Mutual Fund Review – March 2025: Large-Caps Shine as Small-Caps Struggle Amid Market Volatility

March 2025 saw strong market gains, but only 38.64% of equity mutual funds beat benchmarks. Large-caps and flexi-caps led performance, with passive strategies gaining ground.

March 2025 was a month of contrasts for India’s mutual fund industry. On one hand, equity markets posted solid returns, with indices such as the Sensex and Nifty-50 gaining 5.76% and 6.30% respectively. On the other, only 38.64% of equity mutual fund schemes managed to outperform their benchmarks, underscoring the growing challenge for active managers in a competitive market landscape.

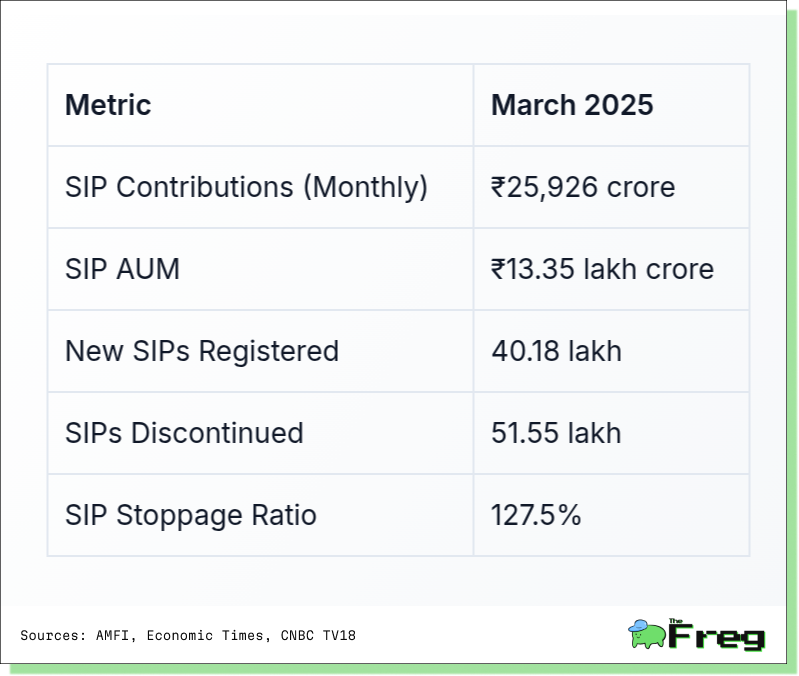

AUM and SIPs: Strength in Flows, Warnings in Attrition

Assets under management (AUM) for mutual funds surged 7.68% to ₹24.90 lakh crore in March, up from ₹23.12 lakh crore in February. This rise reflected not only robust market performance but also consistent investor interest, especially via Systematic Investment Plans (SIPs). Monthly SIP contributions reached ₹25,926 crore – slightly down by 0.28% from February but still marking a 34.53% year-on-year rise.

However, the SIP data also hinted at growing concerns. While 40.18 lakh new SIPs were registered in March, a staggering 51.55 lakh SIPs were discontinued or matured, pushing the stoppage ratio to an all-time high of 127.5%.

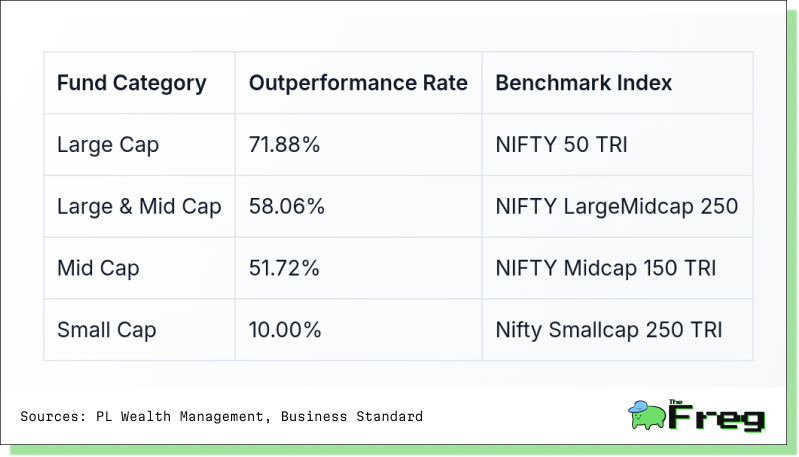

Performance Trends: Large-Caps Take the Lead

Large-cap funds emerged as the top performers in March, with 71.88% of schemes beating the NIFTY 50 TRI benchmark. This is in contrast to small-cap funds, where only 10% outperformed the Nifty Smallcap 250 TRI benchmark despite the index itself rallying 9.10%.

Small-Cap Woes: Liquidity Crunch and Performance Gaps

Despite the Nifty Small-cap 250's 7.65% gain, small-cap mutual funds were largely unable to capitalize. A key reason: liquidity stress. On average, it would take the ten largest small-cap funds 37 days to liquidate half their portfolios, up from 29 days in February 2024. Some, like Quant Small Cap Fund, saw this figure spike to 73 days.

The underperformance was further underscored by a three-year trend where 74% of small-cap funds failed to beat benchmarks. Yet, over five years, small-cap funds have posted a stellar 34.57% CAGR, showing that despite short-term volatility, long-term investors may still be rewarded.

Market-Wide Trends and Sector Preferences

Equity inflows dropped to an 11-month low even as mutual fund AUM climbed to a record ₹65.74 lakh crore. Notably, debt fund outflows stood at ₹2,02,663 crore, mainly due to advance tax payments. Equity-oriented schemes received ₹25,082 crore in inflows, while sectoral/thematic funds suffered a 97% drop in investments.

Interestingly, domestic mutual funds increased stakes in new-age companies like Zomato and Policybazaar, while foreign institutional investors (FIIs) trimmed exposure, suggesting diverging views on these stocks.

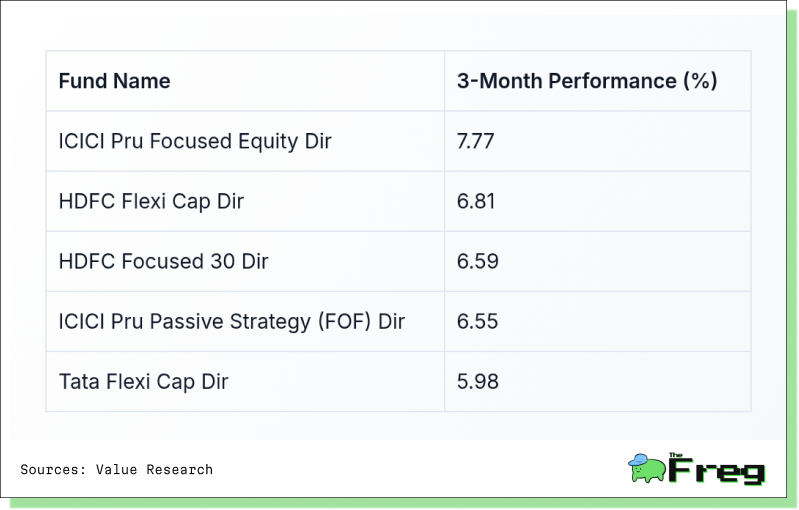

Recent 3-Month Performance of Leading Equity Funds

Focused equity funds appear to have navigated the volatility well, benefiting from concentrated exposures to high-conviction stocks. Flexi-cap strategies, known for their agility in shifting between large, mid, and small caps, have also demonstrated their resilience by capturing opportunities across sectors.

Interestingly, passive strategies have held their ground, reflecting the rising investor confidence in low-cost index-tracking options. This supports the broader shift in investor behavior, where portfolio cost efficiency and benchmark-aligned returns are gaining appeal.

Together, these funds represent a broad cross-section of active and passive management styles. Their recent performance not only illustrates the diversity in fund positioning but also underscores the importance of aligning investment choices with one’s risk profile and market outlook.

Growth Metrics Snapshot

Over the past decade, the Indian mutual fund industry has expanded nearly sixfold, growing from ₹10.83 trillion in March 2015 to ₹65.74 trillion in March 2025. Equity-oriented schemes grew the fastest at 25.39% YoY, with SIPs continuing to anchor long-term participation.

Comparative Growth by Fund Category

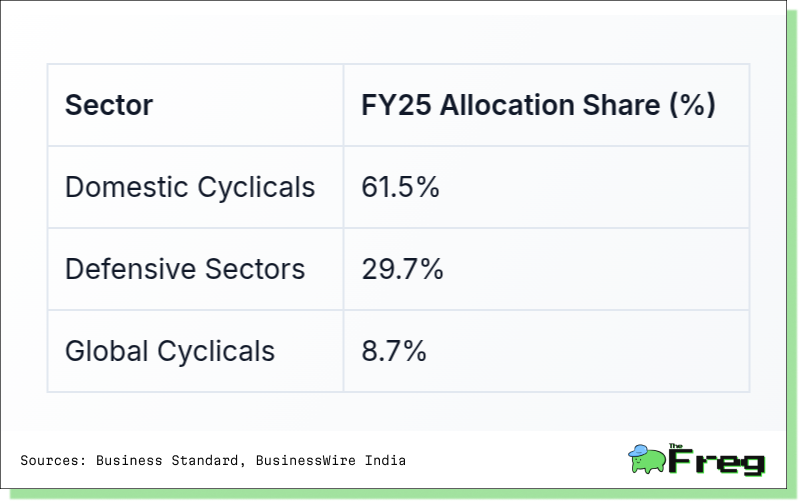

Sector Allocations: Domestic Cyclicals on the Rise

Fund managers pivoted toward domestic cyclicals such as Capital Goods, Oil & Gas, Cement, and Insurance in March, riding on budgetary support and improved sentiment. Defense emerged as a strong theme, bolstered by the AtmaNirbhar Bharat initiative.

Outlook for Q2 2025: Selectivity is Key

As earnings growth shows signs of moderation and BSE 500 profit margins near peak levels, fund managers are adopting a more cautious stance. The focus has shifted to selective stock picking in sectors poised to benefit from domestic demand, fiscal policy support, and global recovery. Regional banks, quality momentum stocks, and non-US equities are gaining favor, while commodities like gold remain attractive as inflation hedges.

March 2025 reaffirmed the complexity of the mutual fund landscape in India. While market indices climbed and long-term trends remained strong, the underperformance of many active funds served as a reminder of the challenges fund managers face. Investors would do well to stay diversified, adopt disciplined approaches like SIPs, and closely monitor sectoral and liquidity trends as we head into the next quarter.