Urban India's Dining Revolution: From Tiffins to Tech-Driven Takeout

Urban India's dining habits have transformed—from home-cooked tiffins delivered by dabbawalas to instant meals via Swiggy and Zomato. This piece explores how tech, convenience, and changing lifestyles are reshaping food culture across cities.

Urban India is in the midst of a culinary upheaval. The traditional home-cooked thali is making way for restaurant deliveries, frozen meals, and instant snacks, as consumer preferences evolve with the times. According to a Deloitte-FICCI report, nearly 50% of urban food budgets are now spent on packaged foods, eating out, and deliveries—a striking shift for a country where food has long been synonymous with home.

This transformation, however, isn't just about convenience. It reflects broader structural and cultural shifts: rising incomes, busy lifestyles, the proliferation of nuclear families, increasing female workforce participation, and digital access. But behind this urban food metamorphosis is a deeper story that spans rural aspirations, sustainability movements, quick commerce, and a nation rediscovering its ancient grains.

The Shrinking Urban-Rural Divide

India’s consumption divide is narrowing. The Household Consumption Expenditure Survey (HCES) reports that the urban-rural consumption gap dropped to 70% in 2023-24, down from 84% in 2011-12. While rural incomes remain lower, their spending—especially on food—has increased substantially. Surprisingly, rural households now allocate 47.04% of their monthly budgets to food, up from previous years, with urban households at 39.68%.

But the big shift isn’t in how much people spend—it’s what they spend it on. Both rural and urban consumers are increasingly purchasing milk products, beverages, and processed foods, while traditional cereals continue to decline in importance.

Rise of the Ready-to-Eat Economy

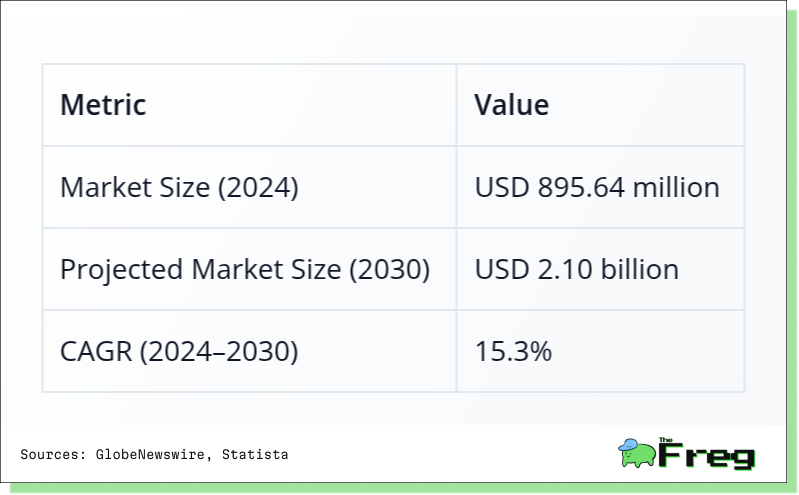

India's Ready-to-Eat (RTE) food segment is booming. In 2024, the RTE market was valued at USD 895.64 million and is projected to reach USD 2.10 billion by 2030, growing at a 15.3% CAGR.

Busy urbanites and professionals prefer frozen meals, instant mixes, and ready-to-cook kits. North India is leading this shift, combining strong infrastructure with a deep-rooted food culture. However, the market faces hurdles—concerns over preservatives, a weak cold chain, and consumer mistrust. Yet, with eCommerce and smartphone penetration increasing, the RTE eCommerce segment is forecasted to grow at 13.41% annually from 2025 to 2029.

Quick Commerce: Feeding India in 10 Minutes

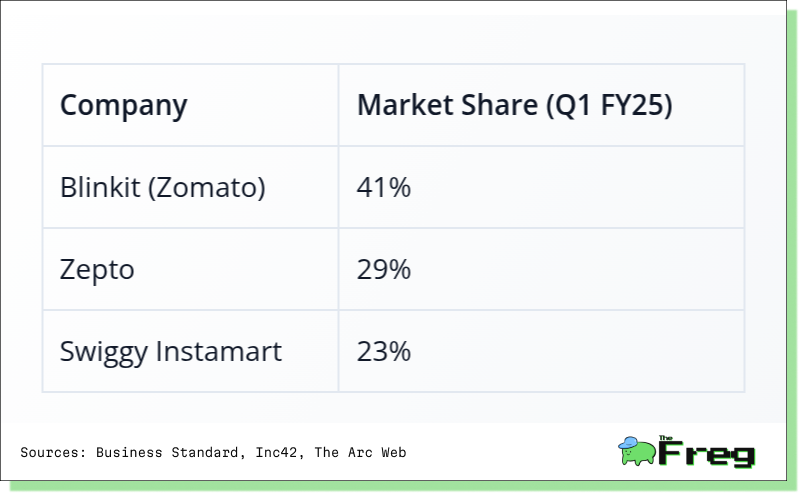

Quick commerce has become the new battleground for India’s food and grocery retailers. Blinkit, owned by Zomato, leads the space with a 41% market share, followed by Zepto and Swiggy Instamart.

The sector is growing at 40-100% YoY and is projected to hit $5-5.38 billion by 2025. However, profitability remains elusive. Zepto, for example, was burning ₹250 crore monthly in late 2024. While Blinkit has achieved EBITDA breakeven, most players are still prioritizing expansion and customer acquisition over profits.

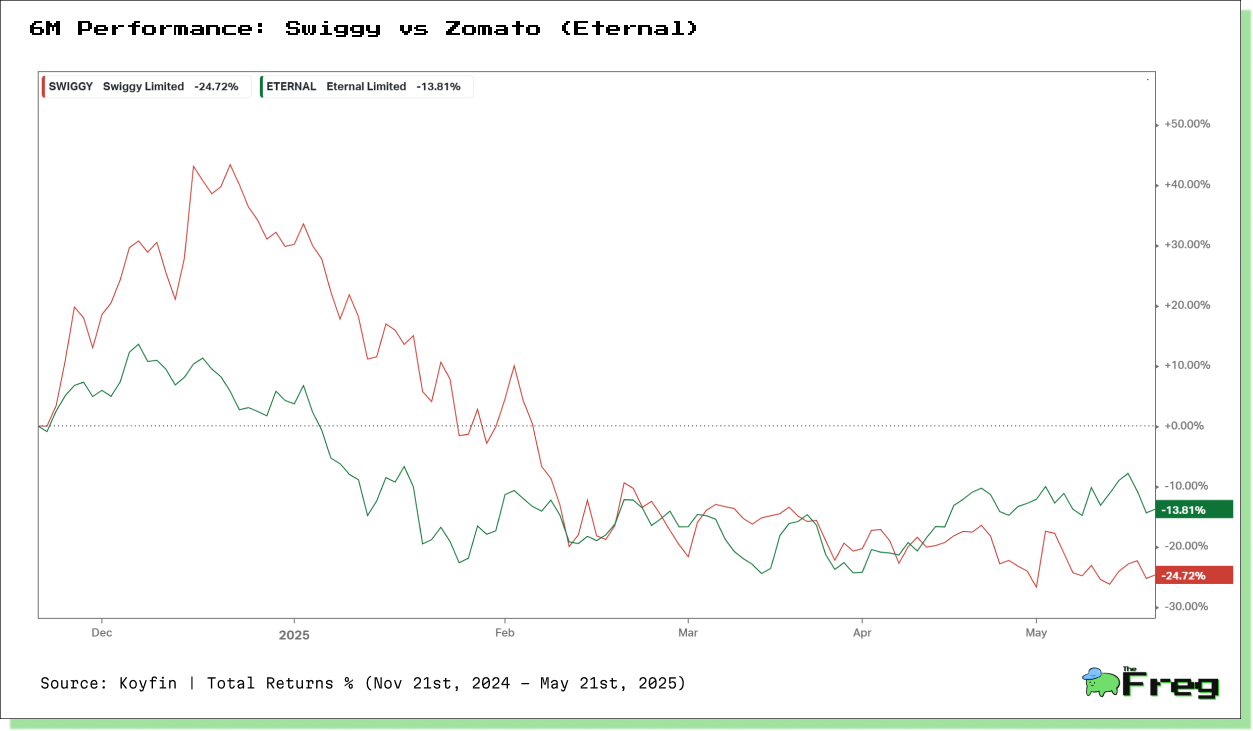

Zomato vs. Swiggy: The Food Delivery Face-Off

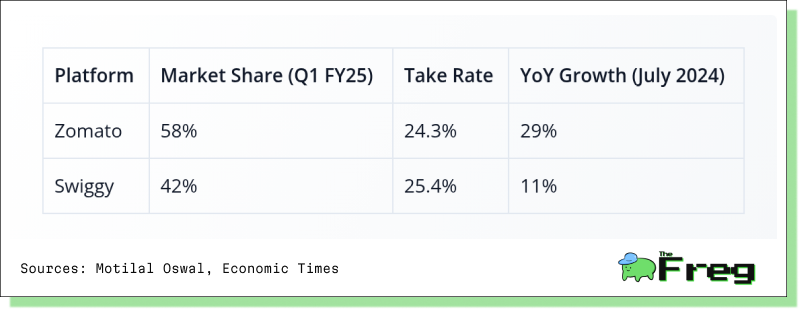

India's food delivery market is now largely a duopoly. Zomato holds 58% of the market, while Swiggy controls 42%, as of Q1 FY25.

Swiggy boasts a higher take rate and a “stickier” customer base thanks to its all-in-one app strategy, but Zomato has steadily grown its share over the last few years. Growth, however, is slowing, prompting both platforms to explore newer verticals like groceries and health food.

Millet: India’s Nutri-Cereal Renaissance

Parallel to the convenience food boom is the Millet Revival Movement, a return to traditional grains marginalized during the Green Revolution. Supported by government policies, NGO initiatives, and grassroots training, millets are regaining their place in Indian kitchens.

Millets are not only nutrient-rich, but also eco-friendly—requiring less water, no chemical inputs, and thriving in poor soils. Programs like the Odisha Millets Mission have boosted rural incomes and empowered women farmers. Millets are also being repositioned as superfoods, fitting perfectly into the health-conscious urban Indian's plate.

Urbanization and Digital Distribution

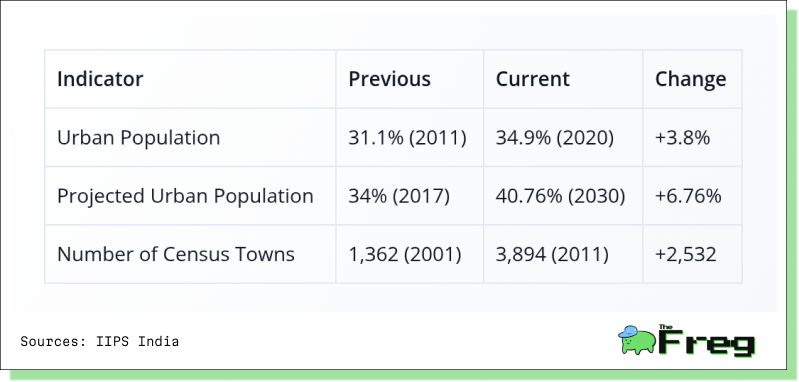

Only 34.9% of India’s population lived in urban areas in 2020, but urban influence far exceeds that figure. Urban households now spend ₹2,530 per capita per month on food, compared to ₹1,750 in rural areas.

Health Impacts and Industry Innovation

The convenience revolution comes with health trade-offs. Processed foods high in salt, sugar, and unhealthy fats are contributing to rising obesity and non-communicable diseases (NCDs), particularly among young, urban Indians. The number of bypass surgeries among people in their thirties has increased by 30% over the last decade.

Yet, there’s hope. Startups like Salad Days are gaining popularity, offering healthy, portion-controlled meals. The food industry is embracing menu engineering and AI-driven personalization to craft menus that are efficient, profitable, and health-friendly.

A Complex, Evolving Palate

Urban India’s dining revolution is not a monolith. It is a rich tapestry woven from threads of digital innovation, traditional food revivals, changing social norms, and economic mobility. From millet bowls in Mumbai to 10-minute grocery runs in Bengaluru, India’s food habits are diversifying like never before.

This transformation presents both a public health challenge and a business opportunity. As consumers, policymakers, and businesses adapt to this new normal, the question isn’t whether Indian food habits will continue to change—but how we can shape that change toward a healthier, more equitable,

and sustainable future.