Fuelling Fears: How Rising Middle East Tensions Are Shaking Oil Security and Global Stability

Rising Middle East tensions are reshaping global oil markets, amplifying supply fears and inflation risks. From chokepoints like the Strait of Hormuz to shifting demand patterns and speculative surges, energy security faces mounting uncertainty in 2025.

As the Israel–Iran conflict intensifies, global oil markets are once again on edge. The geopolitical tension has not only stirred fears of regional escalation but also reignited concerns about oil security, inflation, and the broader economic outlook. From the looming threat of a Strait of Hormuz blockade to speculative volatility in commodities markets, the impact is both wide-reaching and deeply disruptive.

Strategic Chokepoint: Strait of Hormuz at the Center of Crisis

The Strait of Hormuz remains the most critical artery in global oil logistics. Approximately 20 million barrels of oil—or 20% of global consumption—pass through this narrow strait daily. Iran’s repeated threats to block this waterway amid rising tensions with Israel have raised alarms across energy markets. Yet, a full blockade remains improbable due to Iran’s economic dependencies.

Key Fact: Over 75% of Iran’s oil exports go to China, which relies heavily on uninterrupted Hormuz shipments.

Iran’s tactics could include deploying naval mines, fast attack crafts, and limpet mines, but any such move would likely provoke a military response, especially from the U.S. Navy’s Fifth Fleet. The International Energy Agency (IEA) has pledged to release strategic oil reserves if needed, though analysts caution that such moves could further unsettle already jittery markets.

Spare Capacity: OPEC’s Safety Net or Strategic Limitation?

OPEC’s spare production capacity plays a vital role in stabilizing oil markets during crises. As of September 2024, the bloc held 5.3 million barrels per day (bpd) in spare capacity, with Saudi Arabia alone accounting for 3.1 million bpd, according to the IEA.

Despite this buffer, OPEC faces a longer-term dilemma. Its market share is projected to drop to 31.6% by 2028 due to rising production from the Americas. While spare capacity might dampen short-term price spikes, it weakens OPEC's leverage as the global supply landscape shifts.

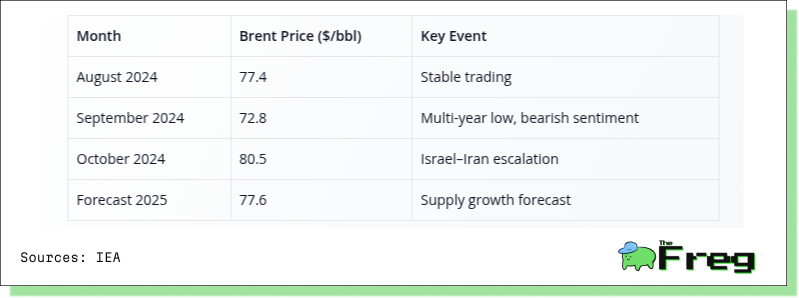

Price Whiplash: Brent Crude Surges on Conflict Fears

Brent crude prices broke above $80 per barrel in early October 2024 following a missile exchange between Iran and Israel—an 8% spike in a single week. Yet the rally contrasts with broader fundamentals. The U.S. Energy Information Administration (EIA) forecasts Brent to average $80.89 in 2024, tapering to $77.59 in 2025 as supply growth outpaces demand.

This suggests a market increasingly driven by geopolitical fear premiums rather than fundamental supply shocks.

Shifting Demand: Power Generation Adds a New Layer of Volatility

Global oil demand is evolving in 2025, introducing fresh vulnerabilities beyond geopolitics. While transportation still accounts for nearly half of consumption, power generation is emerging as a key demand driver. A 63% spike in natural gas prices this year has pushed some utilities to pivot toward oil-based generation, underscoring the energy sector’s growing fuel flexibility. The U.S. EPA’s temporary suspension of coal emissions rules adds to the picture, reflecting a shift toward cost-driven, rather than climate-driven, energy decisions.

This evolving demand landscape is increasingly reactive to price signals. Global oil consumption growth slowed to 0.8% in 2024—down from 1.9% in 2023—yet production is projected to rise by 1.4 million barrels per day in 2025. That mismatch leaves markets exposed to sharp price swings from even minor supply shocks. With crude expected to trade between $70–$80 per barrel, and a $10 geopolitical premium layered in, price sensitivity remains elevated—especially as demand becomes more discretionary and less predictable.

Fear Premiums and Financial Speculation

Speculative behaviour is amplifying oil price swings. CFTC Commitments of Traders data shows hedge funds significantly increasing their net long positions in crude oil futures, reversing from 12-year lows.

Market structures have shifted into backwardation, signalling near-term supply anxiety. Volatility in options markets has surged, as traders seek protection against sudden price jumps. Analysts estimate that $10–15 per barrel of current pricing is driven by geopolitical risk premium alone. These shifts suggest markets are pricing in scenarios not yet realized—a hallmark of sentiment-driven rallies.

Inflation Risks and Economic Feedback Loops

The inflationary effects of oil spikes ripple across sectors. According to Federal Reserve Chair Jerome Powell, a $10 increase in crude oil adds 0.2% to inflation and subtracts 0.1% from GDP growth.

In sectors like airlines and freight, where fuel comprises 15–30% of costs, higher prices quickly translate into broader inflation. For emerging economies such as India, the stakes are higher. A prolonged oil rally could widen trade deficits and exacerbate inflation.

Insight: A $10 oil hike = 0.2% inflation boost + 0.1% GDP slowdown (Fed estimate)

Central banks, especially in oil-importing nations, now face tougher decisions. Rate cut expectations may be deferred, risking further tightening in financial conditions.

Tactical Investment Opportunities

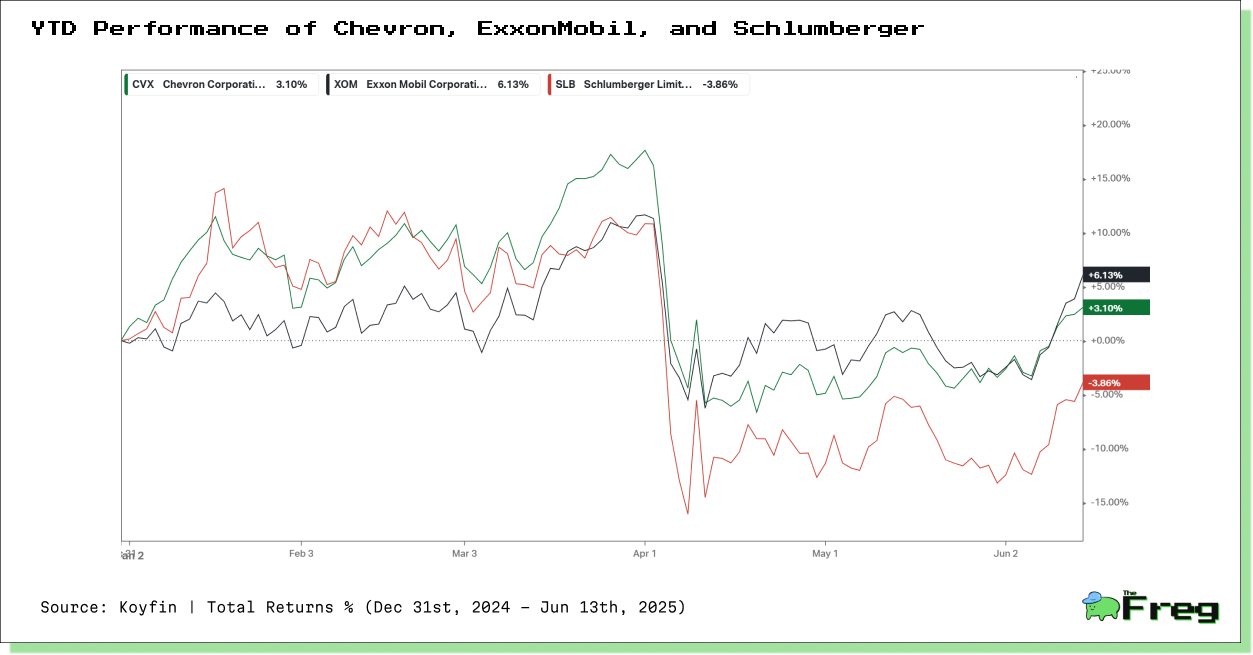

Despite the risks, some sectors stand to benefit from oil-driven market disruption:

- Energy Majors: Chevron (CVX) and ExxonMobil (XOM) have tracked Brent’s rise.

- Oil Services: Schlumberger (SLB) stock rose 22% in 2025, mirroring oil prices.

- Defence Contractors: Lockheed Martin (LMT) and Raytheon (RTX) are seeing higher demand for military systems amid regional militarization.

- ETFs: The PRWF defence ETF outperformed the market by 15% in 2025.

But these opportunities carry caveats. Emerging markets and duration-sensitive assets, such as long bonds, remain exposed to inflation volatility and rate hike repricing.

Conclusion: An Era of Enduring Volatility

Even in the absence of full-scale war, the Israel–Iran confrontation has layered oil markets with a persistent risk premium—estimated between $5–10 per barrel. With no immediate resolution in sight and geopolitical risks likely to remain elevated, strategists urge a defensive stance.

Energy exposure, gold hedging, and selective sector positioning appear prudent. But for policymakers and investors alike, the path ahead is increasingly uncertain, shaped as much by psychology and fear as by barrels and balance sheets.