Tariffs, Trade, and Tensions: Trump’s India Gambit Signals a Fractured Global Order

Trump's steep tariffs on Indian goods reignite U.S.-India tensions, with Russian oil imports and shifting BRICS ties at the center of a deeper global trade and power realignment.

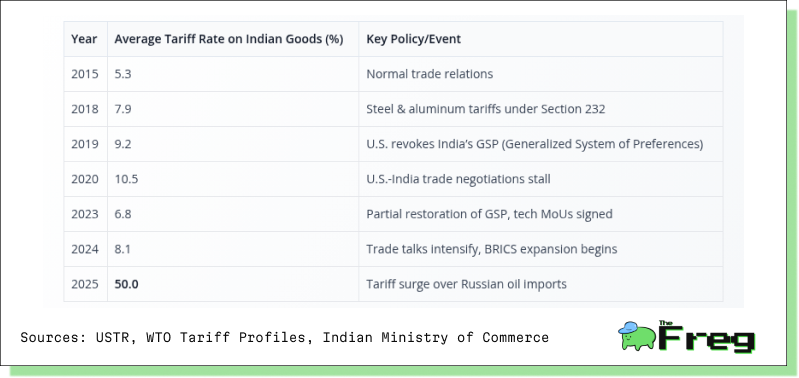

The sudden decision by President Donald Trump to double tariffs on Indian goods to 50% has jolted the foundations of U.S.-India relations, injecting volatility into one of the 21st century's most strategic partnerships. The move—framed as a response to India's continued imports of Russian crude oil—is about more than just energy. It marks a broader pivot in the global trade architecture, one where economic coercion becomes a tool of geopolitical leverage, and where long-standing alliances must now weather transactional turbulence.

From Trade Partner to Target: Unpacking the Tariff Shock

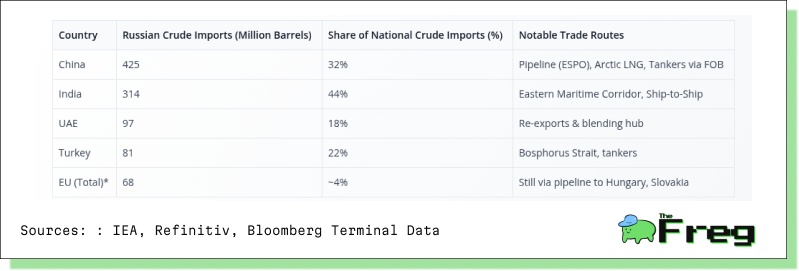

On the surface, the tariffs are retaliation: Washington accuses New Delhi of “fuelling the Russian war machine.” But India is far from the only country maintaining energy ties with Moscow—China, Turkey, and the UAE all continue to import Russian oil at scale. So why is India the only one punished so severely?

The answer lies in a complex interplay of trade negotiations, strategic realignment, and political messaging.

Selective Enforcement or Strategic Signalling?

While the Trump administration cited national security, its lack of action against other major Russian oil buyers undermines the consistency of the rationale. Instead, the tariffs appear to be a form of targeted pressure—deployed just after U.S.-India trade talks collapsed and ahead of a high-stakes U.S. election season.

Trump’s comments have been telling: “We did it with India. We’re probably doing it with a couple of others. One of them could be China.” No subsequent penalties have materialized for China or others, suggesting that tariffs are being used as leverage, not policy.

BRICS and the Breakdown of Consensus

India's balancing act—courting the West while engaging in energy trade with Russia—has reached a breaking point. With BRICS expanding in 2024–25 to include Indonesia, Iran, Egypt, Ethiopia, and the UAE, its growing political and economic influence is reshaping global alignment. For Washington, India’s increasing engagement with this bloc is problematic. For New Delhi, it’s strategic insurance.

Sectors in the Crosshairs: Economic Fallout of the Tariff War

The economic consequences of the 50% tariff escalation are stark—especially for India's export-driven sectors. The industries hit hardest are those most integrated into U.S. supply chains and most reliant on labour-intensive MSMEs.

India's Ministry of External Affairs has called the tariffs “unfair, unjustified, and unreasonable,” highlighting the inconsistency of targeting India alone. The reaction has been swift and unified: bipartisan political support, labour mobilization, and warnings of reciprocal tariffs targeting U.S. agricultural and luxury exports.

U.S. Supply Chains at Risk

The repercussions are not one-sided. For American businesses and consumers, higher input costs and supply chain delays loom large.

- Pharmaceuticals: U.S. healthcare providers depend on Indian generics and APIs for chronic disease management. Disruptions could mean drug shortages and price spikes.

- Textiles & Apparel: Low-cost, private-label garments sourced from Indian MSMEs fill shelves at major U.S. retailers. Tariffs will squeeze margins and limit choices.

- Auto Components: U.S. automakers rely on Indian components for cost efficiency. Increased tariffs could delay assembly timelines and inflate costs.

The Realpolitik of Oil and Energy Security

Since 2022, India has ramped up Russian oil imports to over 35–44% of its crude basket in 2025. The rationale? Affordability, inflation control, and reliable supply amid global volatility.

India’s Oil Strategy: Economic Imperative, Not Ideological Alignment

Indian officials reject accusations of enabling Moscow. They argue that energy decisions are driven by the need to serve 1.4 billion people, not to send geopolitical signals. Their message to Washington: if Western nations could buy Russian oil until recently—and if others still do—why should India be penalized?

The Emergence of a “Non-Aligned Energy Axis”

India is not alone. China, the UAE, Turkey, and parts of Southeast Asia continue to transact with Russia, bypassing U.S.-led sanctions via non-Western financial systems and logistical channels. This informal coalition—uncoordinated yet resilient—is undermining the efficacy of unilateral sanctions and setting the tone for a more multipolar energy order.

Geostrategic Repercussions: From QUAD to SCO

Beyond economics, the tariff escalation risks damaging the geopolitical scaffolding of the Indo-Pacific.

U.S.–India Defence Cooperation: Strain on the QUAD

The U.S. views India as central to its Indo-Pacific strategy, from joint military exercises to supply chain diversification. But punitive tariffs may cool India’s enthusiasm for full alignment, especially if Washington appears to dismiss India’s sovereign priorities.

Modi’s China Visit: Recalibrating Alignments

Prime Minister Narendra Modi's planned visit to China for the Shanghai Cooperation Organisation (SCO) Summit underscores a diplomatic pivot. Expected bilateral meetings with Xi Jinping and possibly Vladimir Putin may be less about grand realignment and more about reminding Washington that India has options.

BRICS Ascendant, Retaliation on the Table

The growing influence of BRICS offers India a platform to counterbalance Western pressure. Enhanced cooperation on alternative payment systems, local currency trade, and multilateral forums could reduce India’s dependence on Western economic frameworks.

Meanwhile, India’s retaliatory options are substantial. Past measures have included targeting U.S. agricultural exports (almonds, apples), luxury goods, and high-end motorcycles. A tit-for-tat response remains likely if tariffs persist.

Domestic Unity: A Rare Consensus in Delhi

Unlike most foreign policy matters, the tariff issue has united India’s usually fractious politics. From industrial chambers to grassroots unions, voices across the spectrum have rallied behind the government’s resistance to U.S. coercion. This consensus arms Modi with political capital—both in dealing with Washington and in recalibrating India’s international engagements.

The Fault Lines of a Multipolar Trade World

This is not merely a trade dispute—it is a litmus test for the future of global economic diplomacy. The U.S. attempt to compel India to choose between energy security and geopolitical alignment has backfired, at least in the short term, by pushing India further toward autonomy and multilateral alternatives.

As trade becomes a battlefield and economic statecraft a diplomatic weapon, countries like India will increasingly define their paths based on national interest rather than alliance expectations. Whether the U.S. recalibrates its strategy or doubles down remains to be seen. But one truth is already clear: the world is entering a post-Western phase of trade relations—fuelled by friction, forged by pragmatism.