Liberation Day 2.0: A Trade Reset or Global Shockwave?

As the July 9 “Liberation Day 2.0” tariff deadline nears, global markets brace for impact. With multiple scenarios on the table—from new deals to sweeping tariffs—this trade reset could reshape supply chains, alliances, and economic stability worldwide.

As the July 9 deadline for President Trump’s “Liberation Day 2.0” approaches, global trade is once again at a crossroads. Initially introduced as a 90-day tariff pause to negotiate improved trade terms, the policy is now a pressure point threatening to fracture multilateral systems, destabilize global markets, and redefine U.S. trade priorities. While some partners scramble for exemptions, others brace for a possible tariff storm. The global economy watches with bated breath.

Trump’s Three Tariff Scenarios

The Trump administration has outlined three possible outcomes for “Liberation Day 2.0,” each carrying serious geopolitical and economic consequences.

- Status Quo Extension – The current pause is prolonged as negotiations continue.

- Deal Announcement – The day is repurposed to showcase new bilateral trade deals.

- Tariff Escalation – The most severe scenario sees the immediate rollout of new tariffs on targeted nations.

According to Henrietta Treyz of Veda Partners, a “potluck” combination of these outcomes is most likely. While President Trump suggests progress, he has simultaneously threatened ultimatums to foreign governments. This contradictory strategy is emblematic of an administration that sees unpredictability as leverage—keeping allies and rivals guessing while trade officials attempt to reshape global commerce through bilateral pressure.

July 9 Deadline Implications

July 9 is more than a symbolic date—it marks the expiration of a fragile truce. Without new deals, a second wave of tariffs could trigger far-reaching disruptions.

The stakes are clear: over 70 countries have formally requested tariff exemptions. Priority attention has been given to key partners like Japan, Vietnam, South Korea, and India. Many now face a tough decision—accept unfavourable terms, or risk punitive tariffs that could range from 10% to a staggering 50%.

Markets are particularly sensitive to this deadline, which could mark either a stabilization point or trigger a chain reaction across sectors already under inflationary and supply chain pressures.

Trade Deal Winners and Losers

While many nations remain in limbo, the UK has emerged as a notable exception. In addition to securing a limited deal with the U.S., it recently finalized a sweeping Free Trade Agreement with India.

India benefits from enhanced access for its exports to the UK. However, its position with the U.S. remains complicated. Though pharmaceuticals have thus far avoided Trump’s 26% reciprocal tariff, this exclusion may be temporary. The sector remains vital: Indian generics account for 40% of U.S. prescriptions, saving American consumers over $200 billion in 2023.

In contrast, India’s automotive exporters—especially JLR (owned by Tata), Bharat Forge, and Sona BLW—remain exposed. With 31% of JLR’s sales dependent on the U.S., the risk is tangible.

Tariff Tremors Ripple Through Global Indices

With Liberation Day 2.0 fast approaching, global equity markets are reacting sharply to the rising risk of a new wave of U.S. tariffs. The July 9 deadline has become a flashpoint for investor uncertainty, triggering heightened volatility across major indices and prompting a broader reassessment of global supply chains, sectoral exposure, and capital flows.

United States (S&P 500): The S&P 500 has swung between gains and losses as markets digest the potential impact of tariffs on tech and industrial giants. While segments like real estate and AI-linked tech have held up, concerns over cost pressures and retaliatory risks are driving defensive rotations.

India (Nifty 50): The Nifty 50 has rebounded strongly on optimism over the UK–India FTA and domestic resilience. Still, export-heavy sectors—especially autos and pharmaceuticals—remain exposed to U.S. tariff action, keeping broader sentiment in check.

United Kingdom (FTSE 100): Buoyed by fresh bilateral deals, the FTSE 100 has seen solid year-to-date gains. However, its export-oriented constituents remain vulnerable to wider global trade disruptions, particularly in consumer and industrial sectors.

Germany (DAX): The DAX recently hit record highs, but its export-heavy profile—anchored by autos and machinery—makes it particularly sensitive to any escalation in U.S.–EU trade tensions, threatening to reverse recent momentum.

Japan (Nikkei 225): Stable above 38,000, the Nikkei has been supported by strong corporate earnings and domestic demand. Yet its key export sectors, especially autos and electronics, face outsized risks if U.S. tariffs expand.

China (CSI 300): The CSI 300 remains subdued, as persistent trade tensions and weakening global demand weigh on investor sentiment. With much of its listed sector tied to exports, any tariff escalation could further cap upside potential.

Markets globally are not just pricing in immediate tariff effects—they're recalibrating for a longer-term shift in trade architecture. July 9 may not just mark a deadline, but a pivot in how capital flows, supply chains operate, and global leadership is contested in the post-liberalization era.

Market Volatility Trends

Financial markets have been anything but stable in the lead-up to July 9. The FTSE 100 has repeatedly tested resistance at the 8200–8300 levels, while Japan’s Nikkei 225 recorded its worst one-day drop since 1987, plunging 12.4% amid fears over U.S. growth and policy uncertainty.

Disappointing earnings from major tech players such as Intel (down 26%) and Amazon (down 9%) have added to the volatility in the S&P 500, reinforcing the historical sensitivity of markets to trade shocks.

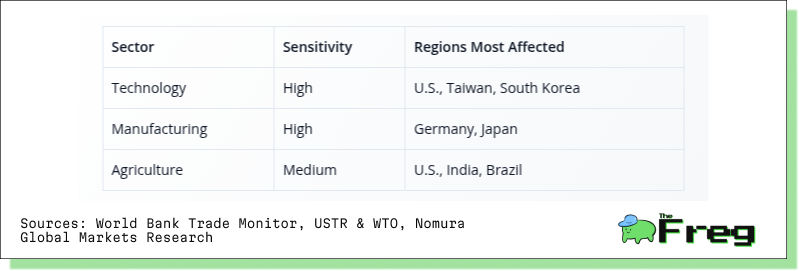

Sectoral Impact Snapshot

Export-driven sectors, especially semiconductors and heavy manufacturing, remain on edge, as do U.S. agricultural producers, who fear retaliatory tariffs from Brazil and India.

Multilateral System Erosion

Perhaps the most lasting impact of “Liberation Day 2.0” will be its erosion of the global trade system itself. Trump's retreat from multilateral agreements in favour of bilateral power plays represents a shift that could outlast his presidency.

His establishment of an “External Revenue Service” to manage tariffs signals institutional entrenchment of protectionism. Moreover, countries such as South Africa, Mexico, and India—once potential partners in supply chain realignment—now face punitive tariffs themselves.

As Josh Lipsky of the Atlantic Council observes, "You can’t build coalitions while taxing your allies." This contradiction has sparked diplomatic backlash and retaliatory measures, especially from the EU and China, further distorting global trade.

Asian Exporters' Vulnerability

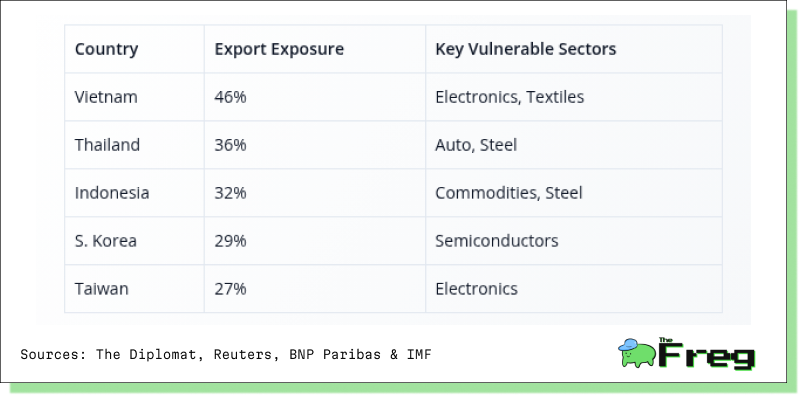

Asian economies, particularly in Southeast and East Asia, stand to lose the most from renewed tariffs.

While India may be somewhat shielded due to limited Chinese inputs in its exports, others face dual risks. Currency appreciation, fuelled by a monetary rally, has made ASEAN exports even less competitive. Thailand appears particularly exposed, facing rising input costs and shrinking margins.

In response, countries are exploring strategies such as regional agreements (like RCEP), nearshoring, and diversification—but time is short, and tariff shocks could hit before these shifts materialize.

Trade Reset Crossroads

“Liberation Day 2.0” may redefine the global trade architecture—or unravel it.

Legal challenges add yet another layer of uncertainty. A federal court initially ruled Trump’s tariffs as overreach, only for an appeals court to temporarily reinstate them pending further review.

Meanwhile, G7 discussions are ongoing, and a framework with China appears close. If implemented, this could see U.S. tariffs set at 55%, while Chinese counter-tariffs would remain at 10%. Canada is facing a barrage of levies—50% on steel and aluminium, and 25% on autos—despite being a core NATO and G7 ally.

The real-world consequences are already visible. Home furnishings retailer At Home cited tariff-related uncertainty in its bankruptcy filing, a harbinger of broader economic fallout.

As July 9 nears, the world stands before two diverging paths. Either the U.S. secures a set of bilateral deals that signal a new, if fragmented, trade order—or it accelerates toward chaos, inflation, and economic decoupling. “Liberation Day 2.0” might indeed liberate, but for whom and at what cost remains the defining question of this global inflection point.