Tesla’s Market Meltdown: The $152 Billion Feud That Shook Wall Street

Tesla lost $152B in market value after a political clash between Elon Musk and Donald Trump over subsidy cuts and EV tax credits. The fallout hit sales, investor sentiment, and raised serious questions about Tesla’s political and financial future.

Tesla has long been a symbol of innovation and disruption—until it became a cautionary tale for how political entanglements can trigger historic financial collapses. On June 5, 2025, a bitter public fallout between CEO Elon Musk and U.S. President Donald Trump wiped $152 billion off Tesla’s market cap in just one day, sending its shares into freefall and investors scrambling for answers.

The Market Crash That Shattered Records

Tesla’s 14.26% nosedive on June 5 marked its worst single-day performance since 2022. The company’s market value fell from over $1 trillion to $916 billion—more than the entire market cap of India’s largest tech giant, Tata Consultancy Services, and nearly 88% of HDFC Bank’s worth.

This financial wreck also hammered Musk’s personal fortune—he lost $34 billion in a day. Tesla’s stock, which had rallied 22% in May, is now down 30% from its December 2024 peak of $488.54, closing at $284.70 after the selloff.

From Alliance to Animosity: The Musk-Trump Breakdown

Once political allies, Trump and Musk have turned on each other in spectacular fashion. Trump’s announcement on Truth Social to cut off all federal subsidies and contracts to Musk’s companies set the stage:

“The easiest way to save money in our Budget, Billions and Billions of Dollars, is to terminate Elon’s Governmental Subsidies and Contracts.”

The financial threat is not idle. SpaceX, a cornerstone of U.S. space missions, received $3.8 billion in government support in FY2024, with total NASA contract exposure nearing $22 billion. Tesla, too, has gained roughly $11.4 billion from regulatory credits that help lower EV costs.

Musk’s counter-threat? Decommission SpaceX’s Dragon spacecraft, the only U.S. vessel capable of ferrying astronauts to orbit. The standoff has triggered real concern among investors and NASA alike.

A Political Feud Goes Public

The friction escalated after Musk lambasted Trump’s “One Big Beautiful Bill”—a Republican-led tax reform package—as a “disgusting abomination.” In a post on X, he warned the bill would bloat the U.S. deficit to $2.5 trillion and urged his 220+ million followers to pressure lawmakers to “KILL the BILL.”

Musk’s opposition stemmed in part from a failed plea to preserve the $7,500 EV tax credit, a key incentive for Tesla buyers. House Speaker Mike Johnson rejected his appeal, prompting further online jabs. Trump fired back, declaring Musk had “Trump derangement syndrome,” despite once benefiting from his administration’s support.

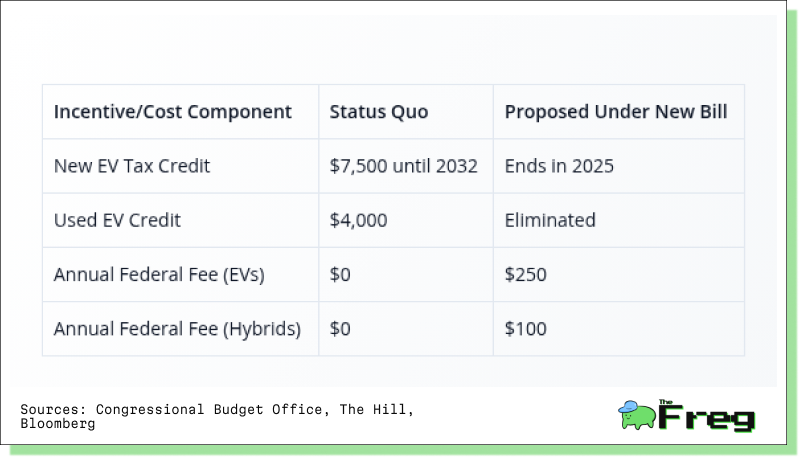

EV Subsidies in the Crosshairs

At the heart of the feud is the proposed EV tax credit rollback. Trump’s bill seeks to end the $7,500 new EV credit by 2025 (seven years ahead of schedule) and scrap the $4,000 used EV credit entirely. It also proposes new annual fees: $250 for EVs and $100 for hybrids.

The financial impact for Tesla is severe. JPMorgan estimates losing the EV credit alone could cost Tesla $1.2 billion annually, not to mention an additional $2 billion if California’s Zero Emissions program is also repealed.

Sales Slump and Brand Crisis

Tesla’s image has shifted dramatically. Once seen as the poster child for clean tech, the brand is now polarizing. According to sentiment analysis, 61% of Tesla-related mentions online are negative, with Musk’s political antics being the main reason. A Yahoo News/YouGov poll found that 67% of Americans would not consider buying a Tesla, citing Musk directly.

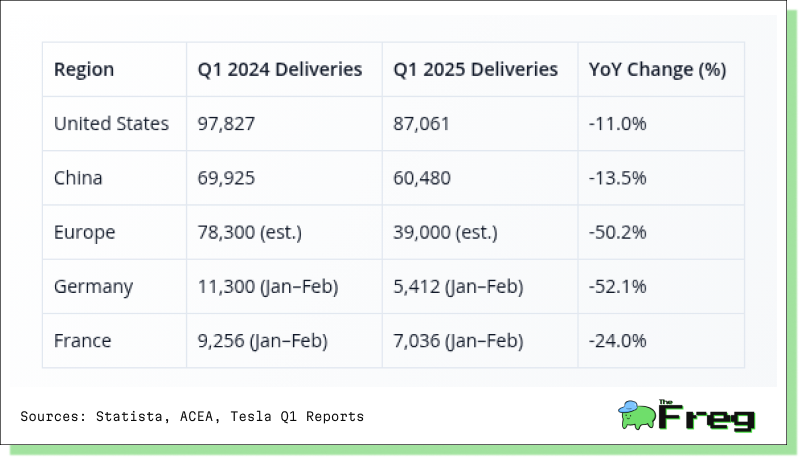

This erosion of goodwill is impacting sales:

In markets like Germany, Tesla sales have collapsed by over 75% in certain months. In China, competition from BYD has pushed Tesla to second place globally, with BYD selling nearly triple the number of EVs in January 2025 alone.

Political Risks: A New Investment Threat

Tesla’s implosion reflects a wider trend—tech CEOs taking political stands that now affect company valuations. About 80% of Fortune 100 CEOs donate to political causes, and when the company and CEO are indistinguishable—as is the case with Musk—market reactions become personal.

Musk’s call to “KILL the BILL” wasn’t just political; it was a shareholder risk. Analysts warn that such activism opens companies up to unpredictable regulation and consumer backlash, particularly in an environment where tech CEOs are shifting alliances—many, ironically, back to Trump amid regulatory fears.

Analyst Sentiment and Valuation Debate

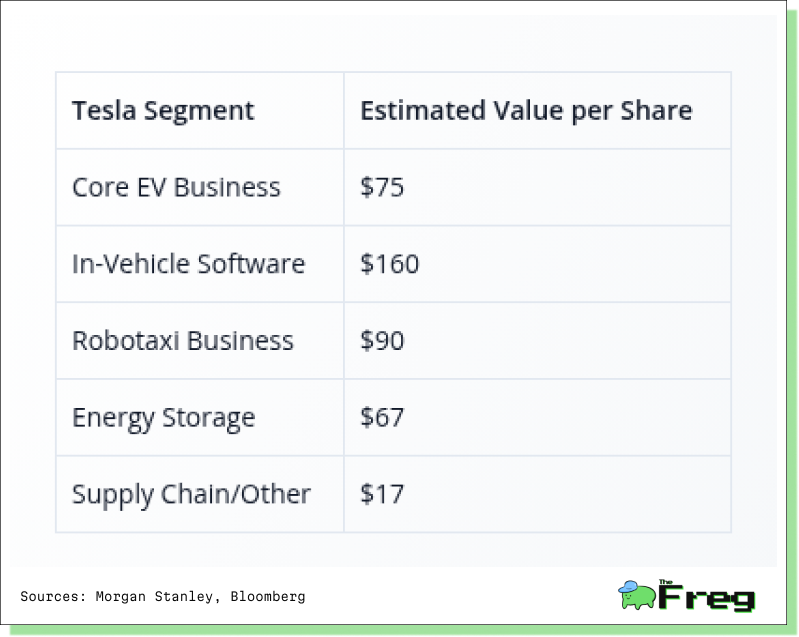

Despite the turmoil, some on Wall Street remain optimistic. Wedbush’s Dan Ives raised his price target for Tesla to $500, citing autonomous vehicle breakthroughs as a future catalyst. Morgan Stanley values Tesla at $410, breaking it down into segments beyond EVs:

However, Tesla’s sky-high 140x forward P/E ratio dwarfs competitors like Ford (8.2x) and GM (10.4x), making the stock vulnerable to sentiment swings, especially as profit margins compress and political risks intensify.

Outlook: High Voltage, High Risk

Tesla’s 2025 outlook remains deeply uncertain. Analysts project a 20–25% profit reduction due to the end of subsidies, tariffs, and potential loss of regulatory credits. At the same time, Musk’s personal brand is hurting Tesla’s broader appeal.

Key investor considerations moving forward:

- Subsidy Cuts: $1.2B loss if EV tax credits expire

- Credit Sales at Risk: $2B from California’s emissions program

- Tariff Impacts: Up to $4,500 more in per-vehicle costs

- Valuation Bubble: High P/E ratio unsupported by recent performance

- Leadership Volatility: Musk’s political activity adds unpredictability

Tesla’s innovation pipeline in AI and autonomous driving may yet deliver a second act. But until then, investors must grapple with a volatile mix of politics, policy, and perception—each with the power to erase billions in seconds.