Gold in 2025: The Tug-of-War Between Fear, Policy, and Fundamentals

Gold’s 2025 surge isn’t just crisis-driven—it’s a structural shift. Amid U.S.–China trade tensions, Middle East volatility, and de-dollarization, gold has become a strategic anchor. With central banks buying and fiat under stress, gold’s role is being redefined.

Gold’s resurgence in 2025 is not a mere reaction to global panic—it’s the manifestation of deeper, structural shifts in how investors hedge risk, store value, and navigate a reordering financial world. Trading near $3,370/oz after peaking at a record $3,500/oz in April, gold sits at the confluence of geopolitics, monetary realignment, and strategic asset allocation.

Geopolitical Crosscurrents: A Fragile World, A Stronger Gold

U.S.–China Trade Shifts

The most dramatic catalyst for gold this year came from the re-escalation of U.S.–China trade tensions. April saw a spike in gold prices as negotiations collapsed. Then came the surprise: a 90-day truce in May, where both countries slashed tariffs significantly—U.S. from 145% to 30%, and China from 125% to 10%. The result: a swift 3% drop in gold, with investors pivoting back to equities and other risk assets. But the ceasefire is tenuous. Ongoing disputes over rare earths and renewed U.S. tariffs on metals have kept the conflict premium alive. As long as policy volatility continues, gold will retain its bid.

Middle East Escalation

Following U.S. military strikes on Iranian nuclear facilities, Iran threatened to close the Strait of Hormuz, a critical oil corridor. Yet, gold’s reaction was surprisingly subdued. Why? The dollar strengthened amid the crisis, and oil surged—Brent crude to $78.89, WTI to $75.71—raising inflation fears and potentially delaying Fed cuts. In today’s markets, gold’s safe-haven appeal is balanced not just by fear, but by the macro forces it triggers.

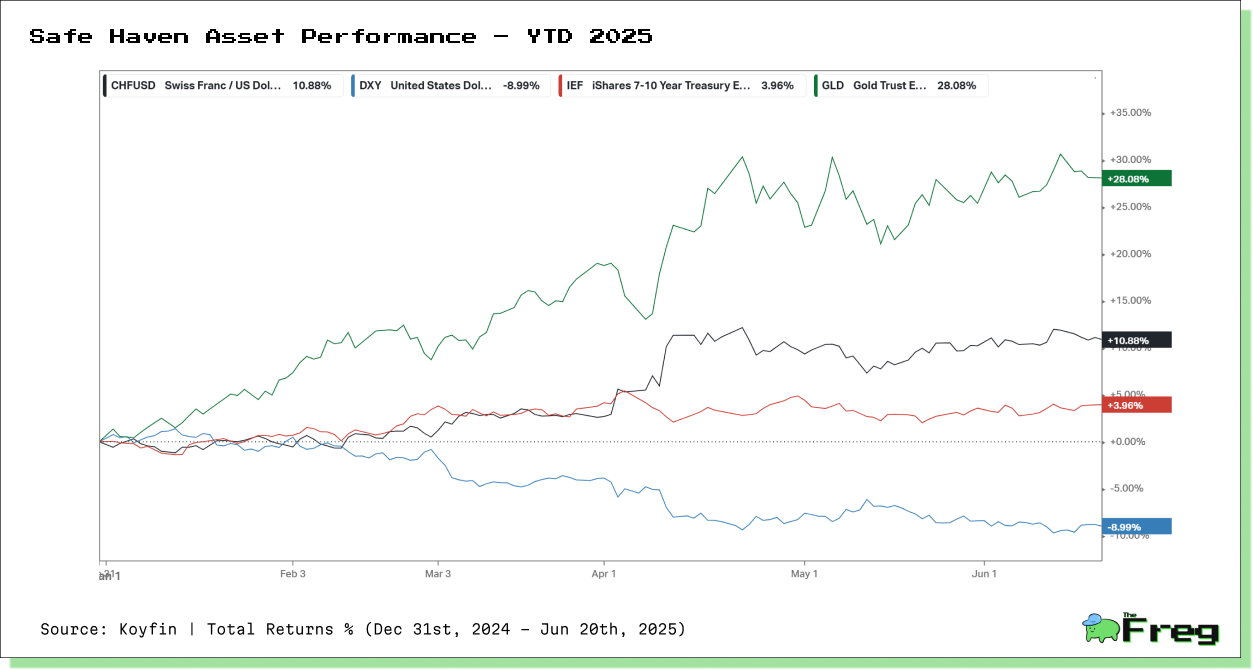

Comparing Safe Havens: Gold Leads the Pack

As traditional safe havens falter under inflationary pressure and rate volatility, gold has emerged as the standout performer of 2025. While government bonds and fiat currencies struggle to provide consistent protection, gold has delivered both resilience and upside—reinforcing its role as a strategic anchor.

These numbers reflect a critical shift in global investor behaviour. Even as the U.S. dollar weakens sharply and bond yields fluctuate, investors are increasingly gravitating toward gold—not just for its historical role as a crisis hedge, but as a store of value in a structurally uncertain financial system. The Swiss franc has also performed well, aided by its safe-haven status and relatively stable monetary policy. However, the positive return on U.S. Treasuries, while modest, underscores that some investors still expect eventual rate cuts and a soft landing.

By contrast, the U.S. dollar’s sharp decline points to broader concerns about fiscal sustainability, trade imbalances, and shifting geopolitical alliances—all of which feed directly into gold’s continued rise.

Dollar-Gold Dynamics: A More Complex Dance

The traditional inverse relationship between gold and the U.S. dollar has undergone a significant transformation in 2025. While historically a stronger dollar meant weaker gold prices, we’ve witnessed several periods this year where both assets strengthened simultaneously—particularly during heightened tensions in the Middle East and amid renewed U.S.–China trade uncertainties. This unusual correlation emerged as investors sought safety in both traditional havens, regardless of their textbook interaction.

Central bank diversification has been a key driver behind this evolving dynamic. China, among other emerging markets, has sharply increased its gold reserves to reduce dollar dependence. Meanwhile, the dollar’s strength has been tempered by the Federal Reserve’s cautious approach to rate cuts, creating what analysts now call a “triangular tension” between gold, the dollar, and U.S. yields. Even with fewer anticipated rate cuts this year, gold has maintained its momentum—demonstrating that structural shifts like de-dollarization and geopolitical realignment are now powerful enough to override historical patterns.

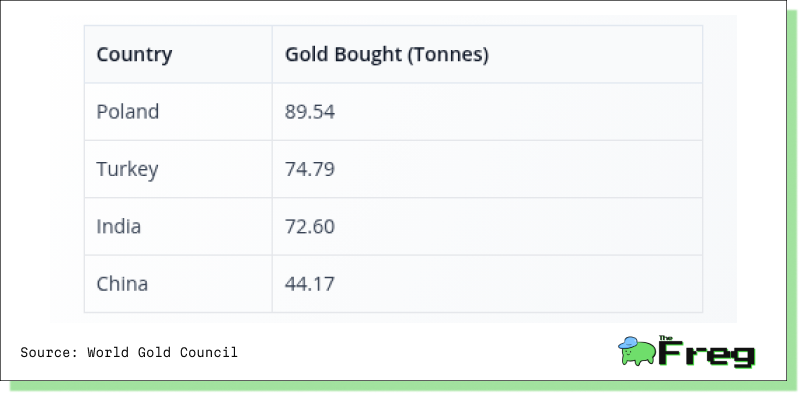

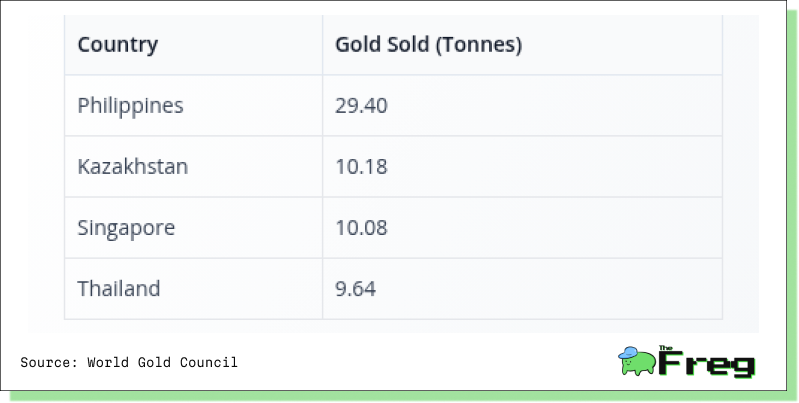

To better understand this structural shift, it's worth examining which central banks are reshaping their gold holdings—and which are offloading reserves.

Future Price Catalysts: What Comes Next?

Gold’s trajectory through the second half of 2025 hinges on several critical catalysts that could either propel prices toward Goldman Sachs’ $3,700 target, or trigger a sharp correction.

The most significant near-term pivot: the U.S. presidential election. A potential “Red Sweep” would likely result in expanded spending, higher deficits, and tariff-heavy trade policy—all bullish for gold. On the flip side, a breakthrough in U.S.–China trade relations could dull gold’s appeal as a geopolitical hedge.

Other key drivers include:

- Middle East tensions pushing oil above $100/barrel

- Continued central bank purchases, which hit 244 tonnes in Q1

- A stimulus wave from China boosting retail gold demand

Yet, risks remain. A surprise Fed rate hike, or a meaningful de-escalation in global tensions, could cool the metal’s momentum. But even amid short-term fluctuations, gold’s role has evolved. It's no longer just a tactical hedge. It’s a strategic anchor—a signal that the monetary and geopolitical foundations investors once trusted are now being re-evaluated.

Conclusion: Not a Panic Bid, But a Structural Bull

Gold’s ascent in 2025 is far more than a reflexive move in volatile times. It is the result of:

- Persistent geopolitical tensions, from trade to regional conflict

- Systemic central bank accumulation and de-dollarization

- Aggressive fiscal policy and record deficits

- Sustained, regionally diverse investor inflows

- Erosion of faith in fiat and central bank orthodoxy

In short, gold is no longer just a hedge—it’s a core conviction in a financial world that feels increasingly unmoored. As the U.S. nears its next tariff deadline and the global economy teeters between inflation, fragmentation, and reinvention, gold may not just hold its ground. It may redefine it entirely.