Riding the Rebound: How Momentum Funds Are Powering India's Market Recovery

Momentum mutual funds are outperforming in the May 2025 rally, drawing investor attention. This article explores how they work, their recent performance, pros, cons, and whether they deserve a place in your portfolio.

As Indian equities claw their way back from a rocky start to 2025, one category of mutual funds is clearly leading the charge: momentum funds. These trend-following strategies, which aim to ride the wave of recent winners in the market, have surged ahead in the latest recovery phase. Spearheaded by the Nifty200 Momentum 30 Index, which has gained 11% since April 7, these funds are dramatically outpacing the broader market’s 7.8% rise over the same period.

A Textbook Recovery After a Brutal Drawdown

Between September 2024 and April 2025, momentum strategies were among the hardest hit, with the Nifty200 Momentum 30 Index plunging 31%, compared to the Nifty 500’s 18% drop. But history shows that momentum funds often bounce back faster—and stronger—than the broader market once a rebound begins.

Since bottoming out in April, the momentum index has gained 11%, comfortably beating the broader market’s 7.8% climb. This aligns with long-observed patterns: momentum thrives in trending markets, especially during recoveries from sharp drawdowns.

Sector Allocation: A Contrarian Approach That Pays Off

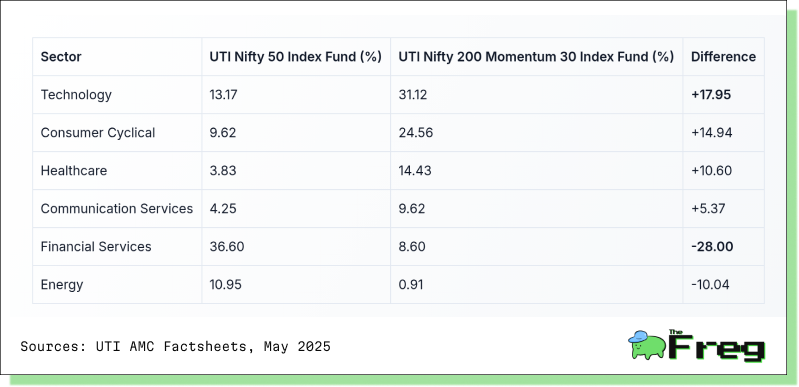

Momentum funds do not mirror the sector weights of major indices like the Nifty 50. Instead, they shift dynamically, overweighting sectors showing strong price momentum while underweighting laggards—even if those sectors are market heavyweights. This aggressive rotation has been a key factor in recent outperformance.

Overweighting fast-growing sectors like tech and consumer cyclicals has powered returns, while underweighting financials and energy—recent underperformers—has limited downside.

What Drives Momentum Funds?

Momentum strategies are built around one principle: stocks that have performed well recently are likely to continue performing well in the near future. Indian momentum funds typically follow rules-based methodologies, tracking indices like the Nifty200 Momentum 30, which uses 6- and 12-month price returns adjusted for volatility to identify leaders.

These portfolios are rebalanced semi-annually (in passive formats) or more frequently in actively managed setups like PMS (Portfolio Management Services), ensuring exposure to the most current trends. Crucially, the strategy emphasizes price trends over fundamentals, allowing it to respond rapidly to changing market dynamics.

Momentum Metrics: Risk-Adjusted Returns Matter

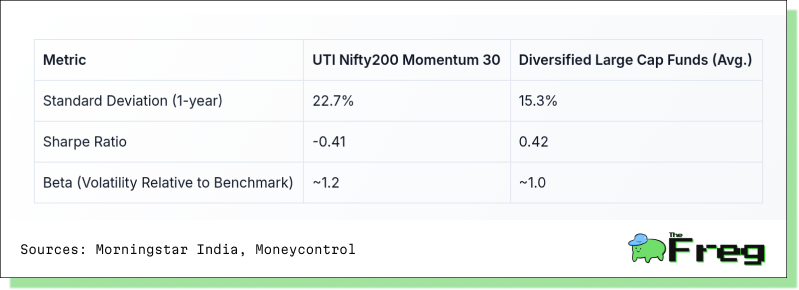

Momentum funds are often volatile—but that doesn’t mean they’re inefficient. Their risk-adjusted returns over long periods have consistently outpaced traditional benchmarks.

While momentum’s volatility is high, its long-term Sharpe ratios have historically beaten traditional equity funds, especially during prolonged uptrends.

Real-World Performance: A Snapshot

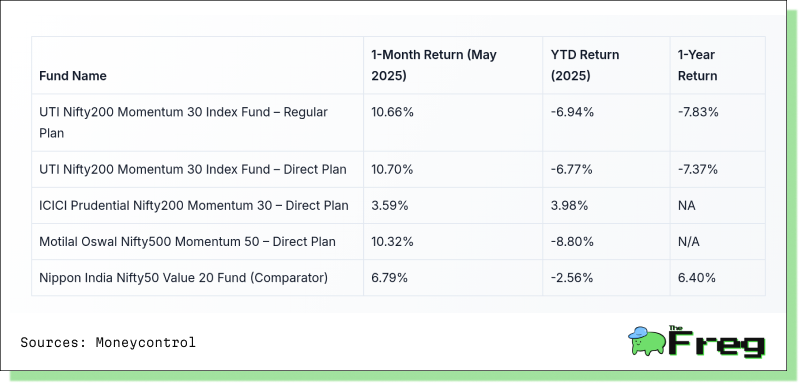

Despite suffering in the early months of 2025, many momentum funds are now showing signs of a turnaround. Here's how key funds have performed:

The recent gains reflect a potential trend reversal, especially for UTI and ICICI’s momentum products, both rebounding by over 12% in May alone.

Fueling the Rally: FPIs and Macro Trends

Momentum strategies have also benefited from renewed foreign interest. Foreign portfolio investors (FPIs) injected ₹18,620 crore into Indian equities in May 2025 alone, following ₹4,223 crore in April, reversing three months of outflows totaling over ₹116,000 crore.

A supportive macro backdrop is bolstering this trend:

- CPI inflation fell to 3.16% in April—its lowest in six years

- RBI rate cuts are expected to continue

- Global sentiment has improved, especially after de-escalation in US-China trade tensions

- The BSE Sensex is now just 4% below its all-time high

These developments have reenergized momentum strategies, which, according to Arihant Bardia (CIO, Valtrust), tend to outperform as markets breach previous highs.

Risks: High Turnover, Crowded Trades, and Volatility

Despite the upside, momentum investing isn’t without its challenges. Momentum funds often lag in sideways or volatile markets, where clear trends are absent. The sharp 27% drop in early 2025 is a recent reminder of the risks.

Additional pitfalls include:

- High turnover, leading to tax inefficiency and transaction costs

- Tracking error in passive funds

- Crowded trades, where too many investors chase the same set of stocks, inflating valuations and reducing liquidity during selloffs

These risks underscore why momentum funds are better suited as satellite holdings—rather than core allocations—in most portfolios.

Strategic Use in Portfolios

Financial advisors generally recommend capping momentum fund exposure at 10–15% of equity portfolios. Their strength lies in enhancing returns during trending markets, not in providing stability.

The Nifty200 Momentum 30 Index has returned 20.62% CAGR since inception and outperformed its parent index 98.3% of the time over 5-year periods, and 100% over 7- and 10-year periods. Yet this success comes with sharp swings.

Momentum works best when used tactically, paired with core holdings in diversified or value-oriented funds. For long-term investors willing to stomach the volatility, the strategy remains one of the most compelling in modern fund management.

The Comeback Play of 2025?

Momentum funds have once again proven their value—not as steady plodders, but as powerful vehicles in bullish recoveries. Their current resurgence is a case study in trend-based investing, showing that with the right timing and temperament, momentum strategies can offer investors a high-octane route to market-beating returns.

But as always, ride the wave with your eyes open—and a solid core portfolio to back you up.