India's Renewable Energy Surge: A Turning Point in FY25

India added a record 29.52 GW of renewable capacity in FY25—driven by solar power and policy support—marking strong progress toward its 2030 clean energy goals.

In an unprecedented year for India’s energy sector, FY2025 saw the nation add a staggering 34,000 megawatts (MW) of new power capacity—the highest in nearly a decade. Of this, 29,520 MW came from renewable sources, a record-breaking contribution largely driven by the exponential growth in solar power. For the first time, India crossed the 100 GW threshold in installed solar capacity, marking a key milestone in its ongoing transition toward cleaner energy sources.

A Historic Year for Green Energy

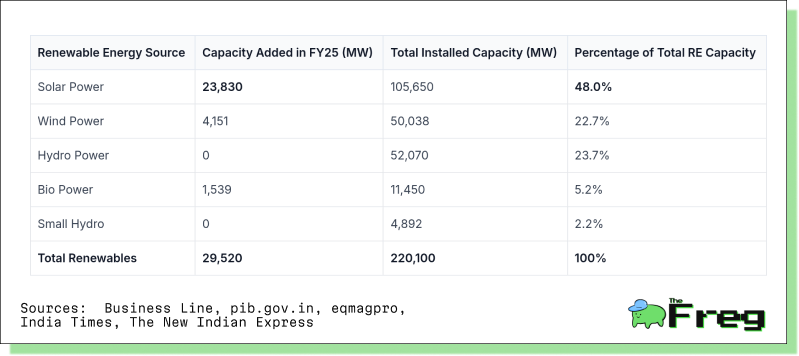

India’s renewable energy expansion in FY2025 was nothing short of historic. The country added 27,983 MW of new renewable capacity, the highest annual addition on record. Solar led the charge with 23,832 MW—an impressive 58.5% year-on-year increase—followed by wind power at 4,151 MW, a 27.9% rise. This surge pushed the total installed renewable capacity to 220 GW.

India’s clean energy portfolio now comprises:

- Solar: 48%

- Wind: 23%

- Large Hydro: 22%

- Bio Power: 5%

- Small Hydro: 2%

These figures reinforce India’s position as a key player in the global renewable energy landscape, moving steadily toward its 2030 target of 500 GW non-fossil fuel capacity and its broader goal of net-zero emissions by 2070.

Renewable Energy Source Breakdown

India’s renewable capacity additions in FY25 are summarized below:

Ground-mounted installations account for a significant 81.01 GW of the total solar capacity. Overall, renewables now represent 47.37% of India’s total installed power generation capacity of 483.26 GW, as of March 2025.

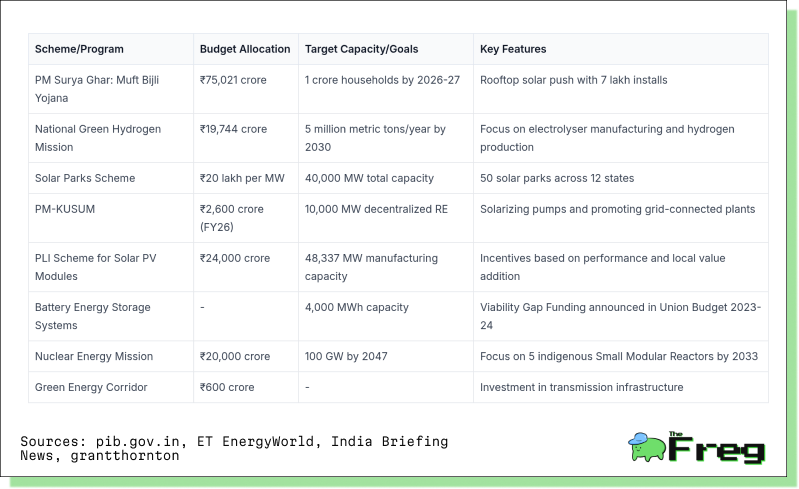

Government-Led Acceleration

India’s clean energy leap has been propelled by robust policy support and generous public investment. The Union Budget for 2025-26 allocated ₹26,549 crore to the Ministry of New and Renewable Energy (MNRE), a 53% increase over the previous year. Of this, ₹24,224 crore was earmarked for solar power.

Among the flagship initiatives:

- PM-KUSUM Scheme: Extended to FY26, it supports decentralized renewable energy installations and solar-powered irrigation systems. With 97,000 pumps installed, the scheme received ₹2,600 crore in the current budget.

- PLI Scheme: The Production Linked Incentive scheme allocated 48,337 MW of solar module manufacturing capacity and is expected to generate over 101,000 jobs and attract investments exceeding ₹93,000 crore.

- Regulatory Reforms: The Electricity (Amendment) Rules 2024 eased infrastructure barriers, enabling large consumers to build their own transmission lines.

- Green Hydrogen Mission: With a doubled budget of ₹600 crore, the mission aims to produce 5 million metric tons of green hydrogen annually by 2030.

Flagship Schemes at a Glance

Collectively, these schemes are crucial to achieving the 2030 non-fossil energy target, estimated to require USD 223 billion in investments over the current decade.

Corporate Momentum

The private sector is actively embracing renewables. India’s corporate renewable energy market grew by 2,011 MW in Q3 2024 and another 2,040 MW in Q4, reaching 43,767 MW. India now holds a 7.4% global share in corporate renewable PPAs, ranking second worldwide.

This growth is especially visible in data centers. Bharti Airtel’s Nxtra uses 140 GWh of green energy annually, while AdaniConneX is setting up fully solar-powered facilities. Adani Green’s 8 GW PPA with SECI is claimed to be the world’s largest green power agreement. These developments are supported by the flourishing green finance market, which crossed $20 billion by January 2023.

Falling Costs and Rising Tech

India's solar boom has been supported by both cost competitiveness and technological innovation. Solar equipment prices have dropped, driving six consecutive quarters of declining project costs. Innovations such as smart inverters and advanced battery storage systems have made renewable energy more efficient and grid-compatible.

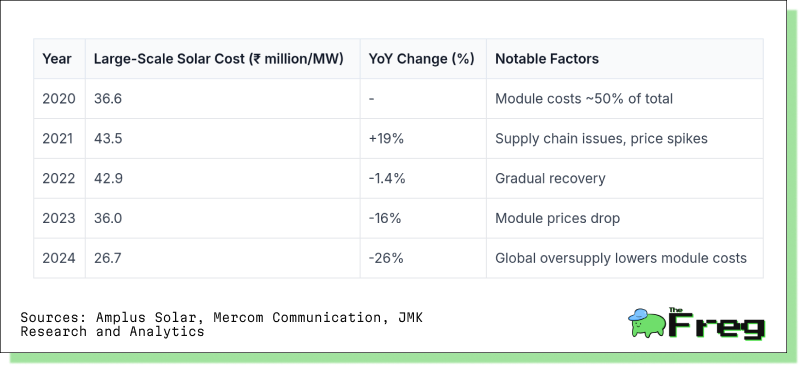

The solar equipment cost trajectory

These cost reductions have translated into falling tariffs—from ₹10.9/kWh in 2010 to under ₹3/kWh by 2016, with a record low of ₹2/kWh achieved in 2020. For residential consumers, a 3 kW system now costs around ₹1.89–2.15 lakhs.

Domestic Manufacturing and Trade Diversification

India is also making strides toward self-reliance in solar manufacturing. Between April and November 2024, imports of solar cells and modules declined by 20% and 57%, respectively. The share of Chinese imports fell below 65%, a significant drop from over 90% a few years ago.

Trade diversification has been enhanced through agreements such as the TEPA with the European Free Trade Association, targeting $100 billion in FDI over 15 years. Major financial backing has come from the World Bank ($1.5 billion) and the Asian Development Bank ($200 million), supporting various renewable subprojects.

Charging Ahead

FY25 has set a strong foundation for India’s clean energy future. The country’s 29.52 GW of new renewable capacity this year is a meaningful step toward its 2030 goal.

That said, sustaining this growth will require continued investment, policy support, and workforce expansion. With India needing to add roughly 50 GW annually to stay on track, the path ahead is ambitious—but not out of reach if momentum holds.