Hong Kong’s IPO Revival: A Global Market Reawakens

Hong Kong’s IPO market is roaring back in 2025, with proceeds surging 701% amid sweeping reforms, rising mainland capital, and booming biotech and tech listings. The city is reclaiming its role as a global financial hub, but risks remain on the horizon.

Hong Kong is staging a powerful comeback in global capital markets, reclaiming its place among the top fundraising hubs in 2025. After years of subdued activity, the city’s IPO market has come roaring back to life, fuelled by regulatory reforms, mainland Chinese capital, and investor appetite for innovation sectors like biotech and AI.

A Record-Breaking First Half

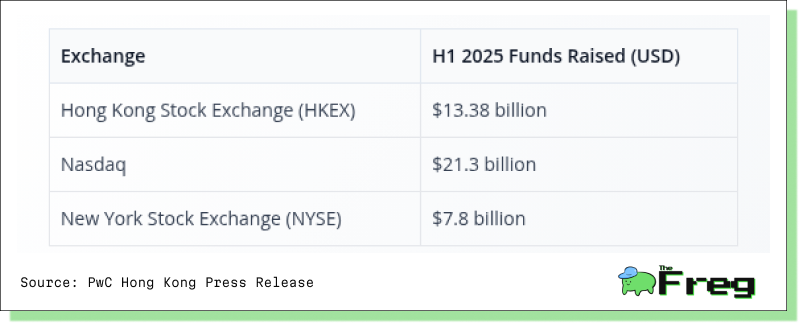

In the first half of 2025, Hong Kong’s IPO market witnessed extraordinary growth, with proceeds surging 701% to HK$107.1 billion (US$13.38 billion) across 44 new listings. This performance has already surpassed the total funds raised in all of 2024, marking a decisive turnaround.

Hong Kong's impressive rebound places it ahead of traditional rivals like the NYSE but still trailing behind Nasdaq in absolute fundraising volumes. Here's how the top exchanges stack up:

The broader stock market also set the stage for this resurgence. The Hang Seng Index posted its strongest performance since 2017, gaining 17% in 2024, with record-breaking turnover reaching HK$620.7 billion in a single day.

Reforms Reshaping the Market

At the heart of Hong Kong’s transformation lies a series of strategic reforms designed to enhance market efficiency, attract global capital, and support the growth of new economy sectors.

Key regulatory innovations include:

- Introduction of the Fast Interface for New Issuance (FINI), shortening IPO settlement cycles to T+2.

- Launch of the Technology Enterprises Channel (TECH) in May 2025, streamlining listings for biotech, AI, and other tech-driven firms.

- Relaxed listing rules and enhanced price discovery mechanisms.

- Expansion of the secondary listing regime and standardized shareholder protections.

These changes have not only improved liquidity but also increased Hong Kong's appeal to companies that previously sought listings in the U.S., particularly in sensitive sectors like AI and life sciences.

Sector Spotlight: Biotech and Tech Lead the Charge

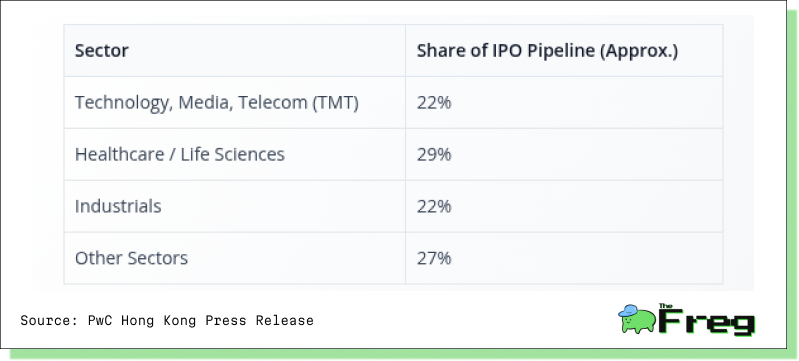

A defining feature of Hong Kong’s IPO surge has been the dominance of biotech, healthcare, and tech companies. The exchange is rapidly positioning itself as a challenger to Nasdaq’s supremacy in biotech fundraising.

As of June 2025:

- 73 biotech companies are listed under Chapter 18A, up from 67 at the end of 2024.

- Many recent biotech IPOs have raised over $300 million each.

The IPO pipeline reflects this shift toward innovation sectors:

The Technology Enterprises Channel has provided pre-listing guidance and reduced barriers for specialist tech firms, reinforcing Hong Kong’s position as a magnet for innovation-led companies.

Mainland Capital Fuels the Boom

A crucial driver of Hong Kong’s IPO revival has been the influx of mainland Chinese capital through A+H listings—where Chinese firms maintain listings in both Shanghai/Shenzhen and Hong Kong.

In 2025:

- Approximately 20–30 Chinese companies are expected to pursue A+H dual listings.

- Four mega A+H listings, along with a large H-share IPO, contributed to nearly three-quarters of Hong Kong’s IPO proceeds in the first half.

This cross-border capital has amplified market liquidity and valuations, making Hong Kong increasingly attractive to both domestic and global investors. With China’s ongoing capital market reforms and policies favouring offshore financing, this trend is expected to continue, cementing Hong Kong’s role as a key conduit for Chinese enterprises accessing international capital.

Outlook: Risks and Opportunities on the Horizon

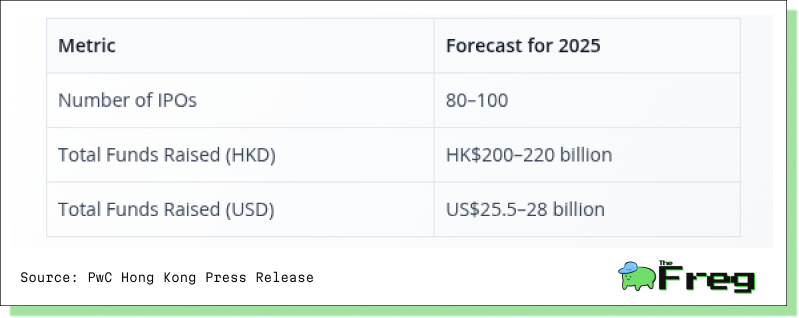

Market participants remain optimistic about Hong Kong’s IPO trajectory for the remainder of 2025. Projections suggest:

Key factors that could shape the outcome include:

- Continued regulatory support from Beijing and Hong Kong regulators.

- The success of the TECH channel in attracting more biotech and specialist tech listings.

- Geopolitical shifts potentially driving more Chinese companies away from U.S. markets.

- Global market sentiment, interest rates, and economic growth in China.

However, risks remain. Uncertain global economic conditions, geopolitical tensions, and valuation pressures could weigh on market confidence. Maintaining transparency, investor protections, and a diversified sector mix will be vital in sustaining momentum. There is also the question of how Hong Kong balances its unique East-meets-West positioning in the face of rising regional competition.

Conclusion: A Market Transformed

Hong Kong’s IPO market in 2025 is a story of transformation, resilience, and strategic renewal. With a robust pipeline, regulatory innovation, and capital inflows from both domestic and international sources, the city is poised to reclaim its position as a leading global listing destination.

The recent surge not only reflects cyclical recovery but signals a structural shift in Hong Kong’s market positioning—away from traditional industries and toward the technologies of the future. As investor confidence strengthens and more companies opt for dual listings or homecoming IPOs, Hong Kong is laying the groundwork for long-term leadership in global equity markets. The journey ahead will require careful navigation of macroeconomic headwinds, but the city’s IPO revival stands as a testament to its enduring role as a financial gateway between China and the world.