India's Quick Commerce Revolution: Speed, Strategy, and the Battle for Urban Consumers

India’s quick commerce sector is transforming urban shopping habits with over 4 million daily orders.

India's urban retail landscape is being rewritten at breakneck speed. In March 2025 alone, Blinkit, Zepto, and Swiggy Instamart collectively delivered over

4 million daily orders, more than doubling their volumes from the previous year, according to Moneycontrol. This surge reflects a fundamental shift in consumer behavior: traditional shopping is giving way to impulse-driven, on-demand convenience.

Market Leaders and the Numbers Behind the Race

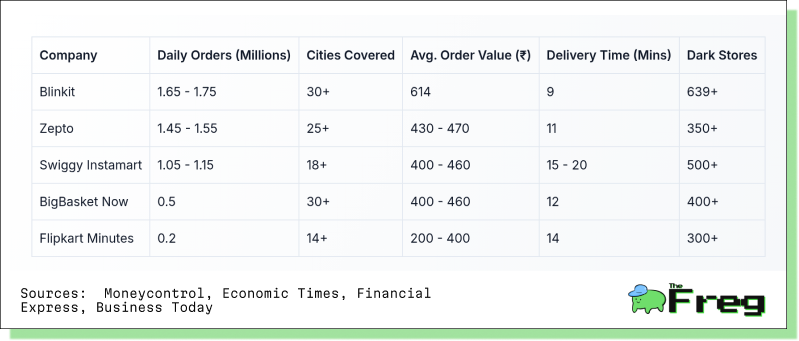

Three players dominate India’s quick commerce sector:

Zepto is the fastest-growing among them, with a 200% YoY growth, compared to Blinkit’s 90% and Swiggy Instamart’s 60%. While these three command roughly 90% of the market, smaller challengers like BigBasket Now and Flipkart Minutes are vying for their slice of the quick pie.

Behind the Scenes: Dark Stores and Hyperlocal Warehousing

Quick commerce thrives on the hyperlocal warehousing model, centered around micro-fulfillment centers or "dark stores." These outlets, stocked with approximately 6,000 high-demand SKUs, are positioned in densely populated areas to meet the 10-30 minute delivery promise. Supporting them are larger "mother warehouses" that manage bulk procurement.

Technology powers these centers. AI forecasts neighborhood demand; handheld devices enable pickers to locate and pack items in under 90 seconds. Blinkit leads with 1,000+ dark stores, with plans to hit 2,000 by the end of 2025. Zepto and Swiggy Instamart trail with 850 and 705 stores respectively.

This growth is fueling India’s real estate demand. By 2027, dark store space is projected to hit 37.6 million sq. ft., growing at a 12% CAGR.

The 10-Minute Delivery Revolution

Globally, the quick commerce sector is on track to hit $352.8 billion by 2030, growing at a 21.3% CAGR. India alone is expected to reach $5 billion GMV in 2025, growing 75–85% YoY—a rate that dwarfs traditional retail growth.

Urbanization, tech adoption, and demand for instant gratification are fueling this phenomenon. With late-night orders up 30% and nighttime spending rising 60%, convenience has become a 24/7 expectation.

Consumer Behavior: From Essentials to Impulse

Groceries, once 80% of quick commerce orders, now account for 60-65%. High-value non-essentials like electronics and cosmetics are gaining traction. Platforms even report sales of iPhones and premium perfumes, reflecting a behavioral shift.

The pre-festive season of 2024 saw a 22% spike in app usage, signaling that consumers now rely on these platforms for impulse and last-minute shopping, not just daily needs.

Unit Economics and Profitability Outlook

Despite rapid growth, profitability remains elusive for most players. Companies often operate at thin or negative margins, driven by deep discounting,

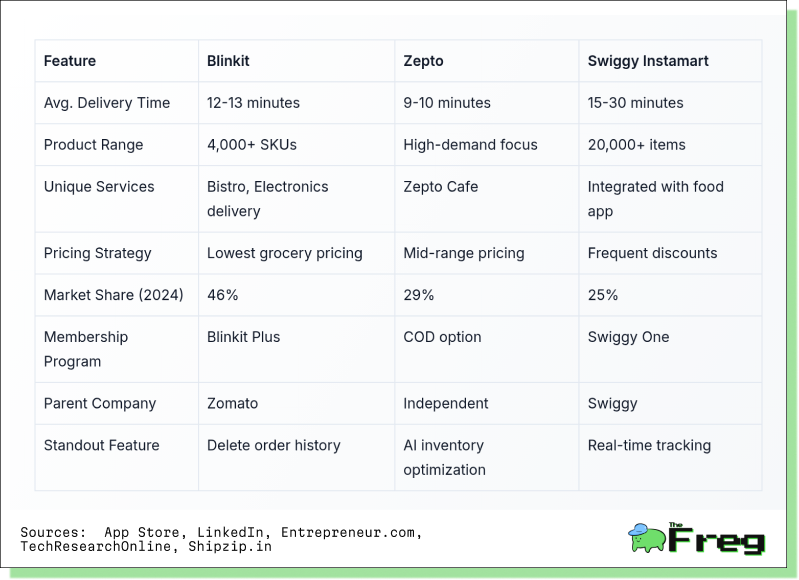

free deliveries, and high customer acquisition costs. Zepto and Blinkit have announced plans to reach EBITDA breakeven by FY26, focusing on:

- Rising Average Order Values (AOVs) through electronics and impulse categories

- Reducing delivery costs via denser dark store networks and EVs

- Private label expansion to boost gross margins

- Membership programs like Blinkit Plus and Swiggy One to drive loyalty

Investors are now scrutinizing contribution margins per order, with unit economics taking center stage in 2025 boardroom discussions.

Strategic Maneuvers in a Crowded Market

Each company is carving its niche:

- Blinkit, backed by Zomato, uses gift cards, discounts, and seasonal offers to reduce grocery bills by up to 50%.

- Zepto aggressively recruits from competitors and promotes features like voice search and smart picks.

- Swiggy Instamart expands into Tier-2 cities, integrating local brands to boost regional appeal.

All three incentivize larger orders above ₹1,000 to improve profitability.

App Features: Who Offers What?

Traditional Retail Feels the Heat

Quick commerce is disrupting the neighborhood kirana store. About 46% of users now shop less at kiranas, and 82% have shifted a quarter of their spending to app-based services. Urban kirana stores are reporting up to 52% decline in essential goods sales.

However, not all kiranas are retreating. Some are partnering with platforms as fulfillment hubs or delivery partners:

Logistics, Congestion, and Sustainability Challenges

With delivery vehicles weaving through already jammed cities, quick commerce is exacerbating urban congestion. Bengaluru and Mumbai are among the top 10 most congested cities globally. Regulations are tightening: Delhi bans heavy vehicles from 7 AM–11 PM, while Bengaluru restricts them during peak hours.

Environmental concerns are also rising. E-commerce creates 4.8x more packaging waste than traditional retail. Licensing hurdles, fire safety norms, and zoning challenges further complicate dark store expansion. Future solutions may include EV adoption, dedicated delivery lanes, and stricter packaging norms.

Going Global: The Expansion Blueprint

India’s quick commerce playbook is influencing global strategies:

- GoPuff (US) operates central warehouses with 30-minute delivery

- Getir (Turkey) boasts a $9.5B valuation and 650+ global facilities

- JOKR (LatAm) is pivoting to emerging markets

Tech is leading the charge with AI forecasting, drone deliveries (up to 30% cost savings), and voice commerce. By 2027, drones may account for 30% of urban quick deliveries, revolutionizing convenience yet again.

India’s quick commerce sector is no longer an experiment—it’s a full-blown transformation of urban retail. As competition intensifies and scale saturates, the next battle will be about profitability, sustainability, and smart expansion. For consumers, the promise is clear: everything, everywhere, in minutes. But for businesses, winning this race demands more than just speed—it requires staying power