HDFC Bank vs ICICI Bank: Scale and Agility in India’s Private Banking Battle

India’s top private lenders, HDFC Bank and ICICI Bank, delivered strong yet divergent Q1 FY26 results—one driven by scale post-merger, the other by digital precision and efficiency.

HDFC Bank and ICICI Bank, India’s top two private sector lenders, reported robust but distinctive Q1 FY26 performances. HDFC Bank executed the first full quarter post-merger with its parent HDFC Ltd, showcasing scale but grappling with integration and margin compression. ICICI Bank maintained steady growth in profits and a focus on granularity, strengthening its position as a nimbler, digital-forward operator.

Key differences stand out:

- Business Mix: HDFC Bank’s portfolio now features a higher share of mortgages and rural business, while ICICI Bank’s mix is still more diversified across retail and wholesale.

- Digital Strategy: Both banks have invested in digital transformation, but HDFC’s approach leans toward platform-led and open-API embedded finance, while ICICI leverages ecosystem partnerships and advanced analytics for targeted cross-sell and operational efficiency.

- Growth Levers: HDFC Bank’s size allows for deeper rural and semi-urban penetration and mortgage cross-sell, but integration execution will be critical. ICICI Bank’s relatively focused risk management, digitization, and customer segmentation provide a more agile growth runway.

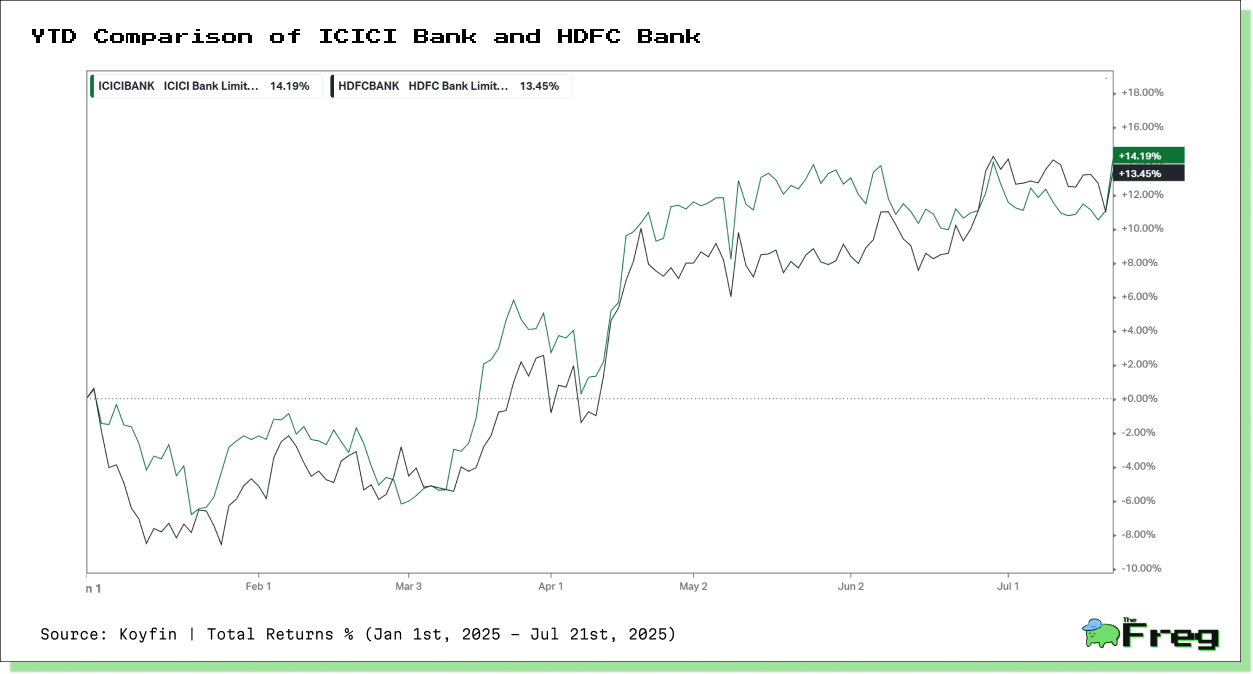

Parallel Paths: Tracking Stock Movements

Momentum Shifts: Both banks experienced a sluggish start to the year amid macroeconomic headwinds and liquidity constraints. However, from late March onward, a sharp rebound was observed across the sector. ICICI Bank slightly pulled ahead during this period, reflecting investor confidence driven by strong asset quality and consistent digital-led growth.

Volatility Factors: Volatility was evident in both stocks. HDFC Bank saw pronounced fluctuations tied to merger-related developments and funding costs, while ICICI Bank’s movements corresponded more with earnings updates and retail loan book performance.

Correlation and Spread: The two stocks tracked each other closely, underscoring shared sector dynamics. Still, ICICI Bank’s modest outperformance into July points to a growing narrative around operational efficiency and digital execution, while HDFC’s performance remains anchored in long-term merger synergies and balance sheet strength.

Sector & Market Landscape

- Growth & Rates: India remains a world-beating GDP growth engine, with the RBI projecting 6.5% for FY26. However, concerns on liquidity, persistent global volatility, and domestic inflation remain.

- Private Sector Banking Trends:

- Credit Growth has been buoyant, led by retail lending (mortgages, personal loans, credit cards) and corporate credit expansion as balance sheets strengthen.

- Deposit Mobilization has tightened, intensifying competition for low-cost CASA (Current Account Savings Account) deposits.

- Digital Disruption: Open banking APIs, UPI growth, and embedded finance are reshaping customer acquisition and service delivery at pace.

Company Overviews

HDFC Bank

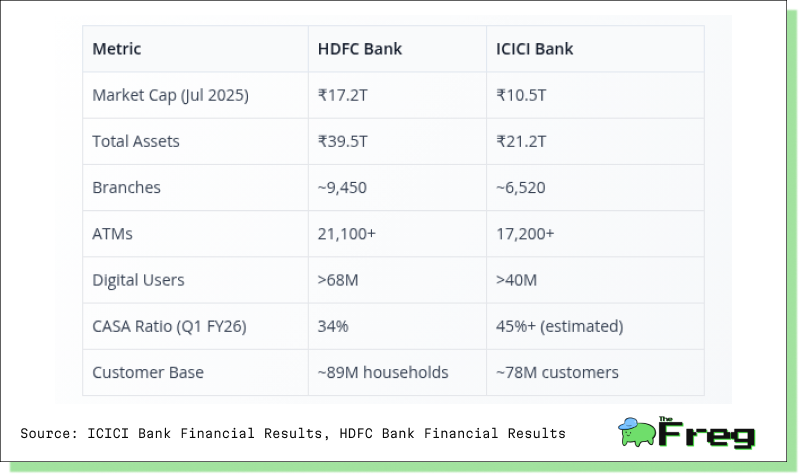

HDFC Bank is now India’s largest private lender by assets, following the merger with HDFC Ltd in July 2023. The bank operates a universal model, offering full retail, wholesale, and treasury services. The merged entity commands leadership in mortgages, payments, rural banking, and digital platforms, with a vast physical and digital footprint.

ICICI Bank

ICICI Bank, with a strong heritage in innovation, is the second-largest private sector bank in India by assets and deposit base. Its business is well-diversified across granular retail, SME, and corporate segments, and its digital adoption metrics consistently rank best-in-class. The bank has a pan-India distribution network, with significant international business through subsidiaries and branches.

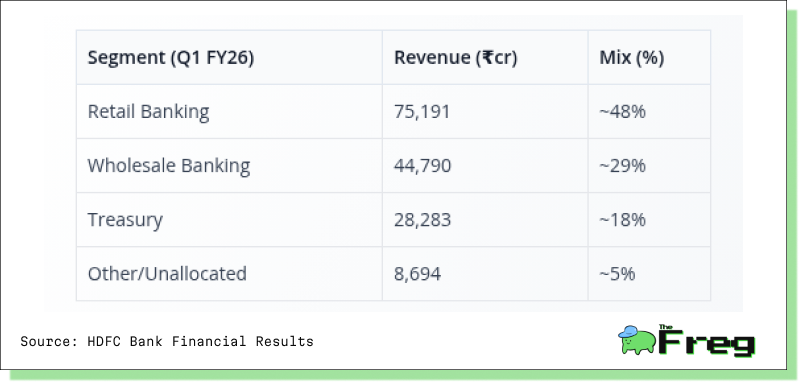

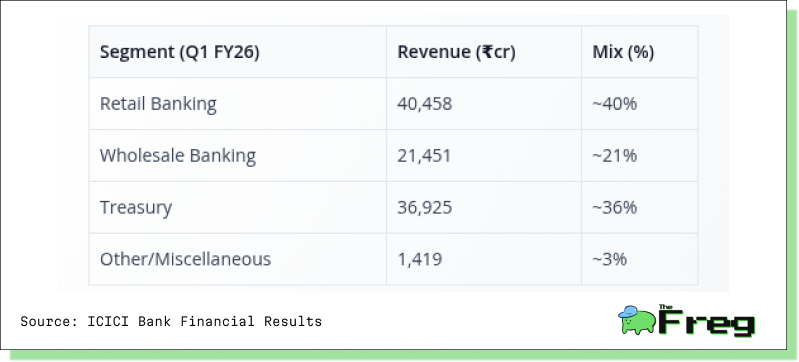

Segment Mix & Revenue Breakdown (Q1 FY26)

HDFC Bank

ICICI Bank

HDFC Bank: Retail-Led with Post-Merger Scale, ICICI Bank: Balanced and Treasury-Focused

HDFC Bank and ICICI Bank reflect two distinct strategic paths—HDFC's post-merger model leans heavily on retail scale and steady consumer income, while ICICI balances retail with a robust treasury engine optimized for rate and liquidity cycles. HDFC's model supports predictable interest income but carries higher exposure to consumer credit trends and integration risks; ICICI’s earnings may be more volatile with market conditions but benefit from capital-efficient treasury gains. As both banks navigate a tight deposit environment, HDFC must defend spreads through CASA strength, while ICICI’s flexible asset-liability mix may help sustain margins. These structural choices define not just how each bank grows, but how they absorb shocks and capture opportunities in India's evolving financial system.

Strategic Positioning & Competitive Dynamics

Core Strategic Focus:

- HDFC Bank: Seamless post-merger integration, capturing cross-sell with the enlarged customer base, and extending into rural geographies and housing.

- ICICI Bank: 360-degree customer engagement, data-driven segmentation, and delivery channel optimization to maximize profitability and operational resilience.

Key Initiatives HDFC Bank:

- Modernizing core banking and rolling out a next-gen modular digital stack.

- Invested in scalable digital platforms: platform-led banking, embedded finance, API-first ecosystem, phased launch of new Net/Mobile-Banking for 3 crore+ customers.

- Mortgage and home loan ecosystem expansion: leveraging merged distribution to upsell deposits, cards, and insurance to new home loan customers.

- Rural banking expansion: innovative models like "Bank on Wheels," deeper business correspondent coverage.

- Sustainability: Carbon neutral operations target by FY32; wide-reaching CSR initiatives.

Key Initiatives ICICI Bank:

- “BankTech” approach: embedding banking APIs in partner platforms, iMobile Pay "Super App," 4,600+ APIs, over 160 million digital transactions/day.

- Granular analytics for underwriting and collections (Unicore, Infinity rule engines).

- Segment-specific STACKS for ecosystem banking (broking, healthcare, education, etc.).

- Streamlined product complexity, single CRM for all client touchpoints.

- Sustainability and green finance: set targets for carbon neutrality by 2032, strong CSR track record.

Notable Differentiators

- Retail Innovation and Segment Targeting: HDFC Bank offers tailored propositions like Vishesh Banking for rural customers and SmartWealth for the mass affluent, while ICICI Bank leads in DIY and DIFM digital journeys, enabling personalized and user-controlled banking experiences.

- Digital Lending and Onboarding: HDFC Bank excels in fully digital loan origination across high-volume retail and SME products. ICICI Bank complements this with advanced digital KYC, live onboarding, and API-led open architecture platforms.

- Technology and Risk Management: ICICI Bank deploys sophisticated fraud analytics and maintains strong partnerships in cross-border payments, while HDFC Bank anchors its scale with leadership in merchant acquiring and an integrated payments ecosystem.

- Customer Experience Leadership: ICICI Bank consistently posts industry-leading Net Promoter Scores, reflecting superior service satisfaction and digital maturity.

- Core Strengths in Lending: HDFC Bank maintains a dominant position in mortgages, leveraging its legacy from HDFC Ltd and continuing to scale through its retail-heavy model.

Financial Scorecard Side-by-Side Comparison

HDFC Bank, post-merger with HDFC Ltd, has emerged as India’s largest private lender by scale, with ₹18,155 crore net profit and ₹31,438 crore in NII—substantially ahead of ICICI Bank. Strong capital adequacy (19.88%) and stable asset quality (gross NPA at 1.40%) underscore its balance sheet strength. However, integration drag is evident: return ratios (RoA at 0.48%, RoE at 14.5%) trail ICICI’s, and a lower CASA ratio (34%) suggests tighter competition for deposits. Yet, its market cap premium reflects long-term investor confidence in merger synergies and retail dominance.

In contrast, ICICI Bank delivers higher efficiency and profitability, with standout return ratios (RoA 2.44%, RoE 17.9%) despite a smaller base. Its higher CASA (≈45%) supports margin resilience, while a low net NPA (0.41%) and robust capital ratio (16.3%) indicate prudent risk management. Though its gross NPA (1.67%) is slightly higher, it remains well-contained. Overall, ICICI Bank’s nimble, digitally-led approach continues to drive superior shareholder returns.

Growth Drivers & Catalysts

HDFC Bank

- Mortgage penetration, rural/semi-urban lending, and deposit mobilization from an expanded customer base.

- Rollout of unified digital customer journeys (onboarding to fulfillment).

- Expansion of embedded finance and merchant ecosystem.

ICICI Bank

- Strong digital user base and continued mobile transaction growth.

- Focus on granular, risk-adjusted lending and cross-sell via STACKS and ecosystem partnerships.

- High capital efficiency leaves ample runway for growth with controlled risk.

Both face opportunities from rising middle-class consumption, fintech collaboration, and digitization—but must navigate global events, monetary tightening, and evolving regulatory frameworks

Risk Landscape

HDFC Bank

- Merger integration: maintaining asset quality, deposit/cost of funds discipline, and culture cohesion.

- Declining CASA and margin pressure in a competitive deposit environment.

- Complexity of a larger balance sheet could reduce historical return metrics if not well managed.

ICICI Bank

- Continued aggressive competition for deposits.

- Asset quality in new/unsecured retail lending, especially amid rapid expansion.

- Margin sensitivity to rate cycles and competitive pressure on yields.

Sector-wide Risks

- Interest Rate Sensitivity: Transmission of rate hikes impacts NIMs, especially for recently merged mortgage-heavy lenders.

- NPA Cycles: Sector-wide gross NPAs are near decadal lows, but unsecured retail lending and new-to-bank segments bear monitoring.

- Capital Adequacy: Indian private banks remain well capitalized above Basel III norms, but deposit competition and changing risk weight guidelines require constant vigilance.

Forward Outlook & Guidance

HDFC Bank

- Management Commentary: Focus on unlocking full merger synergies, boosting cross-sell to merged customer base, and arresting CASA ratio decline with digital-led deposit mobilization.

- 6–12 Month Outperformance Drivers: Effective integration, margin stabilization, and rapid scaling of mortgage cross-sell and embedded finance.

- Macro Sensitivities: Vulnerable to further inflation and funding shocks given balance sheet size, but strong capital adequacy and technology transformation offer a strong defence.

ICICI Bank

- Management Commentary: Steady execution on 360-degree customer engagement and risk-adjusted growth; target is to sustain best-in-class ratios and drive continued digital expansion.

- Outperformance Levers: Cross-sell, superior asset quality, and disciplined loan growth. Rapid adaptation to data-driven digital lending opportunities and partnerships.

- Macro Sensitivities: Defensive portfolio construction and sector-leading digital adoption could buffer against external shocks; prudent growth focus serves as an edge in an uncertain environment.

HDFC Bank stands as a scale behemoth with unmatched distribution, fee businesses, and a merged mortgage engine that could yield benefits for years if integration is executed smoothly. Near-term, investors face deposit/cost pressures and merger digestion risk, but the long-term upside from cross-sell, fee synergies, and rural penetration is compelling for those with patience and conviction.

ICICI Bank, on the other hand, is the nimble, digitally dominant challenger, marrying growth with control and risk granularity. Its superior returns profile, asset quality, and digital ecosystem may offer more resilient compounding and lower volatility over the medium term.

Bottom Line: Both banks are poised to outperform public sector peers and capitalize on India’s structural banking story. HDFC is a giant in transition—with outsized upside and integration risk. ICICI is the discipline-driven compounder—offering steadier but perhaps less dramatic potential. For investors, both names are core holdings for exposure to India’s private financials, differentiated by risk appetite and investment horizon.