Global Pharma at a Crossroads: Tariffs Redraw the Map of Drug Trade and Innovation

A sweeping U.S.-EU trade shift imposes tariffs on pharmaceuticals, disrupting supply chains, reshaping global markets, and pushing pharma toward regional realignment.

The global pharmaceutical industry is undergoing a structural transformation unlike anything seen in recent decades. At the heart of this shift is a sweeping new trade agreement spearheaded by U.S. President Donald Trump, which introduces tariffs on a wide array of European exports—including, for the first time, branded pharmaceuticals. This move has sparked a realignment of supply chains, strategic pivots by multinational drugmakers, and deep uncertainty for patients and policymakers alike.

Tariffs Disrupt Transatlantic Pillars of Medicine

Until now, pharmaceutical trade between the U.S. and European Union operated largely duty-free, a reflection of shared economic interests and public health priorities. That era is over.

Branded medicines, the most valuable category of European exports to the U.S., are now subject to a 15% import tariff under the new agreement. The implications are profound: the U.S. healthcare system relies heavily on these imports, and any cost shocks could be passed on to consumers already battling high drug prices.

The pharmaceutical clause is only one piece of a broader transatlantic realignment that includes the EU’s commitment to purchase $250 billion annually in U.S. energy exports and billions more in military equipment. Yet, it's the pharmaceutical sector—responsible for critical care, chronic disease management, and biotech innovation—that finds itself at the center of this geopolitical recalibration.

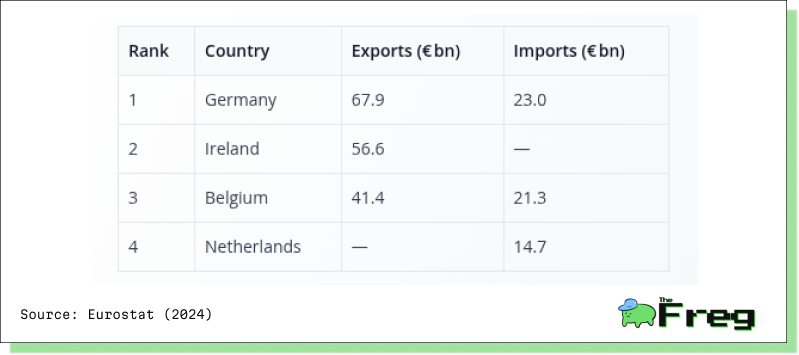

The significance of the U.S. market for EU pharmaceutical exporters is difficult to overstate:

EU’s Main Extra‑EU Trade Partners for Medicinal & Pharmaceutical Products (2024)

The United States alone accounts for nearly 40% of both the EU’s pharmaceutical exports and imports—placing it at the heart of the EU’s trade model. Tariffs at this scale don’t just disrupt trade; they risk destabilizing entire supply systems.

Can the U.S. Reshore Pharma?

The tariffs have kickstarted a rush to expand domestic pharmaceutical manufacturing. Eli Lilly has committed $27 billion to new U.S. production facilities, while Pfizer’s CEO, Albert Bourla, hinted at stateside shifts in manufacturing footprint. This echoes the CHIPS Act strategy that fuelled semiconductor reshoring.

Yet, unlike microchips, drug manufacturing faces distinct hurdles: FDA approvals, labour shortages, and billion-dollar construction costs. Many new facilities won’t be operational for years, creating a costly interim period where tariffs are active but substitutes remain scarce.

Trade experts warn the current 25% tariff ceiling may only be the beginning. A Section 232 investigation launched in April 2025 could allow tariffs to climb as high as 200% under national security provisions. This phased approach acknowledges the reality: reshoring will require not just tariffs, but complementary policy support—subsidies, regulatory streamlining, and government purchasing programs—to become viable.

Europe Adapts with Strategic Flexibility

European pharma companies are responding with agility. Sanofi, for instance, sold its New Jersey manufacturing plant to Thermo Fisher Scientific—securing ongoing drug production at the facility while reducing its tariff exposure. Roche, meanwhile, has announced extensive inventory stockpiling at U.S. sites to buffer against supply disruptions.

These moves are hardly surprising when viewed against the export-heavy structure of the EU pharmaceutical landscape. Countries like Germany, Ireland, and Belgium dominate pharmaceutical trade—and their industries now face immense operational pressure.

This concentration of trade in a few core countries increases exposure to tariff shocks—and explains the urgency of their mitigation strategies.

Generic drugmakers have a slightly different calculus. The agreement includes selective tariff exemptions for certain generic medicines, offering temporary relief. UBS analyst Matthew Weston expects Sandoz to fare "largely manageable" through 2025, although uncertainty remains around the scope of these exemptions.

Across the board, companies are turning to contract manufacturers and research partners in efforts to absorb these shocks without passing costs directly to patients.

Asia and Latin America Step Into the Breach

As EU-U.S. flows become more constrained, pharmaceutical companies are redirecting supply chains and commercial focus toward Asia and Latin America. These regions are not just passive recipients—they're becoming global pharma powerhouses.

China nearly matched all of Europe in new active substance launches in 2022, and India continues to expand both in manufacturing scale and R&D output. Latin America's $100 billion pharmaceutical market—led by Brazil, Argentina, and Cuba—is drawing renewed attention from European firms seeking tariff-free growth opportunities.

This eastward and southward pivot is not merely about market access—it's about avoiding regulatory fragmentation and tariff risk. As clinical trial ecosystems and regulatory standards diverge across regions, Asia and Latin America could become key engines of both production and innovation.

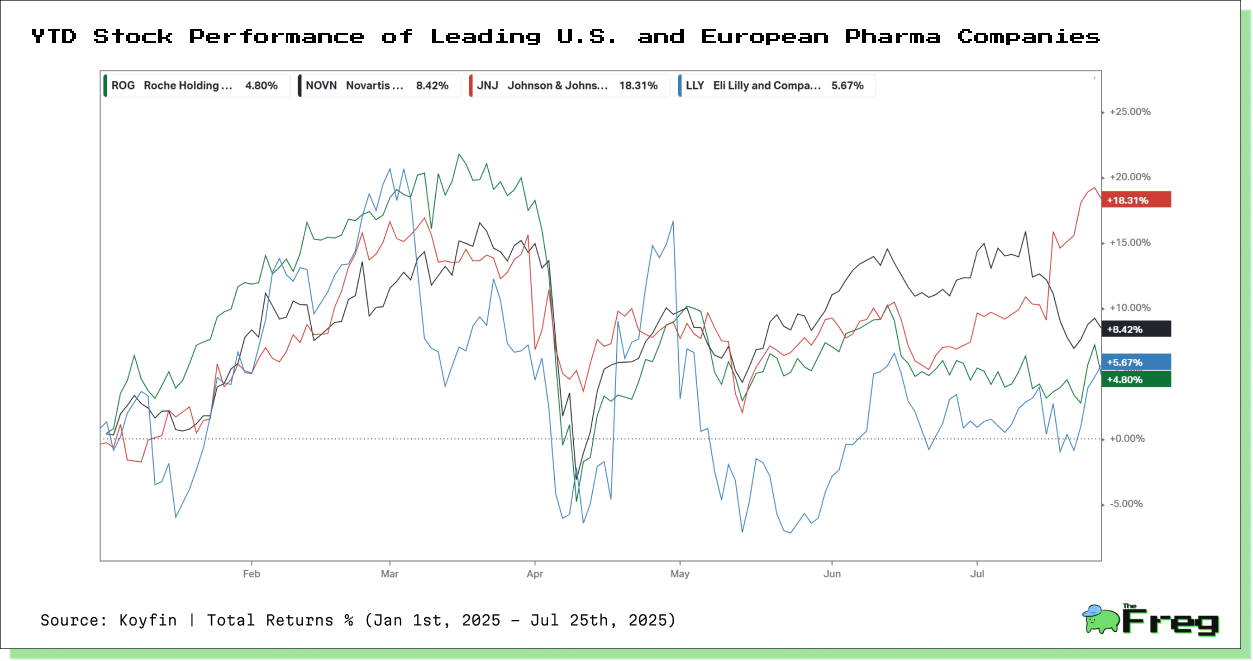

Diverging Fortunes: Pharma Stock Performance

Year-to-date stock returns reveal how differently major pharmaceutical players have weathered the shifting trade and regulatory landscape.

Johnson & Johnson leads with a +18.3% return, supported by strong earnings and less exposure to European tariff risk. Novartis and Roche have posted moderate gains, benefiting from strategic diversification and defensive positioning. Eli Lilly, though volatile, is up +5.7%, buoyed by growth in diabetes and obesity drugs but exposed to U.S. cost inflation.

The split in performance reflects investor preference for operational resilience and geographic flexibility as the global pharmaceutical sector navigates trade friction and supply realignment.

U.S. Inflation and Political Ramifications

The real test of these trade dynamics may be felt in U.S. households. With a projected $13–19 billion in added costs, there is growing concern over drug price inflation. Unlike tariffs on cars or electronics, pharmaceutical price increases are passed directly to patients through higher co-pays and insurance premiums.

Insurance formulary negotiations and premium calculations for 2026 are already factoring in tariff-driven cost increases. This could create a political flashpoint in an election year where healthcare costs are top-of-mind for voters.

President Trump has suggested that tariffs could rise further if the EU does not concede additional terms—a signal that pharmaceutical pricing may become a recurring issue in broader trade negotiations. The ongoing Section 232 investigation has no set timeline, leaving companies and consumers in limbo.

A New Global Order for Pharmaceuticals

The pharmaceutical industry is now decisively post-globalization. Seamless integration across the Atlantic has given way to a multipolar world where companies must navigate a maze of tariffs, divergent regulations, and localized manufacturing requirements.

This fragmentation could ultimately enhance global resilience—reducing overdependence on any single region or market. But it comes at a cost: higher structural prices, slower innovation, and a more complex global supply chain.

In this new era, success will depend not just on scientific innovation but on supply chain agility, regulatory adaptability, and geopolitical foresight. For multinational pharma giants, the next decade will be defined not by blockbuster drugs alone, but by the deftness with which they navigate a redrawn map of medicine.