India's Insolvency Code Marks a Milestone: Record ₹67,000 Crore Recovered in FY25

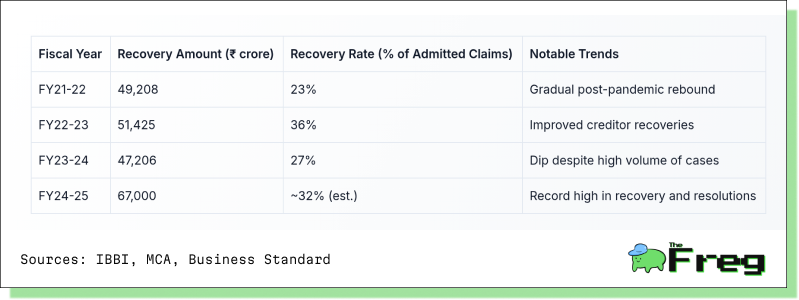

Recoveries under India's insolvency process have hit a record ₹67,000 crore in FY25, with a ~32% recovery rate. While still below peak levels, the uptick signals improving resolution efficiency—positive for lenders and distressed asset investors.

India’s Insolvency and Bankruptcy Code (IBC) has reached a defining milestone. In FY25, creditors recovered a record ₹67,000 crore — the highest annual recovery since the IBC was enacted in 2016. This 42% jump from the ₹47,206 crore recovered in FY24 reflects an evolving insolvency framework that is beginning to deliver consistent results after years of uncertainty and bottlenecks.

The Recovery Surge: What’s Behind the Numbers

The recovery surge in FY25 was driven by a confluence of regulatory, institutional, and market-driven factors. A record 284 corporate resolution cases were approved by the National Company Law Tribunal (NCLT), compared to 275 in FY24. Key contributors to this performance include:

- Expansion of NCLT capacity with the appointment of 24 new members in early 2025, reducing vacancies to just 3 out of 63 sanctioned positions.

- Regulatory improvements, including streamlined case admission and resolution processes.

- A growing culture of pre-admission settlements, with over 30,000 cases settled before formal admission, covering defaults worth ₹13.78 lakh crore.

Recovery Trends Over Time

The data shows that while annual recovery amounts have fluctuated, FY25 represents a clear peak in both resolutions and amounts recovered.

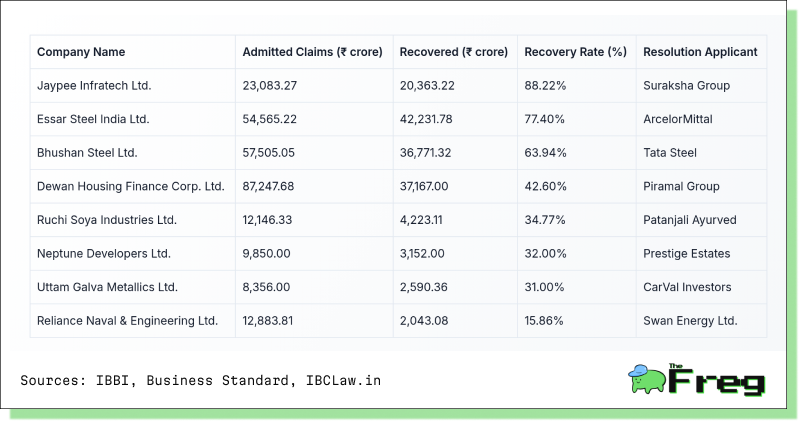

High-Value Cases Driving the Recovery

Several big-ticket resolutions helped drive the ₹67,000 crore recovery. These include long-pending cases in real estate, manufacturing, and infrastructure sectors.

While the average recovery rate remains around 31-32%, the diversity in outcomes underscores the varying asset quality and market interest across sectors.

Institutional Upgrades: NCLT's Expanding Role

The marked improvement in resolution throughput can largely be attributed to institutional strengthening. The appointment of 24 new NCLT members and the proposed expansion to 115 members across 26 benches are already yielding results. From just 100 resolutions two years ago, NCLT is now on track to surpass 300 approvals in FY26.

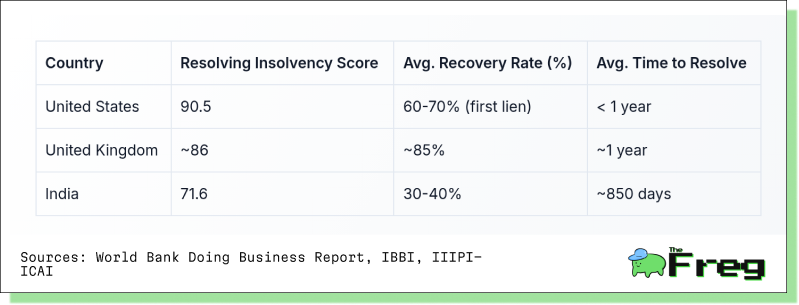

Yet, challenges persist. Nearly 20,000 cases remain pending, and average resolution timelines have stretched to 850 days — far above the statutory 330-day target. The government is now evaluating a Creditor-Led Resolution Process with a shorter 165-day window to reduce delays and ease pressure on NCLT benches.

Sectoral Breakthroughs and Behavioral Shifts

The real estate and manufacturing sectors accounted for about 65% of resolved cases in FY25. Notably, real estate resolutions jumped 200% year-on-year, as rising housing demand attracted resolution applicants.

The IBC has also reshaped debtor behavior. Over 26,000 CIRP applications worth ₹9.33 lakh crore were withdrawn pre-admission, suggesting that promoters are increasingly opting for early settlements to avoid the reputational and operational damage of insolvency proceedings.

Global Benchmarking: Where India Stands

Despite its progress, India’s IBC still lags behind global benchmarks in efficiency and recovery outcomes. The World Bank’s “Resolving Insolvency” score placed India at 52 in 2020, up from 136 in 2016, but well below the US (90.5) and the UK.

India’s “creditor-in-control” model contrasts with the U.S. “debtor-in-possession” system, but execution gaps — not the design — remain the key bottleneck.

MSMEs and Extreme Haircuts: The Remaining Hurdles

Micro, Small and Medium Enterprises (MSMEs) continue to struggle under the IBC framework. With over ₹21,000 crore in delayed payments and limited tangible assets, recoveries in MSME cases are minimal. In several cases, financial creditors have accepted haircuts exceeding 90%, eroding confidence in the system’s fairness and efficiency.

Efforts are now underway to strengthen the Pre-Packaged Insolvency Resolution Process (PPIRP) for MSMEs and develop out-of-court frameworks to resolve defaults faster.

The Road Ahead

The FY25 performance of the IBC is a validation of its long-term promise. With over ₹3.6 lakh crore recovered through resolution plans since inception and 3,293 companies rescued, the system has matured significantly. However, for India to reach global standards, the IBC must evolve in three key areas:

- Speed – Cut down the 850-day average timeline to meet the 330-day statutory mandate.

- Predictability – Ensure consistent legal interpretation and enforceability of contracts.

- Accessibility – Improve outcomes for MSMEs and expand non-court resolution mechanisms.

If these priorities are addressed, India’s insolvency framework could transition from functional to world-class — offering a faster, fairer, and more robust mechanism for dealing with financial distress.