Samsung Electronics: Record Revenue, Margin Pressures, and Strategic Shifts Amid Global Headwinds

Samsung’s strong Q1 2025 results highlight its resilience amid chip headwinds and global risks. With AI integration, robust cash flow, and strategic investments, it remains a top tech player—but faces challenges in leadership, semiconductors, and trade.

The global technology sector in 2025 is defined by robust demand for AI-enabled devices, persistent supply chain volatility, and intensifying competition from both US and Chinese players. While consumer electronics demand remains resilient, the semiconductor industry has entered a cyclical downturn, with memory prices under pressure and customers pausing purchases ahead of next-generation product launches. Regulatory scrutiny is rising globally, and trade tensions—most notably between the US and Korea—are creating additional uncertainty for exporters like Samsung. Despite these headwinds, the long-term outlook for premium smartphones, AI infrastructure, and connected devices remains positive, underpinning investor interest in diversified technology leaders.

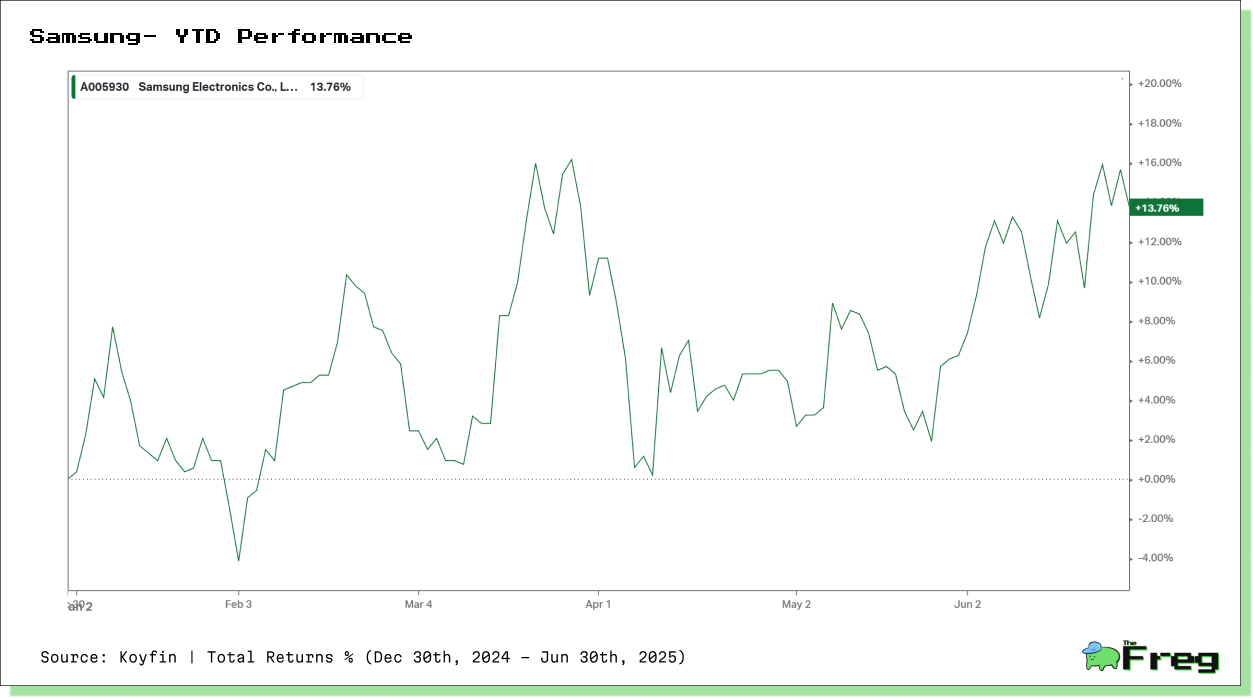

Stock Performance Snapshot

Samsung Electronics delivered a strong start to 2025, posting record quarterly revenue of KRW 79.1 trillion in Q1, up 10% year-on-year, driven by robust smartphone sales and resilient performance in its Device eXperience (DX) division. Despite these top-line gains, the company’s share price has shown only modest movement, reflecting investor caution over semiconductor headwinds and geopolitical risks.

Year-to-date, Samsung shares have climbed 13.76%, as depicted in the chart, with the stock experiencing notable volatility through the first half of the year. The performance has been marked by periods of sharp gains and retracements, ultimately trending higher in June as investor sentiment improved on the back of record revenues and signs of stabilization in the memory market.

As of late June 2025, consensus analyst price targets cluster around KRW 72,800–72,900, with a high estimate of KRW 88,000 and a low of KRW 48,000. The stock closed recently at KRW 58,100, implying potential upside of approximately 25% to the consensus target.

Strategic Roadmap & Capital Allocation

Samsung’s medium-term strategy focuses on AI leadership, advanced semiconductor R&D, and global manufacturing expansion. Over the next three to five years, the company aims to:

- Solidify its position in AI chips and on-device AI, targeting leadership in both consumer and enterprise segments.

- Invest heavily in semiconductor capacity, including major capex for new chip fabs in the US and Korea, and the ramp-up of HBM3E and DDR5 production.

- Pursue targeted M&A and partnerships, as evidenced by the recent acquisition of Rainbow Robotics, which strengthens Samsung’s robotics and AI capabilities.

- Maintain shareholder returns through a mix of dividends and share buybacks. In Q1 2025, Samsung retired over 50 million ordinary shares and 6.9 million preference shares, with a total acquisition cost of KRW 3 trillion, and declared interim dividends totalling KRW 2.45 trillion.

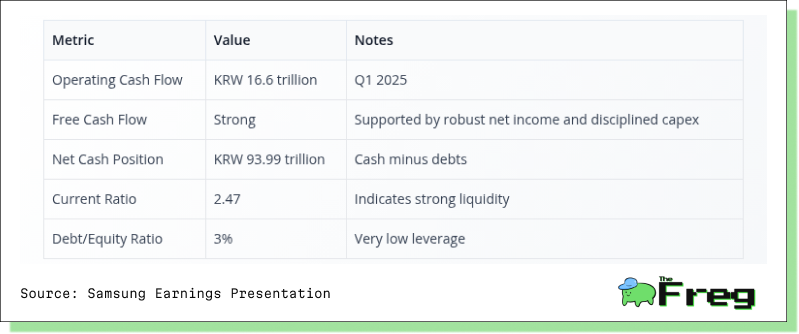

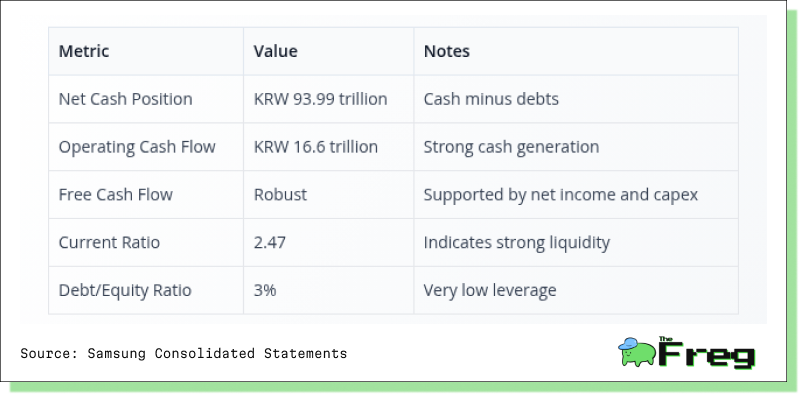

- Balance capital allocation between innovation, expansion, and returns, supported by a net cash position of KRW 93.99 trillion and an industry-low debt/equity ratio of 3%.

This strategic roadmap is designed to position Samsung for sustainable growth and resilience, even as the industry faces cyclical and geopolitical headwinds.

Segment Highlights

The DX division remains the engine of growth, powered by new flagship launches and AI integration across devices. DS (semiconductors) saw a sharp profit contraction due to memory price declines and a pause in HBM demand, though revenue improved on a sequential basis. SDC (Display) benefited from new product launches and stable large-panel demand, while Harman continued its steady expansion in automotive and audio, albeit at lower margins. The diversified segment performance underscores Samsung’s resilience but highlights ongoing margin challenges in semiconductors.

R&D and Innovation Pipeline

Samsung continues to prioritize innovation, with R&D expenses reaching KRW 9.0 trillion in Q1 2025, representing 11.4% of revenue—a level that positions the company among the most research-intensive tech firms globally. Key innovation highlights:

- Flagship launches: The Galaxy S25 series, featuring advanced on-device AI, and new QD-OLED monitors.

- AI integration: AI capabilities are now embedded across smartphones, TVs, appliances, and automotive solutions, with a focus on differentiating user experience and device intelligence.

- Semiconductor advances: Samsung is ramping up HBM3E and DDR5 memory, and accelerating the migration to 8th Gen V-NAND, aiming to regain ground in AI chips against leaders like Nvidia and SK Hynix.

- Robotics and automation: The acquisition of Rainbow Robotics in Q1 2025 brings new synergies in AI-driven robotics for industrial and consumer applications.

- Competitive benchmarking: Samsung’s R&D intensity and innovation output rival Apple, Huawei, and leading chipmakers. However, the company currently lags in AI chip market share versus Nvidia, and faces intense competition in foldables from Chinese brands.

Samsung’s robust innovation pipeline is central to its strategy for maintaining technology leadership and capturing emerging growth opportunities.

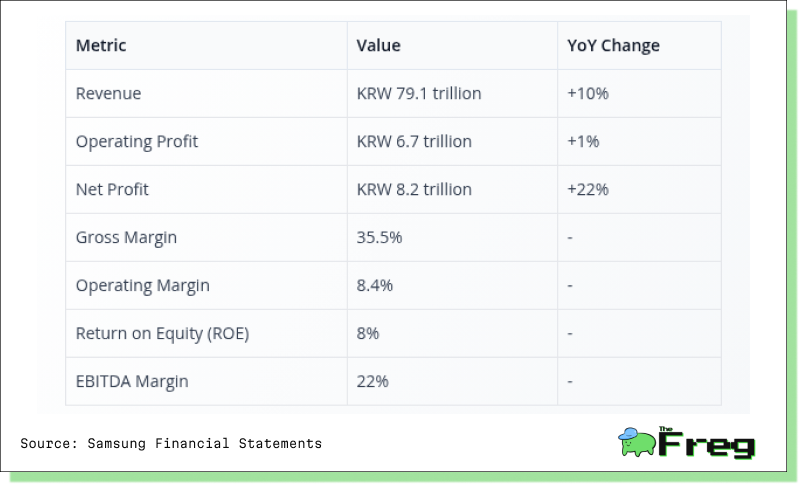

Financial Overview (Q1 2025)

Samsung’s Q1 2025 financials demonstrate the company’s ability to deliver record sales and strong profit growth despite industry headwinds. Notably, net profit outpaced revenue growth, reflecting effective cost control, strong non-operating income, and a positive earnings surprise. However, operating margin expansion remains constrained by semiconductor volatility and elevated R&D and SG&A expenses.

Cash Flow and Efficiency

Samsung’s cash flow generation remains robust, with operating cash flow of KRW 16.6 trillion and a net cash position approaching KRW 94 trillion. The company’s liquidity and balance sheet strength are industry-leading, supporting continued investment in R&D and capacity expansion. Low leverage and a high current ratio provide ample financial flexibility to weather market volatility and pursue strategic initiatives.

Balance Sheet Summary (Q1 2025)

The balance sheet remains a core competitive advantage for Samsung. With nearly KRW 94 trillion in net cash and a conservative capital structure, the company is well-positioned to fund innovation, withstand cyclical downturns, and return value to shareholders. This financial strength also provides a buffer against regulatory and geopolitical risks.

Geographic Revenue Mix

Samsung’s global footprint provides both growth opportunities and risk diversification. As of Q1 2025:

- Asia (excluding Korea and China): Major manufacturing and sales hubs in Vietnam, India, and Southeast Asia, with strong growth in smartphones and appliances.

- Americas: The US remains a critical market for premium devices and semiconductors, and is a focal point for new chip fab investments. Recent acquisitions (e.g., Rainbow Robotics USA) and subsidiaries like Samsung Austin Semiconductor underscore the region’s strategic importance.

- Europe and CIS: Stable sales through subsidiaries in the UK, Germany, France, and Eastern Europe, with a focus on premium products and automotive partnerships.

- China: Despite ongoing regulatory and competitive pressures, China remains a significant market for both sales and manufacturing, especially in display and semiconductor segments.

- Emerging Markets (Middle East, Africa, Latin America): Continued expansion in consumer electronics, though exposure to currency and policy risks is higher.

Samsung’s broad geographic mix helps mitigate country-specific risks, such as India’s recent tax claim and US export controls. However, dependency on the US and China for both sales and supply chain remains a key risk factor, especially amid rising trade tensions and regulatory scrutiny.

Analyst Ratings and Market Sentiment

- Target Price: KRW 72,800–72,900 (24–25% above recent close)

- EPS Surprise: Q1 EPS of KRW 1,192 beat consensus estimates by 38%

- Market Sentiment: Cautiously optimistic, with upside seen in AI, smartphones, and memory recovery, but tempered by trade and regulatory risks.

Analysts remain broadly positive on Samsung’s prospects, citing its leadership in premium smartphones, strong cash flow, and potential for a memory recovery in the second half. However, sentiment is tempered by ongoing concerns over semiconductor pricing, leadership transitions, and external risks.

Forward Guidance and Estimates

- Q2 2025 Revenue Estimate: KRW 76.8 trillion

- Q2 2025 EPS Estimate: KRW 982

- 2025 Outlook:

- DX: Continued AI-driven product launches, strong foldable and flagship smartphone sales, premium TV and appliance momentum

- DS: Gradual recovery expected in memory pricing, ramp-up of HBM3E and DDR5, but near-term earnings to remain under pressure from ASP erosion and export controls

- SDC: Stable with potential upside from new monitor and foldable launches

- Harman: Steady growth in automotive and consumer audio, focus on cost efficiency

Key Insights: Management expects a gradual improvement in memory markets and continued momentum in premium devices. The company is doubling down on AI integration and next-generation chip technologies, but acknowledges that near-term earnings will remain sensitive to global demand and regulatory shifts.

Watchpoints

- Leadership Instability: The sudden passing of co-CEO Han Jong-hee in March 2025 leaves a leadership gap, especially in consumer electronics and mobile, with no successor yet named.

- Semiconductor Volatility: Heavy dependence on chips exposes Samsung to swings in demand and pricing, with AI chip leadership lagging behind rivals like Nvidia and SK Hynix.

- Trade and Tariff Risks: Rising US-Korea trade tensions and the threat of reciprocal tariffs could impact export margins and chip subsidies.

- Regulatory Scrutiny: Tax disputes, such as India’s recent $601 million claim, and global compliance demands add legal and reputational risk.

- Labour Costs: Unionization and wage hikes (5.1% in 2025) add to cost pressures, especially during periods of weak semiconductor profitability.

- Competitive Threats: Intense competition from Apple in the US and fast-rising Chinese brands globally, especially in smartphones.

While Samsung’s financial position is strong, the company faces a complex risk landscape. Leadership uncertainty, regulatory scrutiny, and global trade tensions could all impact performance. The company’s ability to execute on innovation and maintain cost discipline will be critical in navigating these challenges.

Samsung Electronics remains a global technology powerhouse, with unmatched scale in smartphones, displays, and memory. The Q1 2025 results underscore the company’s ability to deliver record revenue and resilient profits, even as the semiconductor cycle turns. Its robust balance sheet, strong cash generation, and diversified portfolio provide a solid foundation for navigating near-term volatility.

However, investors must weigh these strengths against real risks: leadership uncertainty, ongoing margin pressure in semiconductors, and a volatile geopolitical environment. The company’s ability to regain AI chip leadership, manage global compliance, and sustain innovation in premium devices will be critical to unlocking further upside.

With a consensus “Buy” rating and a 25% upside to target price, Samsung offers a compelling risk-reward profile for long-term investors seeking exposure to global tech, provided they are comfortable with cyclical swings and external risks. The next quarters will be pivotal as Samsung executes on its AI, memory, and flagship device strategies in an increasingly complex global landscape.