The Great Global Rotation: Why 2025 Is the Year of International Equities

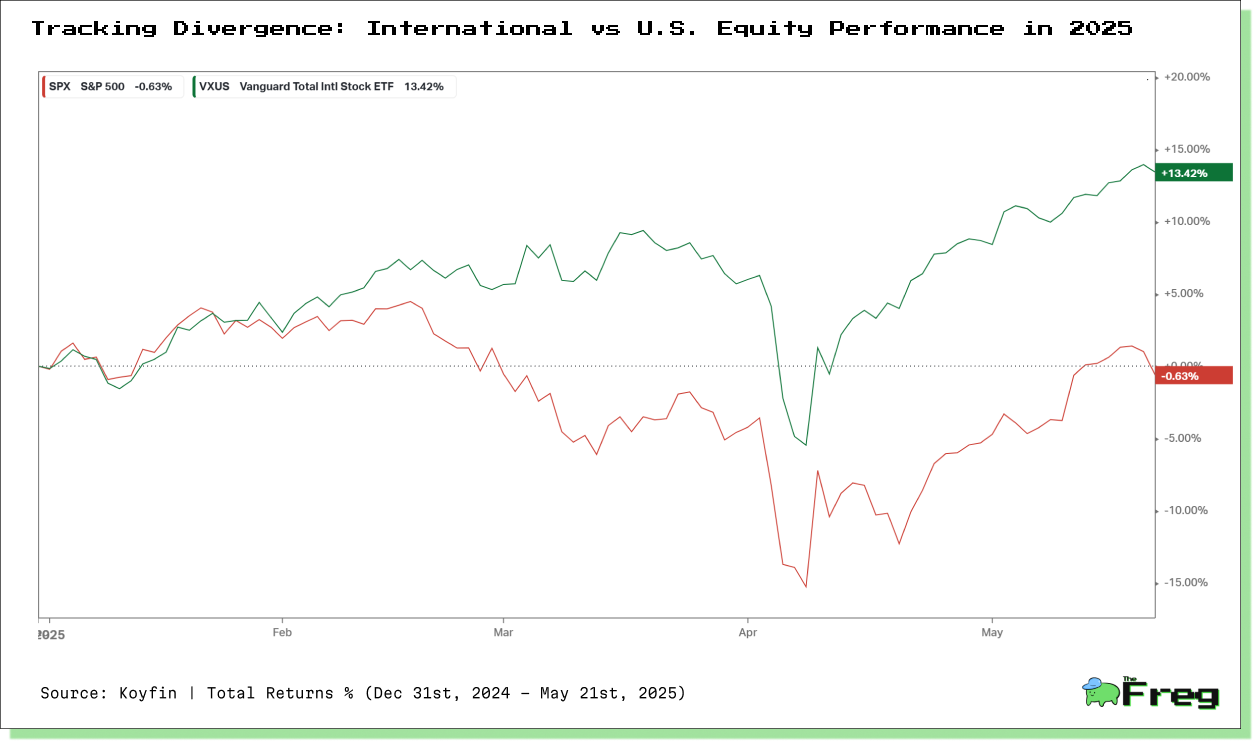

We compare the year-to-date performance of U.S. equities (S&P 500) and international markets (VXUS), analyzing the divergence in returns, underlying drivers, and what it means for global portfolio allocation.

In 2025, a remarkable shift is unfolding in global markets—U.S. investors are moving en masse toward international equities, reversing over a decade of American stock dominance. As of mid-May, international stocks have outperformed U.S. equities by an eye-catching margin, and the divergence is not just historical—it's strategic.

A Reversal Decades in the Making

After years of U.S. equity outperformance—where the S&P 500 delivered an average annual return of 13.8% over the past decade versus just 4.9% for global stocks—international markets have roared back to life. Through April 2025, non-U.S. equities have beaten their American counterparts by over 10%, marking the seventh-largest outperformance gap in 50 years. As of mid-May, the Vanguard Total International Stock ETF (VXUS) posted a 13.42% YTD return, while the S&P 500 declined by 0.63% as of 21st May, 2025, producing a historic 12-point performance gap.

What's Driving the Rotation?

The global rotation isn't rooted in a single factor—it’s the product of policy divergence, economic stimulus, valuation differentials, and shifting investor sentiment.

Valuation Gaps and Earnings Upside

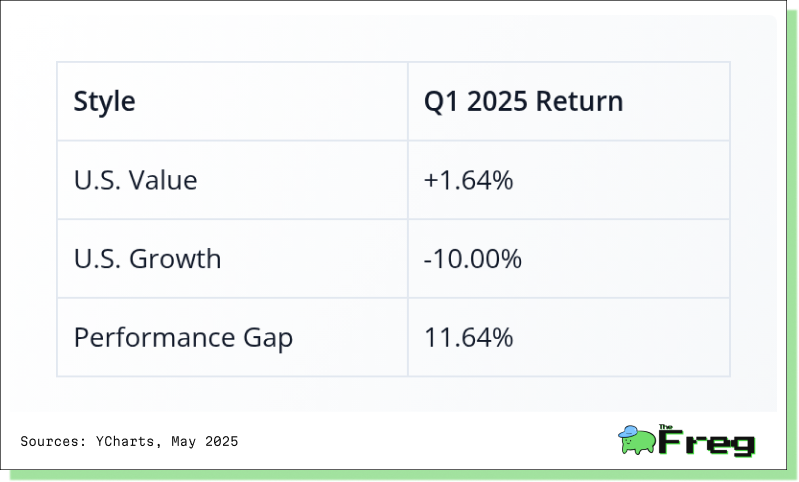

International stocks, particularly in Europe and Asia, are trading at compelling discounts relative to U.S. markets. Value stocks, a dominant force in these regions, are currently priced at their lowest levels relative to growth stocks since the 1990s. While U.S. growth stocks have returned 907% over the last 15 years, value stocks lag with 363%. Yet in Q1 2025, U.S. Value outperformed Growth by 11.64%, signaling a potentially durable shift in investor preference.

Policy Divergence and Currency Tailwinds

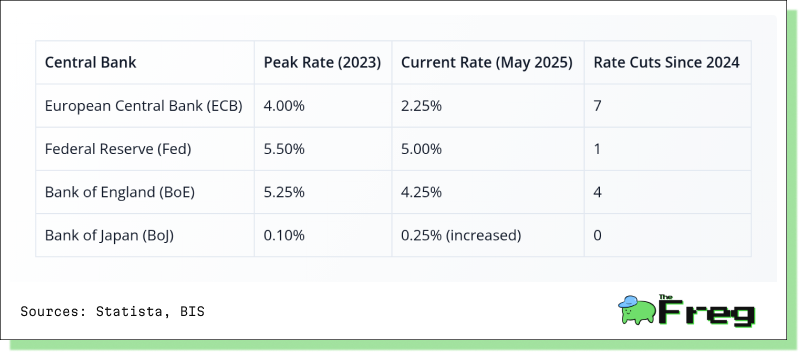

While the European Central Bank (ECB) has cut rates seven times since 2024, bringing its benchmark down to 2.25%, the Federal Reserve remains cautious, executing only a single rate cut as it battles inflation linked to new trade tariffs.

A weakening U.S. dollar has further amplified gains for dollar-based investors in international markets, making foreign stocks even more attractive.

Europe’s Stimulus-Fueled Surge

Europe’s momentum has been fueled by a rare fiscal awakening. Germany's €1 trillion stimulus for infrastructure and defense has ended decades of austerity, injecting optimism into the eurozone. Combined with falling inflation—nearing the ECB’s 2% target—and easing policies, markets are responding favorably.

Growth in the euro area remains modest at 0.9% in 2025 but is expected to accelerate to 1.5% by 2027, thanks to Germany becoming the region’s largest bond issuer. This has supported European equity markets, which are now outperforming the U.S. despite a lower growth base.

Japan's Corporate Renaissance

Another standout in 2025 is Japan. The Tokyo Stock Exchange's 2023 reforms to improve corporate governance—pushing companies to lift price-to-book ratios—have transformed the market. In 2023 alone, Japanese companies announced a record ¥9.6 trillion ($65 billion) in share buybacks. Warren Buffett’s growing stakes in Japanese trading firms have only validated the turnaround, prompting a wave of foreign inflows.

These reforms have reduced cross-shareholdings, improved transparency, and boosted shareholder returns. Japan’s rise is not just a bounce—it’s a structural shift that’s rewiring how investors view its equity markets.

ETF Inflows Reflect the Global Mood

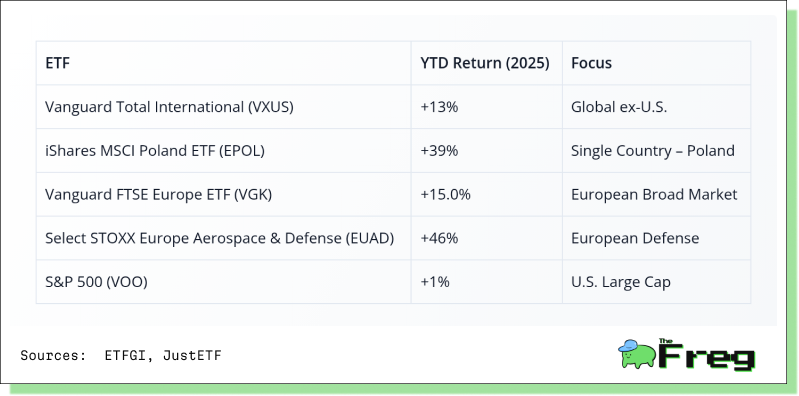

The ETF market offers a revealing look at investor sentiment. The Vanguard Total International Stock ETF (VXUS) pulled in substantial new capital, while niche strategies such as European defense and Polish equities posted some of the year’s strongest returns.

A Strategic Crossroads for Investors

This isn’t just a short-term rebound—it’s potentially the beginning of a multi-year rebalancing. U.S. equities are facing headwinds from tariffs, sticky inflation, and political uncertainty. President Trump’s return to aggressive trade policies and fiscal austerity has clouded growth expectations. Meanwhile, Europe and Asia, though not without challenges, are benefiting from synchronized fiscal expansion, monetary easing, and improving fundamentals.

With the Nasdaq down 7.3% in Q1 and international sectors like industrials, energy, and financials rising, the rotation also reflects a deeper sectoral realignment. Growth-heavy U.S. indices are giving way to value-driven global indices—forcing investors to rethink traditional allocations.

Final Thought

The global equity landscape is undergoing a tectonic shift in 2025. For investors, the message is clear: diversification is no longer optional—it's essential. International markets are no longer the laggards of the past decade; they are emerging as resilient, dynamic, and increasingly central to global portfolios. As the “Sell America” narrative gains traction, now may be the time to look beyond U.S. borders.