Intel: Navigating Transformation Amid Industry Headwinds

Intel's 2025 turnaround is marked by AI focus, foundry bets, and financial strain. Despite volatility, investor optimism is rising on innovation, cost cuts, and strategic execution.

Intel enters the second half of 2025 at a pivotal juncture, balancing the challenges of a fiercely competitive semiconductor landscape with a renewed focus on operational discipline and innovation. Under new CEO Lip-Bu Tan, the company is executing a sweeping transformation—streamlining its organization, refocusing on core product franchises, and driving cost reductions. While recent quarters have seen revenue stagnation and margin compression, Intel’s leadership is betting on next-generation process technologies, a revitalized foundry strategy, and AI-driven product roadmaps to restore growth and profitability. The company’s ability to deliver on these ambitions, while navigating macroeconomic and geopolitical uncertainties, will define its trajectory in the coming years.

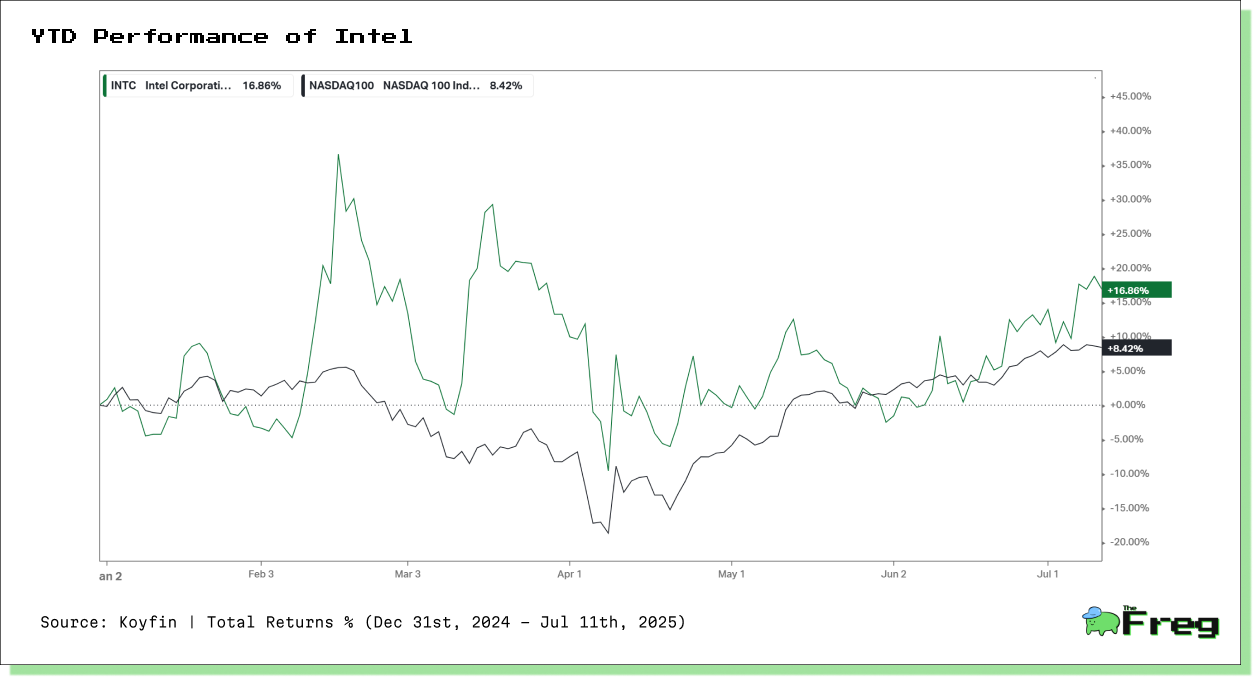

Stock Performance Snapshot

Intel’s stock performance over the past year has reflected investor caution amid operational and market headwinds. The company’s market capitalization as of June 28, 2024, stood at $132.4 billion, with 4.33 billion shares outstanding. Notably, Intel suspended its quarterly dividend in Q4 2024 and has not repurchased shares since 2021, reflecting a strategic pivot to prioritize investment in core operations and capital efficiency.

Analysis of Intel’s YTD Performance

The provided chart shows Intel’s year-to-date (YTD) stock performance compared to the NASDAQ 100 index:

Intel (INTC): +16.86% YTD

NASDAQ 100 Index: +8.42% YTD

Key Observations:

- Intel’s stock outperformed the NASDAQ 100 index for most of the year, despite significant volatility.

- The stock experienced sharp swings in Q1 and Q2, likely reflecting investor reactions to quarterly results, restructuring news, and macroeconomic factors.

- After a period of underperformance in the spring, Intel’s shares rebounded strongly in June and July, closing the period with a substantial lead over the index.

- The outperformance suggests renewed investor optimism, possibly tied to progress in Intel’s turnaround efforts, AI product launches, and foundry announcements.

Intel’s year-to-date outperformance versus the NASDAQ 100 stands out, despite a volatile first half marked by mixed results, restructuring, and shifting sentiment. Sharp swings in Q1 and Q2 reflected sector uncertainty, but a strong rebound in June–July suggests growing investor confidence in Intel’s long-term strategy. Renewed focus on AI, foundry progress, and cost discipline are restoring credibility, positioning Intel as a promising turnaround play in the semiconductor space.

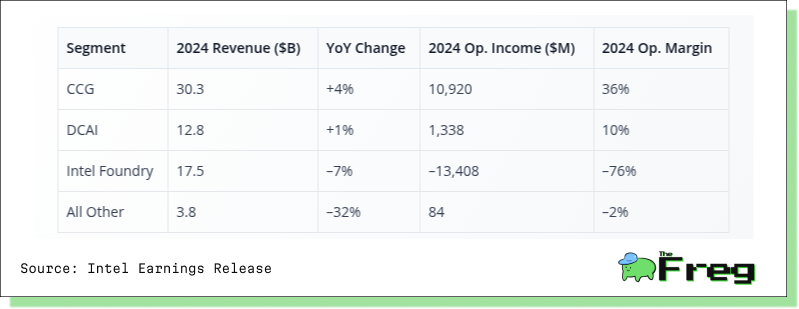

Segment Highlights

Intel’s business is anchored by three primary segments: Client Computing Group (CCG), Data Center and AI (DCAI), and Intel Foundry. In 2024, CCG delivered $30.3B in revenue (+4% YoY), buoyed by a rebound in notebook demand and the launch of AI-enabled Core Ultra processors. DCAI posted $12.8B (+1% YoY), with higher server ASPs offsetting lower volumes. The Foundry segment, however, saw revenue decline to $17.5B (–7% YoY), reflecting lower external demand and internal pricing pressures. The “All Other” category, including Altera and Mobileye, also contracted sharply as customers reduced inventories.

Intel’s 2024 segment results reveal a mixed performance across its core businesses. The Client Computing Group (CCG) remains the profit driver, buoyed by strong margins, rising notebook demand, and the successful rollout of AI-enabled Core Ultra chips—showcasing Intel’s ability to tap into emerging PC and AI trends. In contrast, the Data Center and AI (DCAI) segment saw only modest growth, with higher server ASPs offset by weaker volumes amid intense competition. The Intel Foundry segment posted the weakest performance, with steep revenue declines and significant losses due to heavy investment, underutilization, and pricing pressure. Meanwhile, the “All Other” category, including Altera and Mobileye, contracted sharply as customers cleared excess inventory. Overall, Intel continues to rely on its PC business for profitability, while its broader transformation into a foundry-led tech leader is still unfolding.

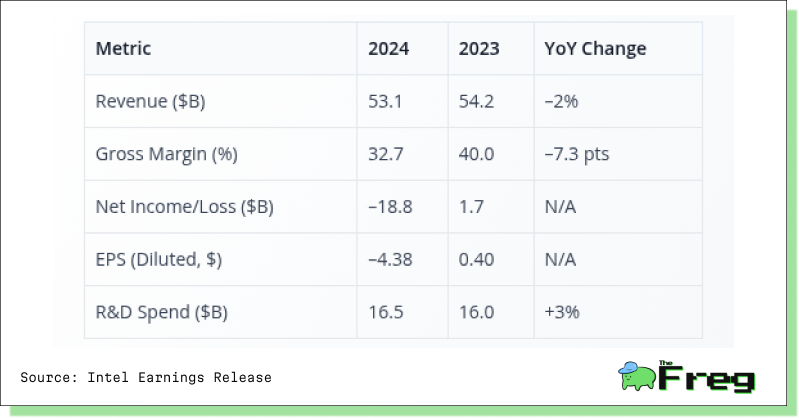

Financial Overview

Intel’s consolidated 2024 revenue was $53.1B, down 2% from 2023, as growth in core products was offset by declines in foundry and non-core businesses. Gross margin fell sharply to 32.7% (from 40.0% in 2023), driven by asset impairments, higher unit costs, and restructuring charges. The company reported a net loss attributable to Intel of $18.8B, or $4.38 per diluted share, reflecting significant non-cash charges and restructuring costs. Operating expenses rose to $29.0B, with R&D investment remaining robust at $16.5B.

Intel’s 2024 financials reflect the strain of its ongoing transformation. A steep drop in gross margin and a swing to net loss were driven by significant non-cash charges—mainly asset impairments and accelerated depreciation related to underused manufacturing and foundry restructuring. Elevated operating and restructuring costs further pressured profitability. Still, Intel increased R&D spending by 3% year-over-year, signalling a strong focus on innovation and long-term growth. The challenge remains converting that investment into sustained revenue and margin recovery. Overall, the results underscore a company navigating a high-stakes turnaround, balancing cost discipline with the push for next-gen tech and manufacturing.

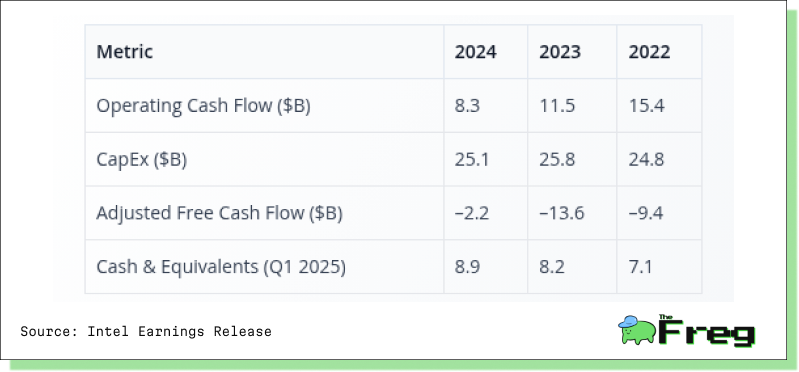

Cash Flow and Efficiency

Intel generated $8.3B in operating cash flow in 2024, down from $11.5B in 2023, reflecting lower profitability and working capital pressures. Capital expenditures remained high at $25.1B, though the company is targeting a reduction to $18B in 2025. Adjusted free cash flow was negative $2.2B for the year, underscoring the capital intensity of Intel’s transformation. The company’s balance sheet remains robust, with $8.9B in cash and $12.1B in short-term investments at the end of Q1 2025. Intel has also secured significant partner contributions and government incentives to support its foundry expansion.

Intel’s cash flow and efficiency metrics reveal both the strain and resilience of its transformation. Operating cash flow has declined over the past three years due to lower profitability and rising working capital needs tied to heavy investment in manufacturing and process technologies. Persistent high capex and negative free cash flow reflect the capital intensity of Intel’s foundry and advanced node ambitions. Yet, the company’s solid cash position and access to external funding—via partners and government incentives—show strong financial management. A planned capex reduction in 2025 marks a shift toward capital discipline, key to restoring free cash flow and ensuring long-term sustainability.

Comparison Between Intel and AMD

Business Overview

Intel and AMD are the two dominant x86 semiconductor companies, but their business models and financial profiles have diverged sharply in recent years:

- Intel operates as an integrated device manufacturer (IDM), designing and manufacturing its own chips and seeking to expand its foundry business for external customers. Its business is organized into Client Computing Group (CCG), Data Center and AI (DCAI), Network and Edge (NEX), and Intel Foundry.

- AMD is a fabless semiconductor company, focusing on high-performance CPUs, GPUs, and adaptive computing, with manufacturing outsourced to third-party foundries (primarily TSMC). AMD’s segments are Data Center, Client, Gaming, and Embedded.

Financial Performance (2024)

Note: Intel’s negative net income and operating loss in 2024 were driven by large non-cash impairments, restructuring, and tax valuation charges, while AMD remained profitable and cash generative.

Segment Highlights

AMD’s Data Center segment nearly matched Intel’s in revenue and far exceeded it in margin, reflecting AMD’s strong position in server CPUs and AI accelerators.

- Intel’s Foundry segment posted a significant operating loss, reflecting the heavy investment and underutilization as it ramps up external business12.

Strategic Position

- Intel is in the midst of a costly transformation, investing heavily in process technology, foundry expansion, and restructuring, but faces execution risk and margin pressure.

- AMD has capitalized on its fabless model and TSMC’s process leadership, gaining share in data centre and client markets, and maintaining higher margins and profitability.

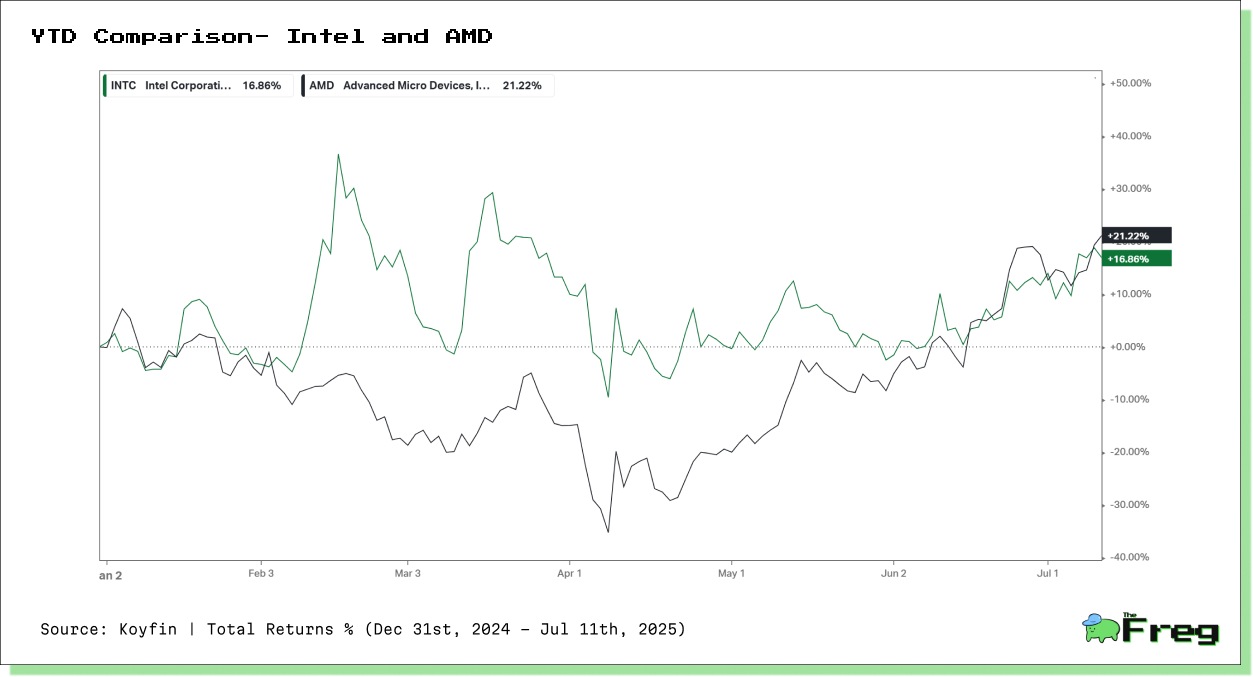

Intel vs. AMD YTD Performance

The chart compares Intel’s YTD stock performance to AMD’s:

Key Insights:

- Both companies delivered strong double-digit returns YTD, outperforming the broader market.

- AMD outperformed Intel by ~4.4 percentage points, reflecting stronger investor confidence in AMD’s growth trajectory, especially in AI and data centre markets.

- The performance gap widened in Q2, as AMD’s stock rallied on robust data centre and AI accelerator demand, while Intel’s shares were more volatile.

- Intel’s stock showed a late-period rally, narrowing the gap, but AMD maintained its lead through July.

- The relative performance underscores AMD’s continued momentum in high-growth segments and Intel’s ongoing efforts to regain competitive footing.

Conclusive Summary: Intel vs. AMD

The Intel–AMD comparison reveals sharp differences in strategy, financials, and market momentum. Intel, as an integrated device manufacturer, is undergoing a costly transformation focused on building its foundry and next-gen process technologies. This has led to negative income, margin compression, and high capital spending, with foundry ambitions yet to yield returns.

AMD, leveraging its fabless model and TSMC partnership, targets high-growth, high-margin segments like data centres and AI accelerators. Its lean structure supports strong profitability, free cash flow, and leading gross margins. AMD’s Data Centre revenue now rivals Intel’s but delivers far superior margins, highlighting its market edge.

While both stocks have gained year-to-date, AMD has outperformed—especially in Q2—reflecting stronger investor confidence in its execution and leadership in AI and data centre markets. Intel’s stock, by contrast, remains volatile amid ongoing restructuring.

Watchpoints

- Execution Risk: The success of Intel’s foundry and process technology roadmap is critical. Delays or underperformance could erode competitiveness.

- Competitive Pressure: AMD, NVIDIA, and ARM-based vendors continue to gain share in key markets, while hyper-scalers increasingly develop custom silicon.

- Capital Intensity: High CapEx and negative free cash flow increase financial risk, especially amid credit rating downgrades and suspended dividends.

- Geopolitical and Macroeconomic Uncertainty: Trade tensions, supply chain disruptions, and regulatory changes could impact operations and demand.

- Legal and Regulatory: Ongoing litigation, including antitrust and IP cases, could result in material financial impacts.

Intel is in the midst of a high-stakes turnaround, with management taking decisive action to streamline operations, invest in next-generation technologies, and reposition the company as a leader in both product innovation and semiconductor manufacturing. The path forward is fraught with risk—execution missteps, competitive dynamics, and macroeconomic volatility could all derail progress. However, Intel’s scale, engineering talent, and strategic partnerships provide a foundation for recovery. For investors, Intel represents a contrarian bet on the resurgence of U.S. semiconductor manufacturing and the democratization of AI compute. Success will require patience, disciplined execution, and a willingness to weather near-term volatility in pursuit of long-term value creation.