Unilever vs. Hindustan Unilever: Divergent Engines in Global and Indian FMCG

Unilever PLC offers global stability with a diversified FMCG portfolio, while Hindustan Unilever excels in India with strong margins and market leadership. Both present distinct growth paths for investors.

Unilever PLC and its Indian subsidiary, Hindustan Unilever Limited (HUL), are both titans in the fast-moving consumer goods (FMCG) sector, yet they operate with distinct business models, market exposures, and financial profiles. Unilever’s global reach and diversified portfolio contrast with HUL’s deep penetration and brand strength in India. This analysis dissects their financials, business structures, and strategic outlooks, offering insights for investors seeking exposure to global versus emerging market consumer growth.

Sector & Market Landscape

- Global FMCG: Characterized by stable demand, high brand loyalty, and intense competition. Key players include Procter & Gamble, Nestlé, and Colgate-Palmolive.

- India FMCG: Rapidly evolving, driven by rising incomes, urbanization, and rural consumption. HUL leads the market, facing competition from ITC, Dabur, and Godrej Consumer.

Business Description & Scale

Unilever PLC

Unilever PLC is a British-Dutch multinational FMCG giant with operations in over 190 countries and a portfolio spanning food, home care, and personal care. Its global brands include Dove, Knorr, Magnum, Comfort, and Vaseline. Unilever’s strategy focuses on premiumization, sustainability, and innovation, supported by significant brand investments and operational efficiency.

In 2024, Unilever generated €60.8 billion in revenue, with 4.2% underlying sales growth and a 2.9% volume increase. Its turnover split is 42% from developed markets and 58% from emerging markets. The company continues reshaping its portfolio, exiting non-core food brands while acquiring scalable premium assets. A notable move is the planned 2025 demerger of its Ice Cream division to sharpen business focus.

Hindustan Unilever Limited (HUL)

HUL, Unilever’s Indian subsidiary, is the country’s largest FMCG player, reaching around 9 out of 10 Indian households with over 50 brands across home care, personal care, and foods. It leverages deep distribution, local consumer insights, and strong brand equity to maintain leadership.

In FY 2024-25, HUL reported ₹60,680 crore (€6.04 billion) in revenue and ₹10,644 crore (€1.06 billion) in net profit. Its growth strategy focuses on segmenting brands into Core, Future Core, and Market Makers to drive premiumization. HUL is also advancing in digital transformation, AI-driven manufacturing, supply chain agility, and sustainability. Its facilities, such as Doom Dooma, are recognized for technological and environmental excellence.

Unilever PLC and Hindustan Unilever Limited embody distinct yet complementary growth models within the FMCG sector. Unilever offers broad-based stability through global diversification, while HUL delivers high-margin growth by capitalizing on India’s expanding consumer market and premiumization trends. Unilever suits investors seeking global exposure with balanced risk, whereas HUL provides targeted access to India’s consumption-led growth.

Business Structure & Market Exposure

Unilever:

- Operates in 190+ countries, with no single market contributing more than 20% of sales.

- Diversified portfolio across categories and geographies.

- Resilient to regional shocks, but exposed to global macro headwinds and currency volatility.

HUL:

- Operates almost exclusively in India.

- Deep rural and urban reach, with a focus on local brands and consumer insights.

- Highly exposed to Indian economic cycles, rural demand, and regulatory changes.

Key Similarities & Differences

- Both leverage strong brands and innovation.

- Unilever’s risk is diversified globally; HUL’s risk is concentrated in India.

- HUL’s margins are higher, but Unilever’s scale and diversification offer stability.

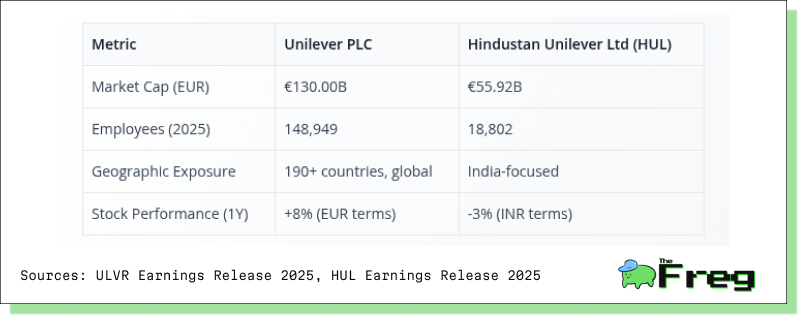

A direct comparison of Unilever PLC and Hindustan Unilever Ltd (HUL) through key quick facts highlights the scale, reach, and market dynamics that differentiate these two consumer goods giants.

- Market Capitalization: Unilever’s market cap of €130 billion is more than double that of HUL, reflecting its status as a global conglomerate with diversified revenue streams. HUL’s €55.92 billion valuation, while substantial, underscores its focus on the Indian market and its role as a regional powerhouse.

- Employees: The workforce disparity is stark: Unilever employs nearly 149,000 people worldwide, compared to HUL’s 18,800. This difference mirrors Unilever’s vast operational footprint and the complexity of managing a global supply chain versus HUL’s more concentrated, India-centric operations.

- Geographic Exposure: Unilever’s presence in over 190 countries provides significant diversification, reducing reliance on any single market and offering resilience against regional downturns. HUL, in contrast, is almost exclusively India-focused, making it highly sensitive to local economic cycles but also allowing for deep market penetration and brand loyalty.

Unilever’s global scale and diversification offer stability and broad-based growth, while HUL’s concentrated exposure to India provides high-margin opportunities but also greater sensitivity to local market dynamics. The quick facts table encapsulates these contrasts, helping investors quickly gauge the relative strengths and risk profiles of each company.

Stock Performance Comparison: Unilever PLC vs. Hindustan Unilever Ltd (HUL)

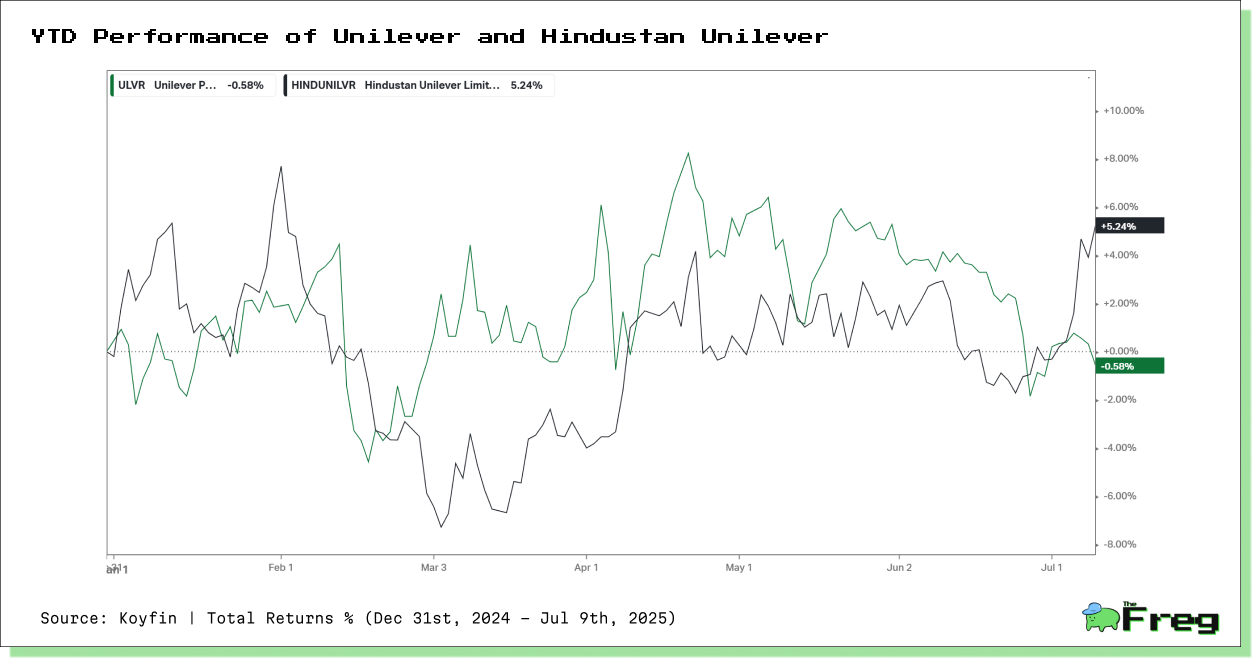

The graph above tracks the relative stock performance of Unilever PLC (ULVR) and Hindustan Unilever Ltd (HINDUNILVR) over the past year, offering a visual snapshot of how each company’s shares have fared in their respective markets.

Key Observations

- Divergent Trajectories: HUL’s stock (black line) outperformed Unilever PLC (green line) for most of the period, ending with a +5.24% gain versus Unilever’s -0.58% decline. This divergence is particularly notable given the broader challenges in the Indian FMCG sector, suggesting HUL’s resilience and strong brand equity in its home market.

- Volatility and Recovery: Both stocks experienced periods of volatility, but HUL’s share price showed sharper swings, especially in the first half of the year. Despite these fluctuations, HUL staged a strong recovery in the final months, while Unilever’s performance remained relatively flat to slightly negative.

- Market Sentiment Drivers: HUL’s late surge may reflect renewed optimism around rural demand, successful premiumization efforts, or positive quarterly results. In contrast, Unilever’s muted performance could be attributed to global macroeconomic headwinds, restructuring uncertainty, or currency impacts.

- Relative Outperformance: The outperformance of HUL over its parent company highlights the strength of its India-focused strategy and the market’s confidence in its ability to navigate local challenges. Unilever’s global diversification, while providing stability, did not translate into superior stock returns during this period.

Comparative Insights

- HUL’s stock delivered superior returns despite a challenging domestic environment, underscoring its operational agility and strong consumer franchise in India.

- Unilever PLC’s shares lagged, reflecting the impact of global uncertainties and perhaps investor caution around its ongoing restructuring and portfolio changes.

- The performance gap illustrates how local market dynamics and company-specific execution can drive significant differences in shareholder returns, even between a global parent and its leading subsidiary.

While Unilever offers global scale and diversification, HUL’s focused execution and deep market penetration in India have translated into better stock performance over the past year. This reinforces the view that, for investors seeking growth and resilience in emerging markets, HUL remains a compelling choice, whereas Unilever appeals to those prioritizing stability and global exposure.

Comparative Analysis: Unilever PLC vs. Hindustan Unilever Limited (HUL)

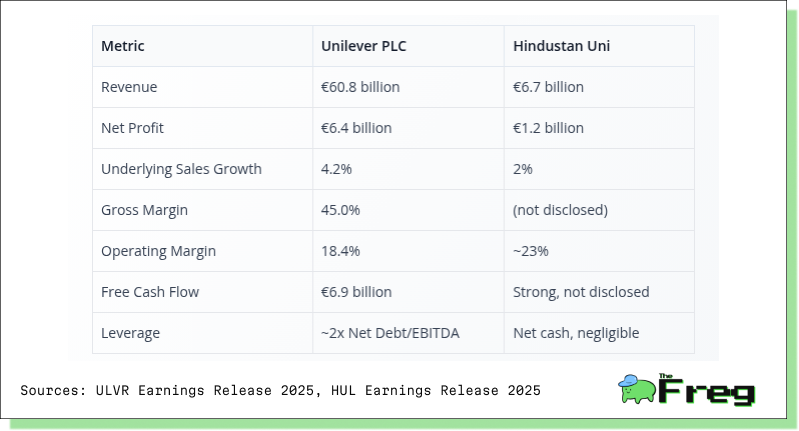

Scale and Revenue:

Unilever’s revenue is nearly nine times that of HUL, illustrating the difference between a global conglomerate and a market leader focused on a single, albeit large, emerging market.

Profitability:

While Unilever’s absolute profit is much larger, HUL’s operating margin is notably higher, reflecting its strong pricing power, brand equity, and operational efficiency in India. HUL’s ability to maintain high margins in a price-sensitive market is a testament to its local dominance and cost discipline.

Growth:

Unilever’s sales growth outpaces HUL’s, likely due to its exposure to a broader mix of developed and emerging markets, some of which are rebounding faster. HUL’s slower growth reflects the challenges in the Indian market, including rural demand softness and inflationary pressures.

Cash Flow and Leverage:

Unilever generates substantial free cash flow but carries moderate leverage, typical for a global player funding acquisitions and shareholder returns. HUL, in contrast, operates with virtually no debt, reflecting a conservative balance sheet and strong cash generation—an attractive trait for risk-averse investors.

Unilever offers global diversification, scale, and steady growth, making it attractive for investors seeking stability and exposure to both developed and emerging markets. HUL, while smaller, delivers industry-leading margins and a fortress balance sheet, appealing to those bullish on India’s consumption story and seeking high-quality, low-leverage exposure. Both companies are financially robust, but their profiles suit different investor preferences and risk appetites.

Segmental Revenue Mix: Comparative Analysis

A close look at the segmental revenue mix of Unilever PLC and Hindustan Unilever Limited (HUL) reveals both strategic alignment and notable differences shaped by their respective market footprints.

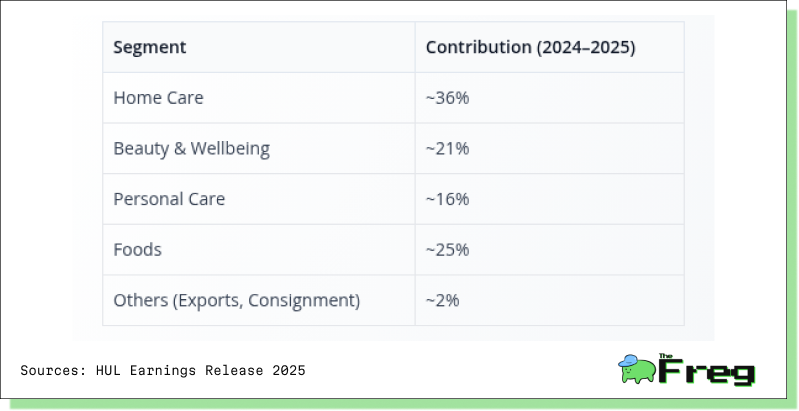

Key Business Segments & Revenue Mix Hindustan Unilever Limited (HUL)

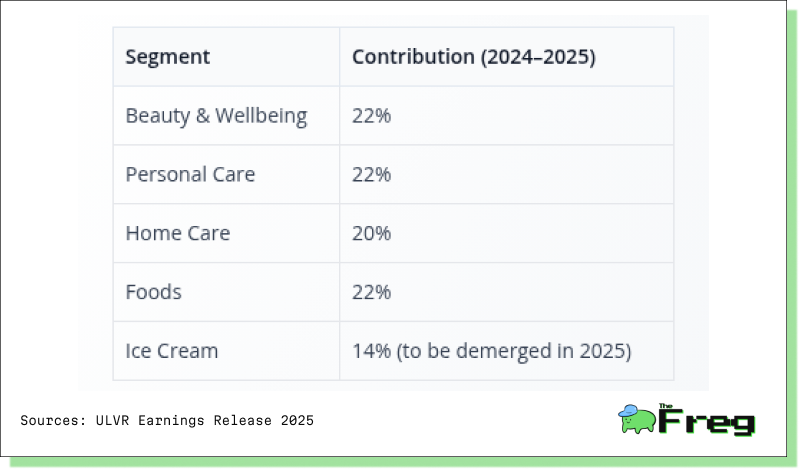

Key Business Segments & Revenue Mix Unilever PLC

HUL’s revenue is anchored by Home Care (36%) and Foods (25%), reflecting the company’s deep penetration into essential categories for Indian households. The prominence of Home Care underscores HUL’s strength in products like detergents and cleaning agents, which are staples in the Indian market. Foods, at a quarter of revenue, highlights the growing importance of nutrition and packaged foods in India’s consumption basket. Beauty & Wellbeing (21%) and Personal Care (16%) are also significant, but together they form a smaller share than in Unilever’s global mix.

Unilever PLC, by contrast, displays a more balanced portfolio: Beauty & Wellbeing, Personal Care, Home Care, and Foods each contribute roughly 20–22% of revenue, demonstrating the company’s global diversification and risk mitigation across categories. The Ice Cream segment, at 14%, is a unique global play and is set for a demerger, signalling Unilever’s intent to sharpen its focus on core segments.

Key Takeaways:

- HUL’s mix is more concentrated in Home Care and Foods, mirroring Indian consumer priorities and the company’s local leadership.

- Unilever’s even distribution across segments provides resilience and flexibility, with less reliance on any single category.

- The upcoming Ice Cream demerger at Unilever will further align its segmental focus with HUL’s, emphasizing core growth areas.

This comparison highlights how HUL’s segmental strengths are tailored to India’s market dynamics, while Unilever’s global spread offers stability and diversified growth.

Strategic Outlook & Growth Drivers

Unilever:

- Restructuring for agility and focus (e.g., Ice Cream demerger).

- Premiumization of brands and portfolio.

- Strong ESG and sustainability agenda.

- Investment in AI and digital transformation for supply chain and marketing3452.

HUL:

- Focus on rural growth and premiumization.

- Digital push via eB2B platforms and data-driven marketing.

- Portfolio transformation with acquisitions (e.g., Minimalist) and divestments (e.g., Pureit).

- Channel expansion into modern trade and e-commerce.

Risks & Challenges

Unilever:

- Global macroeconomic headwinds (inflation, currency).

- Execution risk in restructuring and portfolio transformation.

- Geopolitical and regulatory risks in emerging markets351.

HUL:

- Sluggish rural demand and inflationary pressures.

- Rising competition from local and global FMCG players.

- Regulatory and tax changes in India.

Unilever PLC and Hindustan Unilever Limited (HUL) represent two distinct but powerful engines of consumer growth—one with a global footprint, the other deeply rooted in one of the world’s fastest-growing markets.

Unilever’s strength lies in its vast diversification across categories and geographies, offering investors stability, steady cash flows, and broad exposure to both mature and emerging economies. It is a play on resilience, scale, and long-term transformation, particularly as it sharpens its portfolio with strategic exits and premium brand acquisitions.

HUL, by contrast, is a high-margin, high-growth specialist—a focused bet on India’s consumption boom, urbanization, and rising middle class. Its deep distribution reach, brand loyalty, and operational efficiency give it pricing power rarely seen in such a competitive landscape. While its concentrated exposure to India brings higher market sensitivity, it also positions HUL to capture outsized gains from the country’s accelerating economic expansion.