The Return of the Magnificent Seven: How Tech Titans Reshaped the Markets in May 2025

In May 2025, the S&P 500’s gains were largely driven by mega-cap tech stocks, with Nvidia, Microsoft, and Meta leading the charge. However, Apple’s decline offset some momentum, highlighting a narrow market rally dominated by AI optimism.

May 2025 marked a historic month for U.S. equities, driven by the dramatic resurgence of the so-called Magnificent Seven—Alphabet, Apple, Amazon, Meta, Microsoft, Nvidia, and Tesla. These tech titans collectively powered the S&P 500 to its strongest May performance since 1990, overshadowing geopolitical turbulence and valuation worries.

Tech’s Reign Over the S&P 500

The S&P 500 rallied 6.2% in May, its best single-month showing since November 2023. Leading the charge were the Nasdaq Composite (+9.6%) and the Dow Jones Industrial Average (+3.9%), underscoring the depth of the rally across indices.

This momentum came despite rising jobless claims, manufacturing contraction, and renewed U.S.-China trade tensions. President Trump’s accusations of trade violations and reports of tighter tech export controls didn’t deter investor confidence, largely due to optimism around AI innovation and robust corporate earnings.

Alphabet Tops the Index Hierarchy

Alphabet emerged as the S&P 500’s heaviest component in 2025, with a combined weighting of 8.42% when accounting for both Class A and Class C shares. This leapfrogged Microsoft (6.19%) and Apple (5.42%), highlighting the company’s dominance in digital advertising and its aggressive AI expansion.

This growing top-heaviness in the index is noteworthy: the ten largest S&P 500 firms now make up nearly 40% of its total market capitalization—up from 35% just a few months earlier. Alphabet’s ascent epitomizes how tech giants now shape both market direction and investor returns.

Nvidia’s AI-Driven Surge

After a tepid start to the year, Nvidia came roaring back in May with a 30% monthly gain, pushing its market cap to $3.3 trillion, second only to Apple. This rebound was powered by staggering Q1 results: $44.1 billion in revenue (up 69% YoY) and $39.1 billion from data center sales alone (up 73%).

Despite losing $4.5 billion in Q1 due to U.S. export restrictions to China, Nvidia’s aggressive push into sovereign AI solutions and quantum computing (via its new Blackwell Ultra GPUs) reignited investor confidence. Analysts now forecast a potential $4 trillion valuation by year-end.

Microsoft and Meta’s Stellar Quarter

Microsoft and Meta both exceeded Wall Street expectations with strong earnings in early May, fueling broader tech momentum.

- Microsoft posted $70.1 billion in revenue (+13% YoY), with Azure cloud revenue up 35%, thanks to AI services contributing 16 percentage points.

- Meta reported $42.31 billion in revenue (+16%) and earnings per share of $6.43, comfortably beating projections.

These upbeat results sent Microsoft shares up 7.6% and Meta up 4.2%, playing a key role in the S&P 500’s continued rally.

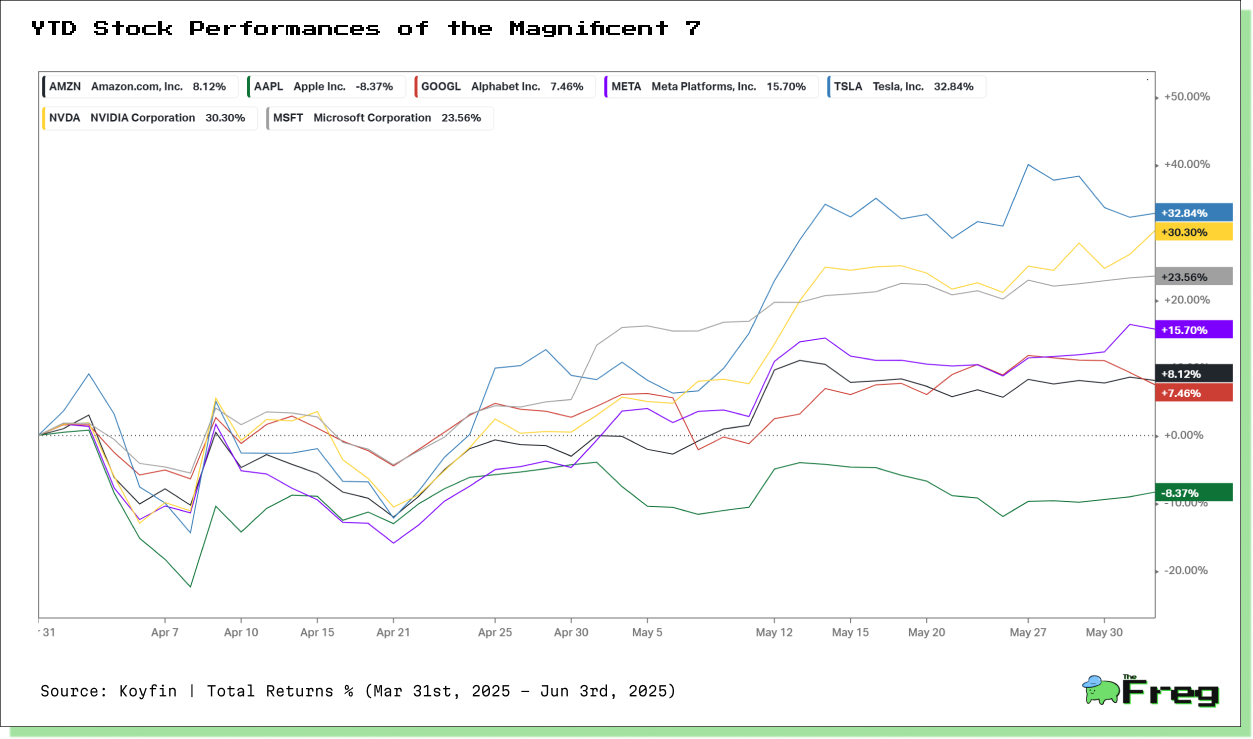

Performance at a Glance

Mega-cap tech stocks were the primary engines of the S&P 500's surge. Nvidia alone contributed 3.24 percentage points to the index's return, with Tesla, Meta, and Microsoft following close behind. Apple was the lone drag, slipping 5.36% for the month.

AI Mania: Nvidia Leads the Pack

Nvidia once again stole the spotlight with a 24% surge in May, fueled by blockbuster earnings and skyrocketing demand for its AI chips. The company now accounts for over 6% of the S&P 500 and contributed nearly 3.24 percentage points to the index’s monthly gains. The AI boom has become the defining theme of 2024 and 2025, with Nvidia positioned at the center of the hardware revolution.

Microsoft and Meta also benefited from the AI narrative, rising 16.7% and 17.9% respectively. Microsoft’s growing Azure AI footprint and Meta’s aggressive infrastructure investments reinforced their roles in the evolving AI arms race.

Tesla, Amazon, and Alphabet Join the Rally

Tesla’s stock jumped 32.8% as optimism returned to the EV space after several months of underperformance. CEO Elon Musk’s announcements around upcoming models and Full Self-Driving (FSD) developments reinvigorated retail and institutional interest.

Amazon rose 11.2%, buoyed by strong AWS growth and renewed strength in advertising. Alphabet followed with an 8.2% gain, helped by stability in search and early enthusiasm for its Gemini AI platform, despite playing catch-up to rivals in the generative AI space.

Apple Lags Behind

Apple stood out for the wrong reasons in May. The stock declined 5.4% as investors weighed reports of weaker iPhone demand in China and growing competition from Huawei. Regulatory scrutiny and a lack of major product catalysts have left Apple trailing its peers in the 2025 tech rally.

Macro Backdrop: Mixed but Manageable

Despite sticky inflation prints and ongoing speculation around Fed policy, investors appeared willing to look through near-term volatility. The PCE index rose 2.7% year-over-year in April, unchanged from March, but core inflation remained stubborn. Fed officials maintained a cautious tone, emphasizing the need for sustained disinflation before considering rate cuts.

Labor market data was resilient, and Q1 GDP growth was revised slightly downward, but not enough to derail equity sentiment. Bond yields stayed elevated, with the 10-year Treasury hovering near 4.5%, but the equity market chose to focus on corporate earnings and innovation.

Outlook: Concentration Risks or Earnings Power?

The May rally has once again sparked debates about market concentration. The top seven tech names now account for over 35% of the S&P 500’s market cap. While critics warn of fragility, others argue that earnings strength justifies the dominance—especially with Nvidia and Microsoft delivering outsized profitability.

With rate cuts unlikely before Q4, market momentum remains tethered to big tech's ability to sustain growth. June will test whether breadth can improve or if the market remains dependent on the same heavyweights.