Nifty Reclaims 25,000: A Market Rally Fueled by Trade Hopes, Earnings Strength, and Global Optimism

Indian stock markets surged on May 15 as the Nifty crossed 25,000, driven by hopes of an India-US trade deal, strong sector gains in auto, IT, and metals, and positive global cues. Investor sentiment turned sharply bullish across the board.

Indian equity markets came alive on May 15 with a powerful surge that sent the Nifty 50 past the 25,000 mark for the first time in seven months, as a confluence of global and domestic catalysts invigorated investor sentiment. The rally wasn’t just technical—it was deeply rooted in macroeconomic tailwinds, strong corporate earnings, and renewed institutional interest.

A Landmark Session for Indian Equities

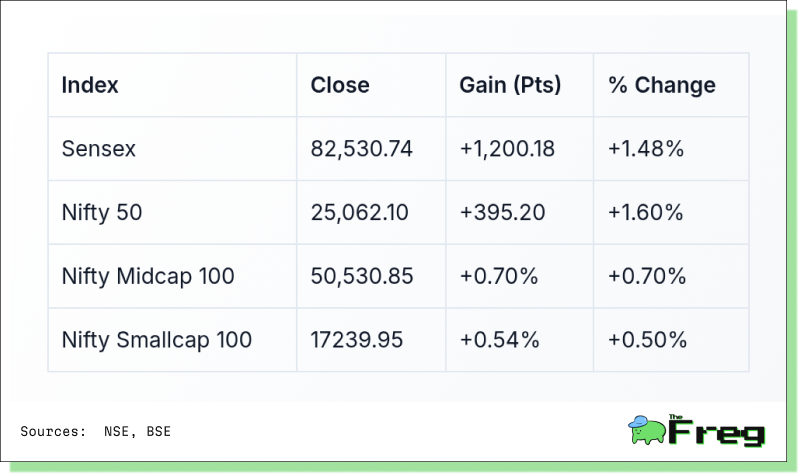

The Sensex vaulted 1,200 points to close at 82,530.74, while the Nifty 50 jumped 395.20 points (1.6%) to end at 25,062.10. Market capitalization across BSE-listed firms expanded by ₹5.05 lakh crore, pushing total m-cap to ₹439.94 lakh crore. Importantly, 49 of the 50 Nifty components ended in the green—an emphatic signal of broad-based optimism.

Trigger: A Zero-Tariff Trade Breakthrough with the US

The immediate spark came from an unexpected source: US President Donald Trump, speaking at a business summit in Doha, announced that India had proposed a trade deal offering "basically zero tariffs" on American goods. Trump remarked, “It’s very hard to sell in India, and now they are offering us a deal where basically they are willing to literally charge us no tariffs.”

Negotiations follow a 90-day truce in the US-India tariff battle. India is reportedly offering to slash its average tariff differential with the US from around 13% to below 4%, removing duties on 60% of tariff lines in the first phase. In return, India seeks exemption from both existing and future US tariff hikes.

Tata Motors, Hero MotoCorp Lead the Charge

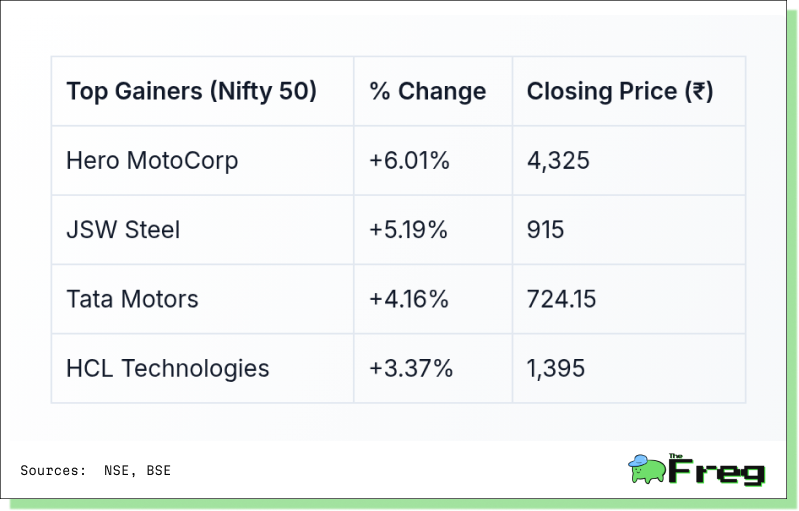

Among the top gainers, Tata Motors stood out with a 4.16% rise, closing at ₹724.15. Interestingly, this jump followed a 51% YoY decline in Q4 net profit—a testament to market confidence in its long-term strategy. Factors driving the surge include:

- UK-US trade deal reducing import duties on JLR vehicles from 25% to 10%

- India-UK FTA improving competitiveness in the luxury segment

- Rising share of CNG and EVs (36% of portfolio)

- Strong short-term momentum (+16.36% in a month)

Meanwhile, Hero MotoCorp soared over 6%, touching a four-month high of ₹4,325.

All major sectoral indices closed in the green. Nifty Auto and Realty were the top performers, while Financials and IT also saw meaningful gains.

Global Tailwinds Reinforce Sentiment

The global backdrop also turned favorable. The US and China agreed to reduce tariffs for a 90-day negotiation window. The US slashed duties from 145% to 30%, while China cut rates from 125% to 10%, easing global trade tensions.

Other global positives:

- Fed held rates steady at 4.25–4.5%, supporting equity risk appetite

- China’s Q1 GDP grew 5.4%, beating estimates

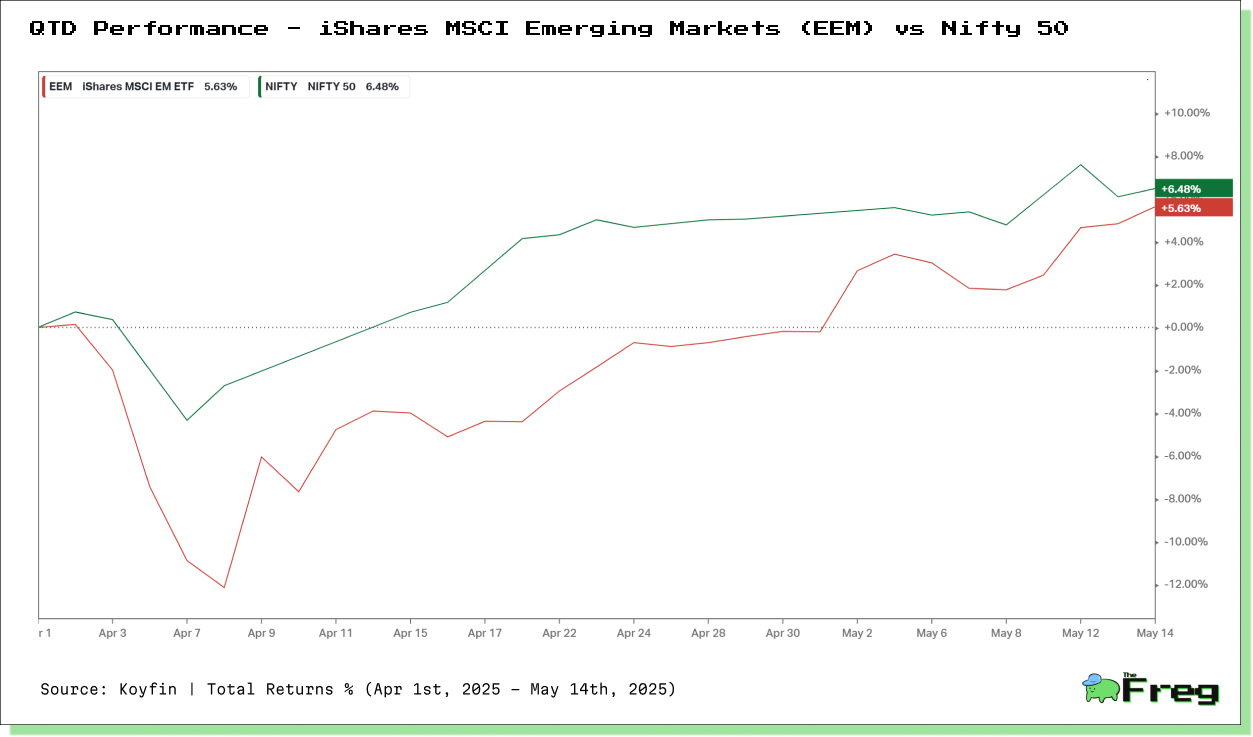

- US Dollar Index dropped to 100.8, boosting EM assets

- US ETF inflows hit a record $360.89 billion in Jan–Apr 2025

Breaking the 25K Barrier: A Technical Milestone

The Nifty's breach of 25,000 marked a critical technical breakout. The index had failed to cross this level for 141 sessions. Analysts now eye a near-term target of 25,300, provided the index sustains above the new support at 24,500. With the India VIX falling below 17, the path of least resistance appears upward—for now.