Nvidia at a Crossroads: Can the AI Titan Sustain Its Meteoric Rise?

Soaring to a $3.2T valuation, Nvidia has redefined its role in global tech, eclipsing Apple and replacing Intel in the Dow. As sovereign AI demand rises and competition intensifies, its future depends on navigating geopolitical and market challenges.

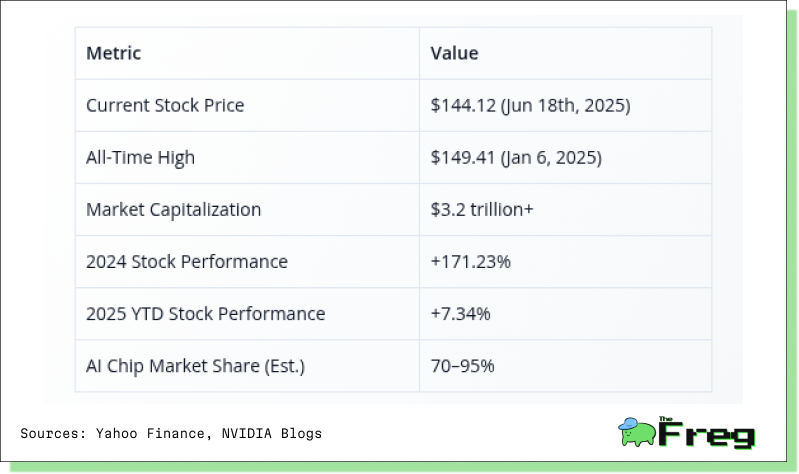

Nvidia’s astonishing ascent has captivated Wall Street, and with good reason. The company’s stock surged to $144.12, inching toward its all-time high of $149.41 recorded on January 6, 2025. After a breath-taking 171.25% gain in 2024, Nvidia’s share price has already climbed another 7.34% in 2025, cementing its position as the second-largest U.S. company by market capitalization, now surpassing Apple with a valuation north of $3.2 trillion, trailing only Microsoft.

At the heart of Nvidia’s success is its dominance in the AI chip space, where demand for its Blackwell GPUs has outstripped supply, reportedly booked out 12 months in advance. This demand explosion has elevated Nvidia not just in investor rankings but also as a key geopolitical actor—caught between extraordinary global demand and an increasingly fractious U.S.-China tech rivalry.

Nvidia’s Market Surge

These figures underscore Nvidia’s extraordinary momentum in both the equity markets and the broader AI economy. With a market cap surpassing $3.2 trillion and commanding up to 95% of the AI chip market, Nvidia’s ascent has been nothing short of historic. Its consistent outperformance—driven by surging demand for AI infrastructure—has not only elevated its stock price but also redefined its position in the global tech hierarchy.

AI Sovereignty and Strategic Positioning

As the global race for AI sovereignty accelerates, Nvidia has emerged as the go-to partner for nations seeking technological independence. The term sovereign AI encapsulates a country’s ability to develop and control AI infrastructure using domestic resources—ensuring alignment with national laws, ethics, and data governance.

Nvidia offers a compelling turnkey solution: Blackwell GPUs, CUDA software, and full-stack AI frameworks. These tools empower countries to build AI systems that not only reflect cultural values but also safeguard sensitive national data. Governments from the Middle East to Southeast Asia are already tapping into these capabilities, and expansion into Europe and East Asia is reportedly gaining momentum.

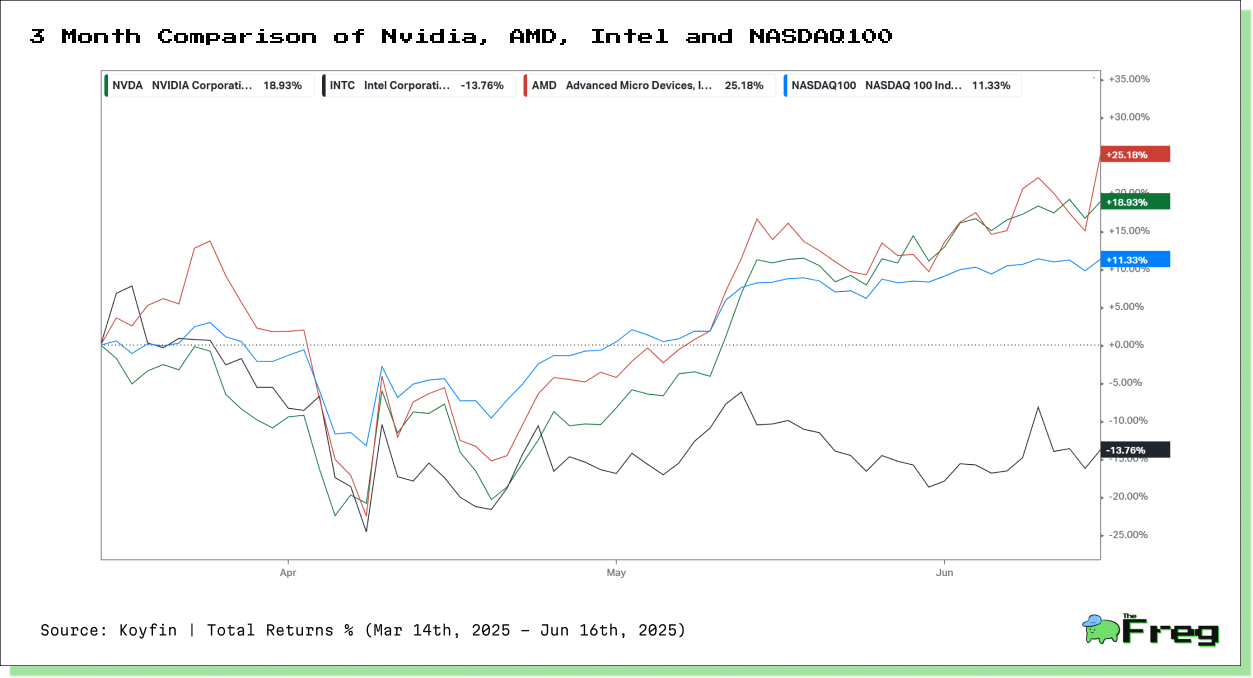

Competition Heats Up—but Nvidia Holds the Line

AMD’s MI300X poses the most credible threat yet to Nvidia’s datacenter dominance. Intel, once the undisputed titan of semiconductor markets, has struggled to keep pace in the AI era. Despite aggressive investment and restructuring under CEO Pat Gelsinger, Intel’s market share in AI accelerators remains minimal. The company’s stock has underperformed tech peers, weighed down by execution missteps and margin compression. Intel's failed attempt to keep up with AI-specific GPU innovation and its inability to match the software ecosystem of CUDA have left it on the sidelines of the datacenter AI boom.

Intel’s exit from the Dow Jones Industrial Average—replaced by Nvidia—is more than symbolic. It reflects Wall Street’s verdict on which company represents the future of computers. While Intel pursues foundry ambitions and promises of future relevance in AI via Gaudi accelerators, the market remains unconvinced, with analysts sceptical about Intel’s ability to reclaim a leadership position in high-margin segments dominated by Nvidia.

What Lies Ahead

Nvidia’s recent entry into the Dow Jones Industrial Average, replacing Intel, marks a symbolic shift in the tech landscape. It’s also a moment of reflection: Can Nvidia continue to lead as both a technological and market force in an era of deepening geopolitical fragmentation?

Investors are watching closely. Upcoming Q2 earnings will reveal whether Nvidia can offset lost Chinese revenues with new sovereign AI deals and continued dominance in datacenter deployments. Hyperscalers are developing custom chips, and rivals like Broadcom are aggressively entering the AI space. Yet Nvidia’s first-mover advantage, vertically integrated stack, and the scale of real-world AI adoption continue to give it an edge.

As Francisco Bido of F/m Investments put it:

“It’s not a fad. There are too many compelling use cases where AI can significantly improve top and bottom lines.”

In many ways, Nvidia has become not just the face of the AI revolution—but also a bellwether of the increasingly fragile and fragmented global tech order. Whether it can remain on top will depend not only on its chips, but on how it navigates the political currents reshaping the world around them.