Larsen & Toubro: Engineering India’s Future with Record Growth and Strategic Resilience

L&T posted record FY25 results by leveraging tech-forward infrastructure, green energy, and digital growth, proving its role as a cornerstone of India’s ambitions.

Larsen & Toubro Ltd (L&T) continues to be a bellwether for India's infrastructure ambitions, demonstrating unmatched resilience and adaptability—qualities that enabled the conglomerate to post record highs in revenue and profit for FY2024-25. The company’s strategic pivot towards high-quality, technologically advanced projects in infrastructure, energy, and digitalization reflects a deep understanding of macroeconomic trends and government policy directions. This year’s performance was underscored by a proactive management team, operational agility, and prudent capital allocation, setting a benchmark for large-scale project execution across developing economies.

Despite global headwinds such as rising interest rates, supply chain disruptions, and commodity price volatility, L&T managed to expand its order book and enhance execution efficiency. The company’s ability to secure major projects in green hydrogen, smart cities, and digital platforms highlights its evolving business model. As ESG considerations and sustainability become central to business, L&T’s investments in renewables and innovation further reinforce its relevance and future-readiness. These initiatives place the organization at the forefront of India’s economic transformation, offering stakeholders both security and growth potential.

Stock Performance: Volatile but Resilient

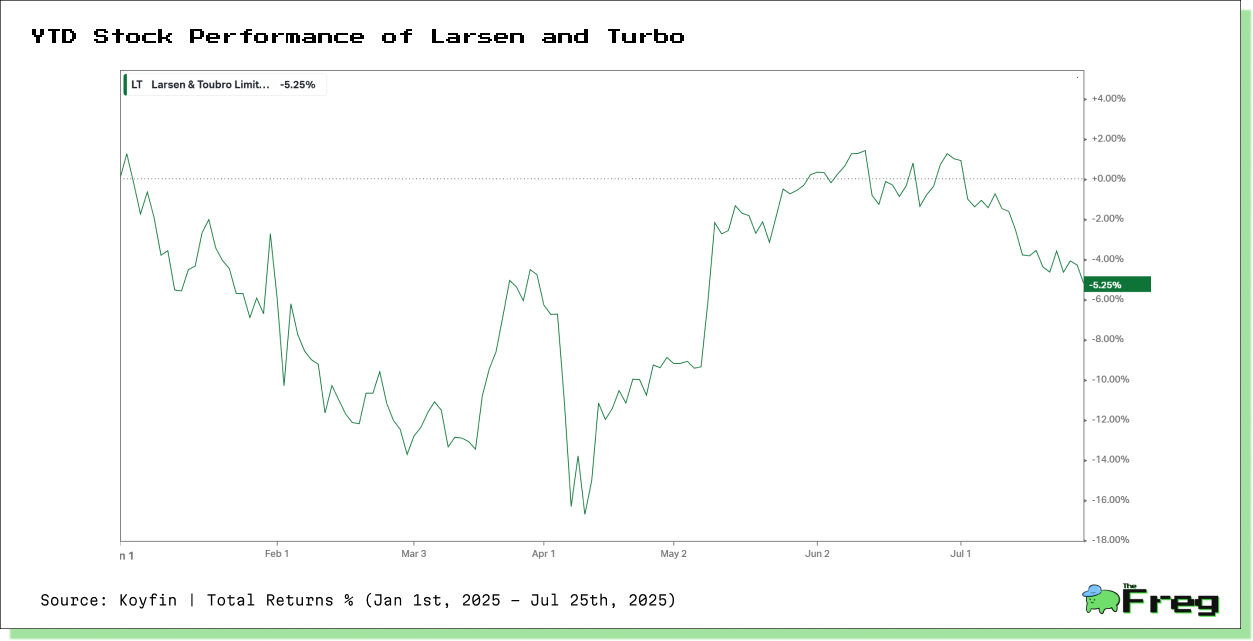

Larsen & Toubro’s stock is down 5.25% YTD as of late July 2025, marked by notable volatility. The year began with a sharp slide, hitting a trough in early April—likely due to macroeconomic uncertainty or sector-specific caution.

A strong rebound followed in May, possibly on the back of upbeat earnings, major project wins, or infrastructure policy momentum. However, gains faded through June and July amid profit booking and renewed market headwinds.

The stock’s trajectory reflects both sensitivity to news flow and the cyclical nature of L&T’s project-based business. While fundamentals remain intact, near-term price action highlights the need for a long-term view. Upcoming order wins and policy cues will be key drivers ahead.

Segment Highlights

L&T’s strength is deeply rooted in its diversified segmental portfolio, insulating it against cyclicality in any one sector. In FY25, the Infrastructure Projects segment remained the primary revenue engine, buoyed by domestic project momentum and a strong international project pipeline. Energy Projects’ resurgence, fuelled by new EPC contracts in hydrocarbons and renewables, was another highlight, validating the group’s efforts to transition towards cleaner energy solutions. The Hi-Tech Manufacturing and IT Technology Services divisions leveraged the digital and automation wave, further diversifying L&T’s cash flow base and reducing dependency on legacy businesses.

The breadth and depth of L&T’s segment spread helps mitigate risks and capture emerging opportunities, especially as digitization, clean energy, and smart infrastructure spending accelerate globally12. Segments such as Hi-Tech Manufacturing are now significant contributors to margin improvement, thanks to higher-value engineering and proprietary technology. Importantly, the capital employed and asset base across businesses demonstrates a disciplined, return-focused approach—key to maintaining L&T’s competitive edge.

Financial Overview

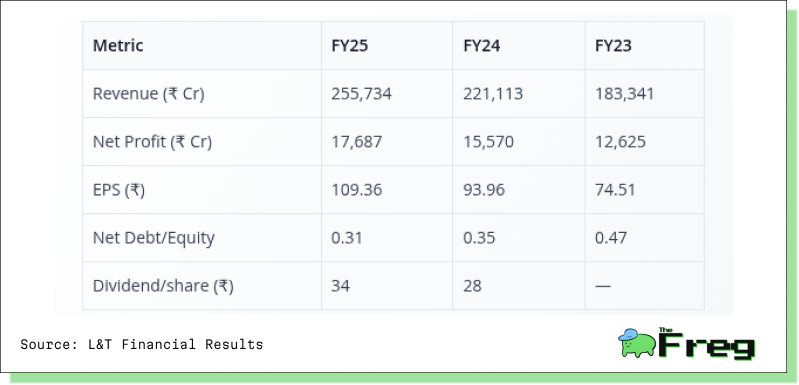

L&T reported consolidated revenue of ₹255,734Cr for FY25, a 15.6% YoY growth, and net profit of ₹17,687Cr, growing 13.6% YoY. The company improved its EBITDA margin to 10.3% and maintained a solid net profit margin of 6.9%. EPS reached ₹109.36, and net debt-to-equity was reduced to 0.31, improving financial leverage. Dividend per share increased to ₹34, underscoring strong cash flows and a shareholder-friendly approach.

L&T’s financial resilience lies in disciplined cost control, well-managed working capital, and a consistently replenished order book that stretches visibility well into the future. Despite large spends on innovation and capex, prudent debt management kept gearing in check and preserved high interest coverage. These factors, combined with a robust, asset-rich balance sheet, enhance L&T's capacity to take on complex, capital-intensive projects while delivering consistent value to shareholders.

The company’s financial strategy remains conservative, balancing growth ambitions with a clear focus on liquidity and return ratios.

Cash Flow and Efficiency

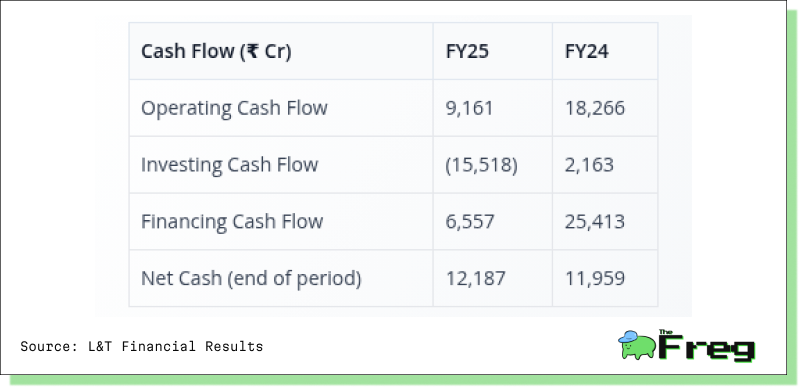

L&T generated ₹23,104Cr in operating profit before tax and exceptionals for FY25, translating to robust operating cash flows of ₹9,161Cr, even amid high capital expenditure and investments. The net cash position improved to ₹12,187Cr, and key efficiency ratios such as current ratio (1.21), debt service coverage (5.92), and interest coverage (9.89) signal resilience against financial shocks1. While investing cash flow turned negative due to strategic asset and project purchases, a healthy liquidity buffer was maintained through prudent treasury management.

Continuing efficiency improvement across receivables, payables, and working capital processes supports L&T’s ability to track large, complex project cycles without liquidity strain. The strong track record of converting operating earnings into cash has enabled the company to fund growth internally, reduce dependence on external borrowings, and maintain its ability to compete for mega-projects globally. The financial agility also provides leeway for opportunistic investments and weathering economic uncertainties.

Analyst Ratings and Market Sentiment

Analysts largely maintain a favourable outlook on L&T, with most ‘buy’ or ‘outperform’ ratings grounded in the group’s order book depth, financial discipline, and execution credentials. The investment-grade credit standing is bolstered by diversified businesses and a conservative balance sheet, though some rating agencies flag the need for vigilant margin management and sustained order inflow as key to future upgrades.

Market sentiment typically oscillates in response to macroeconomic cues, capital expenditure trends, and fiscal policy announcements tied to infrastructure. As L&T sits at the crossroads of these sectors, any improvement in India’s capex cycle or government spending quickly translates to positive sentiment. However, periods of aggressive market rally can trigger caution among investors, especially if near-term results do not meet the high growth bar set by buy-side consensus.

Forward Guidance and Estimates

L&T’s management projects another year of double-digit revenue growth and continued margin improvement for FY26, backed by a substantial order backlog and expanding addressable markets in infrastructure, energy transition, and digitalization. Capital investment in proprietary technologies and international expansion is expected to enhance long-term competitiveness and drive margin enrichment, especially as higher-value projects become a growing revenue share.

The order book, which covers several years of top-line visibility, underpins the company’s confidence in delivering to guidance. The forward-looking strategy includes tapping opportunities in smart infrastructure, modular construction, clean energy, and integrated digital platforms—all poised to benefit from macro tailwinds and policy incentives. Management reiterates its commitment to capital efficiency and value creation for stakeholders.

Risks and Watchpoints

Despite market leadership, L&T faces several risks: project execution delays, commodity price spikes, interest rate volatility, and geopolitical instability—any of which could impact order intake, working capital, or margins. Regulatory uncertainty and policy lags, especially in international jurisdictions, pose further operational risk. Additionally, as L&T takes on increasingly complex and cross-border assignments, project cycle variances and integration challenges increase.

Execution risk intensifies with scale, requiring enhanced oversight and agility to maintain profitability. The ability to continue winning headline projects at target margins, while maintaining stringent financial discipline, will be closely watched by both investors and creditors. Exposure to government-linked projects also means L&T must stay alert to changes in the fiscal and political environment.

L&T’s investment case remains rooted in high entry barriers, unmatched execution capability, and a diversified growth engine that straddles both legacy infrastructure and new economy verticals. The group is exceptionally well-placed to monetize India’s infrastructure ambitions and the global pivot to digital and green energy investments, with an order book and financial position that few can match.

Its proven ability to adapt—visible in the successful diversification into technology, smart cities, and green hydrogen—complements disciplined capital allocation and strong governance. Bottom-line growth, prudent leverage, and strong free cash flow reinforce its core position in growth-focused portfolios. While challenges remain, L&T’s scale, project pipeline, and adaptive management underscore why it continues to be a cornerstone holding for investors seeking quality and growth in emerging markets.