Reliance in FY26: Strong Start, Strategic Questions

Reliance Industries starts FY26 strong with robust profits and margin gains, but faces rising risks in energy, mixed retail signals, and execution pressure on new energy investments.

Reliance Industries Limited (RIL) had an eventful start to FY26, demonstrating robust financial performance but facing notable sectoral headwinds. The group maintains its dominance across energy, retail, and digital services, with a significant focus on transforming its business portfolio towards a digital and green future. However, RIL’s energy segment contends with higher global supply risk, and its retail performance—though steady—is under scrutiny for underlying demand trends. The scale and pace of new energy investments are critical for long-term value, making this a pivotal moment in Reliance’s strategic evolution.

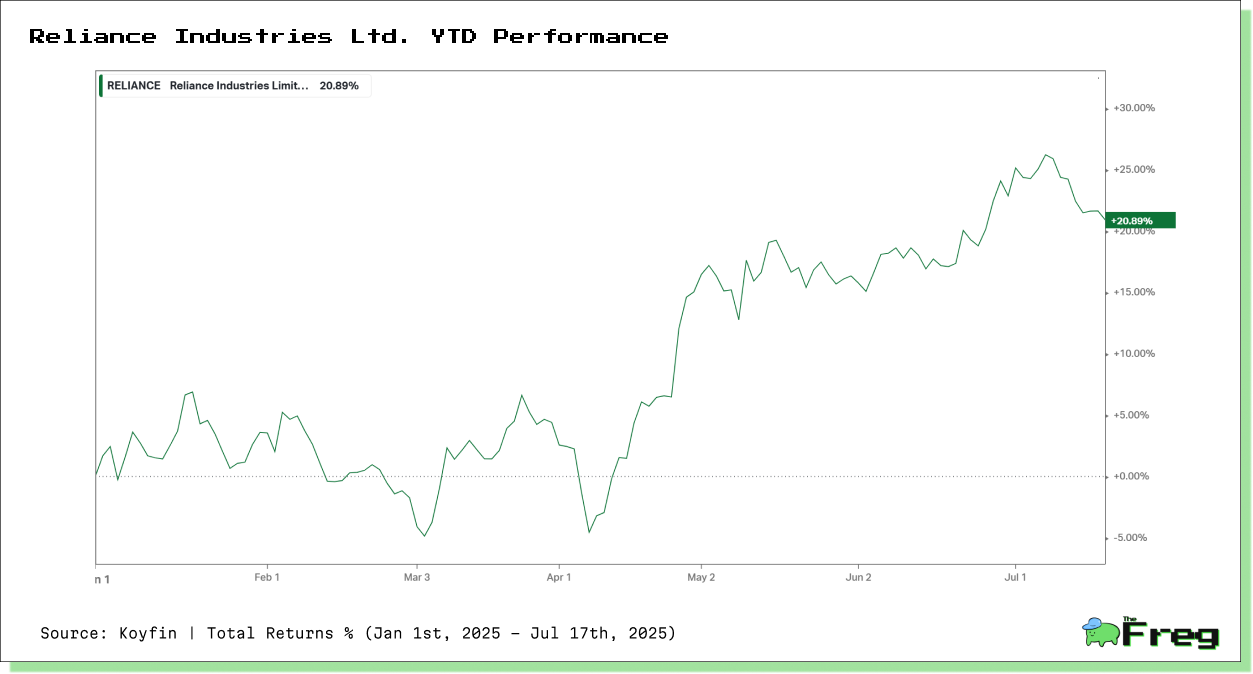

YTD Stock Performance Analysis

Reliance Industries' year-to-date (YTD) stock performance shows a robust uptrend, delivering approximately 20.9% total return from the start of 2025 through late July. The stock exhibited notable resilience, with periods of volatility in Q1 and early Q2 offset by strong upward momentum from April onwards.

Key Observations:

- Q1 Volatility: The start of the year was characterized by moderate fluctuations, likely reflecting mixed sentiment amid global uncertainties and sectoral headwinds.

- Q2 Breakout: Momentum accelerated sharply from early April, coinciding with strong financial disclosures and progress across digital and retail segments.

- Peaks and Plateaus: The stock approached its YTD high in late June, topping over 25% gain before a slight correction, settling near +21% by mid-July.

- Relative Outperformance: This performance notably outpaced broader Indian benchmarks during the same period, underscoring investor confidence in Reliance’s diversified model and forward strategy.

Underlying Drivers:

- Improved domestic refining margins and continued gains in digital and telecom were key drivers.

- Market enthusiasm around new energy investments and retail’s digital transformation further supported sentiment.

- The absence of severe shocks from global crude supply disruptions helped maintain margin stability in the O2C business.

- Investor reassessment on the back of steady results, capital discipline, and visible progress on new energy and consumer tech pivots.

Reliance’s YTD rally reflects its increasing investor appeal as a defensive, innovation-led conglomerate—thanks to successful execution in core and growth verticals alike. The steady stock appreciation positions it favourably for the remainder of FY26, with market focus now turning to sustained delivery in new energy and faster monetization in digital commerce.

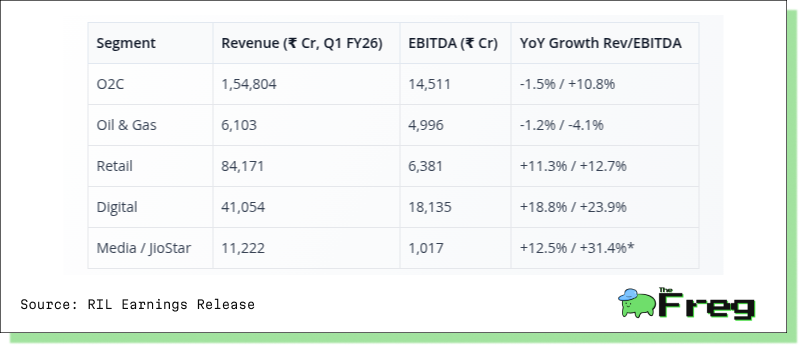

Segment Highlights

O2C & Oil Risks: The Oil to Chemicals (O2C) segment saw improved EBITDA driven by higher domestic margins and Jio-bp fuel retailing, but remains sensitive to crude market volatility. Retail showed steady top-line improvement, yet segment disclosure suggests consumer electronics faced headwinds, offset by gains in grocery and digital commerce. Digital remains a strong margin driver, led by Jio’s 5G subscriber traction.

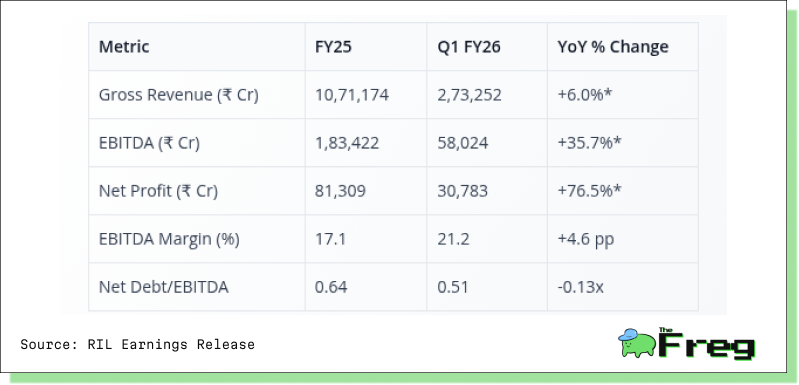

Financial Overview

Reliance Industries posted a strong start to FY26, with EBITDA up 35.7% and net profit surging 76.5% YoY—far outpacing single-digit revenue growth. Margin expansion (EBITDA margin at 21.2%) and investment gains fuelled this outperformance.

Highlights:

- Operational Leverage: Strong cost control and scale benefits drove margin gains across digital, retail, and O2C.

- Balance Sheet Strength: Net debt/EBITDA improved to 0.51x; interest coverage at 6.28x.

- Core Resilience: Even excluding investment gains, EBITDA and PAT rose 15% and 25% YoY.

Reliance’s Q1 performance highlights its ability to grow margins and cash flow amid a muted revenue backdrop. The group’s diversified portfolio, operational discipline, and pivot toward high-margin businesses position it well for sustained investment and shareholder returns.

Cash Flow and Efficiency

Reliance Industries generated robust operating cash flows of ₹1.78 lakh crore in FY25—well exceeding its ₹1.31 lakh crore capex—demonstrating strong internal funding capacity. In Q1 FY26, capex stood at ₹29,875 crore, focused on digital growth, retail expansion, and scaling new energy projects. Despite high investment levels, the company efficiently recycled cash flows, preserving liquidity and reducing reliance on external financing.

The balance sheet continues to strengthen, with net debt stable around ₹1.17 lakh crore and the debt-to-equity ratio improving to 0.39. Higher profits and effective cost management pushed interest coverage to 6.28x. Inventory turnover remained healthy at 5.78x, underscoring solid operational efficiency. Together, these metrics highlight Reliance’s financial resilience and flexibility to fund future growth and navigate macro uncertainties.

Addressing Key Strategic Questions

1. O2C: Exposure to Global Supply and Russian Oil Risk

RIL’s refining business remains exposed to global supply disruptions. In prior years, access to discounted Russian crude materially boosted margins. However, EU and global regulatory changes threaten the repeatability of this profit lever, potentially leading to:

- Tighter Margins: New sanctions and logistical bottlenecks could raise effective feedstock costs and narrow Reliance’s cost advantage, as seen in recent volatility in Brent and Singapore cracks.

- Supply Diversification: Reliance’s scale and sophisticated sourcing allow for some flexibility, leveraging relationships in the Middle East, Africa, and domestic markets, but loss of Russian arbitrage will challenge margin optimization.

- Hedge Strategy: The group uses long-term, arms-length contracts (e.g., with Reliance International) and a fully integrated supply chain to spread procurement risk2. Nonetheless, a return to pre-2022 supply patterns would structurally reduce relative refining/chemicals profitability.

This context is reflected in FY26 O2C revenue decline (-1.5% YoY) despite margin improvement, highlighting dependence on timely arbitrage opportunities—now at greater risk.

2. Retail: Pause or Inflection?

Though up 11.3% YoY in Q1 FY26, Reliance Retail’s performance is under the microscope:

- Consumer Electronics Drag: The segment flagged weaker consumer electronics on early monsoon impact, echoing broader downticks in urban consumption, while grocery, fashion, and JioMart held up well.

- Digital Acceleration: JioMart’s quick commerce segment showed 175% YoY order growth and AJIO (fashion e-comm) is innovating with AI-powered recommendations and rapid fulfilment (AJIO Rush 4-hour delivery). Premium and own-brand expansion, omnichannel integration, and loyalty programs signal a pivot towards tech-enabled, more resilient retailing.

- Consumption Drivers: Registered customer base grew 13.3% YoY to 358 million; store base continues to rise. JioMart Digital and new commerce partner base also expanding rapidly.

While the consumer environment is mixed, wonky electronics demand and broader rural stress have not derailed Reliance’s strategy shift. Retail’s “pause” may reflect cyclical pressure before the full impact of digital/AI-driven retail is realized—management remains optimistic and capex continues.

3. New Energy: Delivering Promise or More to Prove?

Execution Pace:

- New Energy remains a strategic focus—solar, hydrogen, storage, and related giga-factories move incrementally toward operationalization.

- Module and cell manufacturing at Jamnagar has BIS certification; government-linked capex incentives (PLI) are secured for solar, battery, and electrolyser production.

- Pilot lines and first RE PPAs are in place; land has been secured for large-scale projects in Gujarat.

Financial Model & Partnerships:

- The “self-funded” model remains credible—capex is internally funded, with net gearing steady below 0.4x1.

- Alliances with global players (including hydrogen, solar, and storage tech partners) add technological depth but have yet to show material near-term revenue or margin contribution.

Results so far:

- Tangible operational EBITDA from New Energy is not yet visible in segment reporting.

- Management guidance remains bullish, expecting commissioning of several giga-factory lines over the next year. Analysts and stakeholders will watch for project delivery, off-take agreements, and real revenue impact in FY27 and beyond.

Forward Guidance & Risks

- O2C: Expect continued YoY volatility, depending on feedstock economics and global demand; refining margins remain under pressure as Russian discounts diminish.

- Retail: Momentum likely to improve as digital and omnichannel initiatives scale, contingent on consumer recovery and electronics uptick.

- New Energy: Key milestones in solar, batteries, and hydrogen expected in FY26-27.

- Risks: Feedstock supply shocks, slower-than-hoped New Energy ramp, and macro consumption shifts top the watchlist.

Reliance’s financial fortress, dominant scale, and transformation agenda make it a core India equity holding. Though O2C profit levers are structurally less secure and retail faces near-term demand challenges, digital leadership and visible traction in New Energy capex suggest enduring long-term optionality. The company’s ability to diversify risk, innovate on delivery, and deploy capital at scale remain its core strategic strengths. Execution on green energy and further digital/AI-driven consumer business revival are crucial for sustaining premium value—a risk/reward skewed toward opportunity, but not without near-term monitoring needs.