Europe’s Defence ETFs Are Outperforming—and Reshaping Global Investment Trends

We compare Europe’s defence ETF boom with evolving U.S. strategies, showing how NATO rearmament and tech-driven warfare are reshaping global markets. While Europe leads on returns, U.S. funds are gaining ground with AI and cybersecurity exposure.

As geopolitical volatility intensifies and NATO enters a new phase of rearmament, European defence ETFs have surged to the forefront of investor attention in 2025. No longer a niche bet, these funds are now a leading indicator of market sentiment, national policy direction, and strategic capital allocation.

This shift has not occurred in isolation. It is being driven by a rare alignment of political momentum, economic re-prioritization, and a historic transformation in how the West approaches military readiness.

NATO’s Expanding Defence Mandate

2025 is a turning point for the NATO alliance. For the first time, all 32 NATO members are on pace to meet the 2% of GDP defence spending threshold, a stark reversal from 2014, when only three met the goal.

However, the target itself is evolving. Under pressure from President Donald Trump, a new benchmark is under consideration: a 5% GDP commitment—split into 3.5% for defence capabilities and 1.5% for broader security infrastructure, including cyber, AI, and surveillance resilience.

The political response is mixed. Germany, Sweden, and the Netherlands are reportedly open to the proposal, while Spain has rejected it outright as “unreasonable.” The upcoming NATO summit in The Hague will likely determine whether this ambitious target becomes formal policy—or a flashpoint.

Defence ETFs Take the Lead

In financial markets, few themes have outperformed European defence in 2025. ETFs tracking aerospace and military industries have delivered standout returns—reflecting rising budgets, industrial scale-ups, and investor conviction.

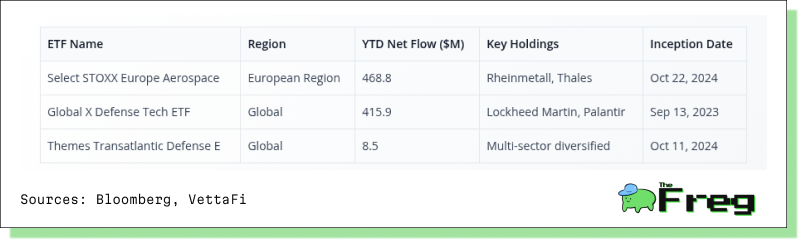

The Select STOXX Europe Aerospace ETF (EUAD) has delivered a 65.76% year-to-date return, driven by holdings like Rheinmetall and Thales. The fund has also attracted $468.8 million in net inflows since its October 2024 debut.

Meanwhile, the Global X Defence Tech ETF (SHLD), which captures a more tech-oriented global exposure, has returned 56.51% YTD. It includes firms like Lockheed Martin and Palantir, reflecting the convergence of traditional defence with AI, software, and surveillance innovation.

U.S. Defence ETFs: Innovation Drives Outperformance

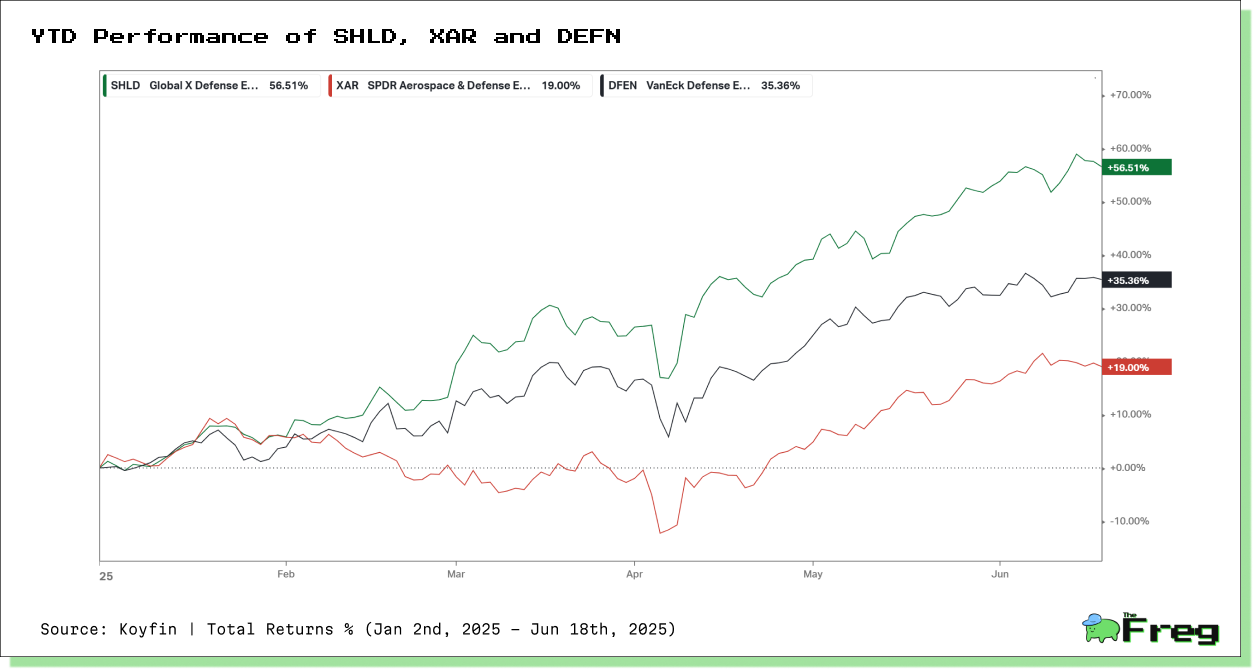

Within U.S. markets, defence ETF performance is diverging sharply in 2025—with tech-integrated strategies leading the charge. The Global X Defence Tech ETF (SHLD) is up +56.51% YTD, outperforming the VanEck Defence ETF (DFEN) at +35.36%, and the SPDR Aerospace & Defence ETF (XAR) at +19.0%.

SHLD’s edge lies in its exposure to firms like Palantir and Anduril, reflecting a growing investor focus on AI, cybersecurity, and autonomous systems. Traditional industrial funds like XAR lag behind, hampered by slower procurement cycles and heavier exposure to legacy contractors.

As NATO priorities shift toward tech-enhanced defence capabilities, investors are clearly backing the digital battlefield.

Beyond raw numbers, the composition of these ETFs offers insight into shifting defence priorities. EUAD emphasizes European industrial powerhouses, while SHLD integrates both defence manufacturers and dual-use tech companies. The Themes Transatlantic Defence ETF (NATO), despite lower inflows, offers a diversified cross-Atlantic approach and may gain relevance as NATO investment alignment tightens.

U.S. Defence ETFs: Innovation Drives Outperformance

Within U.S. markets, defence ETF performance is diverging sharply in 2025—with tech-integrated strategies leading the charge. The Global X Defense Tech ETF (SHLD) is up +56.51% YTD, outperforming the VanEck Defense ETF (DFEN) at +35.36%, and the SPDR Aerospace & Defense ETF (XAR) at +19.0%.

SHLD’s edge lies in its exposure to firms like Palantir and Anduril, reflecting a growing investor focus on AI, cybersecurity, and autonomous systems. Traditional industrial funds like XAR lag behind, hampered by slower procurement cycles and heavier exposure to legacy contractors.

As NATO priorities shift toward tech-enhanced defence capabilities, investors are clearly backing the digital battlefield.

Europe’s Structural Shift, Not a Speculative Cycle

This is more than a short-term investment surge. According to the European Commission’s Spring 2025 Economic Forecast, EU defence spending is projected to rise from 1.3% of GDP in 2023 to 1.6% in 2025, with some countries—like Poland—targeting above 4.5%.

Rheinmetall, the standout corporate performer, recorded a 46% year-over-year revenue jump in Q1 2025 and now holds a record €62.6 billion backlog. This is being echoed across the sector, with firms scaling production to match government orders and ETF flows reinforcing the sector’s attractiveness.

Outlook: Security as a Growth Theme

Defence is no longer just a recession hedge or a short-term play—it is emerging as a structural growth theme that could define capital markets for years to come. With rising geopolitical tensions and shifting national priorities, governments are ramping up military and security spending at a scale not seen in decades.

Investors are responding decisively, channelling capital into companies and ETFs positioned at the intersection of hardware, software, and strategic defence. From traditional weapons systems to cutting-edge AI, cybersecurity, and surveillance technologies, the sector’s scope is rapidly expanding. While European ETFs have gained early momentum, the defence investment landscape is becoming increasingly global, innovation-driven, and integral to long-term portfolio strategy.