Gold Blazes Past S&P as Uncertainty Fuels Flight to Safety

Gold surges past $3,500 amid U.S. policy turmoil, inflation fears, and rising global demand from investors and central banks alike.

Gold prices have surged to all-time highs in 2025, crossing $3,500 per ounce globally and ₹1 lakh per 10 grams in India for the first time ever. The rally reflects a deepening investor preference for safe-haven assets amid U.S. policy uncertainty, persistent inflation, and weakening confidence in the dollar. The United States now finds itself at the epicenter of a monetary credibility crisis—one that gold seems poised to benefit from.

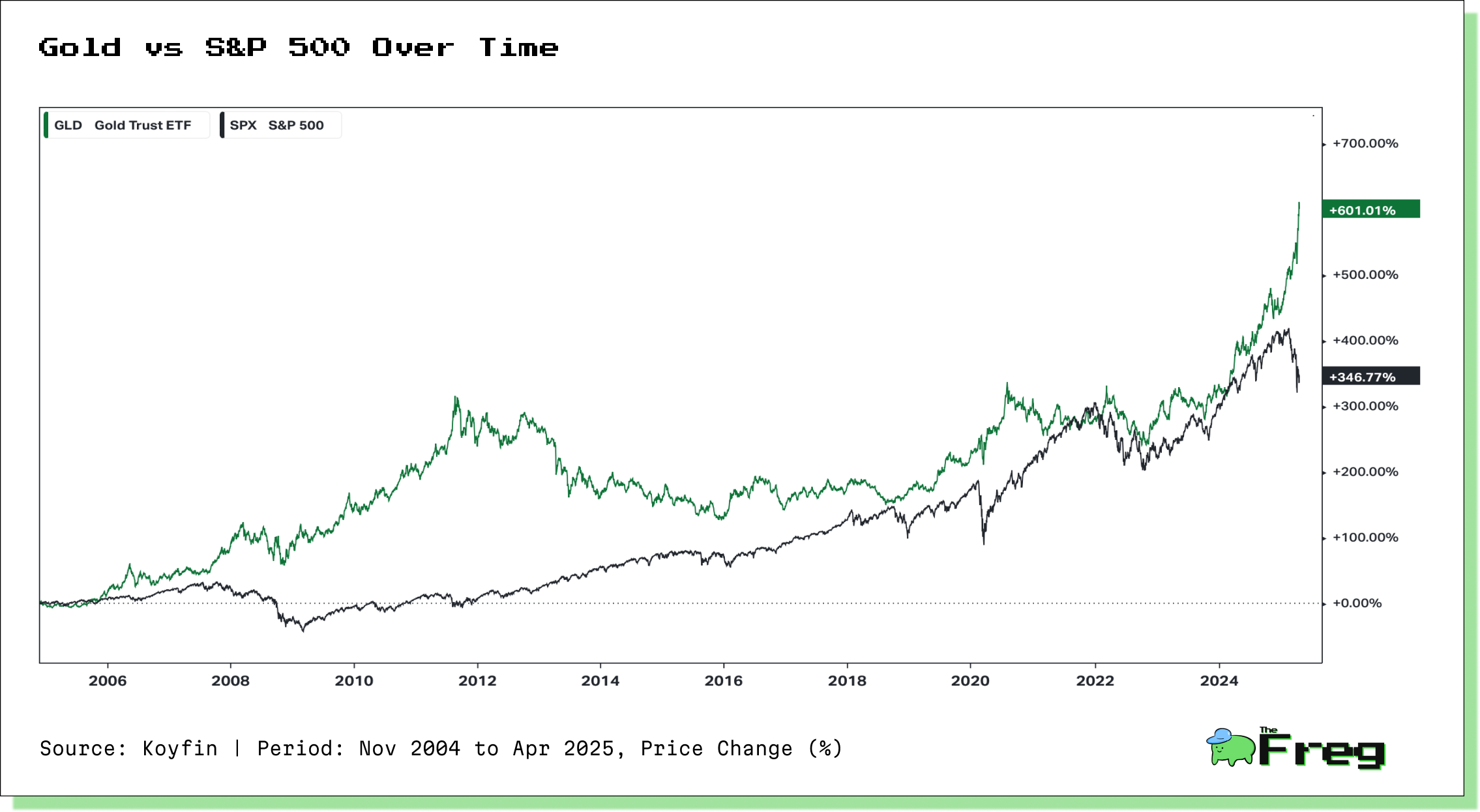

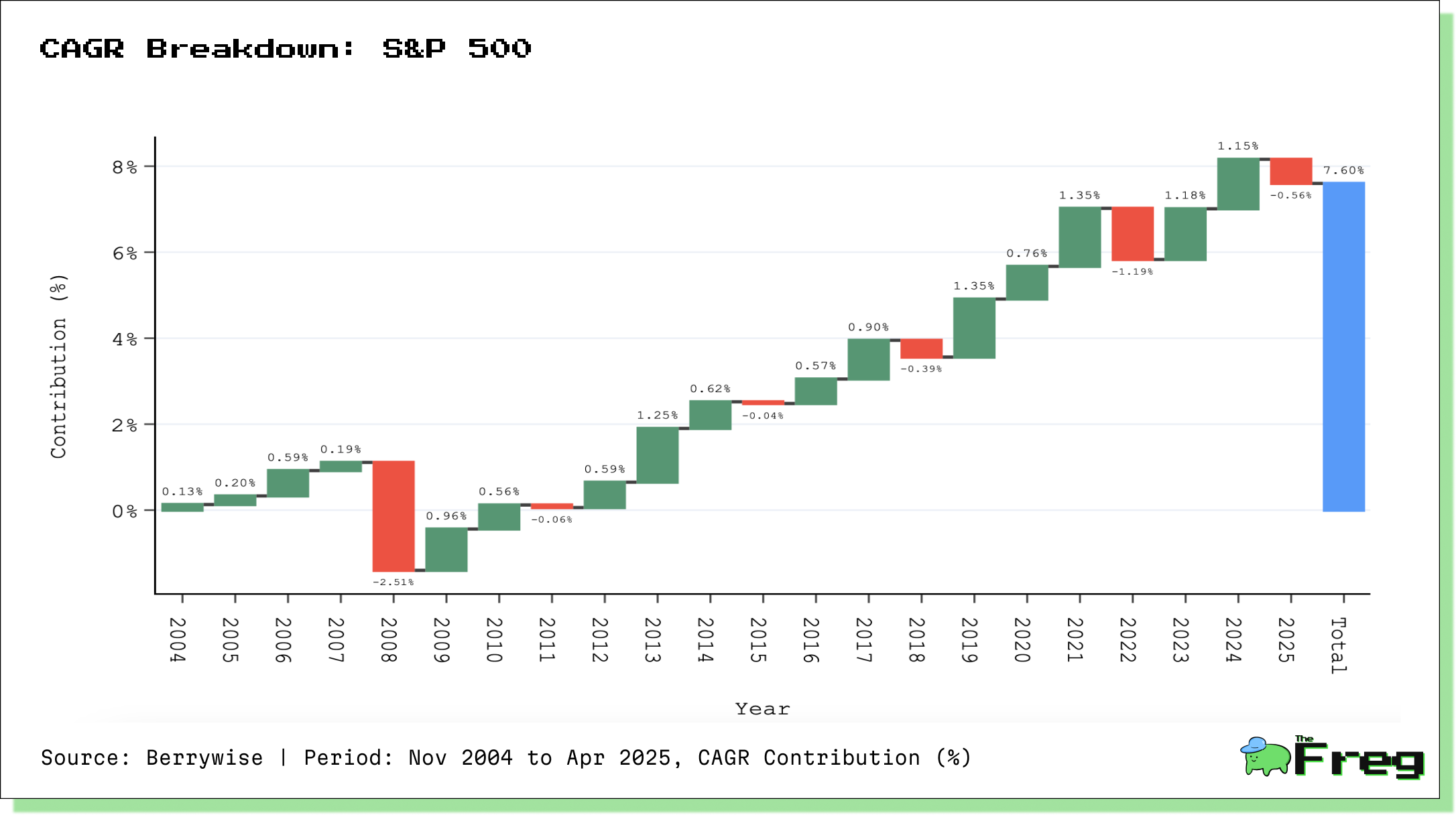

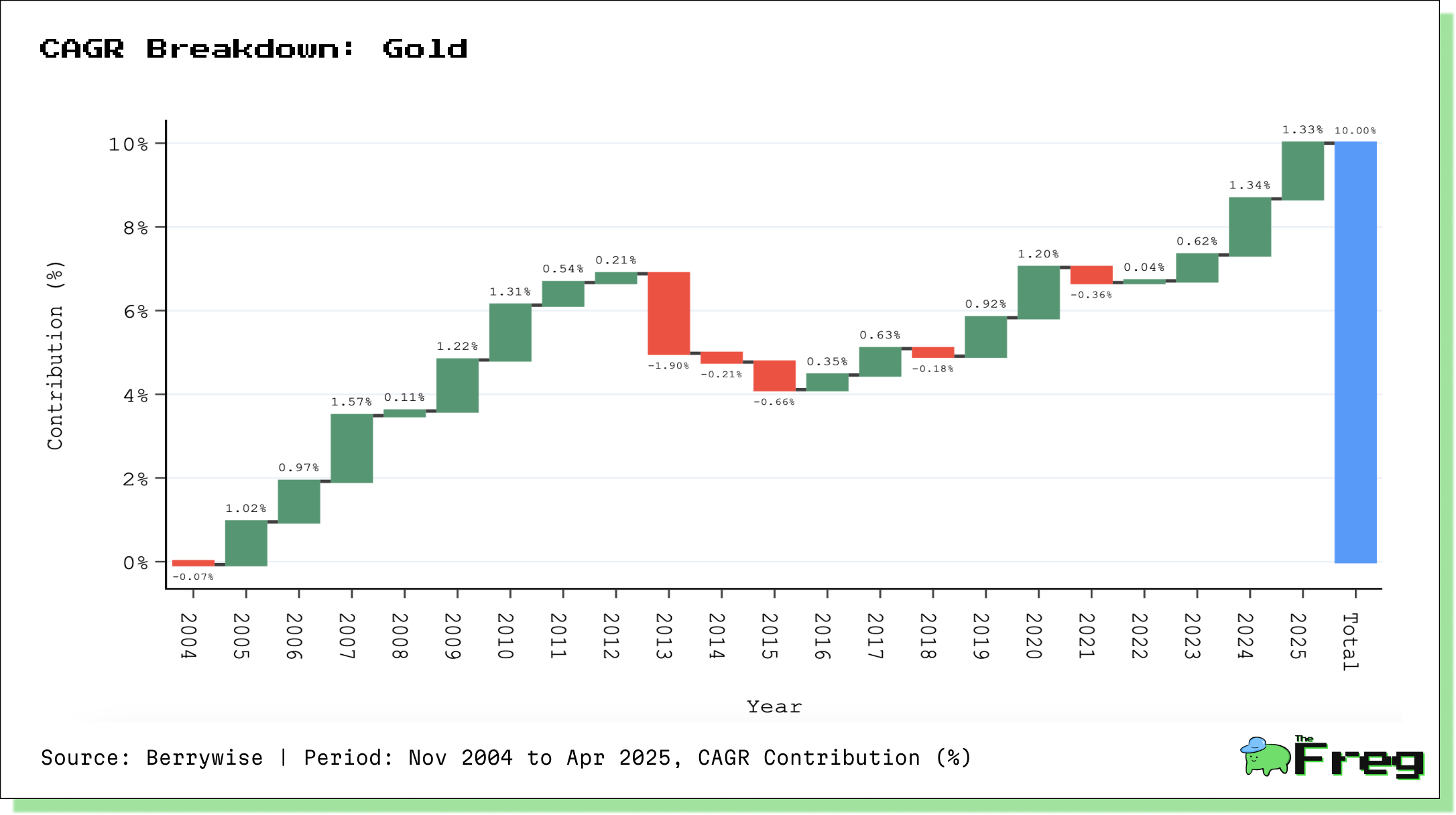

Gold vs. Stocks: A Two-Decade Showdown

Since 2005, gold has outperformed the S&P 500 by a wide margin, posting cumulative gains of +601% versus the S&P’s +347%, as shown below:

Gold’s rise has not been linear—marked by sharp pullbacks and consolidation phases—but its long-term trend underscores a persistent demand for real assets in times of financial and geopolitical stress.

Policy Whiplash and Market Anxiety

A key driver of gold’s surge in 2025 has been a volatile U.S. policy landscape. President Trump’s recent threats to remove Federal Reserve Chair Jerome Powell rattled global markets, briefly pushing gold near $3,500/oz. Although he later reversed course, saying, “I have no intention of firing him,” the damage to market confidence had already been done.

This policy flip-flopping—paired with the Fed’s cautious stance on rate cuts—has stoked fears of political interference in monetary policy, prompting a wave of safe-haven buying.

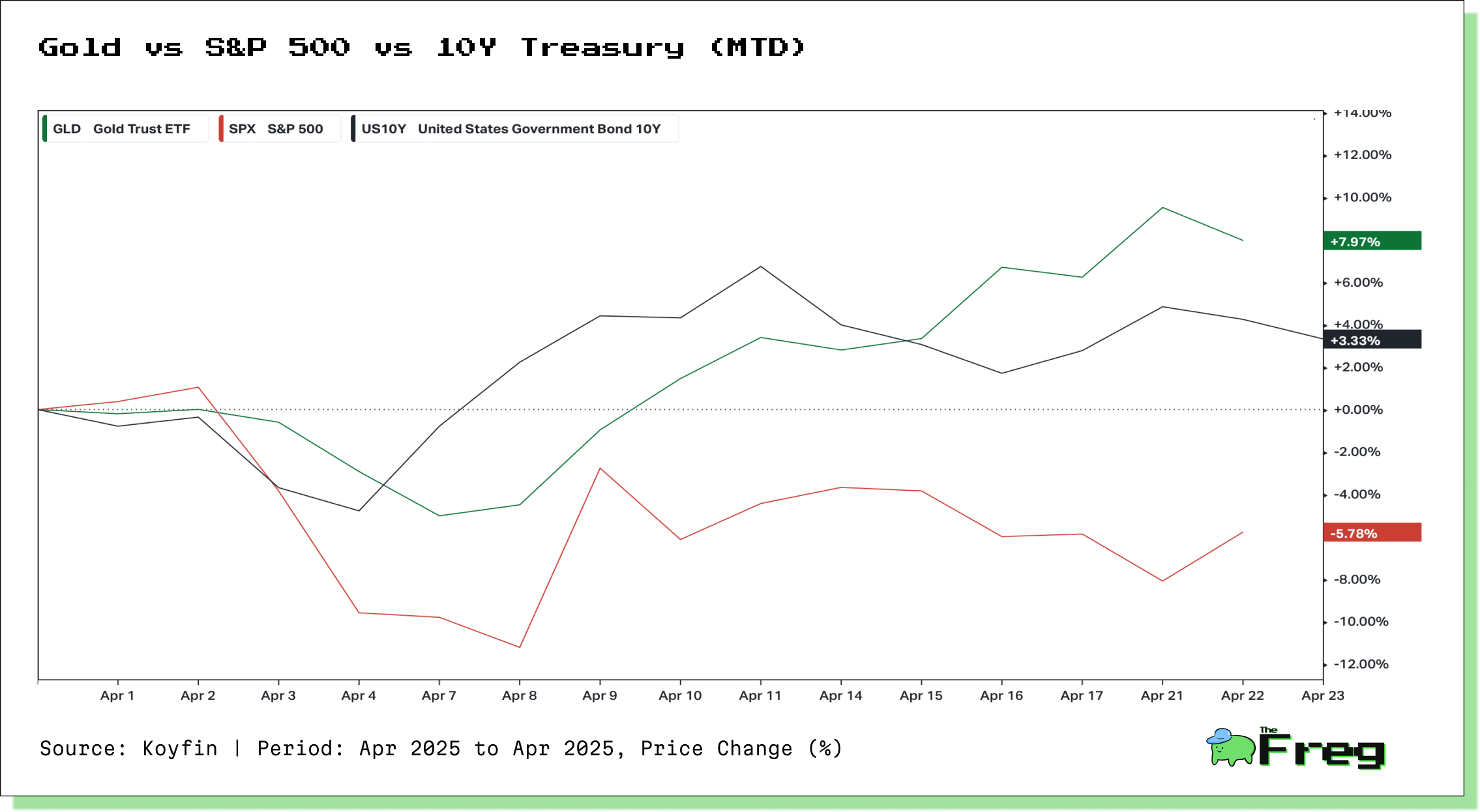

Gold Gains Despite Rising Yields

Traditionally, higher Treasury yields weigh on gold prices. But 2025 has defied that norm. With investor trust in U.S. fiscal discipline eroding, gold has risen even as 10-year yields climbed, reflecting broader concerns about dollar stability.

- Gold (GLD ETF): ▲ +7.97%

- 10Y Treasury: ▲ +3.33%

- S&P 500: ▼ -5.78%

This disconnect between traditional asset behavior and market sentiment underscores gold’s renewed role as a hedge—not just against inflation, but against institutional uncertainty. Which we've covered earlier here.

ETF Inflows and Central Bank Demand

Investor demand has been matched by institutional and central bank interest. In Q1 2025 alone:

- Gold ETFs attracted 226.5 metric tons, worth over $21.1 billion—the highest quarterly inflow in three years.

- Central banks, led by China, India, and Turkey, continued accumulating gold at a rapid pace, reinforcing its appeal as a reserve asset.

Gold as a Counter-Cycle Champion

Gold’s 2025 rally is not a short-term anomaly. Over the last two decades:

- It has outperformed equities during major drawdowns.

- Offered long-term portfolio insulation during periods of extreme volatility and currency debasement.

- Gold CAGR: 10.00%

- S&P 500 CAGR: 7.60%

Can Gold Hit $3,700?

With Goldman Sachs forecasting $3,700/oz by year-end, the momentum remains intact. While some correction is likely in the short term, the broader trend is supported by:

- Persistent dollar weakness

- Geopolitical tensions in Eastern Europe and the Middle East

- Continued ETF and central bank demand

- Political uncertainty ahead of the U.S. election

Gold’s 2025 breakout is more than a chart anomaly—it’s a signal. Amid a shifting global order and faltering trust in fiat systems, investors are rediscovering what centuries of financial history have always known: when certainty vanishes, gold endures.