Storm Clouds Over Solar: Sunrun’s Collapse Signals a U.S. Clean Energy Crossroads

Sunrun’s dramatic stock crash spotlights a growing crisis in U.S. residential solar. Amid vanishing tax credits, soaring tariffs, and shaky investor confidence, the clean energy sector faces a critical inflection point on policy, viability, and resilience.

The U.S. solar industry is entering a period of painful recalibration. On June 17, 2025, residential solar giant Sunrun suffered a staggering 40% single-day stock plunge, closing at just $5.78. While investors reeled, the message was unmistakable: Sunrun's crash is not just a company story—it is emblematic of a broader existential challenge facing American clean energy.

From a sweeping rollback of tax credits to a tariff onslaught and policy whiplash, the future of U.S. residential solar looks increasingly uncertain. What’s unfolding now is not a cyclical downturn, but a systemic stress test of clean energy’s economic viability.

A Swift Dismantling of Federal Support

At the heart of the turmoil is a Senate Finance Committee proposal that accelerates the withdrawal of clean energy tax credits. Under current law, residential and commercial solar installations enjoy generous tax incentives through 2032. But the new proposal would compress that window dramatically:

While commercial solar may see a gradual decline, residential solar will face a cliff-edge: credits will vanish just six months after the bill becomes law. This abrupt shift puts solar access for millions of middle- and low-income Americans at risk.

Residential Solar: The First Casualty

The ramifications for the residential solar market are severe. With tax credits covering 30% of installation costs, their removal could price out a large swath of potential homeowners.

Wall Street has already responded. Citi maintained a “sell” rating on residential solar stocks, warning of a “sharp pullback” across the sector. The industry is also grappling with:

- High interest rates making solar loans less affordable

- California's net metering changes reducing payback incentives

- Investor flight and bankruptcies, such as Solar Mosaic, a key solar loan provider, filing for bankruptcy

Raymond James’ Pavel Molchanov put it bluntly: the Senate’s proposals “look worse than the industry had hoped.”

Sunrun's Meltdown: A Market Wake-Up Call

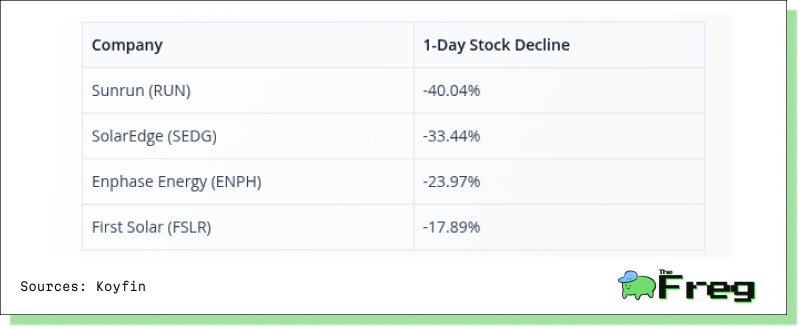

On June 17, 2025, Sunrun (RUN) plummeted 40.04% in a single day—its sharpest decline on record—triggered by the Senate’s proposal to eliminate key clean energy tax credits. The market reaction was swift and widespread across the solar sector:

Sunrun’s losses, driven by its heavy reliance on the soon-to-be-cut 25D residential tax credit, were compounded by broader sector headwinds: rising interest rates, weaker demand, and surging import tariffs. Trading volume surpassed $664 million, signalling a deep loss of investor confidence.

With technical indicators like the long-standing death cross in place, analysts warn the stock may face further downside. Sunrun’s crash is more than a one-off—it’s a reflection of growing uncertainty over the viability of residential solar under an unstable policy regime.

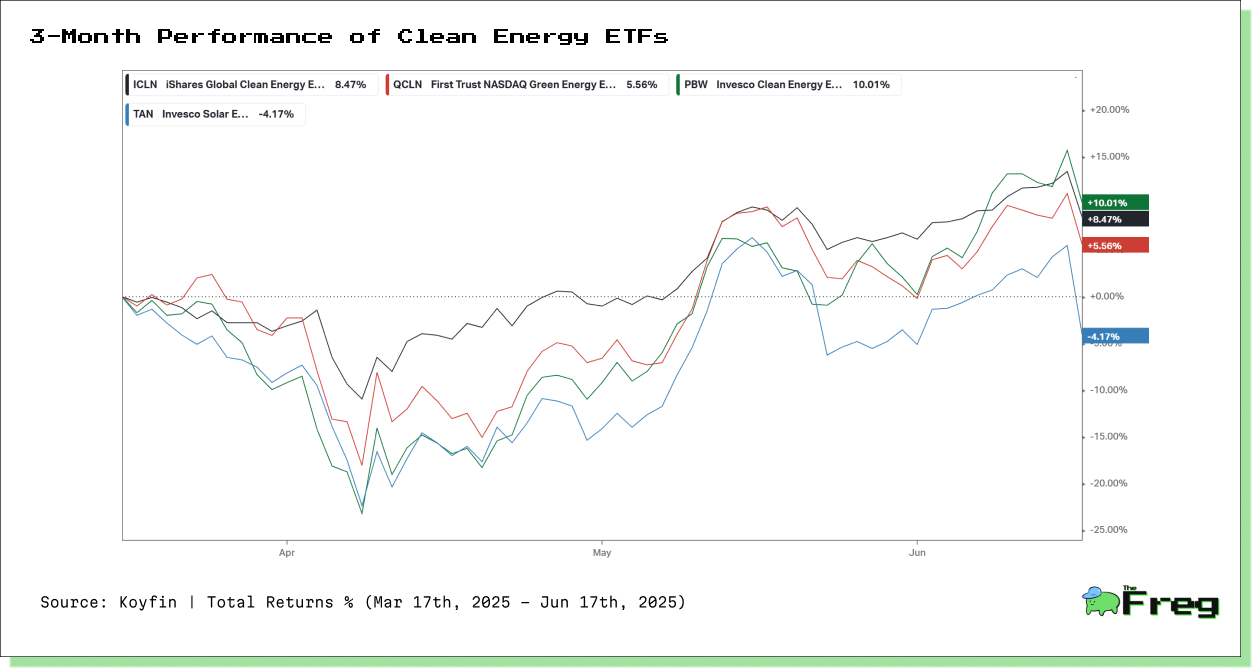

ETF Performance: A Split Clean Energy Narrative

While individual solar stocks have suffered sharp drawdowns, the year-to-date performance of major clean energy ETFs tells a more nuanced story—highlighting how investors are distinguishing between broad-based renewables and solar-specific exposure.

Key Takeaways:

- ICLN leads with +12.78%, boosted by global and utility-scale exposure—less reliant on U.S. policy and interest rate sensitivity.

- QCLN and PBW lag, reflecting investor caution toward U.S.-focused clean tech sectors like EVs, grid tech, and early-stage battery firms.

- TAN outperforms expectations, down just -1.90% despite solar stock volatility, signalling selective investor confidence in solar manufacturers over installers.

- The divergence suggests markets are rewarding diversification and global exposure, while penalizing U.S. firms most vulnerable to subsidy rollbacks and trade policy shifts.

Tariffs: The Other Body Blow

As if tax uncertainty weren't enough, trade policy has added fuel to the fire. In early 2025, the Commerce Department imposed tariffs as high as 3,521% on solar panel imports from Southeast Asia. These measures primarily target Chinese firms who relocated production to avoid earlier tariffs.

The intention is to spur domestic manufacturing, but it’s a double-edged sword. Chinese panels cost $0.16–$0.19/watt, while American ones are about $0.28/watt—a massive gap. For installers like Sunrun, that cost differential undercuts competitiveness at a time when incentives are evaporating.

Can the Industry Rebound?

There are glimmers of hope. Notably, battery storage tax credits remain untouched through 2033—potentially stabilizing growth in solar-plus-storage offerings.

Sunrun, for instance, has deployed over 650 megawatts in distributed solar-plus-storage capacity. Additionally, state mandates and rising concerns about grid stability continue to drive consumer interest in energy independence.

Sunrun CEO Mary Powell warned that without intervention, policymakers would be “ripping the rug out from under over 5 million customers.” The industry is lobbying hard to amend the Senate plan before final passage.

The Road Ahead: Market or Mirage?

Sunrun’s nosedive isn’t just a company story. It’s an inflection point for U.S. clean energy. The sector must now prove it can survive—and thrive—without crutches. The key ingredients for recovery are:

- Policy certainty insulated from short-term political cycles

- Robust private financing models that don't rely on tax credits

- Resilient supply chains with competitive domestic manufacturing

The U.S. is being forced to confront a difficult reality: renewable energy's promise remains alive, but its current business model is broken. And unless Washington offers clarity, American solar may cede even more ground—to economic headwinds and to global competitors.