Johnson & Johnson: Sustaining Growth Through Innovation and Resilience

Johnson & Johnson’s performance highlights resilience, innovation, and steady growth, driven by strong financials, a diversified portfolio, and disciplined capital allocation.

Johnson & Johnson (JNJ) has navigated the past few years as a model of resilience and innovation in the global healthcare arena. Building on its legacy, the company has delivered robust operational growth, expanded its diversified portfolio, and advanced a pipeline focused on high-impact therapies. Its disease-centric strategy—spanning oncology, immunology, and medtech—has enabled J&J to address pressing medical needs worldwide, all while maintaining a strong and stable financial foundation.

Throughout this transformative period, J&J has faced challenges from biosimilar competition and ongoing legal matters. Nevertheless, disciplined capital allocation, sustained investment in R&D, and strategic acquisitions have positioned the company for long-term success. Management’s forward guidance and consistent commitment to annual dividend increases underscore both confidence and adaptability, setting the stage for an in-depth exploration of J&J’s performance, strategy, and outlook in the sections that follow.

Stock Performance Snapshot

Johnson & Johnson’s stock demonstrated steady performance in 2024, reflecting investor confidence in its defensive qualities and innovation-driven outlook. The stock traded near $155, with a 52-week high of $169.76 and a low of $141.30. The company’s market capitalization stands at $376.5 billion, and it offers an attractive dividend yield of nearly 3%. Despite a modest year-to-date return of 8.1%, J&J’s valuation remains reasonable, with a trailing P/E ratio of 15.55, making it a favoured choice for income-focused and risk-averse investors.

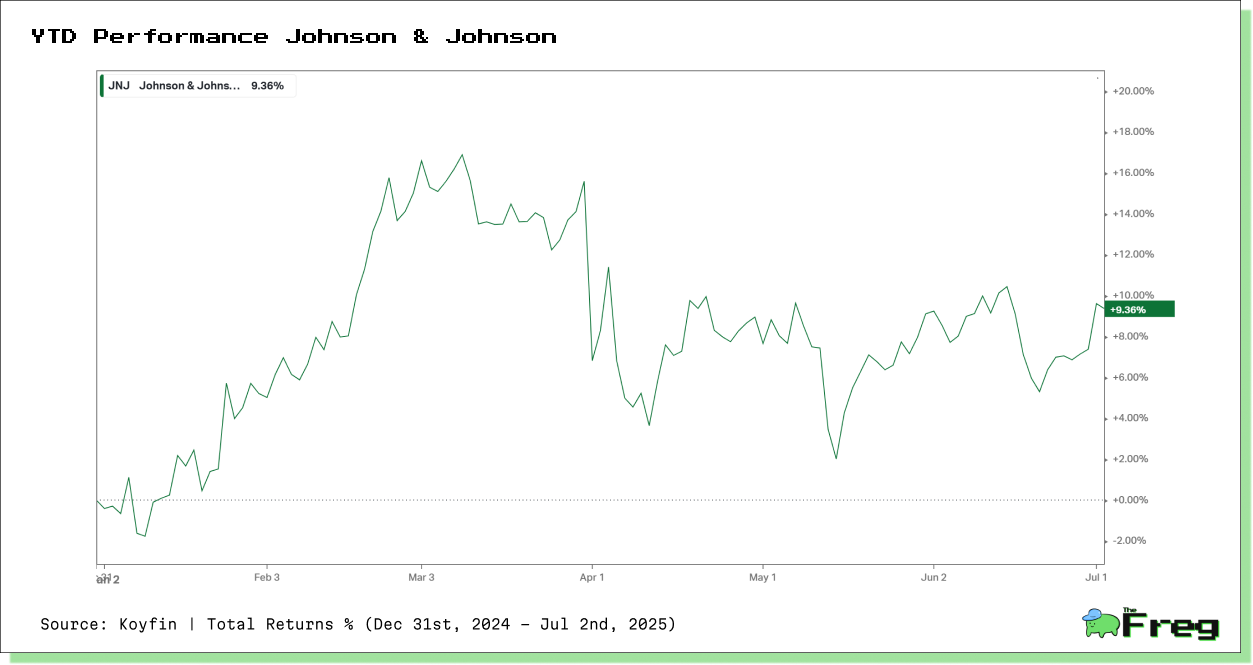

YTD Total Return Analysis

Johnson & Johnson’s year-to-date (YTD) total return, as depicted in the graph, demonstrates a resilient and steadily positive performance throughout 2025. The stock delivered a cumulative total return of approximately 9.4% by early July, outperforming many defensive peers and reflecting robust investor confidence. The trajectory shows an initial period of volatility in January, followed by a strong upward trend through March, where returns peaked above 16%. This surge likely coincided with positive earnings releases and renewed optimism around the company’s pipeline and operational execution.

April brought a brief period of heightened volatility and a pullback, possibly linked to sector-wide macroeconomic pressures or market reactions to regulatory developments. However, the subsequent months saw a stabilization and gradual recovery, with the return curve maintaining an upward bias into the summer. This pattern highlights J&J’s ability to weather short-term market disruptions and underscores its reputation as a defensive, income-generating investment. The consistent positive return, coupled with the company’s reliable dividend, positions J&J as a core holding for investors seeking stability and steady capital appreciation in a turbulent market environment.

Segment Highlights

J&J’s business is anchored by two primary segments: Innovative Medicine and MedTech. In 2024, Innovative Medicine delivered $14.3 billion in sales for Q4, driven by oncology (notably DARZALEX, ERLEADA, and CARVYKTI), immunology (TREMFYA), and neuroscience (SPRAVATO). MedTech contributed $8.2 billion, with growth led by cardiovascular products and wound closure solutions. The company’s focus on high-growth markets—such as interventional cardiovascular, robotics, and digital surgery—continues to expand its global footprint and reinforce its leadership in medical technology.

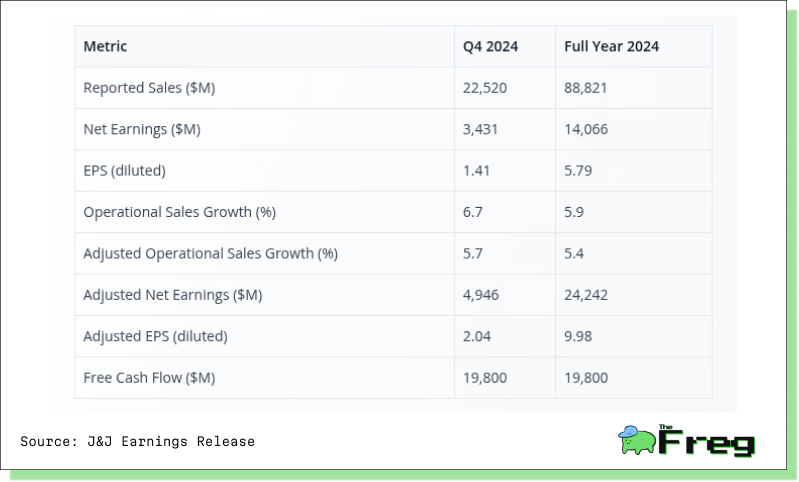

Financial Overview

Johnson & Johnson reported a strong financial performance for the full year 2024, reinforcing its reputation for operational discipline and resilience in a dynamic healthcare environment. The company achieved $88.8 billion in reported sales, marking a 4.3% year-over-year increase. Net earnings reached $14.1 billion, with diluted earnings per share of $5.79. Operational sales growth stood at 5.9%, while adjusted net earnings totalled $24.2 billion. The company’s robust free cash flow of $19.8 billion underpinned ongoing investments in R&D, strategic acquisitions, and consistent shareholder returns. Adjusted EPS for the year was $9.98, highlighting J&J’s ability to deliver stable profitability despite sector headwinds.

Johnson & Johnson’s financial results for 2024 reflect a well-balanced approach to growth, profitability, and capital efficiency. The company’s top-line expansion was supported by continued momentum in both its Innovative Medicine and MedTech segments. A net earnings margin of nearly 16% and a high adjusted EPS underscore J&J’s success in managing costs and maximizing operational leverage.

The free cash flow of $19.8 billion stands out as a testament to the company’s ability to convert earnings into liquidity, providing ample resources for reinvestment in innovation and rewarding shareholders through dividends and buybacks.

Efficient capital allocation remains a hallmark of J&J’s financial strategy, ensuring competitiveness while maintaining a healthy balance sheet.

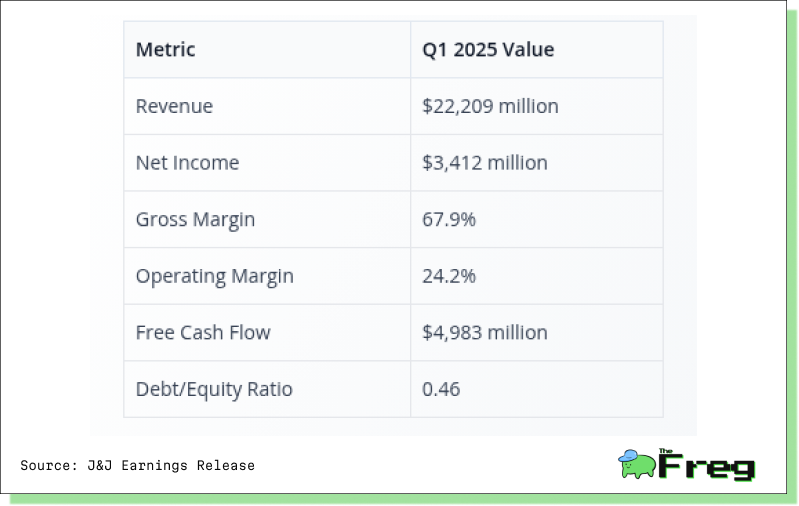

Q1 2025 Key Financial Metrics

The table below presents Johnson & Johnson’s core financial metrics for the first quarter of 2025, as reported in their official SEC filings.

Johnson & Johnson’s Q1 2025 results reflect a continuation of its disciplined financial management and operational strength:

- Revenue of $22.2 billion demonstrates steady top-line growth.

- Net income of $3.4 billion and an operating margin of 24.2% highlight operational efficiency.

- Gross margin of 67.9% underlines strong pricing power and cost control.

- Free cash flow of nearly $5 billion strengthens liquidity for R&D, dividends, and M&A.

- A debt/equity ratio of 0.46 ensures financial flexibility.

Analyst Ratings and Market Sentiment

Analyst sentiment toward J&J is broadly positive, with a consensus rating of “Moderate Buy.” Of 20 analysts, 7 rate the stock as “Buy,” 11 as “Hold,” and 2 as “Strong Buy.” The average 12-month price target is $170.88, implying an upside of 11.3% from current levels.

Risks and Watchpoints

Johnson & Johnson faces several key risks that could impact its operational and financial performance. Each risk area is outlined below with further detail:

- Patent Expirations and Biosimilar Competition

The expiration of patents on major pharmaceutical products exposes J&J to revenue erosion as generic and biosimilar competitors enter the market. This risk is particularly acute for blockbuster drugs in the Innovative Medicine segment, where loss of exclusivity can result in rapid declines in sales and profit margins. The company must continually innovate and replenish its pipeline to offset these headwinds and maintain long-term growth.

- Regulatory and Legal Challenges, Including Product Liability Claims

J&J operates in a highly regulated industry and faces ongoing scrutiny from health authorities worldwide. Regulatory changes, delays in product approvals, or heightened safety requirements can disrupt product launches and increase compliance costs. Additionally, the company is subject to significant legal risks, including product liability lawsuits and mass tort claims, which can lead to substantial financial settlements, reputational harm, and increased insurance costs.

- Supply Chain Disruptions

Global supply chain complexity exposes J&J to risks such as shortages of raw materials, manufacturing delays, and transportation bottlenecks. Events like natural disasters, geopolitical tensions, or pandemics can further exacerbate these challenges, potentially impacting the timely delivery of products and increasing costs. Effective risk management and supply chain diversification are critical to mitigating these disruptions.

- Intensifying Market Competition and Technological Change

The healthcare sector is characterized by rapid technological advancement and intense competition from both established players and emerging biotech firms. J&J must continually invest in research and development to stay ahead of new therapies, devices, and digital health solutions. Failure to innovate or respond to disruptive technologies could erode market share and weaken the company’s competitive position.

- Currency Fluctuations and Global Economic Pressures

As a multinational company, J&J generates a significant portion of its revenue outside the United States. Fluctuations in foreign exchange rates can materially affect reported sales, earnings, and cash flows. Additionally, global economic pressures—such as inflation, recession risks, or changing healthcare spending patterns—can impact demand for the company’s products and overall financial performance.

- Risks from Acquisitions and Divestitures

Strategic acquisitions and divestitures are integral to J&J’s growth strategy, but they carry inherent risks. Integration challenges, cultural mismatches, or failure to achieve anticipated synergies can undermine the value of acquisitions. Conversely, divestitures may result in the loss of profitable business lines or key capabilities. Careful due diligence and disciplined execution are essential to realizing the intended benefits of these transactions while minimizing disruption.

Johnson & Johnson stands as a testament to enduring strength and adaptability in the global healthcare sector. Its ability to consistently generate robust free cash flow, invest in breakthrough research, and expand across markets highlights a disciplined approach to both growth and risk management. The company’s diversified business segments and strong balance sheet provide a buffer against industry volatility, while its ongoing innovation pipeline ensures relevance in a rapidly evolving landscape. Despite the persistent challenges of patent expirations, regulatory scrutiny, and legal uncertainties, J&J’s strategic vision and operational excellence have enabled it to navigate headwinds with resilience.

For investors, the combination of a stable dividend, reasonable valuation, and clear long-term growth trajectory makes Johnson & Johnson a compelling core holding. As healthcare needs expand globally, J&J’s focus on innovation and disciplined capital deployment is poised to deliver sustainable value and reinforce its leadership for years to come.