India’s EV Revolution: Can the Nation Lead the Global Green Mobility Race?

India's EV and battery sectors are accelerating, driven by policy support, rising demand, and skilling initiatives. This article explores market trends, employment shifts, infrastructure gaps, and key players shaping the country’s electric future.

India’s electric vehicle (EV) and battery ecosystems are at an inflection point. Policy tailwinds, manufacturing incentives, and a shift in consumer mindset have converged to supercharge the EV transition. But beyond the hype, this revolution is reshaping supply chains, workforce demands, and global positioning. Here's a deep dive into the landscape across markets, employment, skilling, infrastructure, and competition.

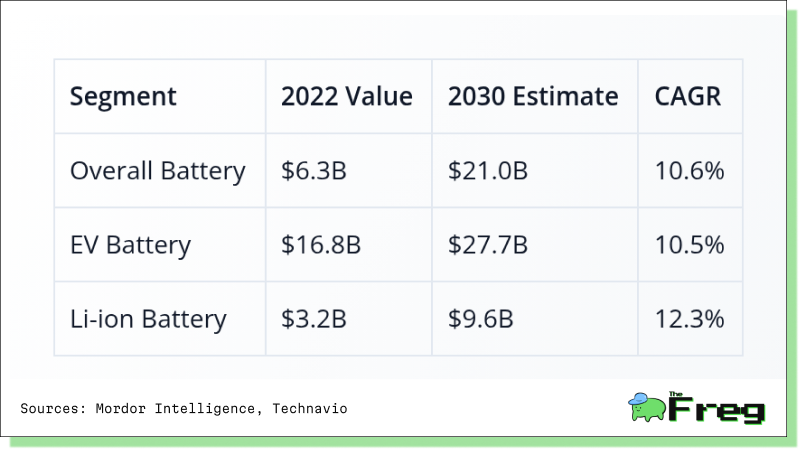

Market Pulse: Battery and EV Segments

India's battery and EV markets are expanding rapidly. The growth is led by automotive demand, renewable energy storage, and supportive policies.

Jobs and Skills: Who Will Power the Shift?

With India targeting 30% EV penetration by 2030, the employment potential is substantial. Industry estimates suggest over 31,000 full-time jobs could emerge by then in battery pack assembly, EV design, charging infra, and testing.

India’s strengths lie in its young engineering talent pool, but there's a critical gap in specialized skills—especially in battery design, thermal management, and BMS software. Recognizing this, governments and skilling bodies have stepped in.

MSMEs also stand to gain, as battery localization and EV component outsourcing open new supply chain opportunities.

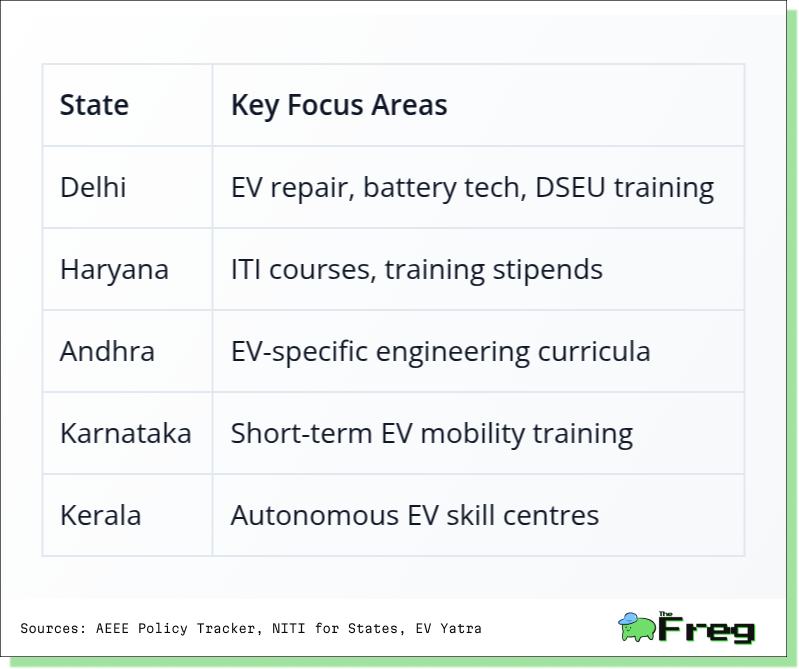

Skilling Push: National and State Initiatives

From Delhi to Kerala, Indian states are backing the EV movement with focused training and re-skilling initiatives. These programs aim to align talent pipelines with industry needs.

Nationally, the PM E-DRIVE scheme and NSDC’s public-private skilling model are creating formal pathways to train EV professionals. Institutions like iHUB (IIT Roorkee) are offering certified EV design programs to bridge the R&D-to-manufacturing gap.

Plugged In or Left Out? The Infra Gap

India’s public charging ecosystem is still a bottleneck. As of February 2024, the country had just 12,146 public charging stations, or roughly 1 charger per 135 EVs—far behind the US (1:20) or China (1:10).

Most chargers (70%) are concentrated in metro areas, leaving Tier 2 and 3 cities underserved. Even operational chargers face issues—about 25% are down due to maintenance or software glitches.

Charging speed is another drag. India's fast chargers take 1.5–2 hours on average, compared to 30–60 minutes in global benchmarks. No wonder 90% of EV owners rely on home charging, which stalls commercial fleet adoption and rural penetration.

Global Positioning: Strengths and Gaps

India is now the world’s largest electric 3-wheeler market, selling ~700,000 units in 2024. With 57% of global sales in this segment, India has outpaced even China in adoption of last-mile EVs.

But passenger EVs tell a different story. Despite growing interest, electric cars made up only 2% of all car sales in 2024. That’s far below the 30–35% EV penetration seen in China and parts of Europe.

Where India excels is affordability. All Indian-made EVs in 2024 were priced below $20,000, creating a market segment untouched by premium foreign brands. This could shape a uniquely "mass-market" EV model that may be exported to other price-sensitive countries.

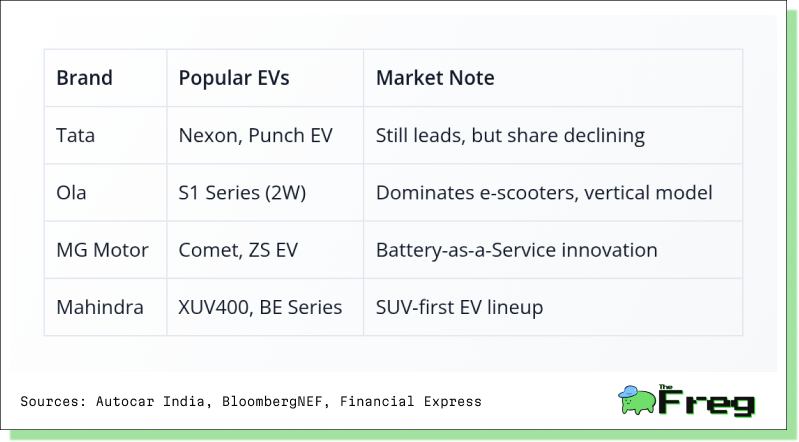

Competitive Landscape: Who’s Leading?

The Indian EV market is rapidly evolving with a mix of early movers, cost disruptors, and global alliances.

While Tata Motors commands over 50% of market share, its lead is shrinking with Ola and Mahindra accelerating new launches. Ola’s vertical battery production and MG’s flexible ownership models (battery leasing) have introduced fresh strategies to grow market share.

Final Charge: Can India Lead the EV Race?

India's EV story is at a crucial juncture. The growth potential is undeniable—on both the demand and supply side. But to sustain momentum, India must scale its charging infrastructure, deepen R&D capacity in batteries, and align skilling efforts with industry needs.

The country’s strength lies in low-cost engineering, favorable demographics, and a growing appetite for clean mobility. If these can be converted into export-ready manufacturing and localized supply chains, India could become not just an EV adopter—but a global EV leader.