Rare Earth Realignment: The Economic and Geopolitical Stakes of Breaking China’s Monopoly

Global rare earth supply chains are splitting into U.S.- and China-aligned blocs, reshaping global trade, manufacturing, and strategic resource control.

Rare earth elements (REEs)—a group of 17 metallic elements—are quietly powering the modern global economy. They’re embedded in everyday devices and advanced technologies alike: smartphones, wind turbines, electric vehicle (EV) batteries, precision-guided weapons, AI servers, and even nuclear reactors. These minerals, while relatively minor in volume, are outsized in impact—serving as foundational components in industries worth trillions of dollars.

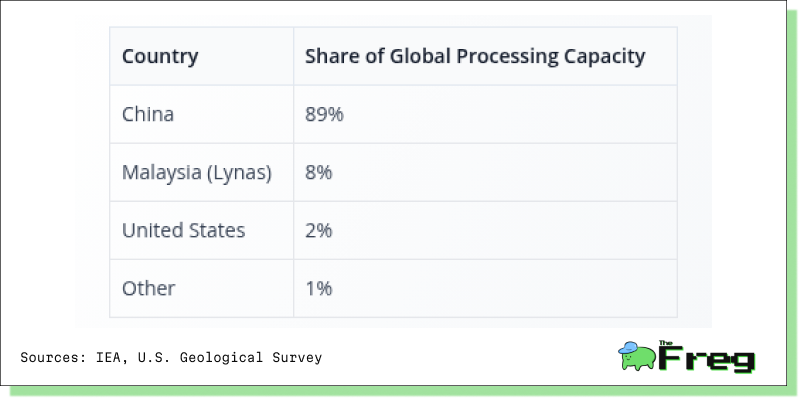

Yet their economic importance is now matched by geopolitical urgency. As the global energy transition and digital transformation accelerate, the world’s dependence on China—a nation that has controlled up to 95% of global rare earth processing—is emerging as a major strategic vulnerability. Western governments are racing to construct alternative supply chains, navigating a complex web of economic trade-offs, national security imperatives, and industrial challenges that could reshape global trade itself.

The Global Trade Bloc Divide: China’s Dominance and the Strategic Response

China’s control over the rare earth value chain isn’t just a matter of mineral abundance—it’s the result of decades of deliberate industrial policy. The country holds roughly 48% of global reserves, but more crucially dominates the refining and separation stage, where value is maximized.

At the heart of this dominance lies China’s vertically integrated control—from Bayan Obo’s vast reserves to sophisticated separation technologies and export quotas managed by state-owned giants. This market asymmetry has been leveraged as a geopolitical tool: most notably during the 2010 Japan export ban and April 2025's restrictions on seven critical heavy rare earths.

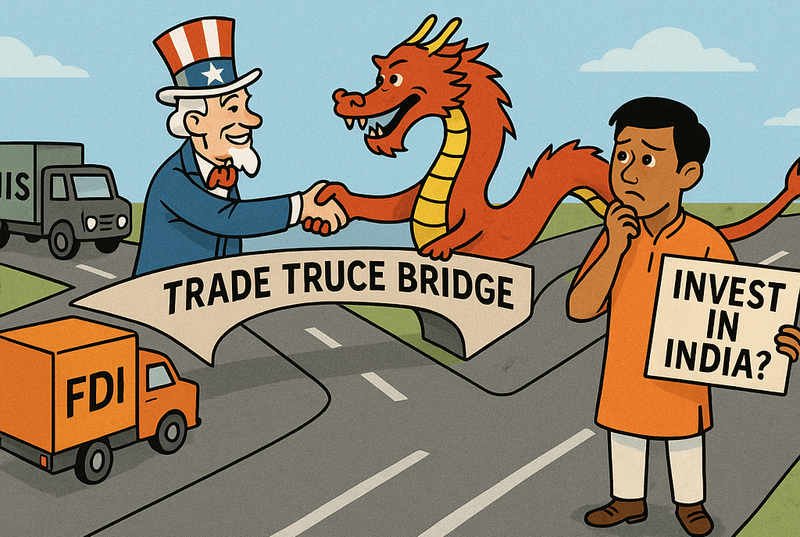

In response, Western nations are aligning into emergent trade blocs—coordinated efforts between the U.S., Australia, Canada, Japan, and others to establish independent REE ecosystems. These partnerships aim to create parallel processing hubs and reorient supply flows away from China, a shift that could upend long-standing trade patterns and redraw the critical minerals map.

The High Cost of Breaking Free

While the ambition to build rare earth independence is clear, the economic burden is steep. A case in point: MP Materials' Mountain Pass mine in California produces ~38,000 tonnes of concentrate annually—yet nearly all of it is still sent to China for processing. The U.S., despite domestic mining, remains tethered to Beijing’s refining capabilities.

This dependency exposes Western supply chains to manipulation and volatility. After China’s 2025 export restrictions, markets like Germany and Japan experienced immediate panic, with delays in defence procurement and inventory disruptions rippling across industries.

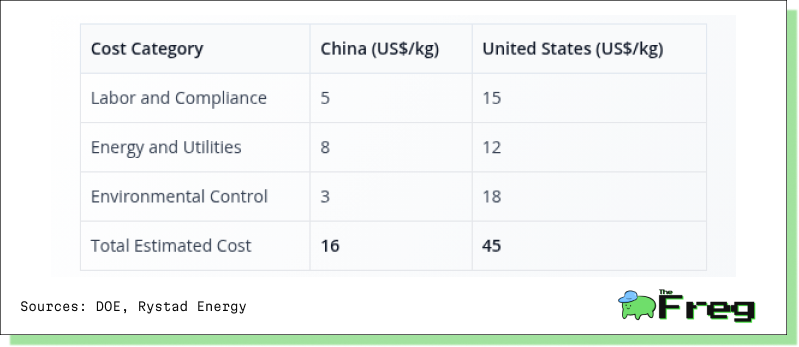

Chinese producers maintain a 40–60% cost advantage, driven by low labour costs, scale, and looser environmental regulations. Western projects may need price floors of $110/kg for critical elements like neodymium-praseodymium to stay viable against sub-$60/kg Chinese prices.

Winners in the Race to Decouple

Despite the headwinds, a few well-positioned companies are thriving in this strategic pivot. MP Materials has emerged as the West’s flagship rare earth firm—its partnership with the U.S. Department of Defense (DoD) involves a $400 million equity stake, price guarantees, and offtake agreements that de-risk the firm’s upcoming "10X" facility.

Private capital has followed. Apple committed $500 million for recycled magnet production, aiming to meet demand for “hundreds of millions of devices” by 2030. JPMorgan and Goldman Sachs added $1 billion in financing, and MP raised $650 million through a secondary offering post-DoD announcement.

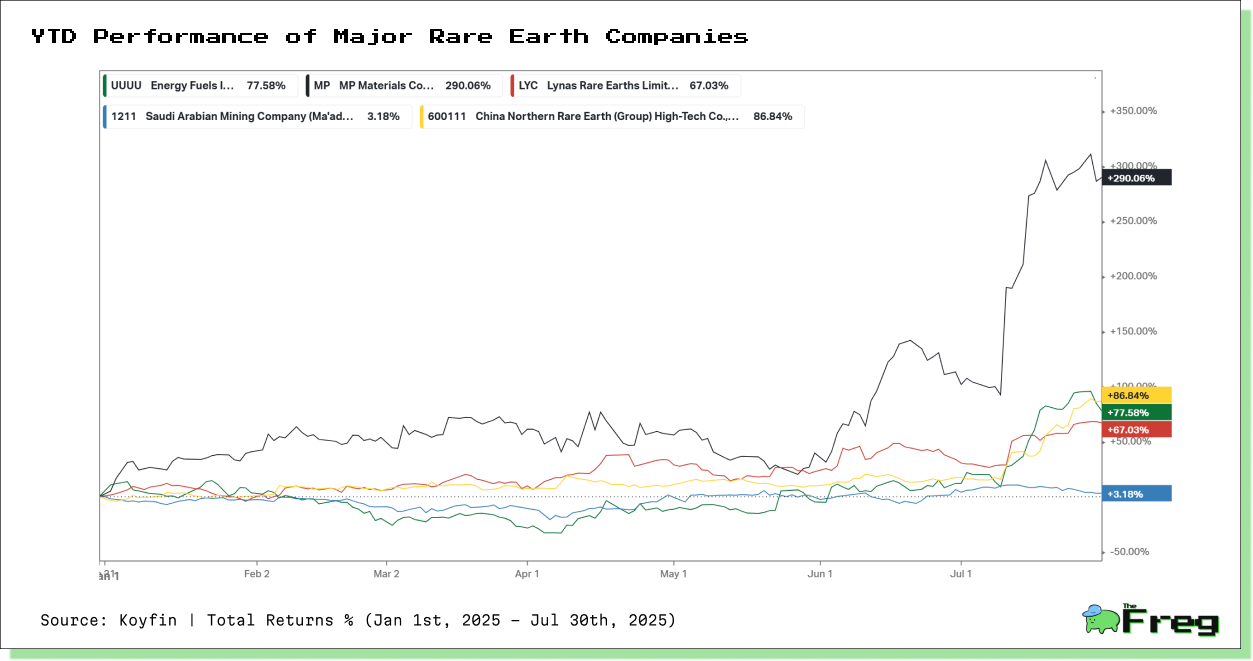

YTD Stock Performance: Investors Bet on Supply Chain Realignment

The divergence in year-to-date stock performance across major REE companies underscores investor sentiment—and strategic alignment.

Performance Highlights:

- MP Materials (U.S.) surged +290.06%, reflecting investor confidence in its Pentagon-backed scaling strategy.

- China Northern Rare Earth posted a solid +86.84%, bolstered by policy certainty and continued global reliance.

- Lynas Rare Earths (Australia) gained +67.03%, driven by optimism around its Texas expansion and stable Malaysian output.

- Energy Fuels Inc. (U.S.) rose +77.58%, boosted by rising demand for domestic sourcing.

- Ma’aden (Saudi Arabia) was relatively flat at +3.18%, indicating investor caution around emerging REE plays.

This performance divergence signals a shift toward firms embedded in aligned trade frameworks, with strong regulatory and capital support.

Regulatory and Financial Barriers

Yet even successful projects face systemic roadblocks. Lynas’ Texas facility—despite full funding—was recently delayed due to wastewater permit issues, underscoring how bureaucratic inertia can stall strategically vital infrastructure. Globally, countries like Brazil present further hurdles, with rare earth mining permits averaging 16 years for approval.

Simultaneously, financial uncertainty clouds the horizon. The U.S. government’s Section 45X production credit under the Inflation Reduction Act is scheduled to phase out by 2033—a timeframe that misaligns with the multi-decade lifespan of rare earth facilities.

Case in point: Meteoric Resources in Brazil has struggled to finance its Caldeira project despite government support. Export permits now face 30–60 day lead times, while cost inflation erodes the competitiveness of new entrants.

Investing in Strategic Sovereignty: Returns and Risks

Building a Western-aligned rare earth ecosystem could cost an estimated $2.1 trillion by 2050—but this investment may be the price of sovereignty. The alternative: continued exposure to price shocks, strategic coercion, and delays in critical technology deployment.

Strategic investment models are gaining traction:

- Australia’s A$1.2 billion strategic reserve guarantees REE purchases at fixed prices.

- Public-private frameworks like MP’s Pentagon partnership offer price floors, long-term contracts, and capital guarantees—creating predictable ROI for infrastructure-heavy projects.

Yet time is running out. With global demand projected to reach 315,000 tonnes by 2030, current development timelines leave little room for delay. Without immediate action, Western economies risk falling irreversibly behind. Delays today mean dependence tomorrow—and in a geopolitical climate where minerals can be weaponized, that dependence is no longer tenable.

The Cost of Inaction

The rare earth race is not merely an industrial competition—it is a high-stakes contest for technological sovereignty. The costs of building alternative supply chains are undeniably large. But the costs of failing to act—economic coercion, national security risk, and permanent strategic disadvantage—are far greater.

As Beijing consolidates its grip, the Western alliance must match ambition with execution. That means capital, regulation, and cooperation—not just at the company level, but across governments. In a world increasingly defined by resource bifurcation and strategic competition, rare earths may well determine who controls the future of innovation itself.