India’s Air Conditioning Boom: A Climate, Consumer, and Energy Crossroads

India's air conditioner market is booming amid rising temperatures and urbanization, with sales hitting 14 million units in 2024. This surge poses energy and climate challenges while unlocking major economic and investment opportunities.

The summer of 2024 rewrote the rules for India’s consumer electronics market. As mercury levels soared past 45°C in cities like Delhi and Lucknow, a record 14 million air conditioners flew off the shelves—marking an inflection point in the country’s cooling economy. Once reserved for the wealthy elite, ACs are now rapidly becoming essential appliances in Indian households, driven by extreme heat, a burgeoning middle class, and rapid urbanization.

From Luxury to Necessity

India's air conditioning market is no longer a seasonal curiosity. According to the Consumer Electronics and Appliances Manufacturers Association (CEAMA), summer 2024 alone saw a 30–40% spike in AC sales compared to previous years. Voltas, LG, and Haier all reported near-doubling of their May sales figures, with Voltas selling over 2 million units in FY24—the highest ever for a single brand.

This boom spans both ends of the affordability spectrum. Premium segment sales surged by 620%, while economy models in Tier-3 cities and towns saw an astronomical 1018% growth. The surge, however, has overwhelmed installation services and inventories, especially for energy-efficient models.

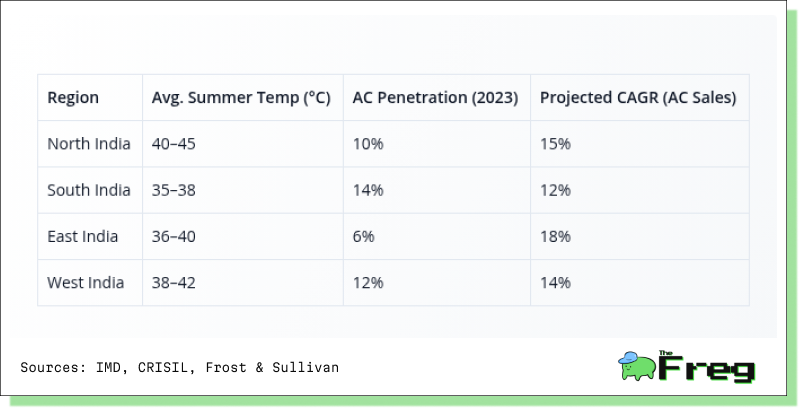

Regional Divide in Cooling Adoption

Cooling demand and AC penetration vary widely across India, shaped by both climatic extremes and income levels.

With penetration still in the single digits in regions like East India, the growth potential remains immense. While North and West India battle the highest temperatures, it is Eastern India that is expected to see the fastest sales growth.

Middle-Class Momentum

India’s middle class—estimated at 400 million strong—is emerging as the key driver of AC adoption. With just 8–10% of households currently owning an AC, India is far behind China (80%) and Indonesia (36%). But this is rapidly changing. About 60 million Indians already earn over $10,000 annually—the income bracket where AC adoption tends to take off—and this group is expected to reach 100 million by 2027.

Manufacturers are tapping into this demand with aggressive financing options, mirroring car loan structures. Coupled with growing housing demand and rising rural incomes, this shift is rapidly transforming the air conditioner into a “quintessential requirement,” not just in metros, but across emerging urban and semi-urban clusters.

The Energy Dilemma

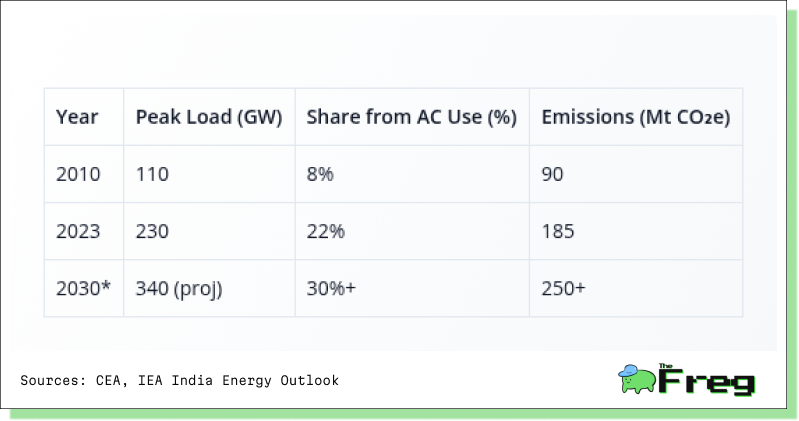

With cooling demand comes a complex energy and emissions challenge. The share of electricity consumed by air conditioners has surged—from just 8% in 2010 to over 22% in 2023.

If trends continue, ACs alone could contribute to 180 GW of peak demand by 2035—nearly a third of India’s projected total. Already, cities like Delhi have reported record energy loads, with cooling accounting for up to 50% of residential power bills during summer months. Without substantial efficiency improvements and renewable integration, India could face electricity shortages by 2026.

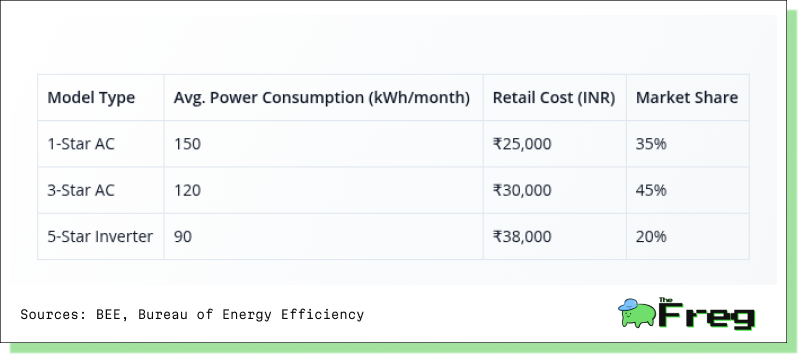

Inverter ACs: A Game-Changer

To address the power burden, energy-efficient inverter technology has taken center stage. These models use variable-speed compressors that regulate cooling output based on room temperature, offering 30–50% savings over conventional models.

Despite the higher upfront cost, consumers are gravitating towards 5-star inverter models for long-term savings. Top brands like Daikin and LG are now integrating AI-based smart cooling, eco-friendly refrigerants, and air purification to cater to evolving consumer expectations.

Urbanization and Climate Stress

Urbanization is further amplifying demand. By 2047, over 60% of India’s population is expected to live in urban areas—up from 36% today. This transformation is not limited to metro cities. Emerging urban centers like Bhubaneswar, Indore, and Surat are leading the charge in middle-class growth and AC adoption.

What’s more, nearly 150 “Developed Rural Clusters” near major metros are exhibiting urban-style consumption patterns, thanks to improved connectivity and electrification. The convergence of heat stress, income growth, and changing lifestyles is creating the perfect storm for an AC revolution.

Balancing Growth with Sustainability

India’s climate pledges—including a net-zero target by 2070 and a commitment to increase non-fossil electricity to 50% by 2030—face pressure from this cooling boom. The India Cooling Action Plan (ICAP) lays out a vision for sustainable cooling and refrigerant transition, with achievements like the early phase-out of HCFC 141b already under India’s belt.

Yet, India notably abstained from signing the Global Cooling Pledge at COP28, highlighting the tension between urgent cooling needs and long-term climate goals.

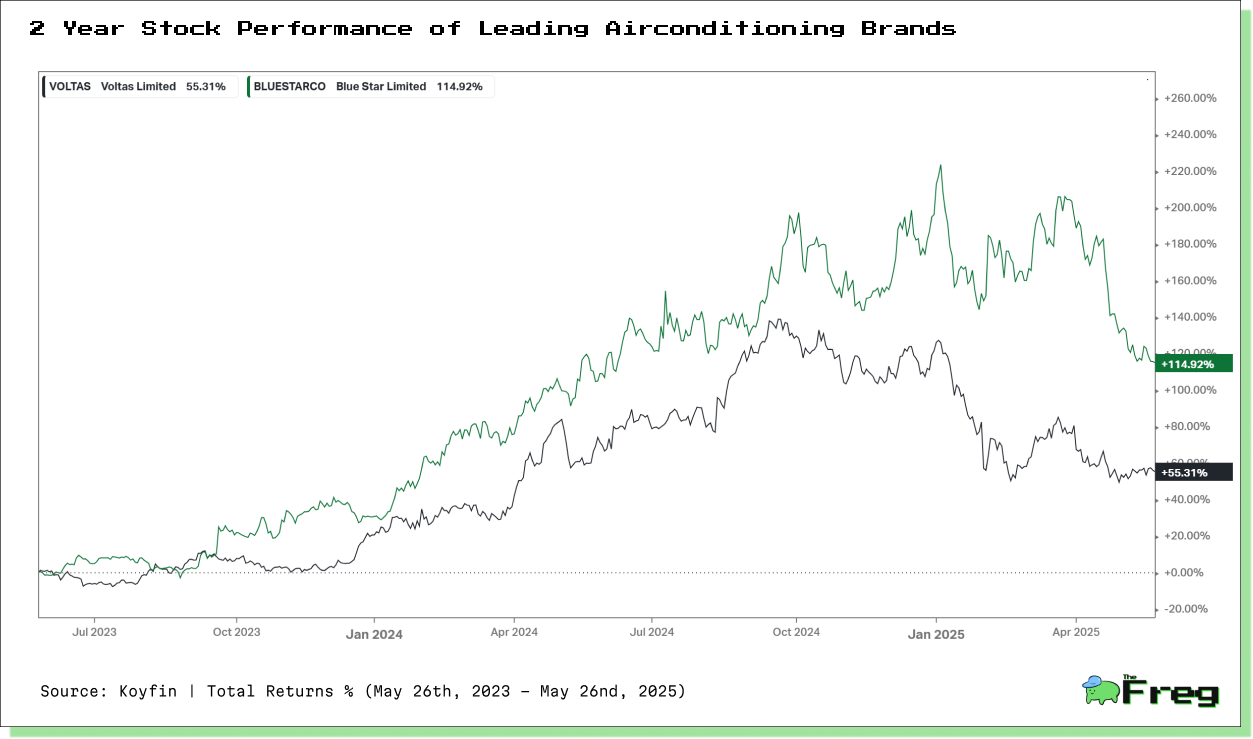

Market Leaders and Investment Frontiers

The AC boom is translating into solid financials for leading firms.

The commercial AC segment—valued at $1.55 billion in 2024—is also gaining traction, expected to grow fourfold by 2033. Demand from industrial parks, data centers, and hospitals in Tier-2 cities is accelerating, and global players like Daikin and Mitsubishi Electric are expanding local manufacturing under India’s Production Linked Incentive (PLI) scheme.

A Nation at a Crossroads

India’s air conditioning surge is a story of contrasts—of aspiration and anxiety, comfort and climate strain, growth and grid overload. As the country hurtles toward becoming the world’s largest AC market, policymakers, businesses, and consumers must find a delicate balance between immediate comfort and long-term sustainability. The next decade will determine whether India can cool smart—or overheat in the process.