Revolut's Bold Entry into India: Targeting the 'Global India' Fintech Frontier

Revolut is entering India with a premium fintech offering tailored for globally connected users. With UPI integration, multi-currency wallets, and global remittances, it's targeting savvy investors seeking seamless cross-border finance.

In a strategic move set to shake up India's fintech landscape, British neobank Revolut is preparing for a high-stakes launch in 2025. Backed by full authorization from the Reserve Bank of India (RBI) to issue Prepaid Payment Instruments (PPIs) and integrate with the Unified Payments Interface (UPI), the company is positioning itself as a premium player in a market teeming with digital disruption.

A Fintech Giant's Indian Ambitions

Founded in 2015 by Nikolay Storonsky and Vlad Yatsenko, Revolut has transformed from a money transfer app into one of Europe’s most valuable fintech companies, now worth $45 billion. With services spanning 38 countries and a user base exceeding 50 million, the company's expansion into India is part of a broader strategy to reduce dependency on Europe, which accounted for over 90% of its $2.2 billion revenue in 2023.

Revolut’s Indian arm, led by CEO Paroma Chatterjee, has been quietly building operations since 2021. With over 4,000 employees on the ground, the company has been rigorously testing products and preparing for regulatory compliance—a process that culminated in April 2025 with RBI's final nod.

The India Playbook: Premium Focus Meets Local Integration

Rather than enter the crowded mass market, Revolut is targeting the top 10-15% of India's 1.4 billion population—the "global India" cohort. These are internationally-minded, tech-savvy consumers who travel frequently, use services like Netflix and Apple, and demand seamless cross-border financial tools.

Revolut’s launch offerings will include:

- Multi-currency accounts in 36 currencies

- Prepaid cards with competitive FX rates

- Instant UPI-based domestic transfers

- Subscription plans with perks like cashback, airport lounge access, and higher withdrawal limits

By integrating international capabilities with UPI—a system that processed over 16 billion transactions in December 2024—Revolut becomes the first foreign fintech authorized for both domestic and cross-border payments in India.

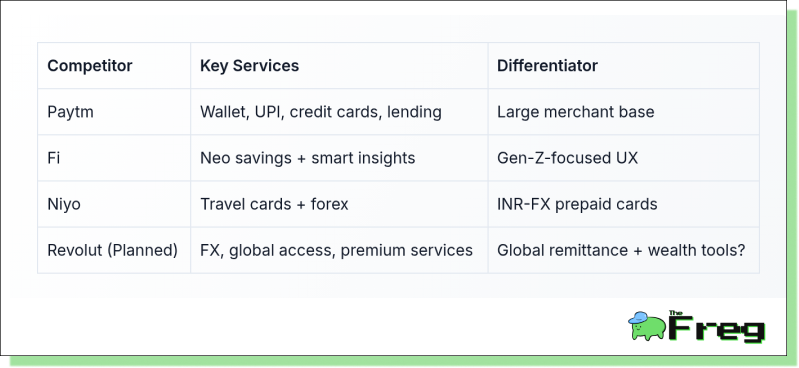

Competing in a Crowded UPI Ecosystem

India’s digital payments market is no stranger to competition. UPI is dominated by local giants:

Revolut enters this arena with a distinct edge: global capabilities merged with full UPI integration. But it also faces tough challenges, including India’s zero Merchant Discount Rate (MDR) policy and entrenched consumer habits favoring homegrown apps.

Navigating Regulation: Lessons from Global Peers

India’s fintech regulatory landscape is among the most stringent in the world. Revolut had to localize its global tech stack, comply with data localization laws, and adapt to the RBI’s regulatory sandbox model. The company’s path stands in contrast to peers like PayPal, which exited India's domestic payments market in 2021 due to competitive and regulatory pressures.

By contrast, Wise has succeeded by focusing solely on remittances. Revolut hopes to avoid these pitfalls through:

- Full compliance as a strategic enabler

- Localized features and user journeys

- A clear differentiation strategy centered on premium services

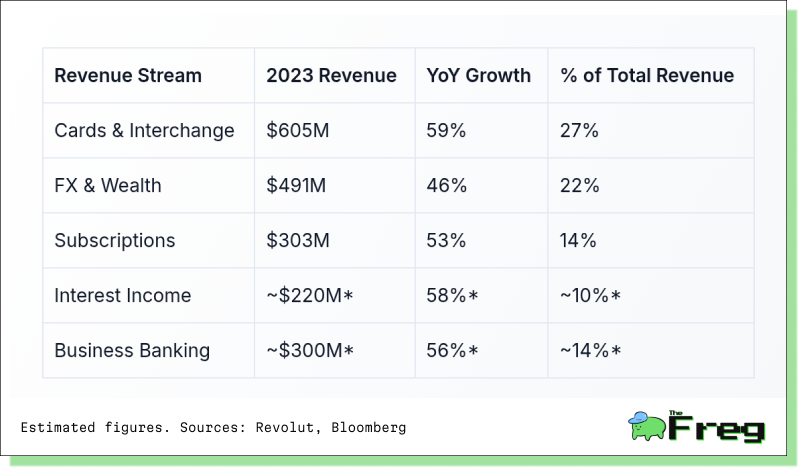

Financial Strength and Revenue Engine

Revolut’s financials highlight the robustness of its business model. In 2023, it reported a net profit of $428 million on $2.2 billion in revenue—a near doubling from 2022. The company’s revenue streams are well-diversified:

Revolut enters this arena with a distinct edge: global capabilities merged with full UPI integration. But it also faces tough challenges, including India’s zero Merchant Discount Rate (MDR) policy and entrenched consumer habits favoring homegrown apps.

What NRIs and International Users Can Expect

Revolut’s India launch isn’t just aimed at domestic users. It holds special significance for Non-Resident Indians (NRIs), who sent $129 billion in remittances to India in 2024. With instant, low-cost transfers from currencies like GBP to INR, Revolut claims users could save up to €31.67 per transfer compared to traditional providers. The funds will be instantly usable for UPI-based payments in India.

A Premium Bet on India’s Digital Future

India’s digital payments market is forecast to triple from 159 billion transactions in FY2023-24 to 481 billion by FY2028-29. With the market expected to reach $990 billion by 2032 at a CAGR of 30.2%, the opportunity is immense—but so is the competition.

Revolut's India launch combines local adaptability with international strength. By aligning its offerings to affluent consumers and building regulatory goodwill, the neobank has a real chance at redefining how Indian consumers—especially the globally connected—manage their finances.

The real test will be whether Revolut can maintain its premium identity while adapting to India’s uniquely complex and competitive digital ecosystem.