Pharma’s New Cold War: How U.S.–China Tensions Are Reshaping Global Healthcare

U.S.–China tensions are redrawing the global pharmaceutical landscape, disrupting supply chains, clinical trials, and innovation. As both nations pursue self-reliance, the industry shifts from globalization to regionalization with lasting consequences.

The pharmaceutical industry, long a beacon of global collaboration and efficiency, is now caught in the crossfire of escalating U.S.–China tensions. Once driven by open research environments and integrated supply chains, the sector is being reshaped by a wave of protectionism, geopolitical rivalry, and national security imperatives. What began as a trade dispute has now metastasized—disrupting everything from drug discovery and clinical trials to regulatory pathways and access to critical therapeutics.

The New Fault Line: From Trade Tariffs to Biotech Breakdown

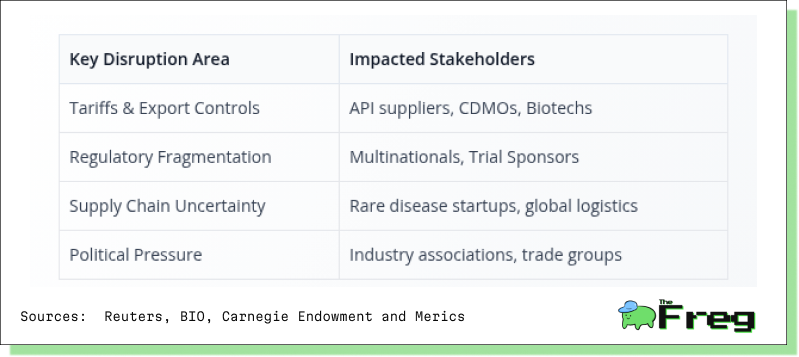

At the heart of this disruption lies the rapid unravelling of long-standing interdependencies. Tariffs, export controls on advanced biologics, and dual regulatory regimes have made cross-border operations more cumbersome and costly. Chinese firms such as WuXi AppTec and WuXi Biologics are adapting by reworking project timelines, stockpiling critical inputs, and considering localized testing protocols to safeguard operations.

Multinational pharmaceutical companies are similarly reassessing their engagement strategies. The Biotechnology Innovation Organization (BIO)’s decision to cut ties with Chinese CDMOs (Contract Development and Manufacturing Organizations) underscores a chilling strategic shift. For small biotech startups—especially those focused on rare diseases—the impact is stark. Many face delays in clinical development timelines, potentially postponing life-saving therapies for patients with limited options.

China’s Strategic Pivot: Self-Reliance with Global Ambitions

As tensions intensify, China is leaning hard into its self-reliance strategy. BeiGene, a flagship Chinese biotech, has significantly reduced its dependence on imported materials in key production facilities. This shift reflects Beijing’s broader “Made in China 2025” initiative, which aims to secure domestic innovation capacity across high-tech sectors, including pharmaceuticals.

Yet self-reliance does not mean isolation. Chinese pharmaceutical exports have found new momentum in alternative markets. Exports to ASEAN countries under the Belt and Road Initiative surged from $4.8 billion in 2013 to $13.7 billion in 2022, transforming Southeast Asia into a pivotal growth corridor.

Simultaneously, Chinese firms are hedging their geopolitical risks by investing overseas. WuXi Biologics’ $1.4 billion facility in Singapore exemplifies this “Made in Singapore” model, allowing companies to maintain global relevance while sidestepping Western scrutiny. These investments also serve to reassure foreign clients and regulators by embedding production within more politically neutral jurisdictions.

Regulatory Fragmentation: Global Pharma Goes Local

For multinational firms, the growing divergence in regulatory regimes is emerging as a major operational hurdle. Companies that once optimized efficiency through globalized clinical trials and centralized labs are now forced to regionalize operations. Thermo Fisher Scientific’s collaborations with Pfizer and AstraZeneca on decentralized next-generation sequencing (NGS) diagnostics highlight this shift. These projects increasingly target country-specific testing regimes to comply with national standards.

The consequences are more than just logistical. Trials like that for ANV419 are now grappling with customs bottlenecks and new bio sample export restrictions. In response, pharmaceutical developers are adopting more flexible methodologies—such as basket, umbrella, and platform trials—that reduce cross-border dependencies while retaining research quality and statistical power.

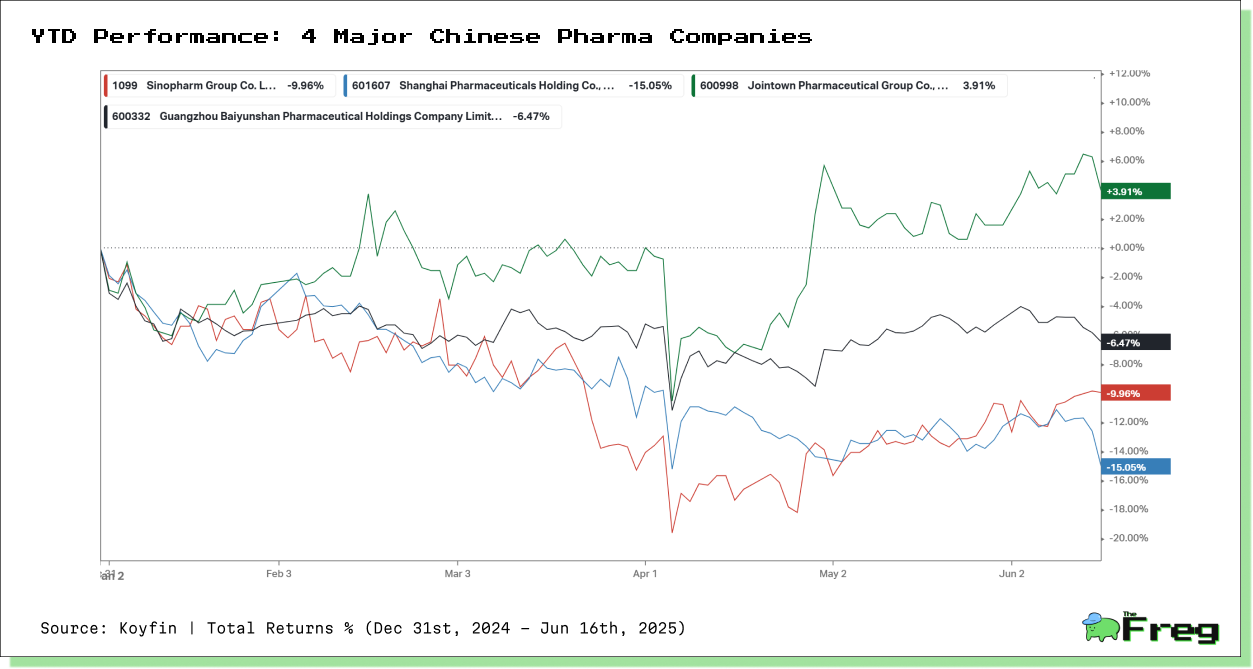

Diverging Fortunes: Chinese vs. U.S. Pharma Stocks

Geopolitical tensions are also being priced into the equity markets. In China, pharma stocks are exhibiting wide disparities in 2025, reflecting how firms are navigating the new geopolitical terrain. Jointown Pharmaceutical is up +3.91%, likely due to its domestic-facing business model. In contrast, Shanghai Pharmaceuticals has fallen -15.05%, weighed down by its global exposure. Larger players such as Sinopharm and Guangzhou Baiyunshan declined -9.96% and -6.47%, respectively—indicative of broad investor caution toward firms with international entanglements.

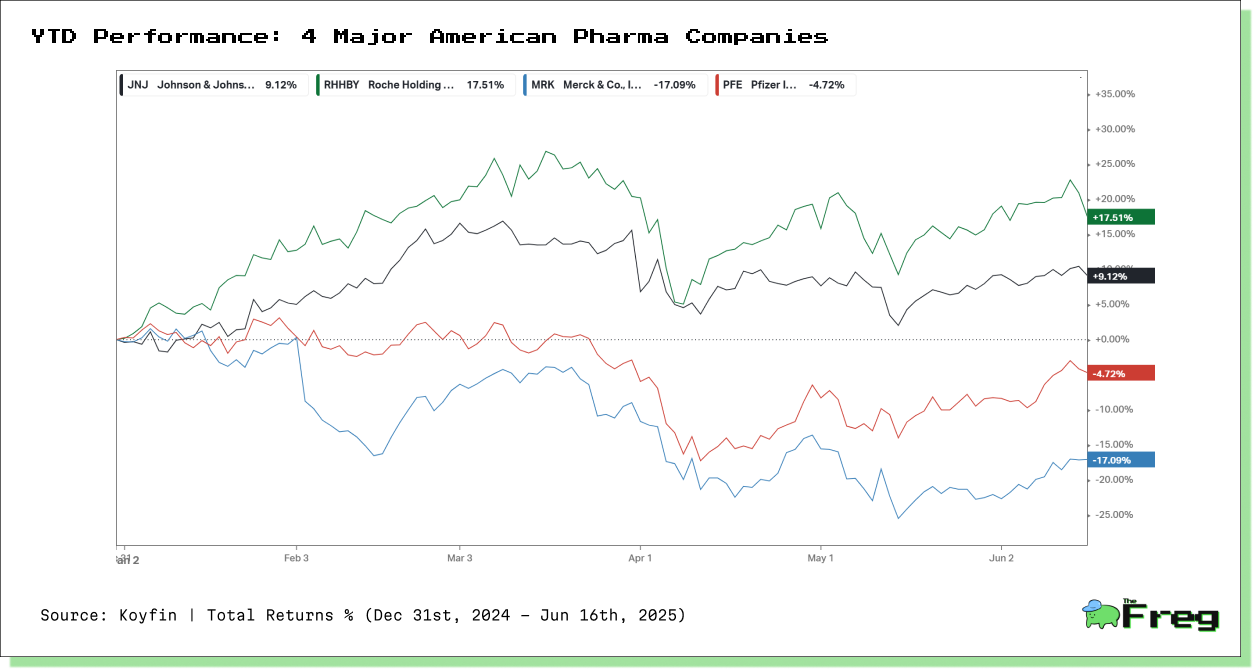

Meanwhile, in the U.S., pharmaceutical stocks are showing a more selective pattern. Roche has rallied over 17% on the strength of its drug pipeline and limited exposure to China. Johnson & Johnson is up 9%, benefiting from its diversified portfolio and stable consumer health division. On the other hand, Pfizer is down nearly 5%, facing sluggish post-COVID growth and a bumpy restructuring process. Merck has suffered the steepest loss, dropping more than 17% amid patent cliffs, margin pressure, and exposure to Chinese supply chains.

A Tale of Two Strategies

Compared to their Chinese counterparts, many U.S. pharmaceutical companies are showing relative resilience—particularly those with minimal reliance on Chinese manufacturing or clinical infrastructure. The market is sending a clear signal: firms with autonomous supply chains and less geopolitical exposure are being rewarded. Localization, once viewed as a backup plan, is now emerging as a competitive advantage.

Still, Chinese companies like Jointown are not without leverage. Their ability to scale rapidly and align with government initiatives allows them to thrive in a protectionist environment. Yet this same environment introduces volatility and long-term uncertainty, especially for those navigating both domestic regulation and foreign suspicion.

A Fragmented but Interdependent Future

The pharmaceutical industry is not so much deglobalizing as it is regionalizing. While Washington and Beijing pursue self-sufficiency in parallel, the web of interdependencies—talent, innovation, clinical data, and supply components—remains stubbornly intact. The future of pharma may be defined less by national borders and more by distributed innovation: regional R&D hubs, localized compliance ecosystems, decentralized manufacturing, and strategic cross-border partnerships.

As one industry observer noted, “Chinese biotech firms are ascending the value chain daily... competing with their Western counterparts.” In a world increasingly divided by political ideology, the shared pursuit of medical innovation might remain one of the few enduring bridges. But if the pharmaceutical sector is any indication, that bridge will be narrower, more regulated, and fiercely contested.