FII preference. But since late 2024, the tide has turned again.

Growth Fundamentals: The Long Game

Despite short-term capital outflows, India's economic trajectory remains intact. It’s expected to become the world’s fourth-largest economy by 2025, overtaking Japan.

Meanwhile, China's growth is projected to decelerate, with the IMF trimming 2025 forecasts to 4.5%. Deflationary pressures, a shrinking real estate sector, and strategic de-risking are dimming the outlook.

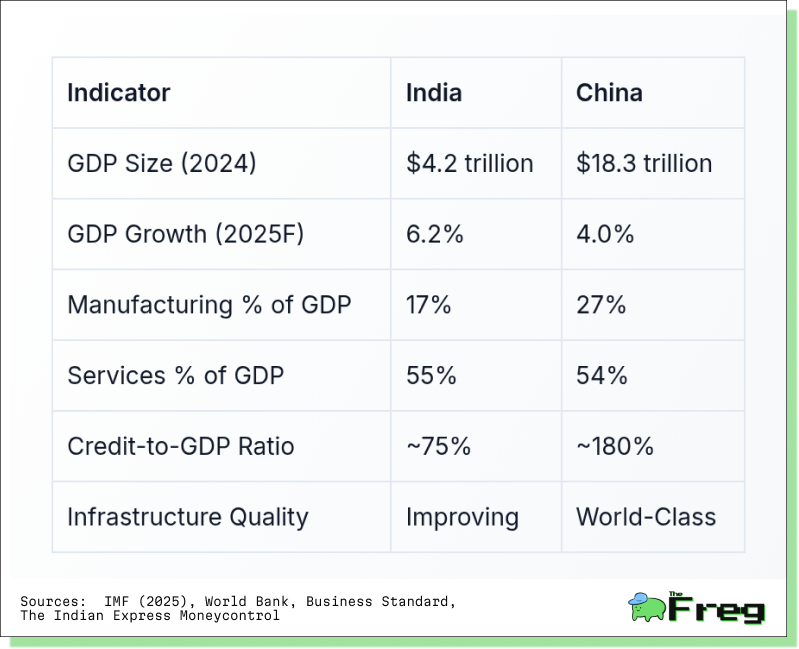

Economic Snapshot

India still lags China in per capita income and industrial capacity, but its consumption-led model and democratic institutions provide a differentiated development path.

India’s Long-Term Bet

The US-China trade truce may reshape near-term capital flows, but it doesn't rewrite the fundamental narratives. India remains a high-growth, youthful economy with increasing global relevance. While FIIs may rotate out of Indian equities tactically, long-term capital is likely to return once valuation froth cools and macro clarity improves.

China, on the other hand, continues to draw in capital—at least temporarily—thanks to aggressive policy support and a valuation reset. But persistent structural challenges make sustained FII commitment far from guaranteed.

For now, India's best defense against capital volatility lies in domestic institutional support, a resilient economy, and a long-term growth story that remains very much intact.