Morgan Stanley’s 2025 Paradox: Outperformance, Decline, and Strategic Transformation

Morgan Stanley beat Q2 2025 estimates with $16.8B in revenue and $2.13 EPS, yet shares dipped as investment banking lagged. A pivot to wealth management marks a deeper strategic shift.

Morgan Stanley’s Q2 2025 earnings confound expectations: the firm posted net revenues of $16.8 billion and earnings per share (EPS) of $2.13—both of which beat analyst estimates. Yet, in a paradoxical turn, Morgan Stanley’s shares slipped by nearly 2% following the results. Behind the headline numbers lies a split: the trading business soared, while investment banking sputtered—raising the question of whether this is a temporary, cyclical lull or the result of deliberate reshaping at one of Wall Street’s iconic institutions.

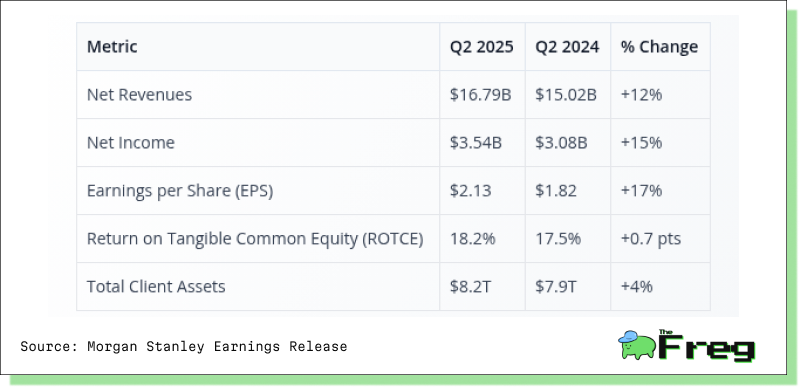

Key Financial Metrics

Morgan Stanley’s latest results reveal solid performance and a strategic shift underway. Double-digit gains in revenue, income, and EPS reflect operational strength, driven by deeper client relationships and scale. Total client assets rose to $8.2 trillion, reinforcing the firm's pivot toward stable, recurring revenues from wealth and asset management.

Beneath the strong headline numbers, the business mix is clearly evolving. Softer investment banking results are being offset by robust trading and fee-based flows. With improved ROTCE and steady asset growth, Morgan Stanley is increasingly positioned for resilience—less reliant on Wall Street cycles, and more anchored in Main Street stability.

A Structural Shift or Temporary Dip? The Investment Banking Conundrum

The headline beat masks a key undercurrent: investment banking revenues fell 5% year-over-year, dragged down by a decline in M&A advisory fees (down 14%) and reduced fixed income underwriting (down 21%), only partially offset by a 42% gain in equity underwriting revenues. Lower deal volumes, especially in M&A and IPOs, reflect global macro uncertainty and risk-averse corporate boards, but also raise questions about Morgan Stanley’s strategic intent.

Is this transient—an artifact of market conditions and Fed policy—or a reflection of a deeper shift away from a deal-centric strategy? The answer remains open as the bank leans on other growth engines.

The $8.2 Trillion Question: Wealth Management as a Stabilizer

Morgan Stanley’s wealth management and investment management divisions now command $8.2 trillion in client assets, continuing a trajectory of robust asset growth, inflows, and resilience. Wealth management generated $7.8 billion in quarterly revenue (up 14%) with growing net new assets ($59 billion in Q2) and record fee-based flows ($43 billion). Fee-based assets represent the bulwark against volatile trading or deal flow, giving the firm a more stable earnings engine.

Losing Ground in Deal-Making? Comparing Wall Street Peers

While Morgan Stanley remains a top-tier M&A advisor, recent quarters show the bank lagging some peers in the deal-making revival. Industry data suggests slower pipeline conversion and possible strategic caution. Factors may include:

- Growing selectivity in client mandates

- Deliberate pacing of the pipeline

- Strategic focus on high-value, complex deals over volume

- Shifting resources toward wealth/asset management

Performance Showdown: Morgan Stanley vs. Goldman Sachs and JPMorgan Chase

The competitive landscape among Wall Street’s biggest banks has shifted in 2025, with divergent paths in stock performance that mirror evolving strategic bets.

The following chart tracks year-to-date total returns for Morgan Stanley (MS), JPMorgan Chase (JPM), and Goldman Sachs (GSBD):

- JPMorgan Chase leads with a 21.61% gain, widely outperforming both Morgan Stanley and Goldman Sachs. This reflects robust earnings momentum and a strong balance across retail, investment banking, and wealth businesses.

- Morgan Stanley delivered a solid 14.84% return. The firm’s ongoing pivot toward fee-based wealth and asset management provided relative stability, even as its investment bank faced cyclical headwinds.

- Goldman Sachs trails, up 6.38%. Its heavy reliance on investment banking and trading left it more exposed to volatile deal flow and capital markets that lagged risk-on peers.

Analysis

- Morgan Stanley’s performance underscores the effectiveness of its strategic transformation. While not as high-flying as JPMorgan Chase, it decisively outperformed Goldman Sachs, thanks to steadier earnings from wealth management.

- JPMorgan Chase’s edge lies in its broad diversification and consistent execution across consumer and institutional divisions.

- Goldman Sachs’ relative underperformance highlights the risks of a more traditional Wall Street model in an environment where steady, recurring revenue streams are increasingly rewarded by investors.

Bottom Line: Morgan Stanley’s stock return sits between its two rivals—outpacing Goldman but lagging JPMorgan. This positioning reflects the firm’s hybrid strategy: less cyclical risk than a pure-play investment bank, but not yet drawing the full premium the street awards to dominant, diversified franchises. As the industry adapts, relative performance will remain a key barometer of strategic success.

Strategic Outlook: Leaning Into Stability or Losing Momentum?

Morgan Stanley’s strategy is to balance growth from high-octane investment banking with the relative stability of wealth/asset management. Catalysts ahead:

- Potential rebound in IPOs and M&A: a more favourable macro, or interest rate cuts, could revive deal flow.

- Product and digital initiatives: enhancements in workplace financial services, AI-powered investment platforms, and alternative products.

- Shareholder returns: higher dividend, active share buybacks signal sustained confidence.

A Transitional Moment Worth Watching

Short-term softness in investment banking alarms some investors, but the long-run outlook may prove the current “decline” is more of an evolution, less a retreat. Morgan Stanley’s $8.2 trillion asset base, expanding wealth funnel, and disciplined strategy set a baseline for durable, fee-driven growth—even as legacy deal-making becomes less central. Watch for further tactical acquisitions, milestones in asset growth, and competitive responses from rival global banks.