Global Growth in the Balance: Trade, Debt, and a Fractured Future

Global growth is faltering as tariffs rise, emerging markets face debt crises, and geopolitical tensions fragment trade. This article explores how the world economy is adapting to a new era of uncertainty, protectionism, and structural volatility.

A Fragile Global Outlook

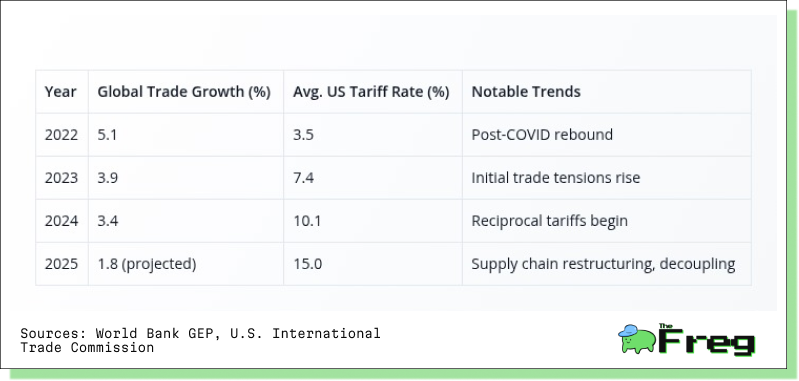

The World Bank’s latest Global Economic Prospects report has painted a sobering picture: global growth in 2025 is now forecast at just 2.3%, down from 2.7% earlier this year. Outside of major recessions, this marks the weakest pace since the 2008 financial crisis. International trade, once the bedrock of global expansion, is expected to grow a meager 1.8%, a steep fall from 3.4% in 2024.

This is no ordinary slowdown. Instead, it signals a deeper, structural malaise driven by a trinity of systemic challenges: escalating trade barriers, rising distress in emerging markets, and persistent geopolitical shocks. As Indermit Gill, Chief Economist at the World Bank, warns:

“International discord—particularly regarding trade—has disrupted many of the policy certainties that have contributed to reducing extreme poverty and enhancing prosperity since the conclusion of World War II.”

The global economic map is being redrawn—not by cooperation, but by fragmentation.

Tariffs Redefined: Protectionism as Policy

The Policy Shift

Protectionism is no longer a rhetorical tool; it is economic doctrine. In 2025, the United States has pushed its effective tariff rate to 15%, the highest in nearly a century. The revived “America First” ethos has led to reciprocal tariffs and further threats of escalation, prompting a retaliatory domino effect from China and other trading powers.

How Corporations Are Reacting

Facing rising costs and political uncertainty, multinational firms are reshaping their production strategies:

- Reshoring: Intel’s semiconductor investments in the U.S. underscore a broader trend of repatriating strategic manufacturing.

- Friend-shoring: Companies are shifting supply chains toward allies like Vietnam, India, and Mexico.

- Diversification: Firms are actively seeking alternatives to China for critical materials like rare earths and APIs (active pharmaceutical ingredients).

While these moves build resilience, they also come at a cost—higher prices, operational redundancies, and a fragmented global trade architecture.

Emerging Markets in the Crosshairs

Capital Flight and Currency Volatility

Rising interest rates in developed economies are draining capital from emerging markets, triggering currency depreciations and inflating the cost of dollar-denominated debt. Policy levers are tightening, just when developing economies need them most.

The Debt Trap Tightens

The International Monetary Fund now warns that over 60% of low-income countries are at high risk of debt distress. With limited fiscal space, governments are being forced into painful trade-offs between debt servicing and social spending.

China’s Slowdown: No Longer the Growth Engine

China’s recovery has faltered under the weight of weak domestic consumption, property sector instability, and a lack of policy clarity. Its annual growth is projected to slow to 4.5%, dragging down prospects for dependent economies in Asia and Africa.

Permanent Geopolitical Risk

From Temporary Shocks to Structural Variables

Wars in Ukraine and Gaza, political instability in Latin America, and an increasingly assertive China have shifted geopolitics from being a risk to a baseline assumption in economic planning.

As the IMF notes:

“Intensifying downside risks dominate the outlook, amid escalating trade tensions and financial market adjustments.”

Splintering into Trade Blocs

The rise of BRICS+ initiatives, dedollarization efforts, and digital regional currencies are fragmenting the global financial system. The World Trade Organization has warned that global trade could contract in 2025 if these tensions persist.

Capital Seeks Shelter

In response to rising volatility, investors are adopting a defensive posture:

- Safe-haven flows: Increased allocation to gold and U.S. Treasuries.

- Commodity spikes: Conflict and sanctions have driven up oil, gas, and grain prices.

- Reallocation: Investment is moving toward North America and select Asia-Pacific nations with relative political and economic stability.

Central Banks Turn Defensive

Emerging market central banks are building up foreign exchange reserves and holding rates steady despite slowing growth. Their caution reflects limited options in a world where volatility and capital flight can quickly spiral into crisis.

The End of Certainty

The World Bank’s downgraded forecast is more than a statistical adjustment—it’s a recognition that the old global order is slipping away. As WTO Director-General Ngozi Okonjo-Iweala cautions:

“The enduring uncertainty threatens to act as a brake on global growth, with severe negative consequences for the world, particularly for the most vulnerable economies.”

The question is no longer whether we are in a new era—but who will adapt fast enough to survive it.

Final Word

Resilience has replaced efficiency as the core tenet of global economics. Investors, policymakers, and business leaders must pivot quickly, or risk being left behind in a world where volatility is not an aberration—it is the new norm. The age of certainty is over. And those who cling to it will be the first to fall.