The GENIUS Act and the Rise of U.S. Stablecoin Power

We explore a major U.S. policy shift that could reshape digital finance, influence global power dynamics, and redefine how digital currencies are regulated and adopted in an increasingly competitive and fragmented economic landscape.

In a historic move that may redefine global finance, the U.S. Senate has passed the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) with a commanding 68–30 bipartisan vote. This groundbreaking legislation lays the foundation for a federal framework governing stablecoins—digital tokens pegged to the U.S. dollar—and marks the first time Congress has advanced comprehensive crypto regulation through one of its chambers.

A Regulatory Breakthrough Amid Growing Global Stakes

Sponsored by Senator Bill Hagerty, the GENIUS Act requires that all U.S.-issued stablecoins be fully backed 1:1 by liquid reserves such as U.S. dollars, short-term Treasury securities, and federally insured deposits. These reserves must be disclosed monthly and independently audited. Redemption rights guarantee that holders can always exchange their stablecoins for U.S. dollars at face value.

“This is a paradigm-shifting development that positions America as a global leader in crypto innovation,” Hagerty proclaimed after the vote.

The bill now heads to the House of Representatives, where it must be reconciled with its counterpart, the STABLE Act. Should it clear that hurdle, it will be delivered to President Trump—who has publicly embraced crypto, even as critics raise concerns about potential conflicts of interest involving his holdings in World Liberty Financial and its own stablecoin project.

Why Full Reserve Requirements Matter

The 1:1 reserve rule is designed to eliminate the kinds of financial engineering that led to major crypto collapses in recent years. The TerraUSD debacle of 2022—when an algorithmic stablecoin lost its peg—wiped out nearly half a trillion dollars from the market. In contrast, the GENIUS Act insists on hard reserves and robust consumer protections, including bankruptcy priority rights for token holders.

By requiring stablecoins to be backed by Treasuries, the legislation also indirectly strengthens U.S. fiscal power. As adoption grows, the demand for Treasuries could rise, providing a fresh funding channel for the U.S. government.

A $238 Billion Battleground

The stablecoin market has ballooned to over $238 billion as of mid-2025, with USD-backed coins like USDT (Tether) and USDC controlling nearly 90% of that share. This dominance is increasingly viewed not just as a financial phenomenon, but as a geopolitical instrument.

In Beijing, this dollar dominance has sparked concern. Chinese officials have framed dollar-backed stablecoins as a strategic threat to financial sovereignty. In response, China is ramping up the internationalization of its digital yuan (e-CNY). The People’s Bank of China has announced a new global operations center in Shanghai and is actively promoting yuan-based digital payment systems via Alipay and WeChat Pay.

"The GENIUS Act could entrench the dollar's dominance further," noted Zhang Ming of China's National Finance and Development Laboratory, warning of a deepening digital currency cold war.

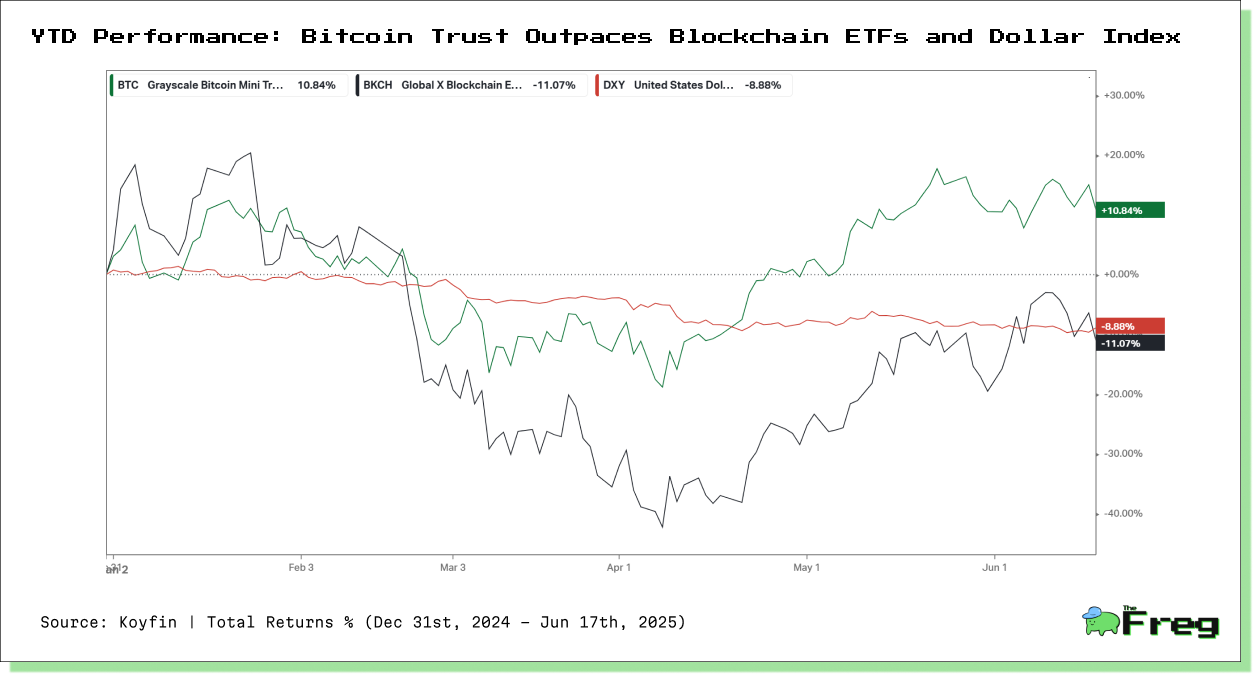

Comparing Crypto and Traditional Markets

A comparison between Grayscale Bitcoin Mini Trust, Global X Blockchain ETF and the U.S. Dollar Index underscores the shifting dynamics in global asset performance in the wake of growing regulatory clarity around U.S. dollar–backed stablecoins. Grayscale Bitcoin Mini Trust (BTC) has outperformed traditional macro indicators, rising +15.05% since early 2025—a move that coincides with legislative momentum behind the GENIUS Act. This surge suggests markets are increasingly pricing in a legitimized future for digital assets underpinned by U.S. policy support. Meanwhile, Global X Blockchain ETF (BKCH) has fallen -6.40%, indicating investor scepticism around blockchain equity plays that lack direct exposure to regulated, reserve-backed tokens.

Most notably, the U.S. Dollar Index (DXY) has declined -9.64%, even as dollar-backed stablecoins gain global traction—highlighting a paradox where digital dollars are strengthening the U.S. financial footprint even as the traditional dollar weakens. This divergence supports the argument that stablecoins, particularly under a federally sanctioned framework like the GENIUS Act, may evolve into a new layer of soft power—securing monetary influence through programmable, borderless digital instruments, even in a period of relative dollar volatility.

The Road Ahead

With just weeks before the House must reconcile the GENIUS Act with the STABLE Act, the final shape of the bill is still in flux. Debates over federal oversight, systemically important issuers, and international harmonization are likely to dominate the remaining legislative calendar.

Whatever the outcome, one thing is clear: America is no longer a bystander in the crypto era. The GENIUS Act could usher in a new age of regulated, reserve-backed digital dollars—ones that may soon be as common as the paper bills they’re pegged to.