The Cost of Protection: How Trump’s Tariff Strategy Is Reshaping Prices, Jobs, and Policy

Trump’s 2025 tariffs push U.S. into “stagflation-lite,” driving up costs ~1.8%, squeezing households, slowing job growth, and testing the economy’s resilience against deeper stagnation.

In 2025, the Trump administration’s assertive tariff policy has ushered the U.S. economy into increasingly uneasy territory. New import duties are reverberating across supply chains—and ultimately, at the checkout counter—raising prices on daily essentials. Economists are tense: inflation remains stubbornly elevated at 2.8 %, above the Federal Reserve’s 2 % target, while job creation has slowed alarmingly. In July, unemployment edged up to 4.2 %, with the economy adding just 73,000 jobs—the smallest monthly gain in more than two years. These numbers signal an “amber alert,” a warning that stable expansion may be giving way to something more dangerous.

Analysts increasingly characterize this moment as “stagflation-lite”—a troubling mix of sluggish job growth and persistent inflation, combining the worst of stagnation and price pressures. The critical question: Are the tariffs accelerating this stagflation-lite trend? As each economic report unfolds, tension mounts between the administration’s protective stance toward U.S. industries and the rising risk of slower growth, elevated costs, and vulnerable workers. In the coming months, the country will test whether it can steer clear of full-blown stagnation—or if the “amber” warnings will flash red.

Tariff Pass-Through: Where Consumers Feel the Hit

Tariffs introduced in 2025 are estimated to have added 1.7 – 2.0 % to overall consumer prices, with most estimates clustering around 1.8 %. That translates to an extra $2,300 – $2,700 per household per year—an immediate and painful squeeze on family budgets already stretched by inflation.

Sector-Level Impacts

The toll is far from uniform:

Regional Strain: Where the Shock Runs Deepest

The tariff impact is highly regional. Areas dependent on imports or manufacturing—especially in the Midwest (Michigan, Ohio, Indiana) and the South (Alabama, Kentucky, Tennessee)—are seeing effective tariff rates north of 10 % in counties tied to auto and textile industries. Coastal regions, such as California and parts of Texas, which are heavily import-reliant for electronics, also experience heavier cost burdens. But the pain is most acute in places where the economy is less diversified.

The Unequal Burden: Who Pays More?

Tariffs function much like a regressive tax. Lower- and middle-income households bear the brunt. On average, low-income households incur extra annual costs of around $1,300—three times the relative financial hit compared to higher-income families. While wealthier households may face losses up to $5,000, their greater disposable income cushions the impact.

In share-of-income terms:

- The poorest 20 % of households see disposable income shrink by 6.2 %.

- The wealthiest 1 % lose just 1 % of their disposable income.

Middle-income families typically face tariff-induced costs of $1,700–$3,000 annually. Import-dependent communities in the South and Midwest—where incomes are lower and spending on essentials higher—are especially squeezed.

“Tariffs are simply taxes on Americans under a different name... They elevate the costs of essential items such as food and clothing, which constitute a larger portion of a low-income household’s budget.” — Heritage Foundation (2025)

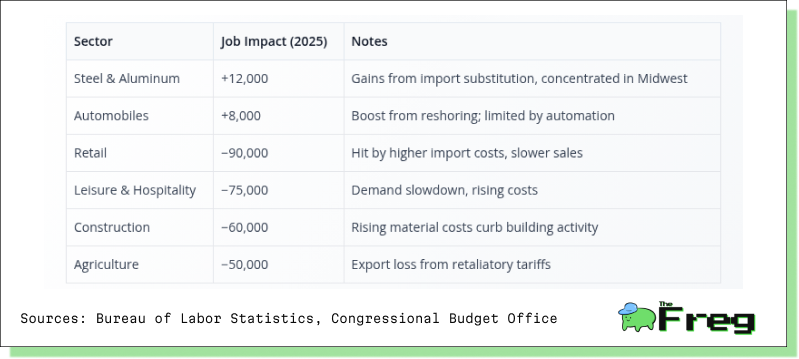

Labour Market Realities: Winners, Losers, and an Uneven Recovery

Tariffs are reshaping the U.S. job market. By the end of 2025:

- Unemployment has climbed by 0.4 percentage points, reaching 4.2 %.

- Total payroll jobs lost are estimated at –594,000.

- Hiring remains slow—July added only 73,000 jobs, and prior months saw downward revisions.

Gain Zones: A Modest Rebound

Some sectors are seeing gains:

- Manufacturing (steel & aluminium): Protected by tariffs, domestic plants—especially in Ohio and Pennsylvania—are expanding.

- Automobiles: Detroit giants benefit from reduced import competition, supporting margin growth and local job creation.

- Textiles & apparel: There’s modest reshoring, notably in the Carolinas, though automation limits job growth.

Areas Under Pressure

Conversely, several sectors are under strain:

- Retail: Squeezed by higher input costs and slower spending, especially in apparel and electronics.

- Leisure & Hospitality: This traditionally resilient sector is stalling, impacted by rising prices and slack demand.

- Construction: Elevated costs for materials like steel and lumber curb homebuilding and stoke layoffs—hit particularly hard in the Sun Belt and Midwest.

- Agriculture: Export-dependent farms—especially produce and livestock—feel the pinch as retaliatory tariffs dampen foreign demand, while equipment costs rise.

Who’s Most Exposed?

- Skill level: Low- to mid-skill workers in manufacturing and construction are most vulnerable. New graduates and entry-level workers face shrinking opportunities in services. By contrast, compliance and logistics professionals find growing demand amid complex trade routes.

- Regions: The Midwest and South—Michigan, Ohio, Alabama, Kentucky—see steep employment drops. Coastal areas like California lose ground in electronics and port operations; Texas falters in energy and electronics. Agriculture-heavy states like Iowa and Nebraska face export contraction.

- Demographics: Foreign-born and migrant workers—common in construction, hospitality, and agriculture—are disproportionately affected. Lower-income households face dual pressure: job insecurity and escalating everyday costs.

Bottom Line: While tariff-led reshoring offers localized gains, the overall picture is bleak: net job losses, rising unemployment, and widespread strain on sectors and workers that are less insulated.

Inventory Buffer: A Temporary Cushion, But Now Waning

Ahead of tariff implementation, many U.S. firms—especially in electronics, apparel, and autos—stockpiled inventory in Q1 of 2025. This front-loading delayed the pass-through of tariff costs, allowing businesses to keep prices stable and avoid immediate layoffs. Warehouses surged with goods, but soon faced demand swings that complicated logistics.

Now, as those inventories dwindle, firms must replenish stock at higher tariff-inflated prices—or else face squeezed margins. This scenario risks triggering a “second wave” of inflation or forcing hiring freezes and layoffs.

Key indicators to watch:

- Inventory-to-sales ratios: Dropping ratios suggest buffer stock is nearly spent.

- Producer price trends: Rising PPI points to upstream cost pressures that eventually trickle to consumers.

- Labour market signals: Signs like staffing slowdowns or hiring halts imply firms bracing for cost shocks.

The Federal Reserve: Caught Between Inflation and Weakening Growth

As of July 2025, the Federal Reserve maintained interest rates at 4.25–4.50%, reflecting caution amid tariff-induced inflation and ambiguous economic signals. Chair Powell emphasizes a “wait-and-see” posture, monitoring tariff pass-through effects before making rate decisions. Market expectations currently price in about 2.5 rate cuts for the remainder of 2025, but the Fed remains vigilant of inflation risks.

The political context adds complexity. Pressure from the White House—particularly from Trump—is for rate cuts to stimulate growth. Yet, the Fed insists on maintaining its independence, focusing strictly on inflation impacts rather than the trade policy itself. Ongoing trade negotiations, tariff exemptions, or rollbacks could shift the financial outlook, while markets watch for Fed flexibility or resolve in response to inflation data.

Investor Implications:

- Expect rotation toward domestic manufacturing sectors favoured by tariffs, and away from consumer discretionary and retail hurt by rising input costs.

- In bond markets, short-term yields reflect inflation signals, while long-term yields tie to growth expectations.

- Regional investment opportunities may favour Midwest and Southern states with manufacturing strength, avoiding areas tied to service and export sectors under duress.

The Road Ahead: Navigating a Narrow Path

In essence, 2025 tariffs have crystallized “stagflation-lite” by boosting consumer costs (roughly 1.8 % above pre-tariff levels) and weakening the labour market—with unemployment up 0.3–0.4 points and payrolls down nearly 600,000 jobs.

That initial inventory buffer bought time—but as it shrinks, the economy faces a fork: higher inflation or slowing growth. Over the next 6 to 12 months, policymakers and markets must weigh inflation trends, labour market data, and supply chain indicators. The outcome—whether the economy bends under strain or recalibrates without breaking—depends on careful navigation of this narrow path.

Tariffs aimed to shield domestic sectors—but the trade-offs are substantial. The burden on families, especially lower-income ones and those in vulnerable regions, is real and immediate. Meanwhile, the policy environment—Fed decisions, trade talks, consumer behaviour—will determine whether stagflation-lite morphs into something more severe.