Trump’s Tariffs and the Dollar: A Counterintuitive Slide

Trump’s tariffs have triggered a surprising dollar decline, raising recession fears and complicating the Fed’s response to economic uncertainty.

The impact of President Trump's tariffs on the U.S. dollar has been counterintuitive, with the currency experiencing a significant decline rather than the expected appreciation. Theoretically, tariffs should strengthen the dollar by reducing demand for foreign currencies. However, the U.S. Dollar Index has fallen below 102.00, marking a nearly 1.80% correction.

Several factors contribute to this unexpected decline:

- Investors are adopting a risk-averse stance, anticipating slower global economic growth.

- The tariffs have sparked fears of a potential U.S. recession, diminishing the dollar's appeal as a safe-haven currency.

- Market participants are reevaluating the likelihood of interest rate cuts by the Federal Reserve in response to economic uncertainties.

- The unpredictability of the current trade regime may be dampening the usual currency effects associated with tariffs.

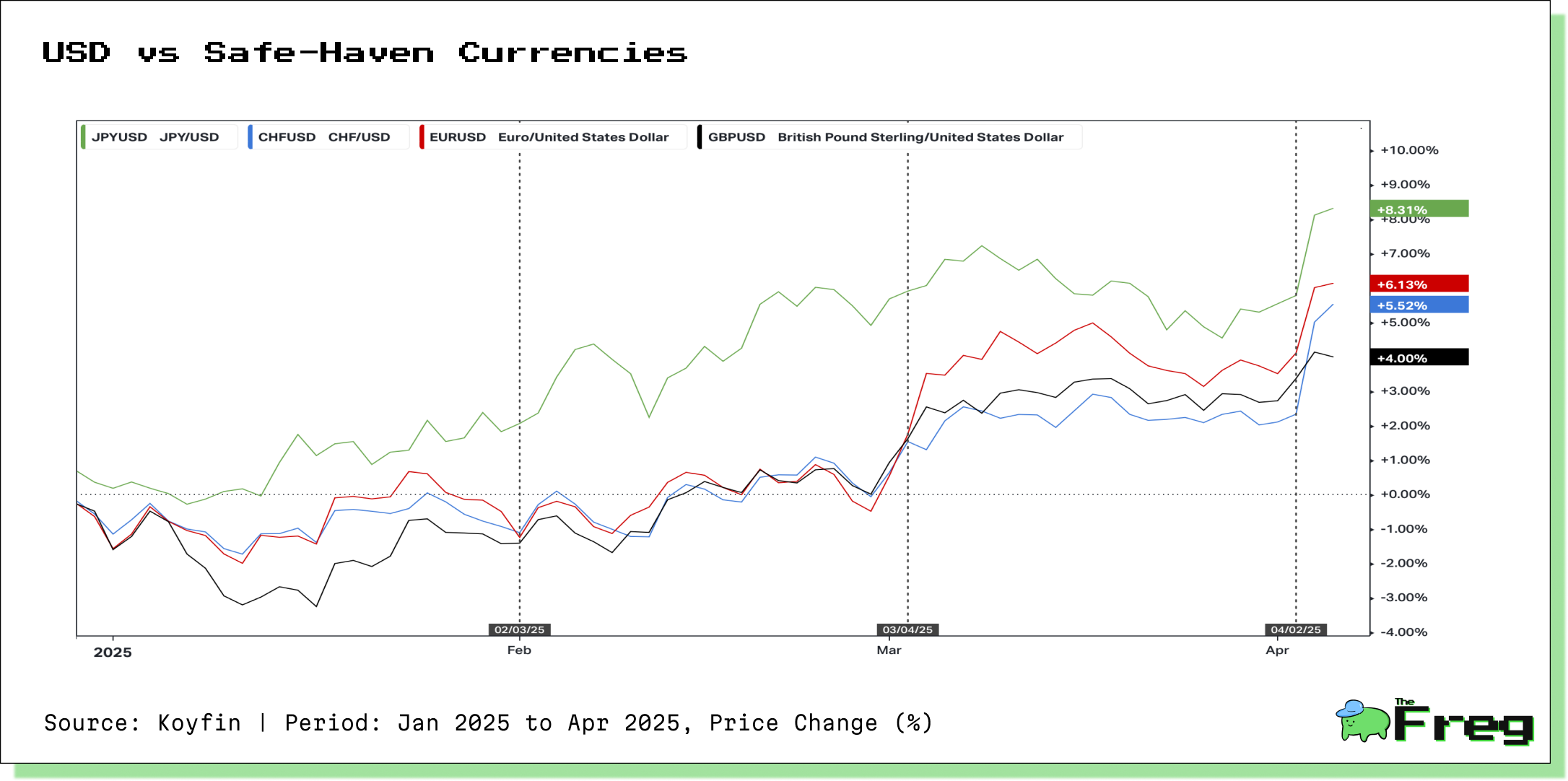

As a result, investors are shifting towards traditional safe-haven assets like the Japanese yen and Swiss franc, raising doubts about the dollar's status as the primary safe-haven currency.

Federal Reserve Policy Considerations

The Federal Reserve faces a complex policy landscape following President Trump's tariff announcement and the subsequent currency fluctuations. The Fed is now balancing the need to combat potential inflation while supporting economic growth.

Key considerations in the Fed's policy outlook include:

- Traders now anticipate four quarter-percentage-point rate cuts this year, with the first reduction expected in June.

- The Fed may need to be highly responsive to rapidly changing economic conditions, complicating its ability to act preemptively.

- If inflation rises due to tariffs, the Fed might find it challenging to provide monetary support for growth, possibly preventing rate cuts altogether.

- Some analysts suggest the Fed could maintain its current 4.25%-4.50% rate range if the economy remains strong and inflation does not decrease.

- The Fed's decision-making process will likely be influenced by the duration of the tariffs and their impact on long-term corporate spending and economic growth.

Despite these challenges, Fed officials have recently emphasized their intention to keep rates steady while assessing the full impact of new trade policies. Their response will ultimately depend on how tariffs affect inflation, employment, and overall economic stability in the coming months.

Currency Market Trends

Since the start of the year, the Dollar Index has dropped 4.2%, marking its

largest decline for this period since 2008. This weakening trend reflects growing concerns about the U.S. economy's vulnerability to trade tensions and potential retaliation from affected countries.

Key currency trends emerging from recession fears include:

- The euro has strengthened against the dollar, rising to $1.1145.

- Safe-haven currencies like the Japanese yen and Swiss franc have gained favor among investors.

- The British pound has maintained an upward trend against the dollar since early 2025.

- Gold prices have surged to record highs above $3,160 per troy ounce, reflecting a flight to safety.

These movements indicate that the market perceives the U.S. economy as more susceptible to negative impacts from tariffs than other major economies, raising concerns about a potential recession in the second or third quarter of 2025.

Investor Sentiment and Market Positioning

Investor sentiment has shifted dramatically in response to recent trade policy changes. Many investors are adopting a cautious stance amid heightened economic uncertainty. The implementation of new tariffs has led to widespread confusion among currency traders, causing a significant reduction in long dollar positions. This shift reflects growing concerns about the potential economic repercussions of protectionist policies.

Key factors influencing investor sentiment include:

- Fears of eroding business and consumer confidence due to protectionist trade policies.

- An increased likelihood of a U.S. recession, with Goldman Sachs raising the probability to 35% within the next year.

- Uncertainty about future cost pressures, affecting companies' spending and hiring decisions.

- Concerns about reduced demand for U.S. goods in international markets, impacting S&P 500 firms that derive over 40% of their revenues from outside the U.S.

As a result, investors are seeking assets that can withstand potential recession and higher inflation, such as precious metals, large value stocks, and defensive dividend-paying companies.

The Broader Economic Picture

Before Trump's tariff announcement, investors had expected the dollar to rise on the news. As The Wall Street Journal points out, tariffs are supposed to reduce demand for imports. In the U.S., this would typically mean businesses need fewer foreign currencies to buy goods, leading to a lower supply of dollars on the currency market and a subsequent rise in value.

However, the magnitude of these tariffs has altered the equation. Market fears of a recession have spooked investors to such an extent that pessimism is now driving the dollar downward instead of upward. This reaction underscores the complex and unpredictable nature of the current economic climate, where traditional market expectations are being upended by policy uncertainties and shifting investor behavior.