Stock Market Diet: Small-Caps Shed a Ton of Weight—But Are They Still Bloated?

The recent stock market correction sent small-cap stocks tumbling nearly 18%, but are they still overpriced?

Indian small-cap stocks have been on a wild ride. The Nifty Small-cap 250 index has dropped nearly 18% from its September 2024 peak. Yet, many experts say valuations remain stretched. Is another correction on the horizon?

Small-Cap Performance: A Rollercoaster Ride

First, a look at the data:

The Nifty Small-cap 250 index has seen extreme volatility but remains a long-term wealth generator.

Are Small-Caps Still Expensive?

Many small-cap stocks are still trading above historical norms. According to Sailesh Raj Bhan, CIO of Nippon India Mutual Fund, nearly two-thirds of small- and mid-cap stocks are overvalued.

Valuation metrics for the Nifty Small-cap 250 index with historical averages.

What's Driving the Sustained Correction?

The sharp decline in small-cap stocks stems from multiple factors. Global economic uncertainty and geopolitical risks have shaken investor confidence. Meanwhile, rising interest rates have increased borrowing costs, putting pressure on smaller companies. Mutual fund inflows have also kept valuations artificially high, preventing a more drastic correction. Additionally, sector rotation is pulling funds away from small-caps toward larger, more stable stocks. Together, these forces have fueled volatility and driven the recent downturn.

Small-Cap Portfolio Shifts

Small-cap mutual fund managers are making strategic adjustments to their portfolios in response to recent market volatility and valuation concerns:

- Increased cash holdings: Some funds have raised cash levels to 10-15% of assets, up from the usual 5-7%, to buffer against volatility and seize buying opportunities.

- Sector rotation: Managers are shifting allocations towards energy, healthcare, and select tech companies while reducing exposure to interest-rate sensitive sectors like housing and utilities.

- Quality focus: Emphasizing companies with strong fundamentals, stable earnings, and reliable business models to withstand market turbulence.

- Gradual repositioning: Avoiding drastic shifts, managers are using market dips to accumulate quality stocks at lower prices.

While some funds are selectively adding mid-cap exposure for stability, most remain committed to small-caps, seeing long-term potential despite near-term challenges.

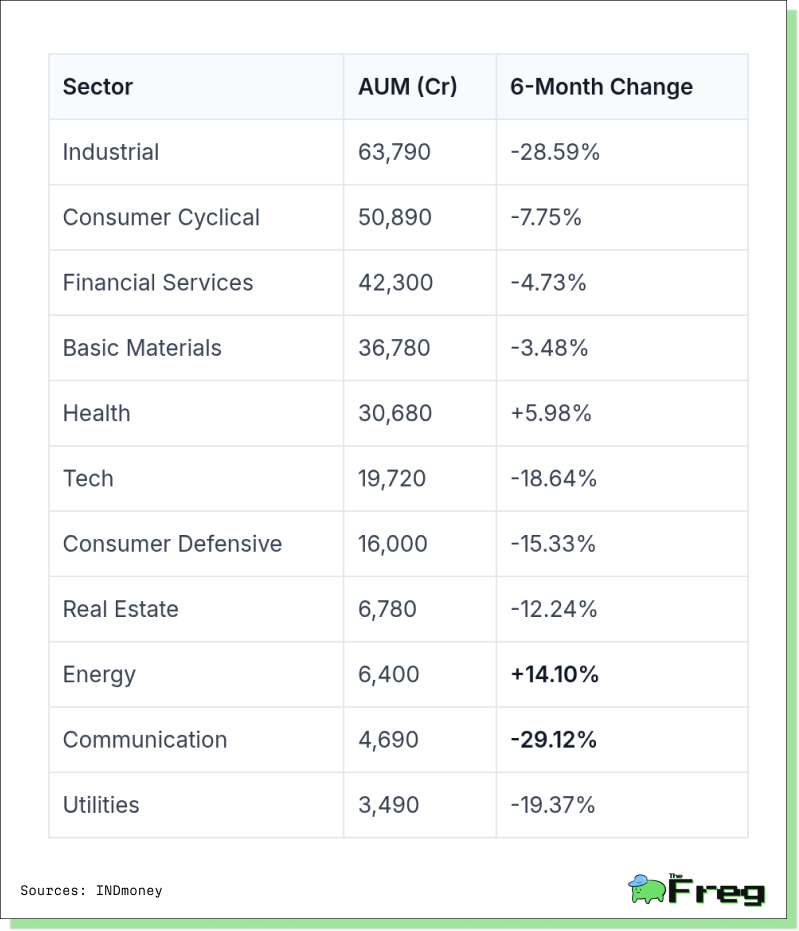

Shifts in sector-wise allocations within small-cap funds over the past six months

Sector Shifts: Who’s Winning & Losing?

Small-cap funds are heavily reshuffling their portfolios. Engineering and Chemicals dominate, making up over 30% of assets. Meanwhile, Energy is on the rise, while Industrials and Communications are losing ground.

Final Verdict: Caution Over FOMO

Small-caps have delivered stunning returns over the years. But current valuations demand caution. While long-term investors can stay put, fresh entrants should be selective. The market may offer better buying opportunities ahead.

Disclaimer: This article is based on data analysis and does not constitute investment advice. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance is not indicative of future results.