Oracle’s Stock Surge: Cloud Momentum, AI Ambitions, and Financial Strength

Oracle’s stock has surged to record highs, powered by robust cloud and AI-driven revenue growth, expanding margins, and strong cash flow, positioning the company as a leader in enterprise technology and cloud infrastructure.

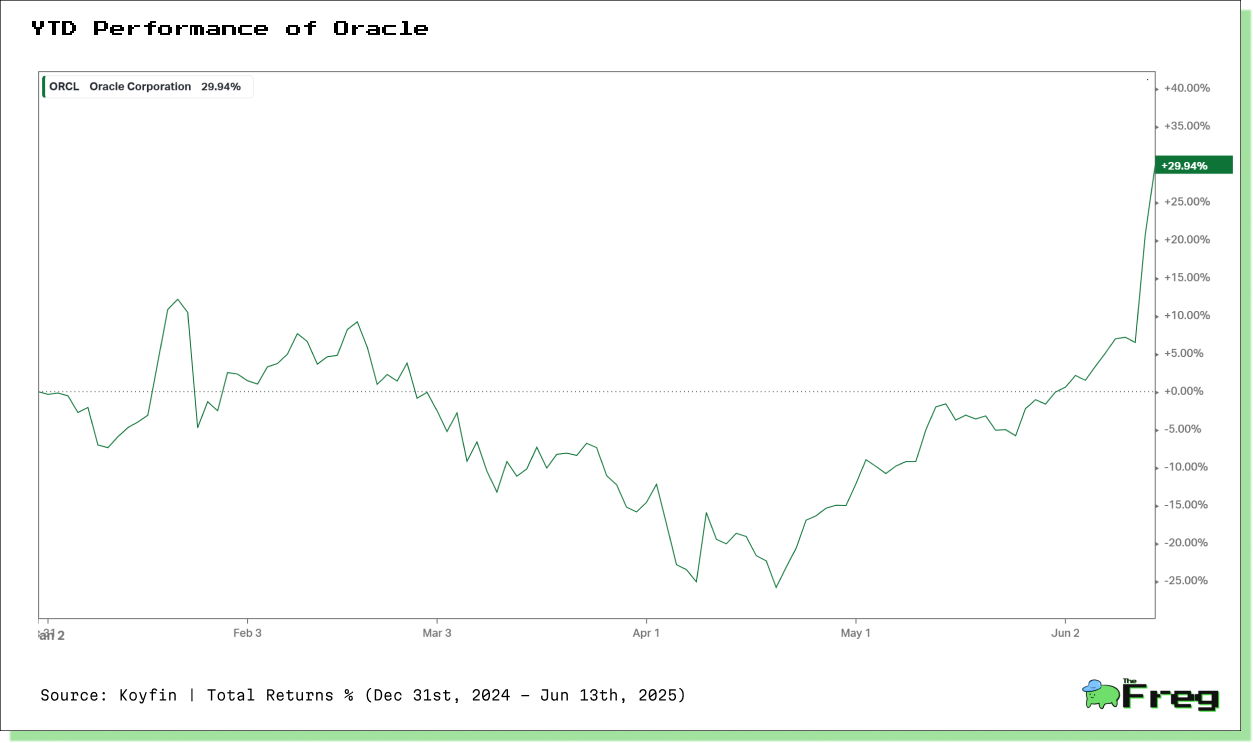

Oracle Corporation (NYSE: ORCL) has delivered a show-stopping performance in June 2025, with its stock soaring to all-time highs and outpacing the broader market. The catalyst? A potent mix of robust cloud growth, bullish forward guidance, and a financial profile that is turning heads across Wall Street. Let’s break down the fundamentals, financials, and the outlook that has investors piling in.

Oracle’s Recent Surge: What’s Driving the Rally?

Oracle shares jumped 13.3% on June 12, 2025, closing just under $200 and notching the biggest gain in the S&P 500 for the day. The rally followed a quarterly earnings report that beat expectations and, more critically, a bullish forecast for fiscal 2026. The company projects its cloud infrastructure revenue will grow over 70% in the coming year—outpacing the growth rates of cloud titans Amazon Web Services and Microsoft Azure.

Cloud services and license support revenues rose 14% year-over-year to $11.7 billion in Q4 FY25, while Oracle Cloud Infrastructure (OCI) revenue surged 62% for the quarter. The company’s multi-cloud database revenue, driven by partnerships with Amazon, Google, and Azure, grew 115% quarter-over-quarter, signaling Oracle’s growing relevance in the AI and cloud ecosystem.

“We expect our total cloud growth rate—applications plus infrastructure—will increase from 24% in FY25 to over 40% in FY26. Cloud Infrastructure growth rate is expected to increase from 50% in FY25 to over 70% in FY26.”

— Safra Catz, CEO.

Financial Highlights: Q4 2024 and FY25 at a Glance

Key Takeaways

- FY25 revenue up 8% YoY; cloud services and license support up 12% YoY.

- Operating cash flow climbed 12% to $20.8 billion, reflecting strong cash generation.

- Non-GAAP net income and EPS were $17.3 billion and $6.03, respectively, highlighting robust underlying profitability.

Financial Metrics

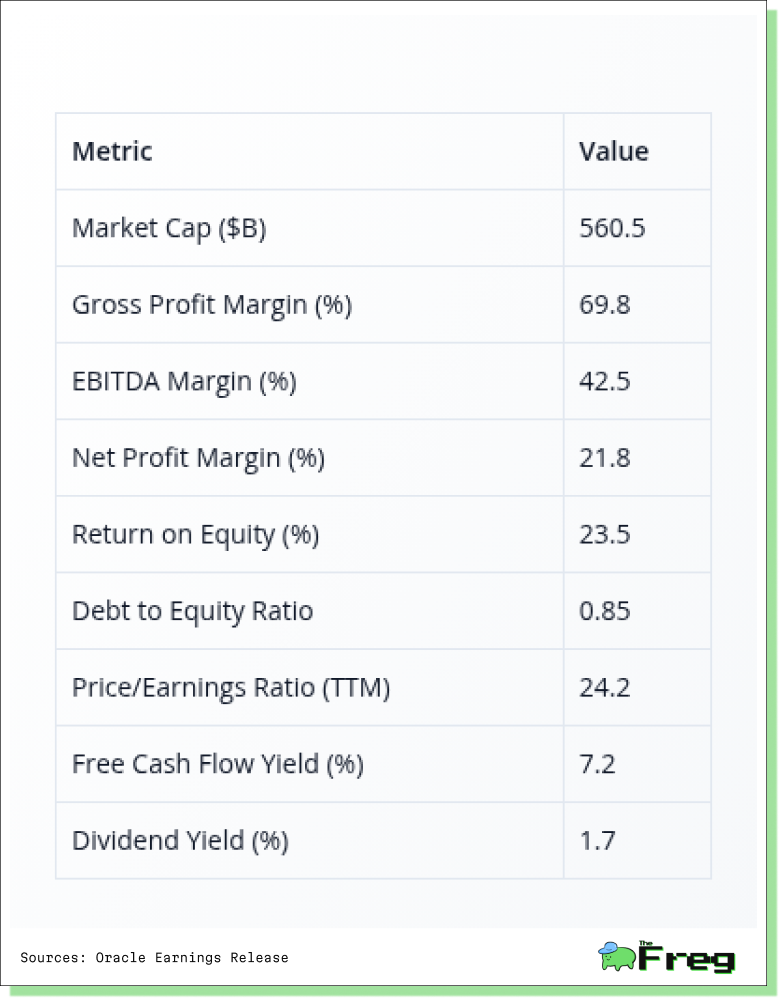

Oracle’s fundamentals underscore its financial resilience and operational efficiency:

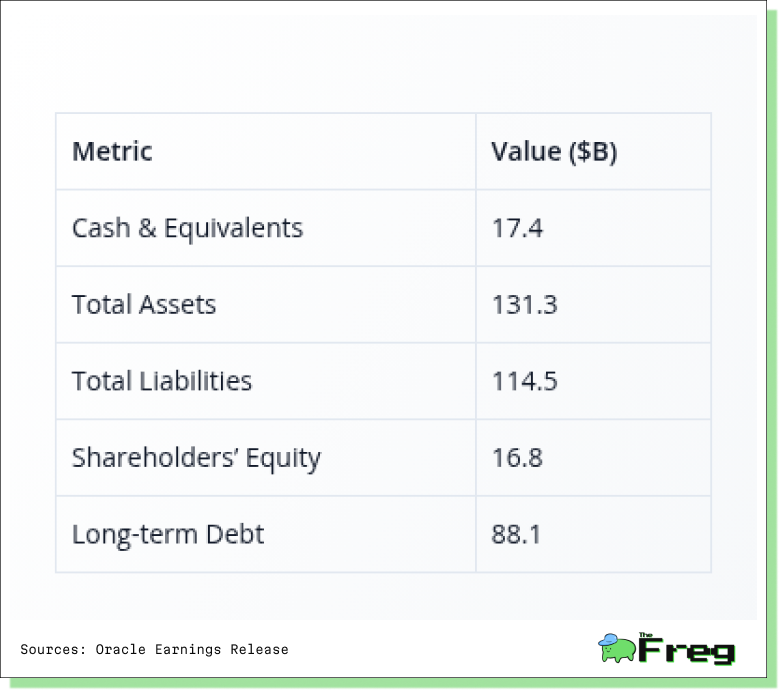

Balance Sheet Strength

Oracle’s current ratio of 1.02 indicate adequate liquidity to cover short-term obligations.

Oracle’s Recent Financials: Revenue Growth and Profitability Trends

Oracle’s latest financial results reveal a company in the midst of a powerful growth cycle, particularly driven by its cloud and AI businesses. Here’s what stands out from the most recent quarterly and annual numbers:

Robust Revenue Growth

- Oracle’s total revenue for FY25 reached $57.4 billion, marking an 8% year-over-year increase.

- Cloud services and license support revenue, the company’s core growth engine, climbed 12% year-over-year to $44.0 billion.

- In Q4 FY25 alone, cloud services and license support revenue hit $11.7 billion, up 14% year-over-year.

- The Oracle Cloud Infrastructure (OCI) segment was a standout, with revenue up 62% for the quarter, reflecting surging demand for cloud and AI infrastructure.

Profitability Trends Remain Strong

- GAAP operating income for FY25 totaled $17.7 billion, with a corresponding operating margin of approximately 30.8%.

- Net income (GAAP) for FY25 was $12.4 billion, translating to a net margin of 21.8%.

- Non-GAAP net income was even higher at $17.3 billion, with non-GAAP EPS of $6.03, underscoring strong underlying profitability.

- Oracle’s gross profit margin remains high at 69.8%, and EBITDA margin stands at 42.5%, indicating efficient operations and cost control.

- Free cash flow for the year reached $20.8 billion, up 12% year-over-year, highlighting Oracle’s ability to convert earnings into cash.

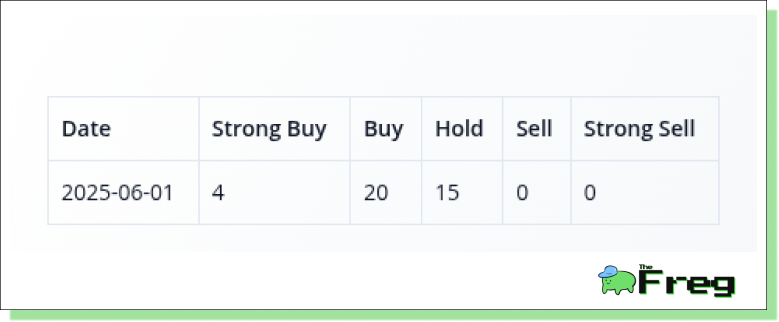

Analyst Ratings and Market Sentiment

Oracle enjoys robust analyst support, with a consensus leaning strongly toward “Buy” and “Strong Buy”:

Recent upgrades from major banks followed the Q4 earnings, reflecting confidence in Oracle’s growth trajectory.

Forward Estimates and Growth Outlook

Oracle’s forward guidance is nothing short of bullish. Analysts expect:

- FY26 cloud growth (applications + infrastructure) to exceed 40%

- OCI revenue growth to top 70%

- Remaining Performance Obligations (RPO) to more than double, indicating a strong pipeline of future revenue

Selected Analyst Estimates

Competitive Position: AI and Cloud at the Forefront

Oracle’s aggressive expansion in cloud infrastructure and AI-powered services is paying off. Its cloud growth rate now far exceeds that of AWS and Azure, even if absolute scale is smaller. The company’s multi-cloud partnerships and AI infrastructure offerings are attracting marquee enterprise clients and driving a record backlog of contracts—RPO up 41% to $138 billion in the May quarter.

Oracle’s stock surge is rooted in fundamentals: accelerating cloud and AI-driven growth, strong financials, and a robust outlook. The company’s ability to deliver double-digit revenue growth, expand margins, and generate substantial cash flow makes it a standout in the tech sector. With analysts raising price targets and the company projecting even faster growth ahead, Oracle is firmly on the radar of global investors seeking exposure to the next wave of enterprise technology.