SMBC's Bold Bet on Yes Bank: A Turning Point in India's Financial Sector

Japan's SMBC is acquiring a 20% stake in Yes Bank for $1.6B, signaling renewed global confidence in India's banking sector and Yes Bank's turnaround.

In one of the largest foreign investments ever seen in India's banking industry, Japan's Sumitomo Mitsui Banking Corporation (SMBC) is acquiring a 20% stake in Yes Bank for ₹13,483 crore (approximately $1.6 billion). This strategic move not only underscores the Japanese financial giant's growing interest in emerging markets but also validates Yes Bank's remarkable turnaround since its near-collapse in 2020.

From Rescue to Revival: The Yes Bank Transformation

Yes Bank's financial resurrection has been nothing short of extraordinary. Triggered by a major crisis in March 2020, the Reserve Bank of India (RBI) imposed a moratorium, froze withdrawals, and superseded the bank's board due to its deteriorating financial health. A swift reconstruction plan followed, led by the State Bank of India (SBI) and a consortium of private lenders.

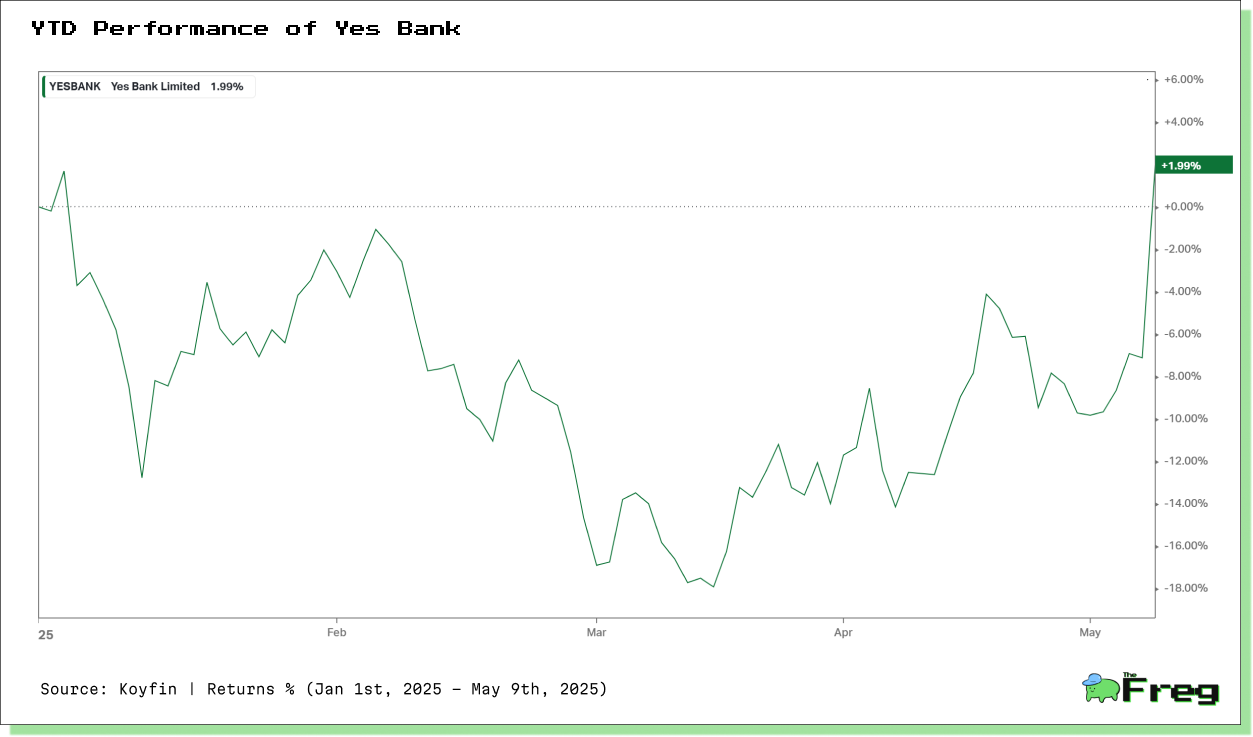

Since then, the bank has seen a steady revival. By FY25, net profit surged by 92.3% to ₹2,406 crore. Key performance indicators such as net interest margin (2.4% for FY25, rising to 2.5% in Q4), cost-to-income ratio (down to 67.3% from 75.8%), and gross NPAs (plummeting to 1.6%) all reflect significant improvement.

Moreover, a strategic pivot toward retail and SME lending, combined with digital infrastructure investments of ₹800-₹1,000 crore annually, has paid dividends. Deposits doubled from ₹1 lakh crore in March 2020 to ₹2.41 lakh crore, and the bank achieved full Priority Sector Lending compliance in FY25.

The Strategic Significance of SMBC’s Entry

SMBC's investment aligns with its "Asia Multi-Franchise Strategy," which aims to build strong, full-service banking platforms in high-growth markets like India, Indonesia, Vietnam, and the Philippines. By acquiring a 20% stake in Yes Bank, SMBC not only becomes its largest shareholder but gains significant influence over governance, including the right to appoint two non-executive directors.

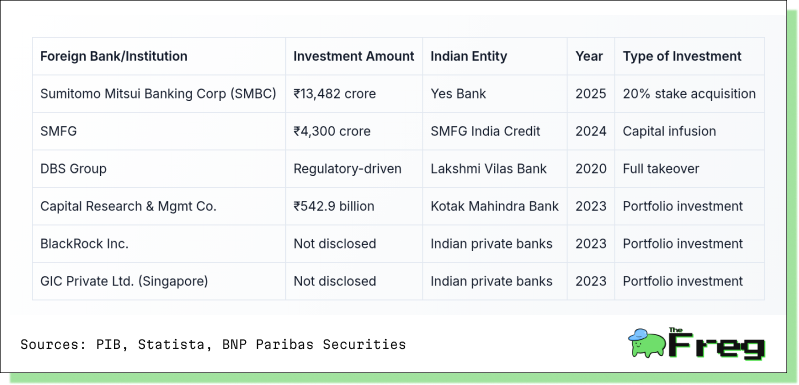

Previously, SMBC fully acquired SMFG India Credit (formerly Fullerton India), infusing ₹4,300 crore in FY25. It has also launched the Asia Rising Fund and established branches in New Delhi, Mumbai, Chennai, and GIFT City, signaling its deepening footprint in India.

A Transformative Deal Structure

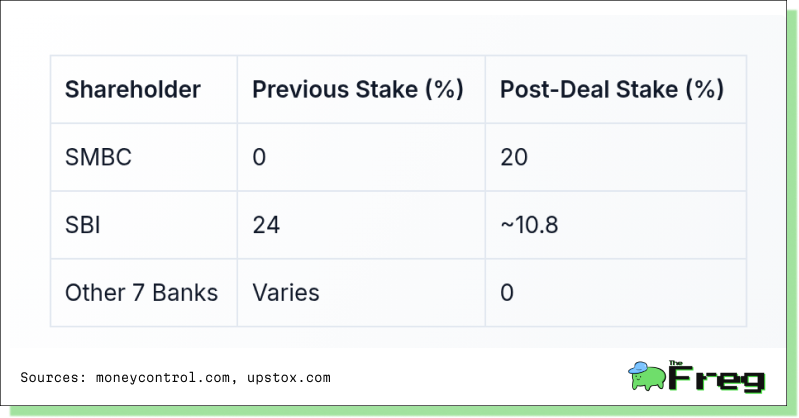

The transaction involves SMBC acquiring a 13.19% stake from SBI and 6.81% from seven other Indian banks that invested during Yes Bank's 2020 reconstruction. The deal, priced at ₹21.5 per share, represents a strong vote of confidence in the bank's long-term prospects. It is still subject to approvals from the RBI, Competition Commission of India, and potentially the Cabinet Committee of Economic Affairs.

Once approved, the deal will reshape the bank's ownership:

India: A Magnet for Global Capital

SMBC's bet on India comes at a time when the country's economy is poised to double from $3.57 trillion to $7 trillion within six years. The digital economy alone is expected to contribute nearly 20% of GDP by 2030. Moreover, the Banking Laws (Amendment) Bill 2024 has modernized governance and investment norms, making India even more attractive for global investors.

Other foreign institutions are also expanding their India play:

Governance Overhaul and Strategic Synergies

With SMBC onboard, Yes Bank enters a new era of governance. The Japanese bank’s global standards, risk management frameworks, and digital expertise—including its retail super app with 3.4 million users—are expected to significantly benefit Yes Bank. In particular, the partnership opens access to international trade finance, Japanese corporates operating in India, and expertise in cash management.

Yes Bank's pivot toward retail and SME banking dovetails perfectly with SMBC’s approach. As Japanese companies increasingly follow a "China-plus-one" strategy, Yes Bank is well-positioned to capture cross-border business opportunities.

Foreign Capital Confidence: India’s Investment-Grade Rebound

India's sovereign credit rating was recently upgraded to 'BBB' with a stable outlook, reflecting structural reforms and fiscal prudence. In May 2025 alone, foreign investors poured over ₹14,167 crore into Indian equities. Maharashtra led in attracting FDI, pulling in $16.6 billion by December 2024.

This confidence is echoed in the broader financial services sector:

A Pan-Asian Outlook

Yes Bank’s ambitions aren’t confined to India. Its recent partnership with Brazilian fintech EBANX marks a decisive step toward cross-border commerce in Asia. Together, they aim to serve India’s 350 million online shoppers through seamless payment platforms tailored for international merchants.

In parallel, Yes Bank has strengthened its MSME services via platforms like YES Connect and YES Smart Pay. With SMBC’s support, these efforts could evolve into scalable, pan-Asian digital banking solutions.

Looking Ahead

The SMBC-Yes Bank deal marks more than a capital infusion—it represents a profound transformation in ownership, governance, and strategy. It cements India’s status as a preferred destination for long-term foreign investment and sets the stage for Yes Bank’s next chapter as a competitive, tech-forward, and globally connected institution.

As the deal clears regulatory hurdles, the financial world will be watching closely—because in many ways, the future of Indian banking may well be shaped by this ambitious cross-border alliance.