Europe's ETF Renaissance: 2025 Marks a Pivotal Shift in Global Capital Allocation

Europe is leading global markets in 2025, with ETF inflows hitting record highs and equities outpacing U.S. stocks. Driven by strong dividends, fiscal support, and ECB rate cuts, investors are shifting capital away from the U.S. toward a revitalized Europe.

Europe’s equity markets and investment funds are enjoying a moment in the sun in 2025. A historic wave of inflows into European exchange-traded funds (ETFs) and a dramatic reallocation of capital from the U.S. has underscored a decisive pivot in global investor sentiment. Backed by compelling valuations, resilient dividends, targeted policy stimulus, and an increasingly accommodative monetary environment, Europe is emerging as the unexpected outperformer in global markets.

A Historic Inflow: European ETFs Break Records

European ETFs have seen explosive growth this year, with $149.79 billion in net inflows year-to-date, pushing total assets to a record $2.61 trillion by May 2025. In May alone, €27 billion flowed into European-domiciled UCITS ETFs—€18.7 billion into equities and €8.3 billion into fixed income—reinforcing the region’s growing appeal.

Investor preferences clearly reflect shifting geographic sentiment. In May 2025, Europe equity ETFs attracted $4.1 billion, surpassing U.S. equity ETF inflows of $2.4 billion, which turned positive for the first time since January. Global equity ETFs led with $5.1 billion, and developed markets drew $3.6 billion, indicating broad-based diversification. In contrast, UK equity ETFs saw net outflows of $670 million, continuing a regional underweight trend.

Performance supports this realignment. European equities have outpaced U.S. stocks by more than 10% since January, fuelled by fiscal stimulus—especially Germany’s—and ETF-specific flows like the iShares MSCI Germany ETF (EWG), which garnered over $1 billion in new assets.

Diverging Policy Paths: ECB Cuts, Fed Holds

At the heart of Europe's capital resurgence lies a growing policy divergence between the European Central Bank (ECB) and the Federal Reserve. In June 2025, the ECB reduced its deposit rate to 2.00%, marking its eighth cut in a year, in stark contrast to the Fed, which has kept its benchmark rate at 4.25%–4.50%.

The impact is significant: a weaker euro has benefitted European exporters, while carry trade opportunities have opened up due to the transatlantic rate gap. Politically, U.S. pressure is rising. Former President Trump has publicly criticized the Fed for “lagging behind” Europe in rate normalization.

The Income Case: Europe’s Dividend Superiority

Beyond macro narratives, Europe’s dividend strength is a major magnet for yield-hungry investors. The MSCI Europe High Dividend Yield Index is delivering a 5.11% dividend yield, with a forward P/E of just 10.8—far more attractive than most global benchmarks.

Dividend payouts across Europe are forecast to hit €459 billion in 2025, with May already showcasing outperformers like Royal BAM Group, Elecnor, and Trigano Group. Austria and Germany are at the forefront, with German dividend yields projected to climb from 2.9% to 3.2%.

Thematic ETFs Take the Spotlight

While broad-based funds have absorbed the lion’s share of flows, thematic ETFs are quietly carving out significant space. These funds allow investors to focus on megatrends—such as biotech innovation, AI-powered semiconductors, and infrastructure upgrades.

The Pharma Breakthrough theme topped Q1 2025 ETF performance, while funds like Pacer US Cash Cows 100 ETF (COWZ) and iShares Semiconductor ETF (SOXX) have seen inflows on the back of 32% projected earnings growth in the semiconductor space.

The rise of model portfolios and strategic allocation tools has further embedded thematic ETFs into advisor workflows—positioning them as structural elements, not niche plays.

American Outflows, Global Rebalancing

While Europe thrives, U.S. equity funds shed over $17 billion in May, marking their worst monthly exodus in a year. In total, $44.57 billion has exited U.S. equities since mid-April, a reaction to persistent trade friction, rate uncertainty, and narrow leadership in tech stocks.

Notably, alternative asset funds, particularly in crypto, have pulled in over $46.2 billion in the past year, revealing a broad-based appetite for diversified strategies.

Europe’s Equity Rally: Outperformance with Momentum

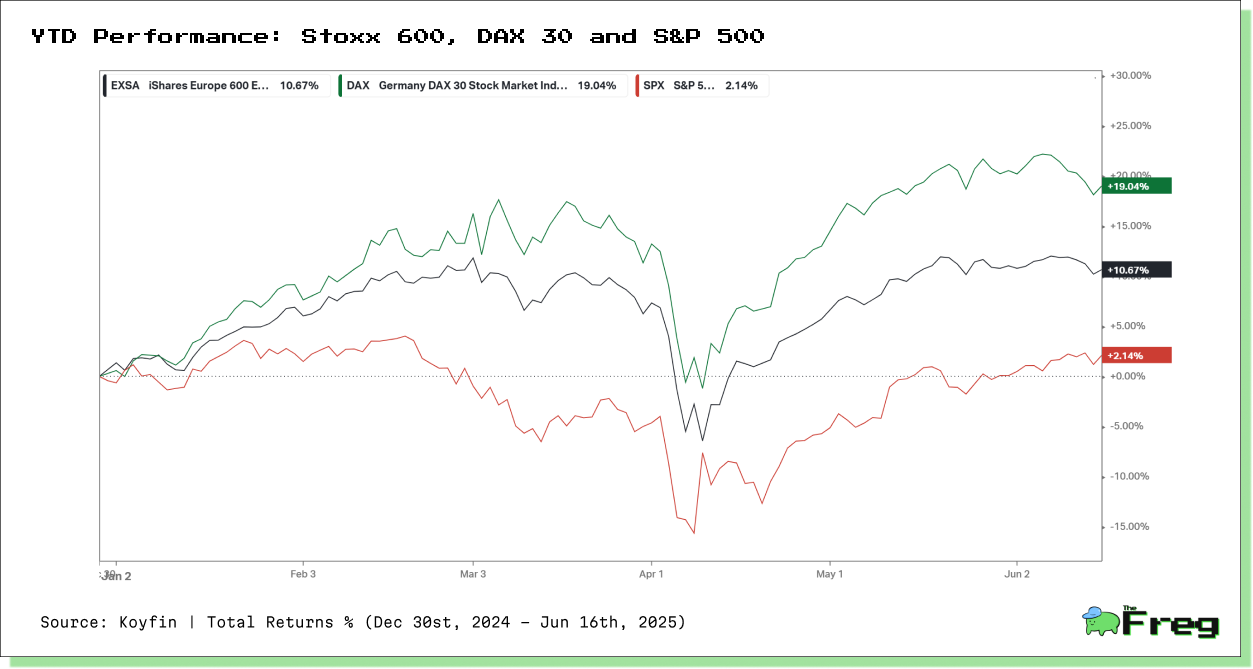

Europe’s equity surge in 2025 is no longer a quiet story—it’s a market reality. As of mid-June, the Germany DAX Index has gained 19.04% year-to-date, far outperforming global peers. The iShares Europe 600 ETF (EXSA) is up 10.67%, handily beating the S&P 500’s modest 2.14% rise over the same period.

The rally has been fueled by a mix of structural and cyclical drivers. Germany’s €1 trillion fiscal package, coupled with a record €17 billion in corporate buybacks in April, injected confidence across sectors. At the same time, easing monetary policy from the ECB and a more optimistic growth outlook have lifted sentiment. While the STOXX 600 is not shown in this chart, its earlier reported 8.5% year-to-date gain aligns with this broader trend of European strength.

With eight of the top 10 performing global stock markets now located in Europe, investor interest continues to shift—reflected in both ETF flows and performance.

Can Europe Sustain the Lead?

Despite impressive momentum, caution still tempers the narrative. Geopolitical friction, particularly around U.S.–EU trade relations, and supply chain vulnerabilities—especially in rare earths and defence-linked industries—remain active risk factors.

Yet, the broader backdrop appears more resilient than in years past. Regulatory reform, expanded fiscal capacity, and relatively cheap valuations could mean this isn't just another cyclical spike. As Deutsche Bank strategist Maximilian Uleer put it, “Investor pessimism may be the best buy signal.” If macro conditions continue to align, Europe may finally shake off the “value trap” label and emerge as a central destination for global capital in a new economic cycle.