Record SIP Inflows in India: April 2025 Marks a Watershed Moment in Retail Investing

SIP inflows hit a record ₹26,632 crore in April 2025, highlighting rising retail investor confidence despite market volatility.

India's mutual fund landscape witnessed a defining milestone in April 2025 as Systematic Investment Plan (SIP) contributions hit an all-time high of ₹26,632 crore. According to the Association of Mutual Funds in India (AMFI), this represents a 3% jump over March and a 30.7% year-over-year surge.

This growth, achieved despite market volatility and an unprecedented number of SIP account closures, underscores the maturity and resilience of Indian retail investors.

A Resilient Investor Base

In a paradoxical twist, even as 1.36 crore SIP accounts were closed or matured in April—a record spike in discontinuations—the number of actively contributing SIP accounts climbed to 8.38 crore, up from 8.11 crore in March. This was fueled by 46.01 lakh new SIP registrations in the month alone, reflecting strong retail appetite for disciplined, long-term wealth creation.

"The rising preference among investors for mutual funds as a disciplined and effective tool for long-term savings" — Venkat Chalasani, CEO, AMFI

This dual trend of mass closures alongside massive new sign-ups points to a dynamic shift in investor behavior: reallocation, consolidation, and a firm belief in the SIP mechanism despite short-term corrections.

Inflow Momentum: Seven-Month Streak Above ₹25,000 Crore

The April 2025 inflow is the highest monthly SIP collection on record, extending a remarkable seven-month streak where inflows consistently crossed the ₹25,000 crore mark.

The SIP Assets Under Management (AUM) also climbed to ₹13.90 lakh crore, accounting for roughly 20% of the mutual fund industry's total AUM.

Macroeconomic and Behavioral Tailwinds

India's SIP boom isn't just a numbers game—it's the product of converging macroeconomic stability and a more financially literate populace:

- Stable GDP Growth & Controlled Inflation: GDP growth at 6-7% and inflation at 4-5% mirror the 2003-2007 investment-friendly phase.

- Post-COVID Investment Maturity: After a brief drop in 2020, SIPs rebounded strongly with most equity funds delivering attractive returns.

- Tech-Enabled Access: UPI and India Stack integrations have democratized investing. Fintechs like Groww and Zerodha Coin are reducing barriers with paperless KYC and low investment thresholds.

- Public Awareness Campaigns: AMFI's "Mutual Funds Sahi Hai" campaign has helped reshape public perception and increase retail participation.

- Demographic Shift: Tier II and III cities now contribute 56% of new SIP registrations (vs. 49% in FY23), expanding beyond metro India.

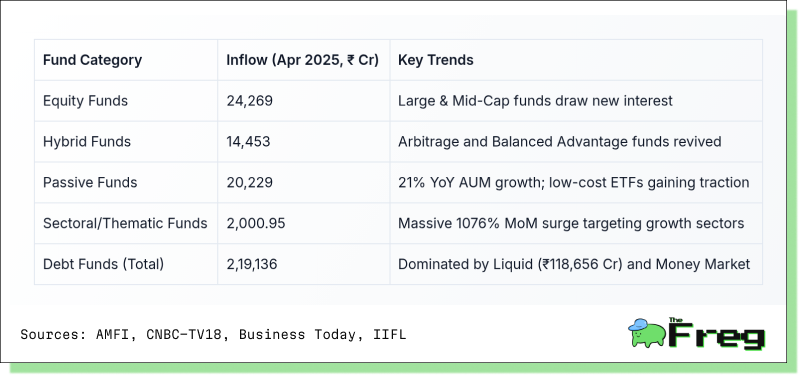

Changing Fund Preferences

While equity funds continue to lead SIP collections, there has been notable interest in hybrid and passive strategies.

Investors are increasingly choosing diversified portfolios, with Balanced Advantage Funds like HDFC's (₹94,865 crore AUM) standing out for their dynamic asset allocation.

Top Mutual Fund Schemes by AUM

The Road Ahead: Growth with Caution

Despite the celebratory numbers, April also highlighted emerging challenges. A 297.74% SIP stoppage ratio suggests that many investors still react emotionally to short-term market corrections. The Nifty Smallcap 250 TRI fell 24% between September 2024 and March 2025, exacerbating exits.

Behavioral finance points to three major biases affecting SIP continuity:

- Loss Aversion: Fear of short-term loss prompts premature exits.

- Herding Behavior: Investors mimic peer actions, often irrationally.

- Present Bias: Preference for immediate gratification over long-term gains.

Education and asset allocation remain key to addressing these vulnerabilities. SIPs with over 10-year durations have delivered >11% CAGR for 92% of investors, according to SEBI. Yet only 27% of investors diversify effectively.

The regulatory framework by SEBI, including transparency norms and AMC compliance requirements, adds a safety net. But long-term sustainability will depend on investors maintaining discipline, resisting behavioral pitfalls, and adopting a balanced portfolio strategy.

India's SIP surge in April 2025 is more than a numerical achievement; it's a sign of financial maturity sweeping across urban and rural India alike. It speaks to a growing middle class investing not just in funds, but in its future. If supported by continued education, technology, and macroeconomic stability, this trend could reshape India’s investment landscape for years to come.