The Global Shipbuilding Boom: Green Ambitions, Geopolitics, and Market Surges

A global shipbuilding renaissance is underway, fueled by green tech, geopolitical rivalries, and market demand.

The global shipbuilding industry is undergoing a striking renaissance. Valued between $160 billion and $221 billion in 2025, the sector is experiencing unprecedented growth, driven by a combination of global trade expansion, green technology mandates, and shifting geopolitical priorities. Once considered a cyclical laggard, shipbuilding is now at the nexus of environmental policy, national security, and international commerce.

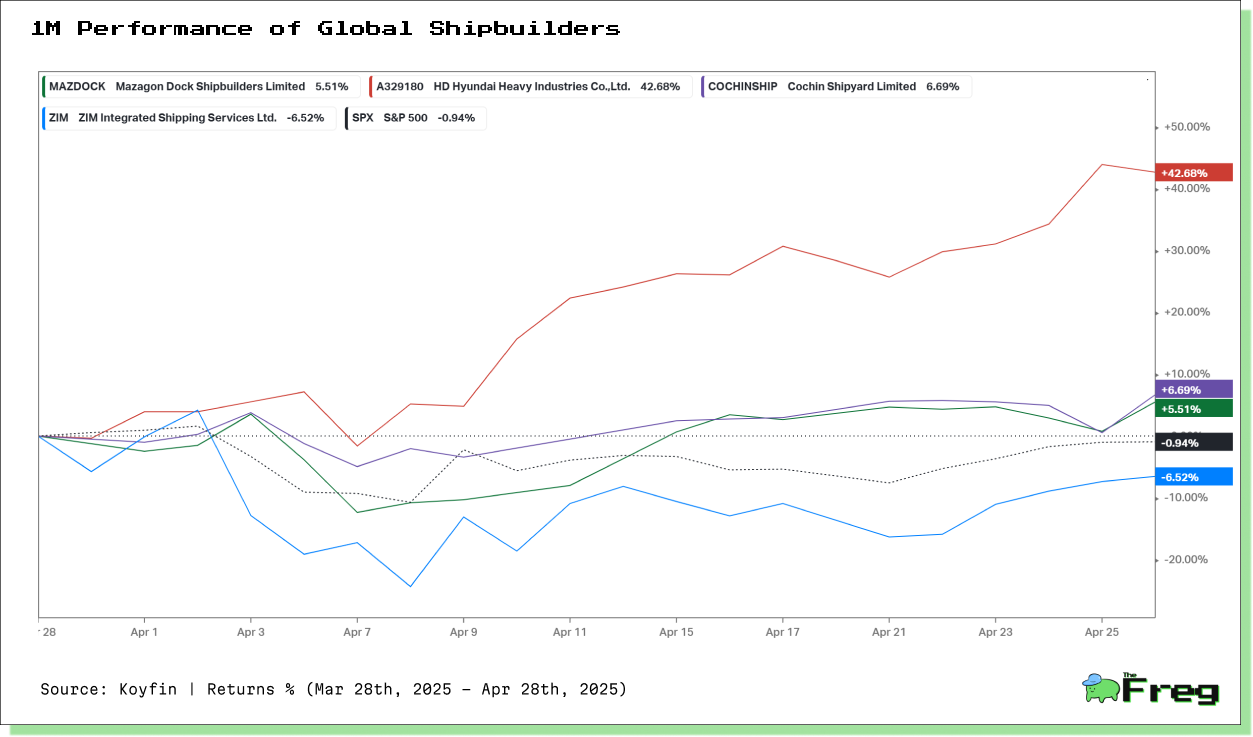

Performance of Global Shipbuilding and Shipping Leaders

The shipbuilding world is going green fast. With the International Maritime Organization (IMO) targeting a 50% cut in shipping emissions by 2050, the adoption of eco-friendly propulsion systems and fuels has become a priority. The global green shipping technologies market is expected to surge from $22.31 billion in 2024 to $140.74 billion by 2032, growing at a staggering CAGR of 25.89%.

Leading green innovations include:

- Alternative fuels: LNG, hydrogen, ammonia, and biofuels

- Hybrid propulsion: Electric motors supplementing traditional engines, cutting emissions by up to 20%

- Wind-assisted propulsion: Kite-Sail and Rig-Sail systems

- Energy-efficient hull designs: Reducing drag and optimizing fuel use

- Smart navigation systems: Real-time route optimization for emissions reduction

The marine parallel hybrid propulsion segment alone is projected to grow at an 8.33% CAGR, signaling a paradigm shift in vessel design and energy use.

China’s Shipbuilding Supremacy

China dominates the global shipbuilding scene with over 50% of total output. In 2024, Chinese yards secured 74.1% of all new vessel orders and 78.5% of green ship contracts. Seven of the world’s top 10 shipyards are now in China.

What fuels this dominance?

- Strong state support and industrial policy alignment

- Dual-use facilities serving both military and commercial needs

- Foreign demand: 75% of orders at Chinese shipyards come from international buyers

- Massive scale: China operates 35 active shipyards, dwarfing the US's four

- Technological prowess: Producing aircraft carriers with electromagnetic catapults

This scale and capability present significant national security concerns for the U.S., whose global market share has shrunk to just 0.11%.

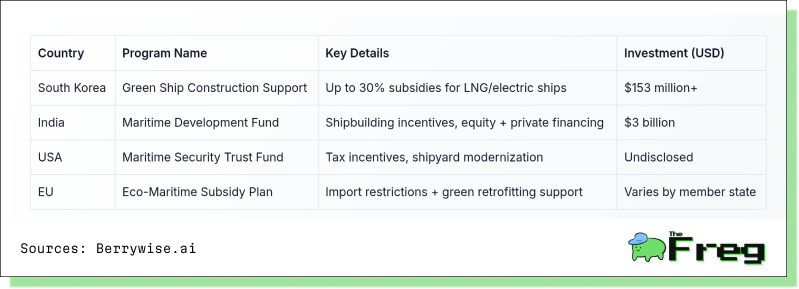

India’s Strategic Response: Maritime Development Fund

India is countering China's dominance with bold initiatives like the ₹25,000 crore Maritime Development Fund (MDF) announced in the 2025 Union Budget. This fund blends 49% central equity with 51% from ports, financial institutions, and private investors. It aims to catalyze up to ₹1.5 lakh crore in investments by 2030 and create nearly 1 million maritime jobs.

The MDF is structured around two pillars:

- Supply-side support: Via Shipbuilding Financial Assistance Policy 2.0

- Demand stimulation: Linking shipbuilders to the Indian Navy and public shipping firms

Sustainability is central to this strategy, prioritizing funding for hybrid propulsion, alternative fuels, and green retrofits. The long-term goal? Increase India’s global tonnage share from 2% to 20% by 2047.

Market Rally: Shipbuilders Surge

The resurgence of shipbuilding has triggered a stock market rally, especially in India. Companies like Mazagon Dock Shipbuilders (MDL) and Cochin Shipyard have seen meteoric rises. Mazagon Dock’s rise of nearly 1,950% between 2022 and 2024 underscores how national policy and defense contracts can supercharge investor sentiment.

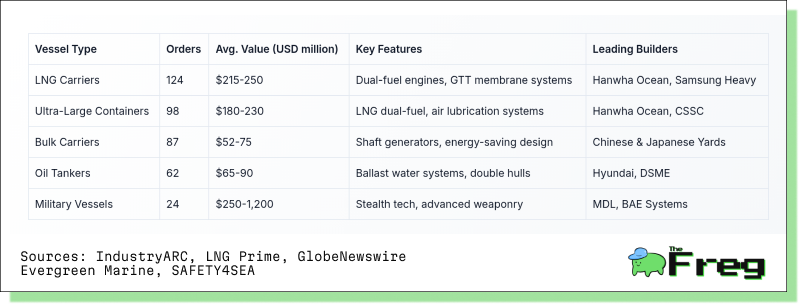

The Green Fleet Revolution

Commercial shipping is also going green. LNG carrier orders are at record highs, and container giants like Evergreen have ordered 11 LNG dual-fuel vessels for nearly $3.2 billion. Methanol-powered ships are in demand—Maersk is commissioning 25 such vessels, 19 of which will be operational in 2025.

Tariffs and Tensions: Steel Showdown

Trade wars have added volatility. The Trump administration's 25% tariff on steel and aluminum imports in March 2025 triggered retaliatory tariffs from China and the EU. The USTR has also proposed million-dollar levies on Chinese-built ships entering U.S. ports—a move analysts warn could be more disruptive than previous tariffs.

A rapid sequence of policy moves has shaken markets:

Naval Arms Race

Defense spending is surging, especially in the Indo-Pacific. Global military expenditure reached $2.46 trillion in 2024. The U.S., China, and Russia lead the charge, with the Quad alliance deepening maritime coordination. Technologies like unmanned surface vehicles and aerial refueling drones are reshaping naval strategy.

India alone plans to add 180+ vessels by 2030 under its "Make in India" defense push. The U.S. is pursuing a "Make Shipbuilding Great Again" strategy with new tax incentives, while the EU explores stricter import policies and defense subsidies.

Global Subsidy Race

Governments are bolstering shipbuilding with generous subsidies, particularly for green and defense-related construction.

A Sector Redefined

Shipbuilding is no longer just about cargo vessels—it is now a strategic industry at the confluence of energy, security, and climate. The rise of green fleets, trade tensions, and geopolitical rivalries has catapulted this traditional industry into the 21st-century spotlight.