Groww's $7 Billion IPO: A Defining Moment for India's Fintech Landscape

Groww is set to raise up to $1 billion in a landmark IPO at a $7B valuation. With 13M+ users, rising revenues, and strong backing from GIC and Iconiq, its listing marks a pivotal moment for India’s maturing fintech ecosystem.

Bengaluru-based wealthtech unicorn Groww has confidentially filed IPO papers with SEBI, aiming to raise $700 million to $1 billion at a valuation of around $7 billion. This marks a key milestone in India’s digital investment landscape and highlights the maturation of its fintech ecosystem.

Confidential Filing Strategy

Groww filed under SEBI’s Chapter IA route, allowing for confidential submissions. This approach enables companies to:

- Receive regulatory feedback without public disclosure

- Delay listing for up to 18 months after approval

- Adjust IPO size by up to 50%

Groww joins PhysicsWallah, Tata Capital, and boAt in using this route, which offers flexibility amid market volatility.

Backed by Global Investors

Ahead of its IPO, Groww has attracted significant institutional capital:

- GIC (Singapore sovereign fund) is investing $150 million for a 2.14% stake

- Iconiq Capital is expected to invest another $150 million

These investments form a $300 million Series F round, valuing Groww at $7 billion post-money, more than double its $3 billion valuation in 2021.

Financials and Market Leadership

Groww has posted impressive growth:

- FY24 revenue rose 119% to ₹3,145 crore (from ₹1,435 crore in FY23)

- Net loss of ₹805 crore, due to a one-time ₹1,340 crore tax from its reverse flip

- Operating profit stood at ₹535 crore

Groww’s active user base reached 13.2 million by March 2025, giving it over 26% market share—overtaking Zerodha in September 2023.

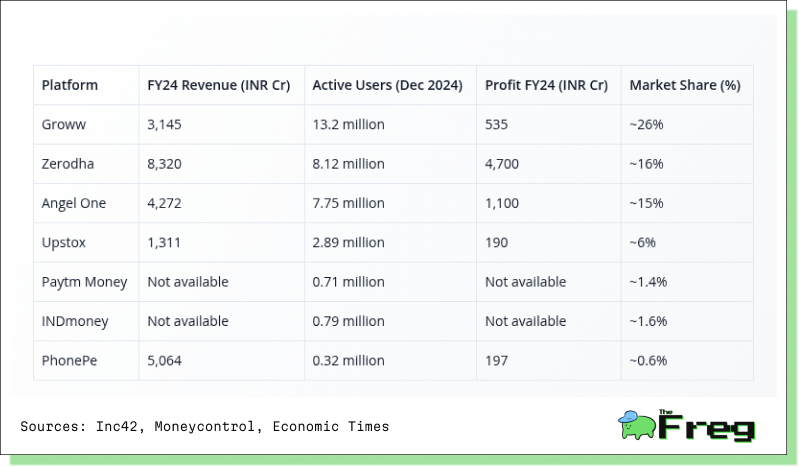

Comparison with Other Discount Brokers

Here's how India’s leading digital brokers stack up:

While Groww leads in users, Zerodha still dominates in revenue and profitability. Upstox reported an 8x jump in profits but has lost market share. Groww’s revenues remain highly dependent on F&O and intraday trading—a model that may face challenges during low-volatility phases.

Reverse Flipping and Tax Costs

Groww's reverse flip—shifting domicile from the US to India—led to a ₹1,340 crore tax payout, mostly due to capital gains and deemed dividend rules under India’s IT Act Sections 2(22)(c) and 46(2). Still, the move signals confidence in Indian regulations and capital markets.

Other startups have followed suit:

- PhonePe paid ~₹1,000 crore in tax

- Razorpay may pay over ₹200 crore

Thanks to September 2024 amendments, reverse mergers with Indian subsidiaries are now easier. Nearly 90% of foreign-domiciled Indian unicorns are now considering similar transitions.

Lessons from Tech IPOs

India’s recent tech IPOs offer important context:

- Mamaearth debuted at ₹10,500 crore and now trades above IPO price

- Zomato has recovered, trading at ₹120 (vs. IPO ₹76)

- Paytm plummeted to ₹652 from its ₹2,150 IPO price

These mixed outcomes reflect shifting investor sentiment. Early IPOs chased scale over profit, while the market now favors sustainable, profitable businesses. Groww’s ₹535 crore operating profit and market share give it stronger footing than earlier tech listings.

A Bellwether for Indian Startups

Groww’s IPO could define the next wave of tech listings. It’s the first major fintech to go public after redomiciling to India and may set a precedent for the 20+ startups preparing to list in 2025–26.

Investors will watch:

- How Groww sustains profitability amid rising competition

- Whether it can diversify revenue beyond F&O trading

- How efficiently IPO funds are deployed to expand market share

As millions of retail investors—many introduced to markets via Groww—consider buying its stock, this IPO may complete a remarkable circle in India’s fintech journey.