India, the New Frontier for Global FMCG Giants

Global FMCG giants are localizing strategies in India—to tap into its booming $1.18T market driven by youth, rural demand, and e-commerce.

As the global FMCG landscape undergoes rapid transformation, India has emerged as a beacon of growth for multinational corporations. Giants like P&G and PepsiCo, once heavily reliant on mature markets, are increasingly pivoting towards India—a market characterized by a young population, rising disposable incomes, digital proliferation, and deep rural potential. With the Indian FMCG market projected to grow from $167 billion in 2023 to $615 billion by 2027, it's no surprise that global players are intensifying their India strategies.

The Market Opportunity: Shifting Focus from China to India

Economic slowdowns and structural challenges in China have prompted global FMCG players to recalibrate their strategies. India, by contrast, offers strong fundamentals: consistent GDP growth, a booming middle class, and the world's largest youth demographic. The FMCG sector is expected to grow at a compound annual growth rate (CAGR) of 21.8% through 2034.

Localized Product Innovation

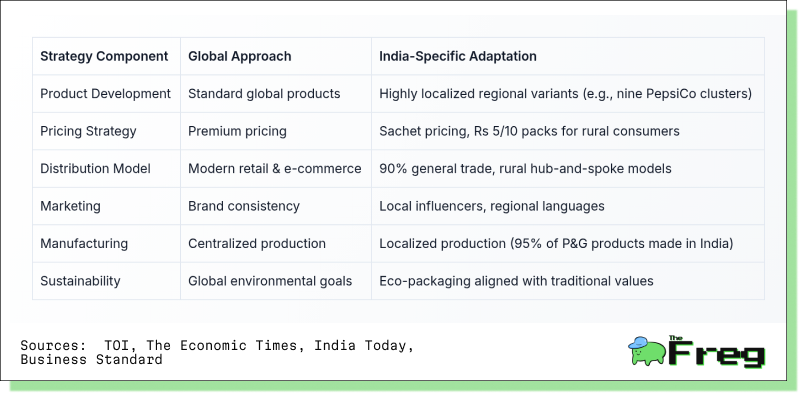

To thrive in India, global FMCG companies have shifted from standardized global offerings to deeply localized product development. PepsiCo leads with its nine regional clusters strategy, customizing offerings such as Kurkure, Lay's, and Nimbooz to suit local palates—even varying cooking oils by region. Similarly, P&G manufactures over 95% of its India-sold products locally, tailoring formats and ingredients to align with Indian preferences.

Fireside Ventures reports that Indian urban consumers are willing to pay 15% more for differentiated food categories and 30% more for health-based snacks, driving innovation not just in flavor but also in health, sustainability, and packaging.

Rural Penetration: Unlocking Bharat's Potential

With rural India accounting for nearly 40% of FMCG sales, companies have deployed highly tailored rural strategies. P&G launched a Rs 500 crore 'Rural Growth Fund' focused on localized media, tech-enabled last-mile delivery, and grassroots brand activations like "Sangeeta Bhabhi". PepsiCo counters with affordable Rs 5 packs, an expansive distribution network, and collaborations with Village Level Entrepreneurs (VLEs) for doorstep e-commerce delivery.

These innovations create employment, increase accessibility, and reflect a deep understanding of rural consumer behavior and price sensitivity.

Strategic Partnerships: Gaining Ground with Local Allies

P&G and PepsiCo have relied on joint ventures to establish and deepen their Indian footprint. Notable examples include:

- PepsiCo-Tata JV (2010): Focus on non-carbonated health beverages

- PepsiCo-Varun Beverages + Indorama: PET recycling initiative

- P&G-Godrej JV (1992): Entry into bar soaps and detergents

These collaborations fuse global best practices with local market wisdom, enabling speed, scale, and cultural fit.

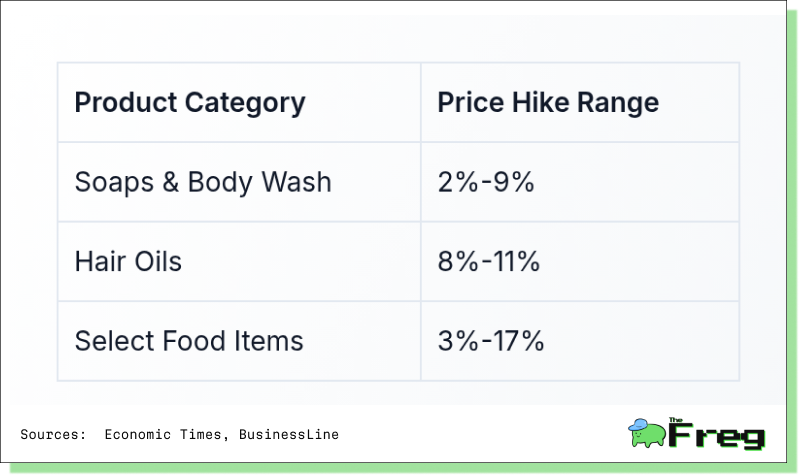

Navigating Inflation and Global Disruptions

FMCG companies worldwide are grappling with rising commodity prices. From wheat (+17.4% YoY) to cocoa (+78% YoY), inflation has driven price hikes across product lines.

These pressures have accelerated India-centric manufacturing and supply chains. As P&G CFO Andre Schulten affirms: “We are profitable, and India is driving mid-single-digit growth very nicely... the market gets better every time we look at it."

From Global to Glocal: Tailoring for India

Global FMCG brands are refining their go-to-market models to suit Indian conditions. Key strategic adaptations include:

Rise of Local Challengers

While global players adapt, local challengers are rapidly gaining ground. Regional brands have outpaced MNCs in multiple categories:

- Tea: Smaller players grew 1.4x faster

- Detergents: Local brands grew 6x faster

- Beverages: Paper Boat's nostalgia-driven drinks

- Soaps: Patanjali and Ghari challenge legacy players

With nearly 45% of non-metro consumers preferring local brands for food and beverages, cultural connection and affordability are proving powerful differentiators.

Government Incentives Fueling Growth

India’s Production Linked Incentive Scheme for Food Processing (PLISFPI) has emerged as a cornerstone of FMCG investment strategy, with a total outlay of ₹10,900 crore aimed at supporting ready-to-cook/eat foods, fruits and vegetables, marine products, and cheese. As of 2023, 158 applications had been approved under this scheme, and ₹517.6 crore had already been disbursed. In addition, a millet-focused PLI scheme with an allocation of ₹800 crore targets health-oriented grain and millet-based products. Out of the 30 projects approved under this scheme, 22 are from MSMEs, underscoring the government’s push to empower smaller enterprises. Several states are also bolstering central incentives; Karnataka, for instance, offers a 20% investment subsidy (capped at ₹25 crore) and a 3% turnover-linked performance grant to attract FMCG manufacturers to regional clusters.

Foreign Direct Investment Trends

FDI into India’s FMCG and retail sectors reflects growing global trust in the market's promise.

India as a Strategic Anchor

Global FMCG majors are no longer treating India as a peripheral market. Instead, India is becoming central to global strategies, not just for sales but also for manufacturing, innovation, and resilience. By blending global scale with local relevance, companies like P&G and PepsiCo are building models that could redefine how MNCs operate in emerging markets. As rural connectivity, e-commerce adoption, and purchasing power expand further, India may well become the epicenter of the next FMCG revolution.